What is P/S ratio?

The price-to-sales ratio a.k.a P/S ratio is a financial ratio that measures how much investors are spending to own a company’s share compared to its sales per share. This ratio can be used to understand investors’ sentiments about the company. The P/S ratio also comes in handy when comparing companies in the same sector.

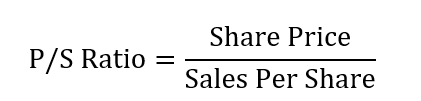

How to calculate P/S ratio?

The price-to-sales is calculated by dividing the company’s share price with its sales per share.

In this formula,

Sales Per Share: Will come from the income statement

Share Price: This is the company’s most recent stock price

How to interpret the price-to-sales ratio?

The P/S ratio helps in understanding the relationship between the company’s share price with its sales per share. In order words, it shows how much investors are paying for every dollar of sales.

A higher price-to-sales ratio could be an indication that a company is overvalued or investors expect the sales to go up in the near future. For example, a stock price could skyrocket if a company is developing a new product that will bring in a ton of revenues in the near future. This higher stock price will result in a higher P/S ratio, and therefore, its expected revenues will justify its high valuation.

On the other hand, a low P/S ratio indicates that the company is undervalued. Companies without substantial growth tend to have a lower price-to-sales ratio. This is because a share price goes down for companies that continue to have a downtrend in revenues and profitability.

Investors compare companies in the same industry using the price-to-sales ratio. For example, if company A has a better P/S ratio than company B under the same conditions; you can conclude that company A is a better investment option.

A deeper analysis is important as the difference could be due to temporary reasons and could not reflect the future growth of a company. In addition, investors should use other metrics to confirm their investment decisions.

More learning resources

- Quick Ratio: What Is Quick Ratio?

- Current Ratio: What Is The Current Ratio?

- Debt To Equity Ratio Or Debt-Equity(D/E) Ratio

- Profit Margin Basics And Definition

- Price-To-Book (P/B) Ratio: What Is P/B Ratio?

- Dividend Payout Ratio And How It Works

- What Is Inventory Turnover Ratio?

- What Is Asset Turnover Ratio? How Does It Work?