Day trading is one of the fastest ways to make money in the stock market. Day trading means that traders buy and sell all shares of stock within the same trading day. Traders who use proper day trading strategies find it quick, efficient, and a profitable way to make money. The downside is that day trading can be the fastest way to lose money in the market.

According to Medium, 80% of day traders lose money in the stock market. As you can see, day trading is not for everyone. Although the fail percentage is high, you can still find yourself among 20% of day traders who succeed.

So, how can you start day trading and make money in a market where most people lose? The answer: You must think and trade like the 20% who succeed.

This article is designed to help the following people:

- People who never traded before

- Investors who never day traded before

- Day traders who have been struggling

- People who are interested in day trading

This article is designed to help you navigate the day trading challenges that destroy novice day traders and experienced ones who never get it right.

Speaking of losing money, I thought you might be interested in learning about why most people lose money in the stock market. The following related article can help. It is very detailed and shows you what you can do differently in order to succeed in the stock market.

>>Related: 14 Reasons People Lose Money In Stock Market

Without further ado, the following are the top 9-day trading strategies for beginners.

1. Learn, learn, and learn

Knowledge is the key to everything. New day traders should learn as much as they can in order to succeed. There are a lot of things to learn in the stock market.

As a new day trader, you should make the following topics a priority.

- How to create a brokerage account

- What stock to trade and why

- Different types of orders (market order, limit order, etc) and how they affect your portfolio

- New traders should know how to use support levels, resistance levels, and how to read candlesticks. Furthermore, day trading beginners should know the basics of trading indicators, patterns, volume, and momentum trading.

- Basics on fundamental analysis: Terms such as earnings reports, earnings per share (EPS), conference call, IPO, secondary offerings, common stock, preferred stocks, financial ratios, etc. come in handy when day trading. This is because markets behave a little differently during earning seasons. Therefore, knowing how stocks behave could increase your chances of succeeding as a day trader.

Learning the basics will not make you a professional day trader. Instead, they will help you get started. For this reason, one of the best day trading strategies is to continue learning and improving your trading methods as you go. The more you learn the better.

>>Related: How To Buy A Stock Step-By-Step

2. Keep up with news

Successful day traders keep up with the news in the market, sectors, and of particular stocks. Your news focus will depend on your trading strategies. A person who likes to trade gapers (gap up and gap down), for example, can scan for pre-market gapers.

Regardless of the methods you use when trading, you should always scan stocks and be prepared before the market opens. Stock screeners are important resources to use when day trading. Day trading beginners should learn how to use stock screeners.

Gapping up does not necessarily mean the stock will rally once the market opens. This is why a trader should know why the stock is gapping up. If the news is good enough, there are chances that it will rally. Otherwise, the stock can experience a major sell-off once the market opens.

Furthermore, it is helpful to know how the market will behave after the opening bell. Stock market futures are great indicators of the general direction of the next day’s trading. For example, if major indexes lost like 2% in points, you would expect the market to experience major sell-offs after the opening.

NOTE: Although futures indicate how the market will most likely behave, the market does not necessarily follow the same trend.

New day traders can also benefit from the news in a particular sector. For example, a major agreement between OPEC members could cause oil and energy stocks to rally. So, knowing this information ahead of time can increase your chances of making successful trades.

Note: Traders should get news from the most trusted and reliable sources. Tips from friends, random social media, etc. should not count as official news about a particular stock or market.

3. Starting Small is a good day trading strategy for beginners

Starting small is one of the most important day trading strategies new traders should use. As a new trader, you don’t understand how markets work, what moves stocks, and how some events affect the market direction. Limited experience is one of the biggest reasons new day traders lose a lot of money.

Starting small does not mean you will need to start with $100 or $500. So, how much is small enough to start with?

The starting amount will vary from one trader to another. For example, $5,000 could be small enough for a person who has a solid savings account, whereas it can be too much for a person with debts or without savings.

Since there is no exact amount you can start with, consider using your risk tolerance when deciding how much to start with.

You need to know the answer to the following questions.

How much money are you willing to lose?

Would your financial situation go south if you start with $500 and lose it all?

What about $1,000, or $5,000?

The amount you can afford to lose will become your appropriate account size to start with. Even if you have a lot of money you want to start with, consider starting with a small percentage of it.

For example, if you have $50,000 you want to day trade with, you can start with 10% ($5,000) and increase it as you go.

Starting with a small account means that your losses will be minimal while you are learning how to play the game.

