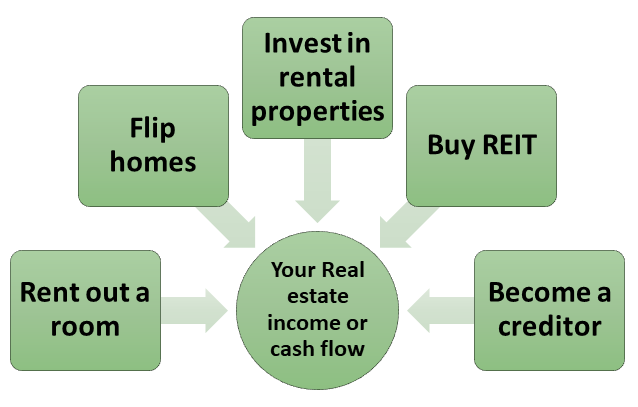

Real estate is one of the easiest investment sectors. If you have been wondering how to invest in real estate, you have come to the right place. You do not need to have a sophisticated education to start investing in real estate. There are a lot of options to choose from, depending on your budget and risk tolerance.

We are going to walk you through the top 5 methods you can use to invest in real estate no matter how much money you have.

1. Buy REITs (Real Estate Investment Trusts)

According to investor.gov, a REIT is a company that owns and typically operates income-producing real estate or related assets. These assets may include buildings, hotels, shopping malls, resorts, warehouses, apartments, etc. You can invest in real estate without buying a physical property by owning shares of a REIT of your choice.

Most REITs are publicly traded on exchanges and you can buy and sell their shares like other publicly traded securities. As a result, prices are clear and there are no conflicts of interest when you invest in these REITs.

REITs that are not publicly traded may have conflicts of interest, lack of liquidity, and charge premium prices.

If you can’t afford to buy a physical property, REITs will be a perfect option for you. You must remember that prices are volatile with these securities.

2. Invest in rental properties

This option is a favorite for a lot of investors. The formula is simple. You buy properties, have tenants living in them, and then collect cash flows from your tenants.

You must decide what size of the property you want depending on how much money you have. You can buy condos, townhomes, single-family homes, or multifamily properties.

It is difficult to deal with angry tenants? Well, you can buy your property, rehab it, and have a manager takes care of it. There are a lot of property management companies in your area. You must remember that they will take a portion of your revenues.

Are you worried about not having enough money to start with? You can always start small. One technique some investors use is house hacking. It works like this: Let’s say there is a duplex for sale next door. You can buy this property, live in one unit, and lease another unit to a tenant.

By using this method, your tenant is paying off your mortgage and some of your expenses. In other words, you are living for free. This is the greatest way to start in real estate investment. You must find a way to live for free if you don’t have enough money. House hacking will be your solution.

3.Flip homes

Maybe you don’t want to do anything with tenants at all. According to you, they are loud, messy, impossible to manage, calling you in the middle of the night, don’t pay on time, and eviction problems come with them.

You are right. If this is the case, flipping homes will be a great choice for you. You buy broken houses; you fix them and sell them to motivated buyers. Sounds simple.

There is a lot that goes into it. It is recommended that you learn as much as you can to tackle some of the projects yourself. You will save money from labor expenses and material costs by fixing these homes yourself.

Your job is to have your properties fixed the best you can at the lowest prices possible as fast as you can. If you don’t know how to flip homes and you don’t want to learn, you will need a very experienced partner or a trusted contractor who will not rip you off. You must get your properties on the market very fast. If you don’t, you will keep paying the mortgage on them from your pocket.

4.Rent out a room

If you are willing to live with one or more tenants inside your house, this could be an option for you. Let us say that you have a house with 4 B3B and your family uses only 2B2B. You have those two bedrooms and 1 bath sitting there. You can outsmart yourself and get a tenant to live in them. This is an effective way of reducing the cost of living and putting money in your pocket.

Even if you don’t own the house, you can still implement this technique in the house you are renting. Let’s assume that you are renting a house of the same size and you are paying $3200 every month.

By having 2 tenants, each one paying $800/mo, your rent will be $1600/mo. You are not living for free, but your rent is slashed in half by applying this simple trick.

The downside of this technique is trust and safety. It is a little awkward and hard for some people to live with complete strangers in the same house. However, if this is not a big deal for you, rent out a room.

5. Become a creditor

None of the techniques we described above works for you? You can become a creditor. By doing so, you are staying away from tenants’ complaints, evictions, market volatilities, etc.

How does it work? Let’s say that you have your money and you want to invest it in real estate. Instead of jumping in the water yourself, you can have another person do it for you.

It is simple. You give your money to a real estate investor, for example, a property developer, and get an interest return. Just remember that you will need the right paperwork with terms and conditions that guarantee the return of your capital plus interest and charges. Your borrower must agree and sign before you hand them the money.

If you can’t find a person you trust enough with your money, consider using online platforms. There are many real estate online platforms that connect investors and borrowers.

Investors receive returns on their investments from borrowers. Keep in mind that the speculation is high, and you pay a membership fee to use these platforms.

You might have to be rich to use some of these platforms. Like, have millions of dollars and over $200,000 of household income. So, this might not be a good option for the average investor who is looking for ways to make ends meet.

Final Words

It is possible to make money in real estate investments. You just need to find one or a few techniques that work for you and stick to them.

Like every investment option available, there are risks worth considering when investing in real estate. Choosing the right investment technique will help you maximize your returns and protect your portfolio from a downfall.