What is Asset Turnover Ratio?

The asset turnover ratio is a financial ratio that measures how much sales a company generates from its assets. This is an efficiency ratio, and therefore, it focuses on how efficiently companies use their average total assets to generate sales.

As noted by Accounting Tools, companies with a high asset turnover ratio can generate more sales with few assets. As a result, these companies can use less debt and equity to maintain their operations.

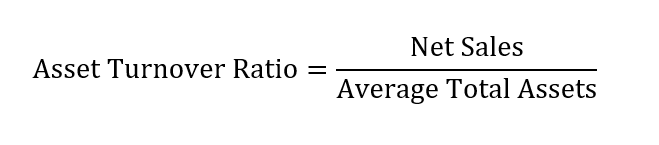

How to calculate the asset turnover ratio?

As the name suggests, the asset turnover ratio is calculated by diving the net sales by the company’s average total assets.

Where,

Net sales = Gross Sales -(Allowances+ Returns + Discounts) [Credit: FreshBooks]

Average Total Assets = (Total Asset of previous year(Beginning assets) +Total Assets for current year(ending assets))/2. In short, the Average Total Assets = (Beginning Assets + Ending Assets)/2.

Example

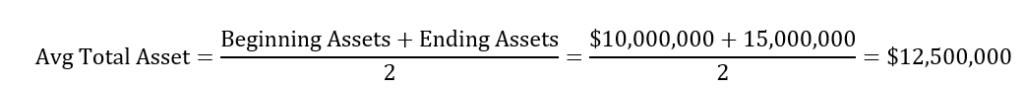

Let’s assume that before you invest in a company, you want to know how efficiently the company is using its assets to generate sales. So, you looked at the companies financial reports and realized that the beginning total assets were $10,000,000 whereas the ending assets were $15,000,000. Also, the company reported net sales of $5,000,000 at the end of the year.

What is the asset turn over ratio of XYZ company?

>>Related: Average: What Is The Meaning Of Average?

To answer this questions, we will follow these steps.

Step 1: A list of what we have

- Beginning total assets = $10,000,000

- Ending total assets = $15,000,000

- Net sales = $5,000,000

Step 2: Calculate the average total assets

Next, we will need to plug our numbers into the above formula to calculate the turnover ratio.

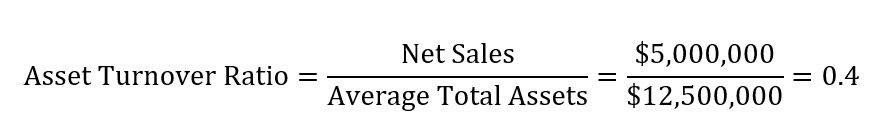

Step 3: Calculate the ratio.

After all calculations, we can conclude that the company has an asset turnover ratio of 0.4. In other words, for every dollar invested in assets, the company generates $0.4 or 40 cents in sales.

How to interpret the asset turnover ratio?

A high ratio indicates that the company’s management team allocates all assets wisely and generate optimal sales.

On the other hand, a low ratio indicates that the company generates fewer sales compared to assets it has in hand. For this reason, a low ratio can signal a poor management style and mediocre asset allocations.