What Is Compound Interest?

Compound interest is an interest that is calculated on the principal and accumulated interest from the time the loan was issued or investment was made. This interest makes the money grow faster compared to simple interest.

The simple interest is only calculated on the principal. The borrower will not pay interest on accrued interest charges. This interest stays constant over the lifetime of the loan or mortgage.

If you invest your money with simple interest, you will only get a return on the principal.

How to calculate compound interest?

You will calculate the compound interest by multiplying the principal (p) by one(1) plus the yearly interest rate(r) raised to the number of the compound period (n) minus one (-1)

Please refer to the following formula.

Compound Interest = p{[(1+r)^n]-1}.

P = The principal amount

n = The number of compounding period

r = Is the annual interest rate in percentages

Example of compound interest

Let’s say that you invested $100,000 and want to invest it for 10 years. Let’s also assume that you are getting a 6% interest that compounds annually.

Our next step is to calculate how much our investment will be at the end of year 10.

To do this we will apply the formula as follow:

Compound Interest = P{[(1+r)^n]-1} = 100,000{[(1+0.06)^10]-1} = $79084.77

Your total interest earned after 10 years will be $79084.77 and your total investment account will be around $179084.77

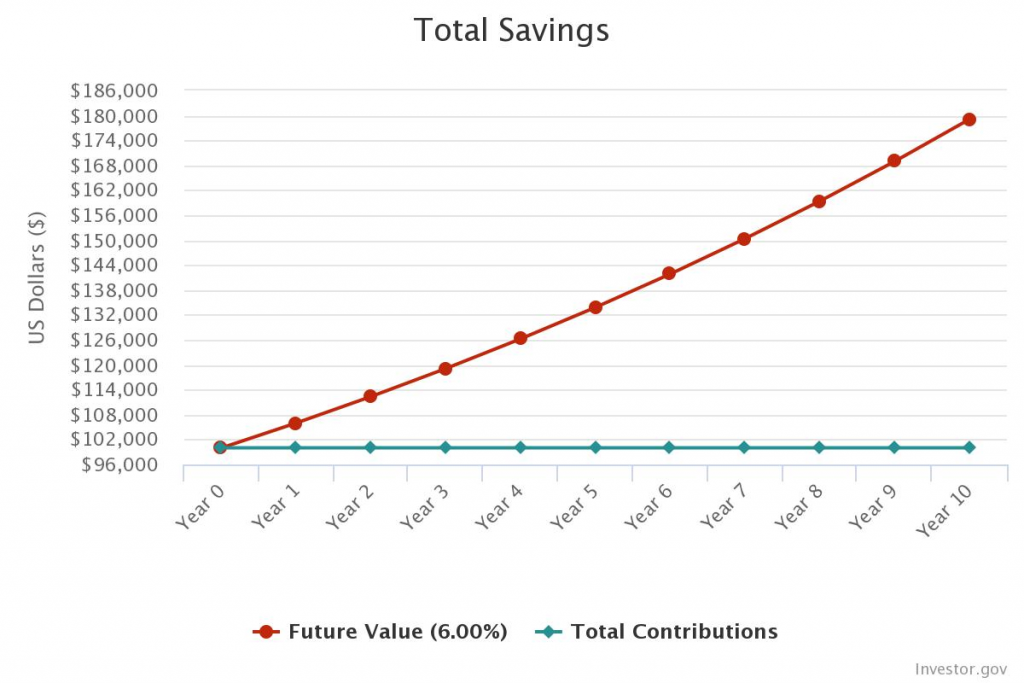

Please, refer to Figure 1 below to see how your money grew every year.

We are assuming that there was no other contribution you made since your initial investment.

