What is return on Investment or ROI?

The return on investment a.k.a ROI is a financial ratio that measures the profitability of an investment in relation to its cost. This ratio tries to quantify how much gain you are receiving for every dollar you spent on investment. The ROI comes in handy when investors are evaluating possible returns from different investments.

A high ROI is directly correlated to a good investment whereas a low ROI indicates that inventors do not gain much compared to the cost of their investments.

In addition, this ratio is also important when comparing two or more different investments, especially in the same sector. A good investment is the one that yields a high ROI.

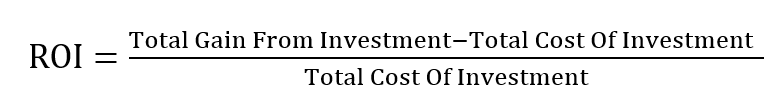

ROI Formula

The return on investment compares the total gains with the total cost. As noted by Calculator.Net, to calculate the return on investment, you will divide the difference between the total gain from an investment and the total cost of investment by the total cost of an investment.

The ROI can be expressed as a decimal or a percentage. To express the ratio as a percentage, you would multiply the result from the above formula by 100.

Example of return on Investment

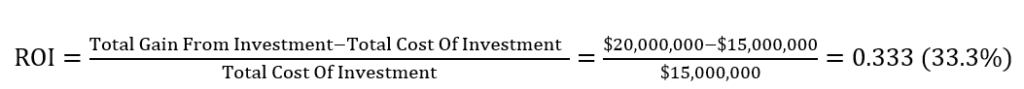

Example 1: Let’s assume that XYZ company had $20,000,000 and $15,000,000 of total gain from an investment and total cost of the investment consecutively. What is the return on investment ratio of XYZ company?

To answer this questions, you would put these two numbers in the above formula. The following is the ROI for XYZ.

From our calculations, we can conclude that XYZ company has an ROI of 0.333 or 33.3%. In other words, for every dollar of investment, the company gained 33 cents.

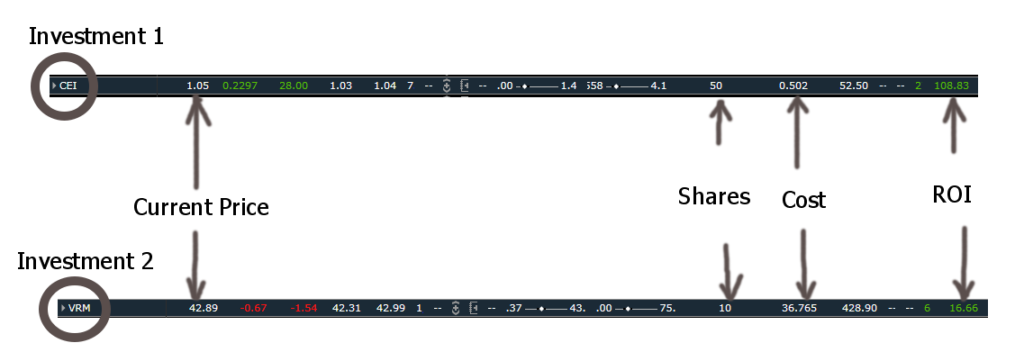

Example 2. Let’s now compare two different investments made in the stock market. Two stocks were bought at two different prices and their returns on investments were compared after some time.

The first investment returned 108.83% whereas the second investment returned 16.66%. In other words, for every dollar invested in each of these two stocks, the first investment returned $1.08 whereas the second investment returned only 0.16 cents.

You can clearly see that investment 1 performed much better than the second investment.

Why does the return on investment matter?

The return on investment ratio evaluates the performance of a company or an investment. A higher return on investment ratio shows that the company/investment generated more returns for every dollar invested. On the other hand, a lower ROI shows that a company/investment generated fewer returns compared to the total cost of the investment.

Investors use this ratio to make a broader assessment of companies, their competitors, or different investments. Strong and stable companies consistently report better ROIs. Weaker and less effective companies report lower or declining ROIs.

More learning resources

- Price-To-Book (P/B) Ratio: What Is P/B Ratio?

- Dividend Payout Ratio And How It Works

- What Is Asset Turnover Ratio? How Does It Work?

- Quick Ratio: What Is Quick Ratio?

- What Is Inventory Turnover Ratio?

- Debt To Income Ratio (DTI): What Is DTI?

- What Is Dividend Yield And How Does It Work?

- Debt To Equity Ratio Or Debt-Equity(D/E) Ratio

- Profit Margin Basics And Definition

- Return On Assets (ROA) Definition

- Accumulated Depreciation Ratio

- Asset Coverage Ratio