If you have a credit card or thinking about getting one, then you have come to the right place. Even if credit cards are treated like money we use and pay them later, we need to avoid some transactions on our credit cards.

Credit cards are known as life savers to some and a curse to others. If these cards have been curses to you, you need to read and learn how to stop the situation from escalating and ruin your financial life.

On the other hand, if credit cards have been a blessing, you need to avoid mistakes millions of people are making while using these cards. You need to learn how to stay away from these never ending desires of using credit cards on everything we buy.

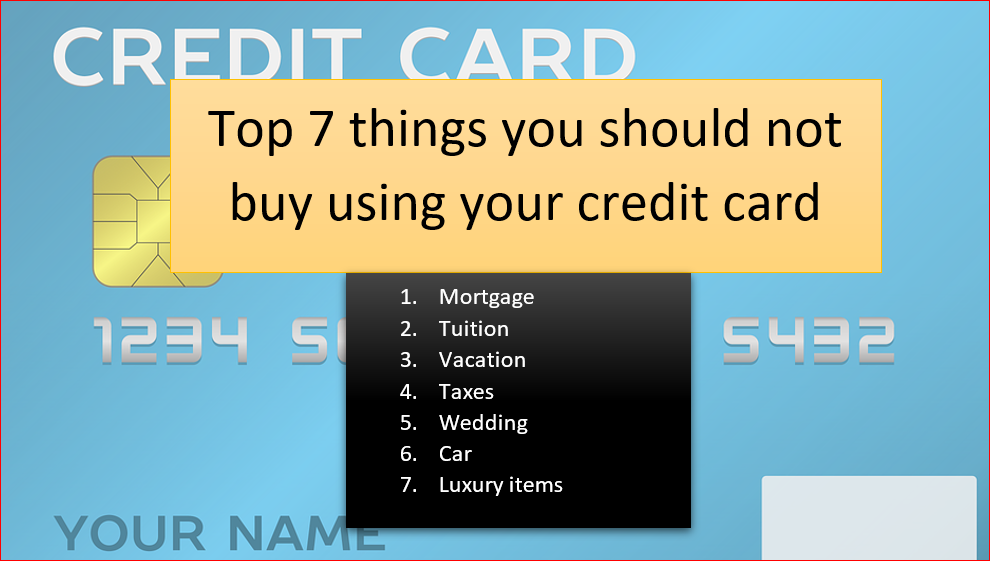

I have compiled a list of top 7 things you should not buy using your credit card.

Feel free to skip to the ones you would like to read using the table of contents below.

Table of Contents

- Paying your mortgage

- Paying your tuition and related expenses

- Your vacation expenses

- Taxes

- Wedding

- Your car

- Luxury stuff

1. Never pay your MORTGAGE with your credit card

Well, if you own a house that is not fully paid off, or any other kind of mortgages, you understand the burden of financial dependency.

Yeah, mortgages are some of the biggest burdens on shoulders of many innocent citizens around the world. They will strip life away from you until you either pay them off or die while paying them. No offense. I am not a hater of mortgages, by the way.

Paying off a mortgage is stressful and takes time. It is easy when you have a stable job that helps you out.

Unfortunately, many of us do not have the luxury of stable jobs and yet we need a safe place we can call home. If you know what I mean. When our jobs are not helping much on our mortgages, we tend to find alternatives to help us pay our monthly dues.

It would make a sense to use a credit card for a few months to pay off our mortgages until we get back on our feet. However, this is a terrible mistake.

What would happen if I pay off my mortgage using my credit card?

Paying off a big sum using your credit card takes away most of your credit line. And one of rule of thumb on credit card is to NEVER use more than 30% of our credit limit. Why?

Because you need to protect your credit score. So, overusing your credit limit sends a bad message to investors. This hurts your score. The last thing you wanna do is hurt your score. You can learn more about what hurt or improve your credit score and what you can do to rebuild your score if you wrecked it already from these links.

If you said that you don’t care much about your credit score, keep reading. We are not done yet.

Credit cards debts have the highest interest charges (15% and over) in the world of money lending. So, by accumulating more debts on your credit cards, you end up paying more money on interest charges. These rates are even more than what you pay on your mortgage. You see !

What can you do instead?

Tips: If you need more money to cover your mortgage monthly charges, forget that you have a credit card. Instead,

- Find another job or a side hustle to help you cover your charges. This will protect you from destroying your credit score and keep you from paying a ton of charges on your cards.

2. Never pay your TUITION with your credit card

Are you a student, planning to go to school or know someone who is ? If the answer is yes, you need to keep reading this.

How much is your tuition? $5000? No matter how much it is do not pay it off using your credit card. Usually, your tuition will be a big sum and using your card to take care of it is a little foolish actually more foolish.

You can wreck your financial world by just swiping your credit card once at your university. That is not a typo. You can wreck your score and increase your monthly charges by hundreds of dollars if you are not careful.

What can go wrong?

- Your credit score will be demolished

- You will pay interest charges on your debts by hundreds of dollars (15% or more)

- It will be hard to get a mortgage with a wrecked credit score

- If you get the mortgage, you will pay higher interests on it (investors will not trust you with their money)

- You will probably fall behind on your payment which will push you deeper into a hole you just dug

- There is not even a guarantee that you will get a job to pay off all your debts after your graduation. Why would you accumulate debt, if the odds are against you?

If you can’t find a way to pay off your tuition at all without wrecking your credit cards; you are probably not supposed to be going to school at this time.

