How to save for a down payment? Are you trying to buy a house and yet you are struggling with a down payment? If so, this article was written with you in my mind.

The down payment will be the biggest upfront cost you will encounter when buying a house. Many people delay buying houses because of the down payment. So, how can you overcome this barrier and buy the house of your dream?

This article will walk you through 6 steps you need to take in order to save for a down payment with ease.

What is a down payment?

A down payment on a house is an initial payment or upfront payment you must pay when you are financing a house with a mortgage. This amount will be required by the lender and must be paid in full at the closing date.

The down payment is a percentage of the total sale of the house. When you put down money, it becomes your initial equity in the house. However, you can claim it only after paying off your mortgage balance, interest, fees, and other charges required by the lender based on the terms of your contract.

When borrowers default on their mortgages, the down payment helps the lender to recover some of the funds extended to borrowers. That is the lender will keep the down payment if you cannot afford to pay off the house you bought. In addition, the lender will lawfully take the house through foreclosure and sell it at auction. Once the property is in the hands of the lender it will become a real estate-owned (REO) property.

The down payment will reduce the amount you owe the lender. As a result, you will pay less interest on the mortgage and have fewer monthly payments.

So, how can you save for a down payment and make sure that you spend as little as possible on the house?

This article is going to walk you through every step you need to take.

Without further ado, the following are 6 steps you need to take to save for a down payment.

1. Know how much house you can afford

When you are buying a house, the first thing you need to do is to know your budget. That is how much you are willing and afford to spend on a house.

This is not the official value of the house you will buy. Instead, is a rough estimation of what you will spend based on your income and budget. For example, if you have a good income and don’t want to be in debt for a long time, you can decide to buy a $100,000 home.

This does not mean that you will spend exactly $100,000. It is possible that you will spend a little more or less depending on the market. For example, if you are in a buyer’s market, you will pay less for the house. On the other hand, if you are in a seller’s market, you should expect to pay more money for the house.

After knowing how much you are willing to spend on a house ($100,000 in our case), you will estimate your down payment.

2. Know your down payment

Down payment requirements will vary based on the mortgage you are getting.

Conventional mortgages require a 20% down payment. As noted by Bankrate, a down payment is a percentage of the total sales on the house that is not financed and it is paid upfront. In our example, your estimated down payment would be $20,000 (20% of $100,000).

Other forms of mortgages require a different down payment. For example, you can put down as little as 3.5% on FHA mortgages or $3,500(3.5% of $100,000) in our example.

Keep in mind that a small down payment will make you pay more money on the house overall. This is because you will be borrowing a lot of money which will increase the monthly interest payment. Besides, you will be required to purchase mortgage insurance to protect your mortgage lender.

At this point, you know that you need to save at least $20,000 before you buy the house in our example.

It is always a good idea to put down more money on the house. This is because the more money you put down, the lower the interest charges, and therefore, the lower monthly payments.

In addition, you must save more than your down payment estimation. This is because there are other costs you will encounter when buying a house. Some of these costs involve but not limited to mortgage insurance, title search fee, appraisal, inspection, etc.

These costs are known as upfront costs and they vary based on the type of mortgage, down payment, value of the house, etc.

>>MORE: What Are The Upfront Costs In Real Estate?

3. How to save for a down payment: Have savings plan

Now that you know how much house you can afford and the down payment estimation, it is a time you start saving some money. Saving money becomes very complicated to the majority of people because they approach it the wrong way.

Without a plan and a reason to save, it can be difficult to save money. The good news is that you are not like everyone else. Yes, you have a reason to save which is: Save for the down payment.

The next piece of the puzzle is to have a plan.

Your plan will include the money you can afford to put aside every week, month, or year.

How do you come to this amount?

First, you need to know how much you make and where it goes. This is where the budget will come into place.

Your budget should tell you every penny you make and where you spend it.

If you need help creating a budget, use the following article about budgeting. It will walk you through every step you need to take in order to create a meaningful and working budget.

>>Related: How To Make A Budget: Step-By-Step

The budget will help you estimate a meaningful and achievable amount to save for a down payment. In addition, the same budget will show you where you are spending more money than you were supposed to.

After knowing every dollar you make and spend, you will then decide how much you should allocate toward the down payment every week, month, and year.

For example, let’s say that you want to buy a house in 5 years from now and you should have saved $20,000 in down payment. The following can be a simple break down of your saving plan.

