What is interest coverage ratio?

The interest coverage ratio is a financial ratio that measures the ability of a company to make interest payments on its debt using EBIT. The EBIT stands for earnings before interests and taxes. A higher ratio means that a company generates enough money to cover its ongoing interest charges.

On the contrary, a lower ratio shows that the company does not generate enough earnings to cover interest charges on its debt. For this reason, more financing will be required to meet its debt terms and conditions. For this reason, a lower ratio does not look good from investors’ and creditors’ point of view.

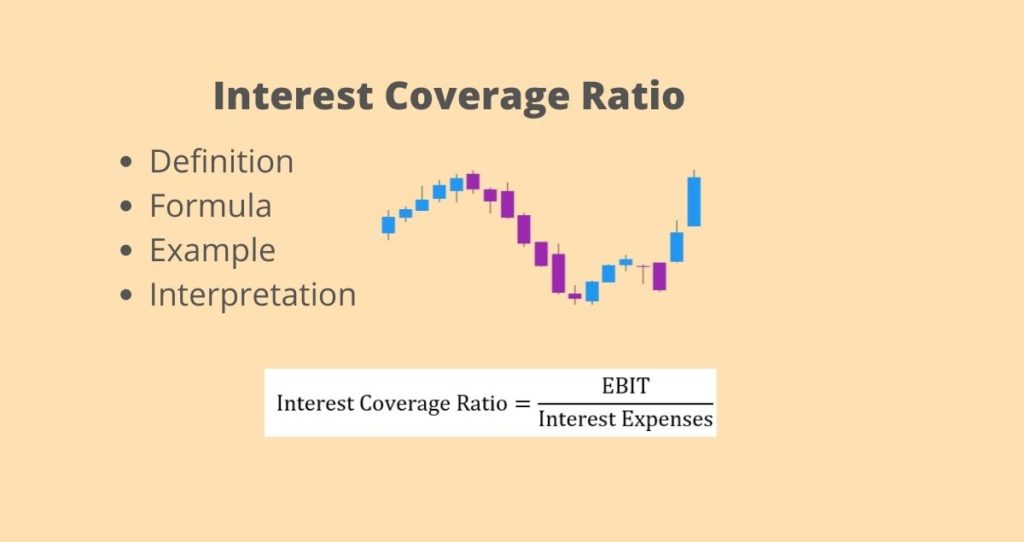

How to calculate the interest coverage ratio?

The interest coverage ratio is calculated by dividing the EBIT with interest expenses, according to Gocardless.

In this formula,

EBIT = Earnings Before Interests and Taxes

Example

Let’s assume that XYZ company reported an EBIT of $850,000 on its income statement at the end of the year. At the same time, the company has an annual interest charge on its loan of $250,000. What is the interest coverage ratio?

We will use the following steps to answer this question.

Step 1: Available data

- Earnings before interest and taxes (EBIT)= $850,000

- Annual interest charge = $250,000

Step 2: Calculate the ratio

From our example, we can conclude that XYZ company has an interest coverage ratio of 3.4. In other words, the company can pay off interest charges on its debt using EBIT 3.4 times.

How to interpret interest coverage ratio?

This ratio shows investors and creditors how many times a company can pay off the interest on its debt only using EBIT. Without enough earnings to cover the interest, the company may end up in a huge financial crisis.

For this reason, this ratio is one of many risky assessment metrics investors and debtors use when evaluating companies.

Having a high ratio is important as it shows that the company can cover the interest many times. That is the higher the ratio the better.

A ratio under 1 shows that the company cannot cover the interest on its debt only by using EBIT. Without the ability to cover the interest charges from generated money, the company will be risky for investors. In addition, creditors will not easily trust the company with more money since it will be struggling to pay off the debt it already has.