What is a brokerage account?

A brokerage account also known as a taxable account is an investment account that an investor or a trader opens with an investment firm. A brokerage account gives the investor access to buying and selling stocks, ETFs, and other tradable securities.

The reason the account is taxable is that the investors will make or lose money during their trading activities. For this reason, they will have to pay taxes on the capital gain from their investments.

Is it difficult to open a brokerage account?

Opening a brokerage account is not difficult. There are many brokerage firms out there to choose from. The time and steps involved in opening an account will depend on the broker and the type of investment you want to make.

According to Investopedia, if you have all documents required, it would take you around 15 minutes to open a brokerage account.

The following are some of the documents you may need to provide when opening a brokerage account, according to FINRA.

- Social Security Number or Tax ID number

- Proof of employment and financial information

- A trusted person that can be contacted

- Valid identification such as a driver’s license or a passport

Types of brokerage accounts

There three main types of brokerage accounts you can choose from. The first one is a cash account where an investor will have to pay in full for every security they buy in the account.

The second type is the margin account. For a margin account, an investor will have an option to use leverage in their trading strategies. That is they can borrow funds from their broker and take a big position size in a particular stock, for example. With a margin account, you can have an option of shorting the market.

With a cash account, you can only take long positions and you cannot borrow money from your broker. However, if you have a margin account, you can take short positions. You must understand that the risks are exponential when shorting stocks or other securities.

The third type is option account which is used for buying and selling options.

Where can I open a brokerage account?

There are a ton of brokerage account providers out there. The following are a few places where you can open an online brokerage account. You can do your own research on each one of them before you open the account. There other brokerage firms that are not included in this article.

If you want to trade stocks, you can read this article on how to buy a stock step by step.

- E*Trade: Good for trading activities especially day trading

- Fidelity investment: Good with research material and investment

- TD Ameritrade: It is good for beginners and good research materials

- Charles Schwab: Good for an individual retirement account and research tools

- Merrill Edge: Good for rewards programs

- TradeStation: Has good platforms to use

- Robinhood: Easy to use. There are not tools or enough research materials and it works well on mobile.

How to open a brokerage account?

You have done your research about the broker you want. Now there is one question remaining. How do I open a brokerage account?

In the next few sections, we will give you a summary of how you will open a brokerage account.

Before you open an account, there are some documents you need to put together. We provided a list of some of those required documents in this article(in the first few paragraphs of this article).

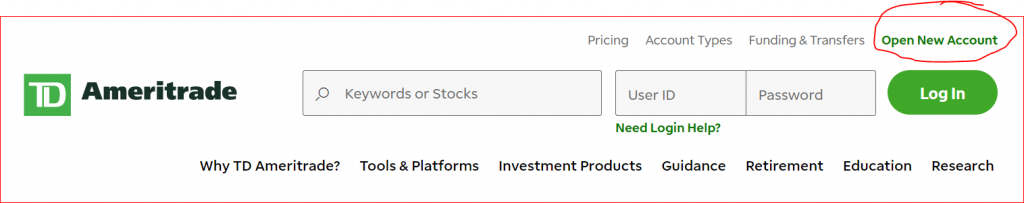

Once you have your documents, you will have to go to the homepage of the broker you want to use. Let assume that you decided to use TD Ameritrade.

You can use the following steps to open an account.

- First, go to https://www.tdameritrade.com/.This link should take you to the home page.

- Then, click on Create a new account find on the top left corner.

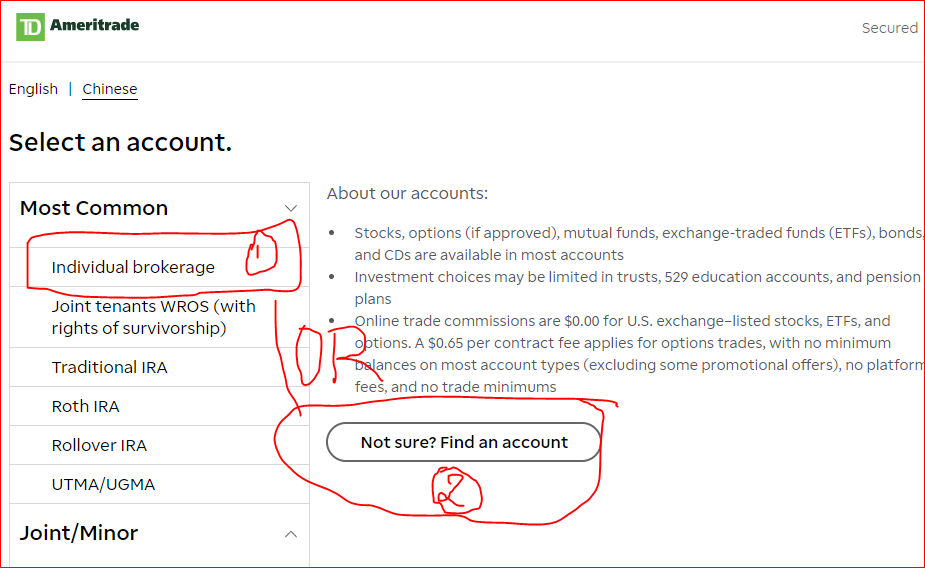

You will be taken to the next page where you will select the type of account you want to open.

