What is dividend payout ratio?

The dividend payout ratio measures the total dividends a company paid to its shareholders with reference to its generated net income. Companies usually pay dividends to their shareholders quarterly. The dividends amount is a portion of the net income generated during the payment period.

How to calculate Dividend payout ratio

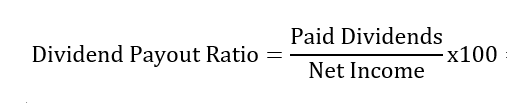

To calculate the dividend payout ratio, you will divide the dividends a company paid to its shareholders by the net income, according to Investopedia. You will then multiply the ratio by 100 to express it as a percentage. Both the dividends and net income are reported on the income statement.

Where,

Net Income = Total sales – all expenses that the company experienced to generate those sales such as cost of goods sold, administrative expenses, interest, taxes, etc.

Paid dividends = The portion of net income a company paid to its shareholders. The remaining part of net income that stays in the company is called retained earnings. These earnings fund the company’s projects, research, product developments, expansions, paying off debts, etc.

Example of DPR

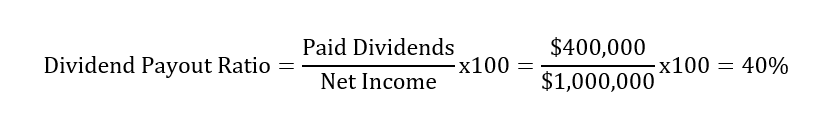

Let’s assume that XYZ company reported $1,000,000 in net income on its income statements. At the same time, the company decided to retain $600,000 to fund its research facility. What is the dividend payout ratio?

Answer

To answer this question, we need to know the percentage of dividends that were given to its shareholders. Since the company retained $600,000, the remaining portion of the net income was paid in dividends.

So,

The total dividends = $1,000,000 -$600,000 = $400,000.

We now have all numbers needed to calculate the dividend payout percentage. By plugging all numbers in the above formula, we obtain the following result.

From our calculations, we can conclude that 40% of the XYZ company’s net income was paid to its shareholders.

Interpretation of dividend payout ratio

The dividend payout ratio helps investors to know the percentage of earnings that shareholders receive in the form of dividends. This ratio comes in handy for investors who have a high interest in dividends than growth.

A high percentage of dividends means that the company pays its shareholders a big percentage of its earnings. Higher and stable dividends provide huge cash flows to many investors.

On the other hand, if a company’s dividend payout ratio is low, it will indicate that shareholders receive a small percentage of generated earnings. This can send a bad message to dividend seeking investors.

Earnings retained by a company helps it to fund its projects, pay debts and related expenses, expansions, etc.

By retaining more cash, a company can attract investors who are interested in growth. For example, shares of companies that invest in research and product development grow at a fast rate. As a result, investors collect capital gains through stock growth rather than dividends.