Your journey to financial independence will not depend on how much money you make. Instead, how you choose to spend the money you make and where it is spent will make all the difference. By avoiding big financial mistakes that thousands of people make, you will increase your chances of becoming financially free in no time.

In this article, I have put together a list of 6 financial mistakes you must avoid at all costs in order to turn your life around and reach financial independence.

1. Accumulating too much debt

The biggest reason millions of people are struggling financially is due to debt. Those who are not being crushed by student loans or mortgages are having trouble with their personal loans. The ones who managed to dodge these two loans can’t figure out a way out of car loans, credit cards, etc.

Debt is the biggest enemy of many families out there. According to Bankrate, Americans have an accumulated debt of over $14 trillion with an average household debt of $92,727. Shift Processing also reported that 80% of Americans have consumer debt.

These statistics are overwhelming. Unless you decide not to make the same financial mistakes, you will end up like millions of people who think they will carry debt until they die.

Why having too much debt is one of the biggest financial mistakes?

Debt is good only if it helps you make more money or achieve something that will pay it off later. For example, a business gets in debt because the money helps through expansion, product improvement, increase production efficiency, etc. Other than this, debt is not worth getting. These activities increase production output and bring in more revenues.

What makes debt bad is the interest rate. Most debts come with simple interest. Others have a compound interest which makes your debt grow unless you pay it off fast.

So, you pay off your principal and the interest. If there were no interest charges applied on borrowed money, debt would be good.

Having too much debt makes your life miserable. Every penny you make goes toward your debt which makes it difficult to achieve anything else in your life.

- You can’t travel if the bank is knocking on your door

- You cannot buy what you want when you owe the lender too much money

- Eating out will be almost impossible

- The chances of you going bankrupt will be much higher especially when your debt surpasses your income

- Too much debt will make it difficult to borrow money for something you actually need. A bank will not give you more money to start a business if your debt-to-income ratio is beyond acceptable levels.

- You can’t put your kids in good schools, feed them well, clothe them well, pay for their soccer practices, dance classes, etc if your bank account is dry.

There are more sad stories about having too much debt. But in general, you should avoid accumulating too much debt. Debt is bad if it is not used properly.

The question is: When should you get into debt?

This question will vary from one person to another. But the simplest answer is that you should always evaluate your priorities and alternatives before you borrow.

The following quote from Jay-z summarizes it all. “If you can’t buy it twice you can’t afford it”, Jay-z said.

I want you to think about this quote one more time. What the quote means is that if you don’t have enough money to buy it and buy it again without borrowing, you cannot afford it. That is it.

Financial mistakes: How to avoid debt?

I talked about why accumulating too much debt is one of the biggest financial mistakes. So, how can you avoid too much debt?

In this section, I will give you a few tips you can use to avoid accumulating too much debt. Remember, having debt is not really a bad thing. But having too much of it is one of those financial mistakes you don’t want to make.

So, the following are some of the tips you can use to avoid too much debt. I used some of these tips myself.

- Do not buy brand new cars: Buying a new car is one of the biggest financial mistakes you should never make. This is why a brand new car is a big no-no when it comes to clever financial decisions.

- You will pay high interest on the loan. So, a $30,000 new car will cost you around $35,000 due to interest.

- You will buy all coverages possible and all of them must be full coverages

- The gas will probably be premium

- The parts you will buy will be premium

- On top of this, borrowing money will affect your credit score due to hard inquiry and an increase in debt

- Car loans will increase your debt to income ratio which will make it hard for you to borrow more money for something else.

How can you navigate his issue? Buy a used car like 4 to 5 years old. This car would have depreciated already, and therefore, it will cost you much less. You will borrow less money which will reduce your overall expenses on the car.

- Never buy a house without at least 25% down payment: When buying a house, you need to have at least 25% of the total cost of the house as a down payment. You are probably wondering why I did not say 20%. The 20% down payment is good for a conventional mortgage but I don’t think it is enough. You need more. The more money you put in, the lesser you borrow. As a result, you end up paying less interest which lowers your monthly payment and increases your chances of paying it off faster.

- Do not have a combination of two major debts at once: Having too much debt means that there is no correlation between your total income and the debt you have. My advice to you is: if you have dozens of thousands of dollars in student loans, do not buy a house until you pay off your student loans. If you have too much in personal loans or credit cards, do not have any other loans unless these are fully paid off. This way you will be in control of your finances and borrow only what you can afford to pay off.

Bottom line question: If you are having trouble paying off your student loans, how will you pay it off together with an extra $300K of mortgage? Be smart on how you borrow.

- Make all your monthly payments on time: Every debt you have will come with a monthly payment. So, must make all these payments no matter what. Even if you have to work your a** off. Without making your required monthly payment, you will end up paying interest charges, penalties, unnecessary fees, or end up in foreclosure, bankrupcites, or collections.

