What is profit margin?

Profit margin is a profitability ratio that compares the company’s profit with its sales. This ratio tells investors how well a company is managing its money in terms of profitability. In other words, investors use the profit margin ratio to understand the percentage of the company’s sales that has turned into profits.

How to calculate the profit margin and its margin ratio?

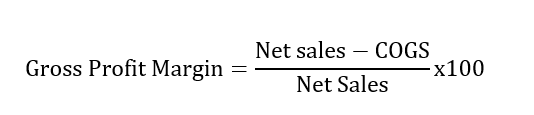

To calculate the profit margin ratio, investors divide the profit (total sales-expenses) by the revenues, according to Investopedia. The gross profit margin is the difference between net sales and cost of goods sold.

Profit Margin = Net Sales -Cost of goods sold

In this formula,

COGS = cost of goods sold

Use of the profit margin

The profit margin is used by investors to assess the performance of a company and its health in general. Business activities are sustainable only if a business can make money. By using this ratio, investors calculate how many cents in profit a company makes for every dollar of sales.

Investors favor businesses that continue to grow and expand over time. By comparing the company’s historical profit margins, investors can understand the trend in profit. If the trend is going down, it will indicate that the returns on sales are declining which raises a red flag to investors.

On the other hand, if the trend is going up, it will indicate that the company is making more profit from its sales. This is a good sign for investors as they expect more returns in the future.

In addition, the profit margin can be used to compare a company’s profitability within its sector or competitors. For example, an investor can use the profit margin to see how a renewable energy company is doing compared to the renewable energy sector.

What is a good profit margin

Let’s assume that you want to evaluate a company’s profitability using the profit margin ratio before making an investment decision. How will you know that a profit margin is good enough for your investment?

As noted by Freshbooks, one way to know if a profit margin is good is to compare it to other companies in the same industry. If a company is doing better than companies in the sector, then its profit margin would be considered good.

This means that the profit margin will vary considerably from one industry to another. However, a profit margin of 20% is considered good whereas a margin of 5% is not good, according to Corporate Finance Institute (CFI).

In order words, a company with a good profit margin will make at least 20 cents in profit for every dollar of sales.