4. Day trading strategies for beginners: Manage your losses

What do I mean by managing your losses? Well, after buying a stock three things will happen: (1) the price will go up, (2) the price will stay the same, and (2) the price will go down.

(1) The price increases: This will be what you have been waiting for. That is you will be making money. So, you don’t have to worry about it. The only thing to do next is to lock in profits by selling a portion of your shares or selling all of them.

(2) Price stays the same: If the price is not changing, you would have bought a stock that is less liquid (less supply and demand). That is a few shares are being bought and sold. Therefore, it is hard to predict the price’s trend because indicators, patterns, and trading methods will not give you a proper analysis.

For this reason, you will likely lose money on these trades.

(3)The Price goes down: If the price goes down, you will be losing money (assuming that you are taking a long position). So, what would you do?

Are you going to freeze and assume that it will come back up?

Or are you going to sell at some point and get out at a small loss?

If you stay in a losing stock, you will not be managing your losses. This is not a good day trading strategy. The only way to save your account is to exit losing trades with the smallest loss possible.

So, how well can you manage your losses?

This is where loss management methods come in.

Your risk tolerance will help you know when to sell if the stock price moves in the direction you did not anticipate.

Quick Def: Your risk tolerance is the level of loss you can comfortably take without affecting you financially, psychologically, or both.

How much money are you willing to lose on each trade? Before you take any trade, you will need to know this amount and include them in your day trading strategies.

The following are some of the loss prevention methods you can start with when day trading.

- Do not use market orders: A market order means that you are willing to buy a stock at whatever price it is currently trading on. This strategy gives the position size you want faster than any other orders. The downside is that your orders could be filled at a much higher price (a losing price). Paying a premium price prepares you to fail as a day trader.

- Use limit orders: With a limit order, you decide how much you want to pay per share. Your order will not get filled if the price does not reach your limit price. This protects you from paying more than you are supposed to. The downside of this method is that there are chances your order will not be filled, and if they do, you may not get all shares you want.

- Use stop-loss orders: A stock loss order kicks you out of the market when the price goes against you and reaches the limit you set. Should the stock continue to tank? This order protects you from a major loss. The downside is that once triggered, your stop loss will become a market order to sell your shares. That is your shares can be filled at a much lower price than you wanted. Hence locking in a huge loss.

Before you trade any stock, you must know how much you are willing to pay and lose per share. This technique will help you place orders using appropriate order types and manage your losses.

Once you master basic loss prevention methods, you will move to more advanced ones like trailing-stop orders, stop-limit orders, etc.

It is important that you learn how to reduce your losses before you invest too much money in the stock market.

From Estradinglife: You can always have money to trade with if you lose less. However, you cannot make more trades once all your money is lost.

5. Have a good trading platform

Day trading strategies are different from other investment types. People who invest in stocks for the long term focus on fundamental analysis instead of technical analysis. That is long-term investors focus on analyzing companies’ financial reports, their competitors, sectors, economic conditions, etc.

On the other hand, day traders focus on price movement and use using technical analysis techniques. Trading indicators, trading patterns, and other methods such as support levels and resistance levels, volume, trend, etc. come in handy when day trading.

All these methods give you a chance to get in and out of stocks in a matter of seconds, minutes, or a few hours. In order to achieve this trading speed, you need a platform that is designed for day trading.

Most top brokerage firms such as:

- TD Ameritrade

- TradeStation

- Interactive Brokers

- Fidelity

- E*Trade, etc

Offer high-speed trading platforms. Day trading beginners should learn how to use these platforms with the smallest amount possible. It is possible to lose thousands of dollars in one second. So, learn the platform first.

6. Have a plan and stick to it

A plan is like a blueprint of your trades. Each trading plan should include the stock you will trade (Ticker), position size, how much you will pay per share, and exit strategy. In addition, profit-taking strategies, stop loss, and much more should be in the plan.

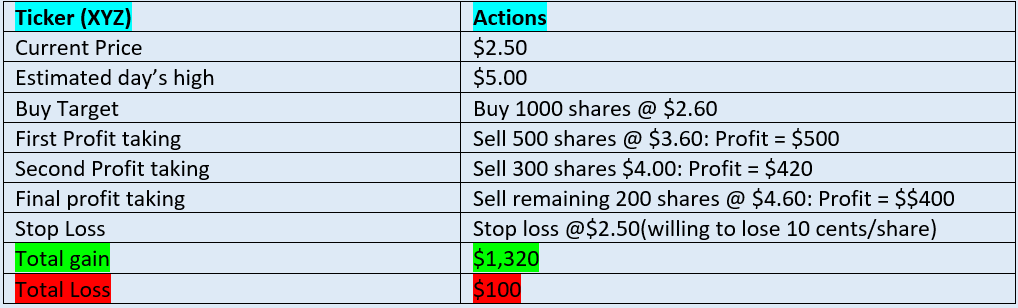

To clarify this strategy we are going to use an example. Let’s assume that a company (sticker: XYZ) has positive news and therefore, it is expected to go up. Due to trading activities in the pre-market, the stock gapped up and it is currently trading at $2.50.