- Do not spend all the money your lender qualifies you for: There are times when your lender such as a bank will qualify you for more money than you need especially when you are buying a house. Do not start looking for a house base on that amount. Your job is to look for a house based on what you can afford to spend not based on what your bank thinks you can afford to spend.

- Do not borrow unless you have to: Before you submit your mortgage/loan application, look around and see if you really need to borrow that money. Most of the time you will realize that you are not ready or there are alternatives that can give you the money you need without borrowing. For example, you should not take thousands of dollars for school just because student loans are available. There are ways to go to school for free by using someone else money!

More tips on debts, loans, and mortgages

- Why is it a bad idea to pay off the smallest debt first?

- How to pay off student loans: 16 easy tips to use

- How to pay off debt? 11 Tips you can use

- How to pay off credit card debt? 10 tips I used

- How to save for a down payment?

- 10 tips to go to college without student loans

- 9 Things to know before getting a credit card

2. Not Investing early or at all

I am going to tell you my secret about investing that you probably never heard of.

“Investing works the same way as the snow builds up into an avalanche”, Estradinglife.

The snow avalanche process does not happen in a single day. The avalanche is created because every little snow that falls accumulates on top of the previous ones to a level where you big mass of snow. What happens when you put a huge mass on a mountain without anything to hold it in place? It falls/slides due to gravity.

This is how investing works. It is impossible to rip the benefits of investing in a short time. Why? Because compounding principles work better in the long term.

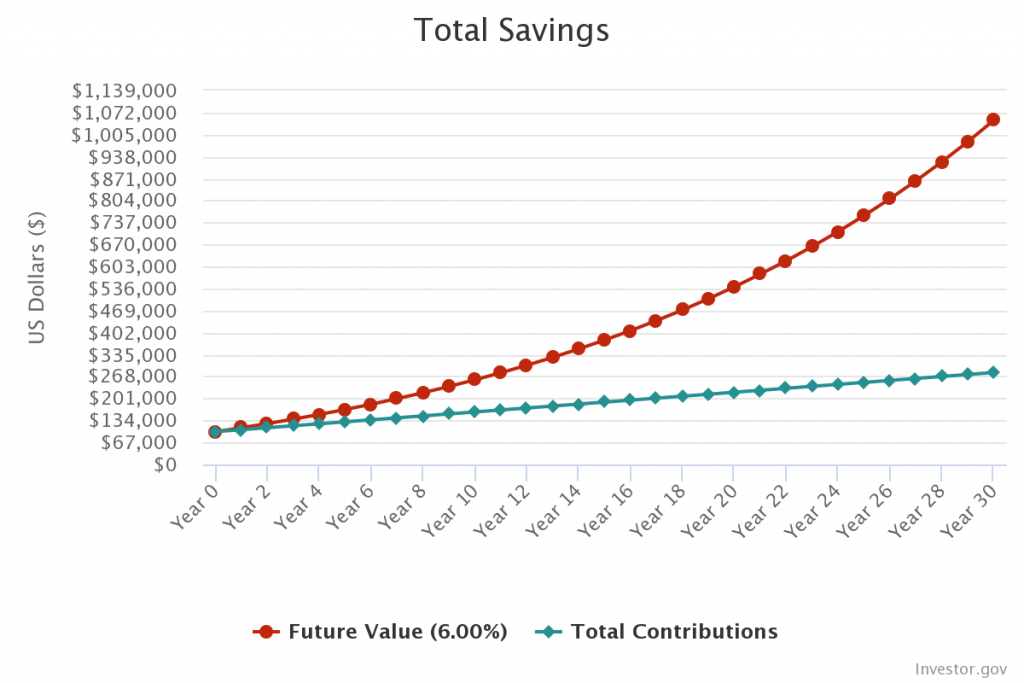

Refer to the following graph that shows how compound interest works.

From the graph above, you can see that by getting a 6% compounded interest, your portfolio would not grow that much in the first few years. As time goes on toward year 15, the portfolio starts growing exponentially. When you get to year 25, the graph becomes steeper which translates to exponential growth.

That is how compound interest works.

What makes compound interest a powerful tool for long-term investing?

The idea behind compound interest is that for every interest you earn, that interest gets added to the principal, and then the interest is recalculated based on that new principal. That is you earn interest on interest. This makes your portfolio grow much faster compared to earning simple interest. Over time, your portfolio starts growing exponentially.

Financial mistakes: Example of dividends

When you buy a dividend stock and reinvest your dividends, your portfolio goes higher. This is because, for every few dollars of dividends you earn, you reinvest that money by purchasing more shares of the same stock which increases the total number of shares you own. As the number of shares you own increases, your dividend payout becomes larger which will increase your portfolio.

The only way to build long-lasting wealth is to start investing early.

In order to achieve the same results in a short period of time, you must start with a large principle and have bigger monthly contributions. This adds a lot of pressure to your finances and makes it hard for you to live a peaceful life. For this reason, not investing early enough is one of the biggest financial mistakes you will make in your lifetime.

