Can you use a credit card at an ATM? Or can you withdraw money from a credit card?

The answer is: Yes, you can withdraw money from a credit card at an ATM. This service is provided by most credit card companies and it is known as a cash advance.

Keep in mind that you will pay a huge price for this service.

What is a cash advance?

A cash advance is a service that allows you to get money from your credit card either at an ATM or over the counter. Financial institutions you can use for this service could be your bank or other businesses such as grocery stores, shopping malls, etc.

A cash advance is a short term loan that lets you access funds by borrowing against your credit card limit.

Many credit card providers include this service to help their customers in every way possible.

The ability to withdraw money from your credit card at an ATM or over the counter gives you access to quick cash. In other words, your credit card can be used as a debit card with a string attached.

NOTE: Cash advance comes with very high fees and does not look good on your credit report.

Will my credit card work at an ATM?

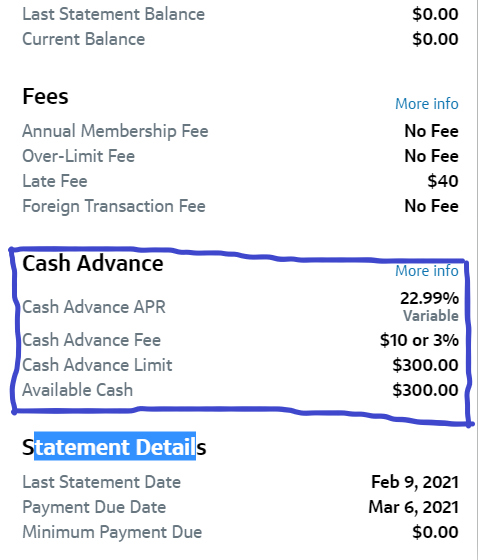

Most credit card providers will let you use your credit card on ATM machines to withdraw cash. You must understand that by withdrawing cash from your credit card, you will be getting a short term loan that comes with APR.

Since you will be borrowing against your credit card, there is a limit to how much you can borrow. Many credit card providers keep the borrowing limit into hundreds of dollars.

They give you a lower limit to protect you from maximizing your credit use in a single transaction. At the same time, a lower cash advance protects you from high APR that starts accumulating right after your cash advance transaction.

This loan is subjected to a high immediate Annual Percentage Rate (APR) a.k.a cash advance APR and related fees.

NOTE: You must check terms of use and services associated with your particular card to make sure that it will work at an ATM and how much interest and fee you will be paying.

Should I withdraw money from my credit card?

It is never a good idea to withdraw money from your credit card. Not only that you will pay a lot of charges and interest, the transaction will also affect your credit score.

Related article: 6 factors that improve or hurt your credit score.

The following are some of the reasons you should never withdraw cash from your credit card.

- Cash advance APR: It is never a good idea to borrow cash against your credit card. You will pay a much higher interest rate compared to regular APR for paying goods and services. For example, Discover charges a 27.24% cash advance APR, according to WalletHub. This is a much higher APR compared to an 11.99%-22.99% standard APR, according to Discover.

- Cash Advance fee: On top of the cash advance APR, you will pay a cash advance fee. According to Creditcards, most credit card providers will charge you either $10 or 5% of the total withdrawal amount depending on the one that is bigger. For example, if you borrow $30, you will be charged $10 in fee because 5% ($1.5) of $30 is less than $10. However, if you withdraw $400 from your credit card, you will pay 5% ($20) in fees because 5% of $400 is greater than $10.

- Bank and ATM fee: Getting money from your credit card through ATM or a bank could come with fees. Even on normal debit cards, you pay fees when you use an ATM that is not provided by your bank. Expect to pay a fee on the ATM when getting a cash advance.

- There is a limit to how much you can withdraw: Even if your credit limit is in thousands, many credit card providers will not allow you to withdraw that much. They put a limit on the amount you can borrow to protect you accumulating a lot of debt with the highest APR possible in the lending world. Why would your lenders intervene? Because they know that people who get cash advance are already in bad shape financially. Therefore, it will be difficult for them to pay off a huge debt at a hectic interest rate. In the end, credit card providers are protecting themselves. They give you a small amount and charge you the highest rate possible. As a result, they end up making the same profits they could have made if they allowed you a higher limit at a low APR.

- No grace period: According to the Consumer Financial Protection Bureau(CFPB), a grace period is a time between the billing cycle and the time your payment is due. Credit card companies must allow you at least 21 days grace period before the due date of your payments. This is not the case for a cash advance. Your credit card provider will start charging you interest from the time you withdrew from your credit card.

NOTE: Check with your credit card provider for terms and conditions on cash advance as they change from one provider to another.

- A cash advance will increase your credit utilization: Withdrawing cash from your credit card will increase your credit use since you will borrow against your credit card limit.