Down payment in 5 years: $20,000

Savings Per year: $4,000 ($20,000/5)

Savings Per month: $334 ($4,000/12 months)

Weekly savings: $83.5 ($334/4 weeks)

After knowing what you will need to save at a given time, you must adjust your budget to include this amount. It is possible that your disposable income will cover this amount. That will be good news for you.

What if you don’t have or make enough money to cover your weekly, monthly, and yearly savings?

This is where advanced level of saving and making money comes in. Continue reading to find out.

4. How to save for a down payment: Cut down your expenses

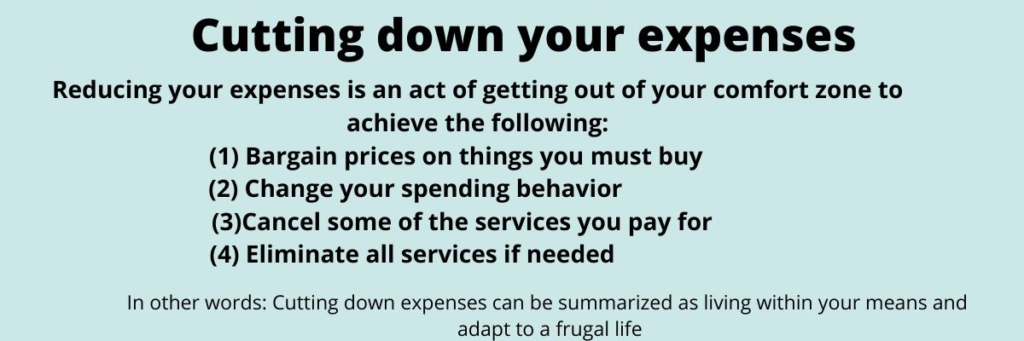

If the remaining amount does not cover all your savings requirements, you must find other means to save for a down payment.

The first thing to do is to cut down your expenses. Yes, look where you spend every dollar you make and decide where to cut. The truth is that everything you buy is not important.

You should always start with things that will not affect your life or loved ones if they are cut or eliminated. For example, if you are spending too much money on entertainment, consider reducing them or canceling them entirely.

Are you paying a premium price on the apartment? If so, move into a cheaper area/apartment and allocate saved funds toward your down payment.

Are you spending too much money on food, car insurance, books, etc? Find a way to minimize these expenses. These are the best ways you will free some cash to use for your down payment.

For more money saving tips, please, use the following articles.

- 45 Ways To Save Money On Groceries

- 44 Things You Should Stop Buying To Save Money

- How To Save Money On Car Insurance? 20 Tips

- How To Save Money On Gas? 9 Tips To Use

- 11 Easy Ways To Save Money On Flights

- 16 Ways To Save Money On Utility Bills

What if you can’t come up with enough money after cutting down all your expenses? Well, you can always find a way to make extra money. Continue reading for more details.

5. How to save for a down payment: Get a second job

If you have saved every penny and still fall short, you need to increase your income. There are 3 ways to increase your income.

(1) get a promotion/raise/ and bonusses at your current job,

(2) Get a second job, and

(3) Start a side hustle.

All these three options are possible as long as you are willing to adjust your schedule and get out of your comfort zone. If you are really busy consider option (1). It could be easy for you to increase your pay rate than starting a new job or creating one.

The following article can teach you step by step how to get a promotion at work, raise, or a bonus.

Related article: How To Get A Raise Or A Promotion At Work?

You can also get a second job. It does not have to be a full-time job. For example, you can grab a part-time job for the evening hours or at in weekend.

If not, consider starting a side hustle. Do you have a ton of clothes that you can sell online, are you a blogger, are you good at giving reviews, etc.? All these ideas can be turned into side hustles that can bring in more than what you are trying to save.

The following articles can walk you through some side hustles you can start today.

6. How to save for a down payment: Automate your savings

After figuring out what you will be saving and how often, you will then move to the next step which is the automation of your savings.

Automating savings means that the money will be sent to your designated account automatically. If you have a checking account, consider opening a savings account and have money moved there from your checking account.

It is also possible to have your funds deposited into your savings account directly from your employer.

By automating your savings, you will avoid the issues of forgetting to transfer money which is a major issue for most people. In addition, the automation will prevent you from postponing the transfer on purpose.