More readings:

- Where to invest money: An Investment guide

- How to invest money: An investment guide

- How much money should I invest?

3. Not saving for your retirement

Just like investing, not saving for your retirement is the biggest financial mistake you be making.

Your body is made of fresh bones. As we both know it, it (your body) will one day shut down and crave a break even when you are not working. That is you will get old to a level where waking up every morning will feel like an 8-hour shift.

At this time, you will not be able to show up to work or do anything that brings in a regular paycheck.

The bad news is that you will still require a place to live and food to survive. More importantly, your medical bills will be much higher than before.

How are you going to sustain yourself and live a life you once dreamed of?

The only source of income will be your savings. Only the money you have saved for retirement will be able to save you. Without money saved, you will end up living on the street or begging the government to support you.

Sorry, I did not mean to make it sound harsh on you. I meant to tell you the truth. If you don’t want to have financial struggles during your retirement, start saving money. Save enough money and invest it in high-yield investments.

Related articles:

- 10 things to buy at garage sales to save money

- 33 ways to save money while traveling

- 16 ways to save money on utility bills

- 16 ways to save money in college

4. Financial mistakes: Not budgeting

Before I tell you something about budgeting, I will start you with the following quote.

“A budget is telling your money where to go instead of wondering where it went”, Dave Ramsey.

This quote summarises it all. The reason you need a budget is to simply help you decide where your money should go instead of spending it and then start asking how you lost it.

Your budget is like the air you breathe. By creating a budget, you will be able to understand how much you really make, how much you spend, and where to make adjustments when necessary.

A budget is like a companion who warns you when you are about to trip on a rock and fall.

Living a life without a budget is like walking toward a cliff without ways to tell you where the cliff starts. Without a budget, you will not know how to manage your expenses. That is:

- You will not know where you are spending too much money

- It will be hard for you to understand your incomes and how they related to your expenses

- Without a budget, you will not be able to make proper adjustments

- It will be hard for you to set up goals or execute money challenges

- You can’t properly save without a budget

- You will most likely end up in financial hardship if you don’t use a budget

Never allocate money to something without including it in your budget. Just because people around you do not use budgets, it does not mean that you have to follow in their footsteps. Without following proper budgeting methods, you will be making one of the biggest financial mistakes of your lifetime.

Related articles:

- 8 Budgeting Mistakes you need to avoid at all cost

- 6 Great Benefits of budgeting your money

- 8 clever ways to live on a tight budget

- How to make a budget: Step-by-Step

5. Financial mistakes: Not paying yourself first

You probably heard of this term before. Pay yourself first.

What does it mean? If you thought about writing a check to yourself and spending it on whatever the heck you want because you made that money, you are 100% wrong.

Paying yourself first has nothing to do with the idea of spending your money on whatever you want because you made it.

What it really means is that the money you made is yours alone to keep, and therefore before you spend it; you must think twice. This powerful sentence means that a portion of the money you make should be saved and remain with you. More importantly, you must take out your share before you start giving your money away through meaningless spending and before anyone else touches it.

What does this mean?

Paying yourself first goes beyond saving money in your jar. It also includes taking advantage of money-saving hacks through taxes. That is you don’t have to hand over a fat check to the government. Instead, you decide how much you give to your government by reducing your taxable income. That is by maximizing your 401K contributions, contributing to HSA, engaging in long-term investments, purchasing Municipal Bonds, etc; you will be able to reduce your taxable income.

This will keep money in your pocket and prevent you from giving it away.

Related articles

- 8 ways to legally pay less tax: Save on tax

- How to lower property tax? Save money on tax

- 20 clever ways to reduce expenses and increase savings

6. Not shopping around on a major purchase

One of the best ways to avoid major financial mistakes is to make major purchase decisions that are educated. That is you do research on the big product you are buying and compare as many products as you can.

For example, a big common mistake many people make when buying a house is to buy the first or second house they tour. They see a fenced yard and picture their dogs and kids playing in it and then say: This is our dream home.

Two months later, they learn that the house has smaller bedrooms, they can’t stand outdated bathrooms, a tiny closet, etc. Wait for a minute. These are the same people who toured the house, looked at everything, and decided to buy it.

What went wrong? The problem was an emotionally driven decision. You cannot convince a person to change their minds once they are fixed on something.

This big financial mistake happens to thousands of people when making major purchases. You should not make the same mistake. You are stronger than this.

So, before you sign that sale agreement paper, regardless of what you are buying, make sure to compare multiple products. Get quotes from different providers and buy one that best meets your needs. That is how you avoid impulsive financial decisions.

More resources

- 8 Budgeting Mistakes you need to avoid at all cost

- 18 mistakes to avoid when buying a house

- 7 important steps to get out of poverty

- 5 things to avoid before bed: If you want to be successful

- 3 Things to do before applying for a mortgage

- 4 Things to know before flipping a house

- 9 Things to know before getting a credit card

- 22 retirement hobbies to stay happy and motivated