- You could reduce your credit score: Taking a huge sum out of your credit card could reduce your credit score if you don’t pay it off before the grace period. Learn more about what credit scores are based on.

- Cash Advance does not look good from the moneylenders’ point of view: Your credit card provider will think that you are in financial hardship when you use cash advance services. There is nothing wrong with being broke. However, your lender could update your profile and make you a risky borrower due to excessive use of cash advance services.

Where can I withdraw cash from a credit card?

You should avoid withdrawing money from your credit card at all costs. However, if it comes to that; the following are the top 4 ways you can use to get cash advance from your card.

- Get the money in person: You can go to your bank and ask them for cash advance withdrawal. They will give you the money and also probably remind you about the terms and possible charges you will be facing by doing so.

- Get the money from an ATM: Most credit cards can be used to withdraw cash from an ATM. The money will show on your credit card statement as a cash advance. Like debit cards, you must have a credit card ATM PIN before you can withdraw money from your credit card.

- You can use a convenience check: According to Bankrate, convenience checks are checks offered by your credit card provider. They are different from regular checks because they come with charges and fees. Convenience checks are linked to your bank and you can use them to pay for goods and services, get money out of your credit line, or pay off other credit cards. So, by using convenience checks, you will be able to write a check to yourself and deposit it into your account.

- Get money over the counter: You can withdraw cash from your credit card over the counter. For example, if you use your credit card for shopping, your card may have an option of getting cash from the cashier desk.

How can I withdraw money from an ATM with a credit card?

Getting money from your credit card is not difficult. However, you need to follow proper procedures when getting cash advance as you are subject to stricter terms and conditions compared to debit cards.

The following are some of the steps you can use to get money from an ATM with a credit card.

- Make sure that this is the last option you have: Before getting cash from your credit and taking the risks we discussed above; explore other alternatives. Do you really need to get money out? Is there any other option for you to get the money you need? Can you wait a little longer for your paycheck? Will it be easier to borrow from your friends and family members? These are the questions you can ask yourself before you borrow against your credit card.

- Does your card allow cash advance? Not every credit card allows cash advance. Make sure that your lender permits this service on the credit card you have.

- What are the terms and conditions? This question will help you understand the charges and fees you will pay for cash advance services. If you think you will make peace with these terms, move to the next phase.

- How much you want to take out? You need to know how much you want to take out and if it will be enough. You don’t want to find yourself withdrawing money at ATM from the same card or other credit cards the following day.

- Put payment a plan in place: Are you going to pay off this loan in a timely manner? By having a cash advance, you will face the harshest penalties in the world on lending. For this reason, you will need a plan to pay off this loan as soon as possible. Otherwise, you will not keep up with your payment since your lender will most likely apply compound interest on your charges. According to Experian, most credit card providers will compound account interest charges daily.

- Know your credit limit: You cannot withdraw any amount you want from your credit cards. Moneylenders usually have a max amount you can withdraw from each card. This amount will depend on your credit limit, credit history, payment history, credit use, etc. You need to make sure that your lender will allow you to withdraw the amount you want.

- Do you know your ATM PIN? You must have a PIN in order to use your credit cards on an ATM. If you have one, you can proceed to the next phase. Otherwise, set up a PIN in your account or contact your credit card provider to setup ATM PIN before going to the ATM.

- Get the money from an ATM: By using your credit card, your PIN, and following instructions on the ATM screen, you will be able to withdraw your money. After you receive the money, log out of your account.

- Start paying off your loan: This is the most important part of all these steps. You could survive without getting a cash advance. However, you will put your financial situations in jeopardy if you do not start paying off the loan. Your lender will start charging you the same day you withdrew the money. So, to keep up with the payment and set yourself free, you must pay off this loan as soon as possible.

Alternative to cash advance

Instead of getting cash in advance, you could use other financing methods. The following methods can be used as alternatives to cash advance.

- Get a personal loan: Personal loans can be safer that cash advance. This is because they usually have better terms (charges, fees, interest, etc) compared to the cash advance. In addition, a personal loan will most likely have a simple interest that could be fixed for the lifetime of the loan. Furthermore, a personal loan can give you more credit if you are not a risky borrower. That is being a Super-prime or a Prime borrower will help you get more money with better rates. Learn more about the kind of borrower you are based on your credit score.

- Borrow money from friends and family members: The fact that you are trying to borrow against your credit card could be an indication of financial hardship. If this is the case, you could have ruined your credit and lenders may not give you a penny. The good news is that there is still one last option to consider which is: Borrowing from friends and family members. Your family members and friends understand you better than you think and there are chances that they can lend you money free of charges. If they do lend you money, you will avoid interest charges and fees associated with a cash advance.