Instead, you can do the following

Tips: Here are some tips to help you pay off your tuition without using your credit cards

- Get a job off campus that pays you more per hour

- If not, get one on campus and manage carefully whatever you make

- Live frugally. Trust me. As a student, you don’t need to live in the best apartment on campus. It is temporally and you don’t own it. Therefore, you should not spend more money on it.

- Take advantage of assistant-ships. You know your teachers. They give you more homework and more problems than they can correct to show off. So, you can get assistant-ships from them and help them out.

- Take advantage of scholarships. Each school has a lot of programs, alumni, and companies who are willing to give back on the money they probably stole from regular citizens. You can use some this money to help you out before you graduate and join their clubs.

- You can also use federal grants not loans. I am not a big fun of federal loans. These grants might not cover all your tuition, but every little bit helps.

- Take a semester off and make the money for your next semester. Going to school is not a marathon or a competition. It is about you. I would encourage you to take off a semester and make your tuition instead of getting in debt that will get you killed. Oops.

- Take advantage of payment installments provided by your school. If your school does not have these installments, then it is probably not the school you are supposed to be attending.

3. Never pay your VACATION EXPENSES with your credit card

All of you travelers out there hear me out. I love traveling too and I know it costs a fortune. If you use your credit cards for all your travel expenses, you might end up sinking in a hole you wish you have not dug.

Just like other cases we talked about above, traveling takes a big chunk of your money away. If you use your credit card to pay off these expenses, you might end up in jeopardy afterwards. You can get in financial trouble real quick.

In addition, there is no limit to where to travel. For this reason, you could pay a lot of charges if you use your credit cards abroad.

What can you do instead?

Tips:

- Start saving for your trip if you know you are traveling sometimes in the future

- Avoid major expenses while traveling

- Have a budget for your trip and stick to it

- Use cash or debit cards whenever possible while traveling

- Travel when there are discounts from airlines

- Use airline credit cards to get discounts

- Do not buy something that you don’t have cash for

- Do not travel at all if you don’t have cash to cover your expenses

4. Never pay your TAXES with your credit card

If you are an employee or have worked somewhere before, you know there are times we have to write a check to the government. If you find yourself in situation where you have to give money to the government instead of getting money back; do not use your credit card.

The reason I insist on this point is because you will not get cash backs on that transaction and you will pay high interest charges.

This situation can land you in more debt after paying your beautiful government that you love so much. As a result, your government might end up taking care of you later on. The government already knows that this could happen to you. That is why, your government provides option of paying your taxes in installments in some cases.

How to take care of your taxes without your credit cards

Tips:

- Use payment installments provided by your government

- Pick up extra hours to cover your taxes

- Save and live frugally while paying off your taxes

5. Never pay your WEDDING using your credit card

I know I know. All of us love weddings. The most important day in our lives. Many of us think we should do whatever it takes to get the wedding we want, deserve, or like. The truth is: we should do whatever it takes to stay out of debts.

This brings me to the idea of using your credit card to payoff your wedding. Sure! You will have good time and your friends and families will be very happy. They will sing your name and tell you how amazing you are and look in your clothes.

What happens next? A few days after the wedding?

Yo, bay! I found out that we need to pay $500 interests charges every month on our credit cards debts. What? That is a lot of money. Where are we gonna get it from? I don’t know, honey. What were you thinking? Honey, we did it together, remember? The conversation might not go exactly like this. But, you can see that your marriage is starting off on the wrong foot.

The point is this: Your wedding is yours and yours alone. Whatever you go through, money you spend on it, and what happens after the wedding is on your head. The people you invited will tell you sorry. You are the one who will go to jail for not paying off your debts. You are the one who will file chapter 13 or 11 (whatever it is) bankruptcy. Who will go to bed hungry? You! You alone will have a wrecked credit score and will have a lot of interest charges every month.

If you had your wedding and you have gone through all these, you know what I am talking about. Those who are about to have their weddings need to be careful on how much credit card money they use on their weddings.

What can you do instead?

Tips:

- Save money for your wedding

- Use cash for your wedding

- Fundraiser for your wedding

- Work extra houses to make that extra dollar needed

- Postpone the wedding until you have means to deal with it

- Do not have a wedding at all

- Always remember that your wedding can wait but your debt cannot

6. Never payoff your CAR using a credit card

I know some of you might not agree with me about this point. Your car is not an investment in general. It is slowly costing you money over time through gas, cosmetic repairs, depreciation, insurance,etc.

If you use a credit card to payoff your car, you get this big extra debt added on your shoulders. Think about this situation. Your car is aging and costing you money. You have more debt related to your credit card and they are charging you the highest interest charges possible. Beside, if you wreck your car, you would still pay the money on it and having credit card debts would make matters worse.

What can you do in this case?

Tips:

- Use cash when buying your car

- Do not buy new car (sometimes used ones are good)

- Save money you will use to buy your car

- Use transportation alternatives such as bikes, public transportation, etc

- Find cheap cars

- Walk to work (it is healthy!)

7. Do not buy EXPENSIVE stuff with your credit card

Everything we talked about so far emphasized on large purchases or expenses. This is true also for luxury items and other larger expenses. No matter what it is, you should not consider using credit card to buy such items. This is because you accumulate a large debt faster than you can pay it off. These expenses can leave a scar in your financial world.

Tip:

- Avoid large purchases if you don’t have cash to cover them

- Save money before you think about these items

- Don’t buy them at all

- If your only option is to use a credit card, you do not deserve to have these items.

- You wanna propose to your girlfriend? That can wait. She will understand

- Get a second job to raise money you need