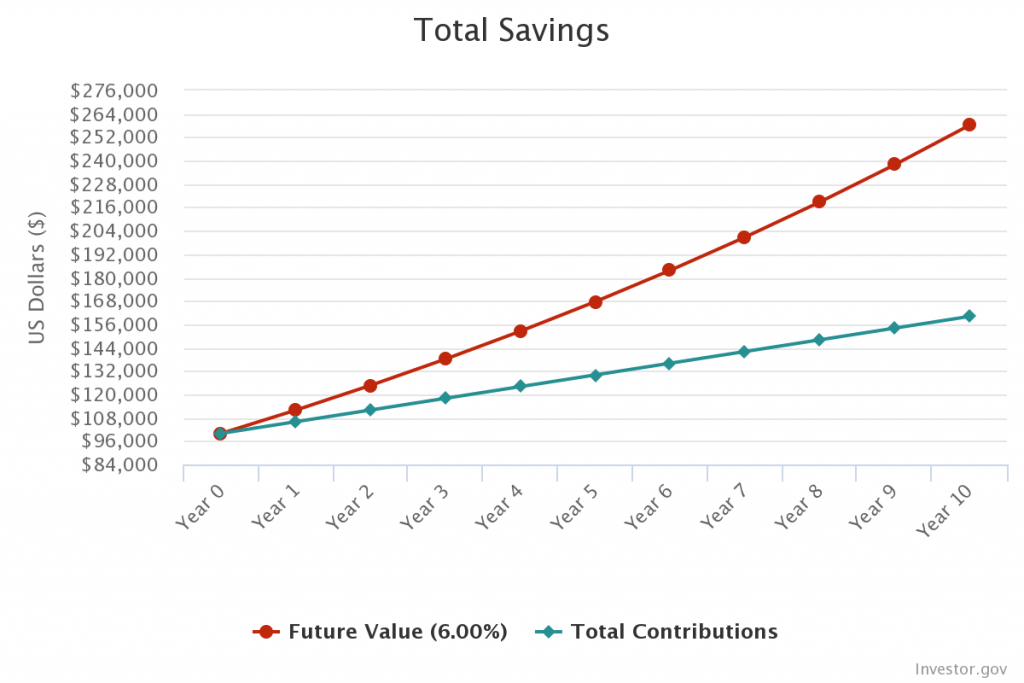

What if you added like $500 every month toward your investment? How much would you have at the end of the year 10?

Using the same formula, we are going to see how our monthly contribution changes return on our investment. Our account will grow much faster compared to our previous example.

Again what we are doing is add $500 every month or $6000 every year to our investment. We are also getting the same percentage return on the added money. Please refer to Figure 2, to learn how the account changes every year.

You can see that our investment grew much faster with a monthly contribution.

Tips on gaining more returns: More time is equal to more gains

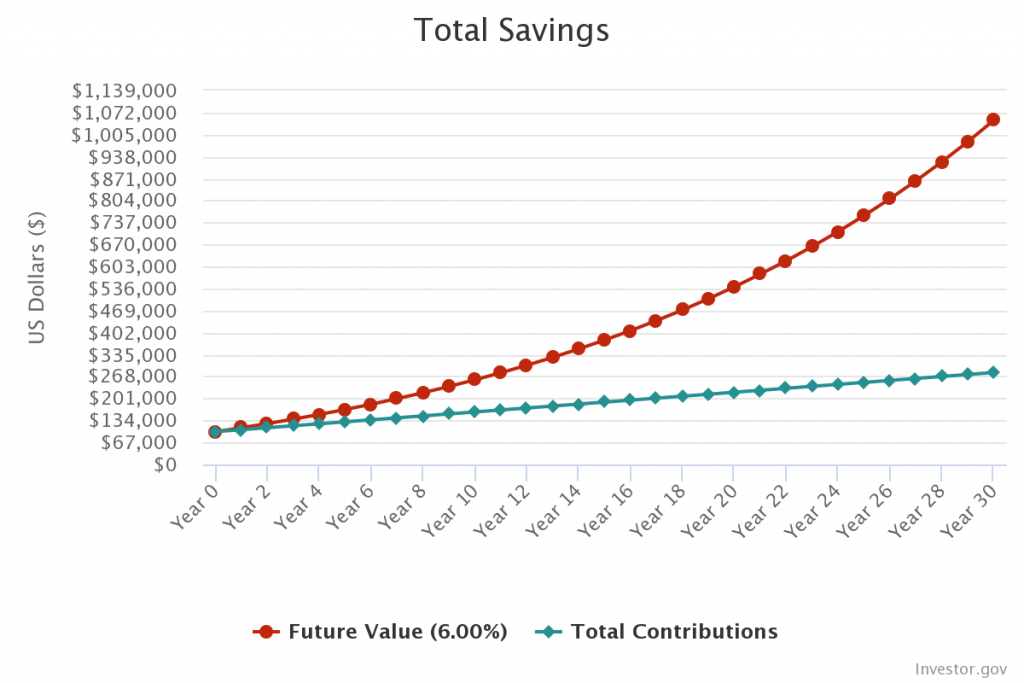

To gain more return, it is important to go in for the long term. That is the more time you leave your money invested in compound interest, the more return you will get. It is also important to make some monthly contribution as they increase your gains.

Remember you are making interest on the principal, interest, and your monthly contribution.

Look how much money you will have if you decide to leave the money invested for 30 years instead of 10 years.

You can see that your account will be well over $1,000,000 if we keep the money in the account.

Since the compound interest gives you the best benefits only when you stay there longer, start now. Invest what you got and watch it grow.

People who are in their 20’s and 30’s should start investing. You will be surprised by how much money you will have by the time you retire.

Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.

Thank you for stopping by, ปั้มไลค์! I am glad you find the article helpful.