What is dividend yield?

The dividend yield is a metric used to measure the dividends a company pays to its shareholders in relation to its share price. Dividends can be a secure way to earn passive cash flows for investors who own shares of stable and steady companies that give dividends.

The dividends are not constant and can vary based on the performance of a company. As noted by YCHARTS, a company can reduce its dividends when facing financial troubles.

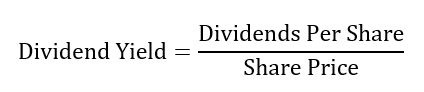

How to calculate dividend yield?

To calculate the dividend yield, you will divide the dividends per share by the stock price, according to Forbes. Since the yield is expressed as a percentage, the result will then be multiplied by 100.

Where,

- Dividends Per Share = Total dividends / Total outstanding shares

- Price Per Share = The most recent share price of a company.

Example of Dividend Yield

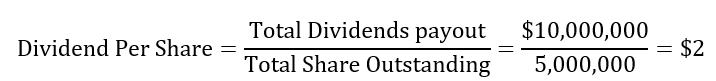

Let’s assume that an XYZ company has 5,000,000 shares outstanding and it is currently trading at $30 per share. Let’s also assume that the company reported a total dividends payout of $10,000,000 on its income statement. What is the dividend yield of the company?

To answer this questions we will use the following steps.

Step 1: List of what is given:

- Total outstanding shares = 5,000,000

- Price per share = $30

- Total dividends paid = $10,000,000

Step 2: Calculate the dividends per share

From the above calculations, we can conclude that the company paid $2 for every share investors own. At this time, we can go ahead and calculate the yield.

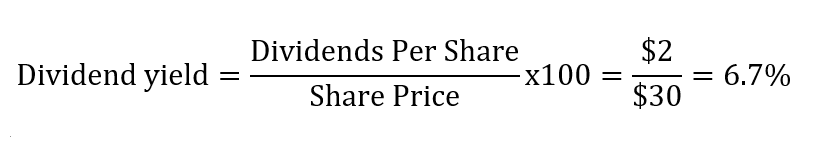

Step 3: Calculate the yield

Our imaginary company has a yield of 6.7 %. So, what does this % mean? Continue reading to learn more.

Interpretation of Dividend Yield

Making investment decisions can be a very daunting task. As an investor, you must analyze the management of the company, performance in terms of product development, its competitiveness, its future growth, industry, etc.

Investors who are interested in dividends collection rather than stock growth focus their attention on dividends payments.

The dividend yield measures the return on investment investors receive for every share they own in a company, according to the balance. As an investor, you would want to receive the highest return for every share you bought in a company.

A higher yield indicates that investors receive a higher return compared to the companies share price.

On the other hand, a low yield shows that investors receive a smaller dividend compared to the company’s share price.