- Click on individual brokerage or any other account you want to open. If you are not sure about the account you want to open, you can click on Not sure? Find an account. This will walk you through many questions to help you figure out the best account for you.

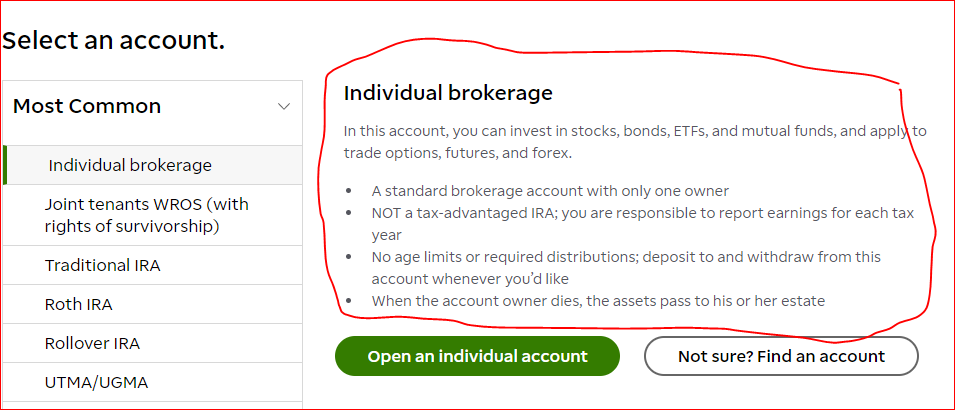

- After clicking on individual brokerage, you will be taken to the following page where they describe in detail what you will be able to do with this account.

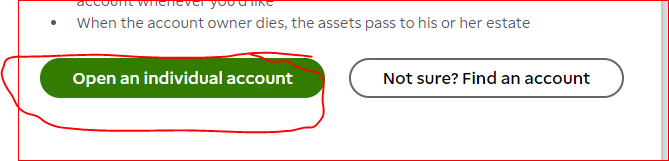

After reading and understanding what the account in about,

- click on open an individual account.

This will take you to an application to be completed. On this application, you will provide information about you as well as your financial information.

- Complete the application as required by the broker.

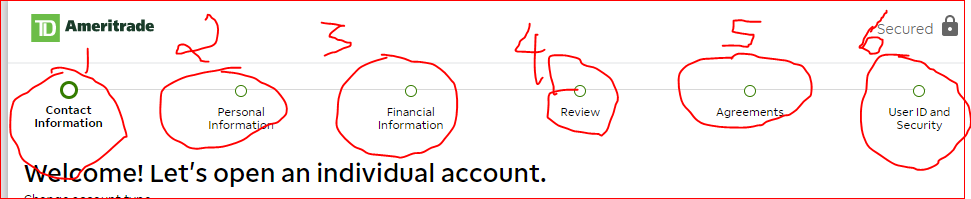

As you can see from figure above, the application has six sections.

- Contact information

- Personal information

- Financial information

- Review

- Agreements

- User ID and Security

You must go through each step and provide the information required on each step, in order to open an account. Once you are done, you will be taken into your newly opened account (if there are no more questions or steps left).

What do I do after opening a brokerage account?

After opening a brokerage account, it will be empty. There will be zero balance in the account because you have not funded or traded in the account yet.

Depending on your broker’s rules, the type of brokerage account you opened, and the type of investment you are pursuing; there could be a minimum balance you need in order to start investing.

This brings us to the next step of opening the account which is funding your account. You will need to have money in your account in order to buy stocks and other securities.

You can either use a bank account where you will provide your bank information or use other methods your broker accepts. Keep in mind that it may take a few business days to verify the bank account.

Once the bank account is verified, you will transfer the amount of money you want to trade with.

In the meantime, you must educate yourself about the kinds of securities you want to trade. In addition, you will need to learn basics terms used when buying and selling stocks and other securities such as market order, limit order, stop-loss order, etc.

Benefits of a brokerage account

- You can buy and sell stocks and other tradable securities

- A brokerage account can help grow your portfolio through long term investments

- It will give you an opportunity to learn about the stock market due to available research material provided by your broker

- You can save money to fund your retirement or college fund for your children or yourself.

- There will be no penalties for not depositing a certain amount in the account every month

Disadvantages of brokerage accounts

- There are chances of losing your money from making wrong investment decisions

- You will pay taxes on the capital gain in your account

- Your portfolio will experience volatility due to conditions in the market

- There will be penalties if you violate the terms of use. For example, if you use a margin account and violate margin terms, your account can incur a margin call. If you fail to deposit the required amount to cover your margin call, your account can be locked for 90 days.