Given the quality of the news, you estimate the price will reach $5.00 or higher. Since you are not certain, you want to get in and out before the stock reaches your estimated high value.

The following is a simple illustration of this day’s trade.

From the table above, you can see that we have included important details about this trade. That is we know how much we are willing to lose on this trade, our entrance, and exit strategies, etc. In total, we are planning to win at most $1,320 if the stock goes up and lose $100 if the price goes down.

Keep in mind that the stock may not follow the predictions we made. For this reason, you must stick to the plan and adjust it as you go. For example, if your indicators show that the stock will not reach your estimated high, you can start taking your profits much earlier.

7. Avoiding penny stocks is one of the most important day trading strategies

Penny stocks are stocks that trade under $5 dollars, by default. These stocks are usually small-cap and respond to market changes faster than mid-cap and large-cap stocks. The following are some of the characteristics of penny stocks.

- Trade under $5 dollars

- Low market capitalization (market-cap)

- High bid-ask spread

- Highly volatility

- Less liquidity

- Highly sensitive to news

- Poor management

- Susceptible to manipilation

All these characteristics make penny stocks the riskiest stocks you can trade.

Good news can send a penny stock to the moon. This could double or triple your return on investment. On the other hand, bad news on a penny stock can bring it to almost zero. That is you could lose your investment on a single trade.

Traders who are not experienced should avoid penny stocks. Instead, they should trade large cap stocks.

High capitalization stocks are less volatile, less affected by the news, well managed, and therefore, less risky.

8. Start with paper money

One of the best day trading strategies is to start with paper money. Paper money accounts let you make trades using fake money. The investments in these accounts mimic real trades. By using this technique, new day traders build experience for free.

Furthermore, a paper account will give you a chance to mess up. That is making mistakes and correcting them without using your hard-hard earned money.

Websites like Investopedia provide free paper accounts. In addition, some brokerage accounts offer an option to trade with paper money.

>>Related: Brokerage Account: Everything you need to know

9. Day trading strategies: Avoid emotions

Here comes your greatest day trading enemy: Emotions. Many people lose money not because they took losing stocks.

Instead, they trade with a lot of emotions. As a result, they end up losing too much money in the stock market.

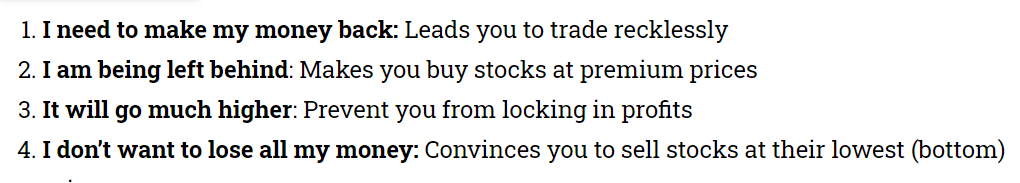

The following are some of the emotions you will face when day trading.

These emotions hinder your ability to make profits.

This is how it goes. After buying a stock, a panic attack kicks in and people start sweating. Then, they start thinking about losing money on a trade, making more than they thought, etc.

These thoughts come into their minds.

- I can make a ton of money if it continues to go up. So, they stay in a position and end up losing gains they already had.

- I just lost my gains but I know it is going to go back up. So, they continue to hold the stock even if it is losing them money. The longer they hold it, the more money they lose.

- If I add more money in the stock, I will make a ton: So, they increase their position sizes and put an entire portfolio in one stock. Sounds like the fastest way to go bankrupt.

- I can no longer bear the pain. After losing like 70% of their positions, they sell. Who sells at a 70% loss? Only losers do. Yes, they hit the SELL button after a stock hits the bottom. Hence locking a huge loss.

- I am going to stay in and sell it tomorrow: Since it went down today, I am going to stay in. I know for sure it will go up tomorrow. What happens the next day? The stock plunges more. A losing day trade turns into a disastrous swing trade.

One of the most important day trading strategies is to avoid emotions. With fewer emotions, you will be able to take a position at the right time, lock in profit, and more importantly, manage your losses.