How do I check my credit score? Your credit score is probably one of the most important numbers in your life. It will determine your worthiness to credit and how much you are qualified for.

In addition, your credit score will be used to determine the interest rate on your mortgages and loans. Furthermore, your score can help you get into your new apartment without paying a deposit.

Knowing your credit score will help you decide adjustments you need to make on your finances before a major purchase.

For example, if you want to buy a house; you will need to bring your credit score into an acceptable range (620-850) to qualify for a mortgage. This is the range you need for a conventional mortgage. Other loan types such as FHA Loan can accept a lower credit score such as 580.

The bottom line is: The higher your credit score, the better.

Related article 1: Why is a credit score important?

Related article 2: Credit score chart

Now that you know the importance of your credit score, it is time to answer the following question. How do you check your credit score?

In this article, we are going to help you learn methods you can use to check your credit score.

1. Check your credit card/bank statements from your banks or financial institution

Because of high competition in the credit card business, some banks and financial institutions provide credit score information for free on statements.

Some banks and institutions do not include your score on your statement due to privacy concerns. If yours does not include your credit score, you can always use other methods to know your score.

2. Find your credit score from your credit card provider account

To attract and retain customers some financial institutions waive fees on credit score information. This means that you could have access to your credit score for free from your account. You must be a customer of these institutions and you will need to have an online account.

To know your credit score, log into your account, and follow instructions in your account.

For example, you will follow the following steps to get your credit score if you use Discover.

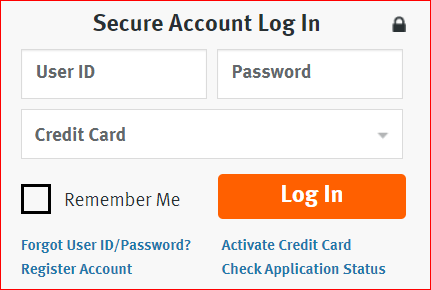

- Go to discover.com

- Log into your account using your username and password.

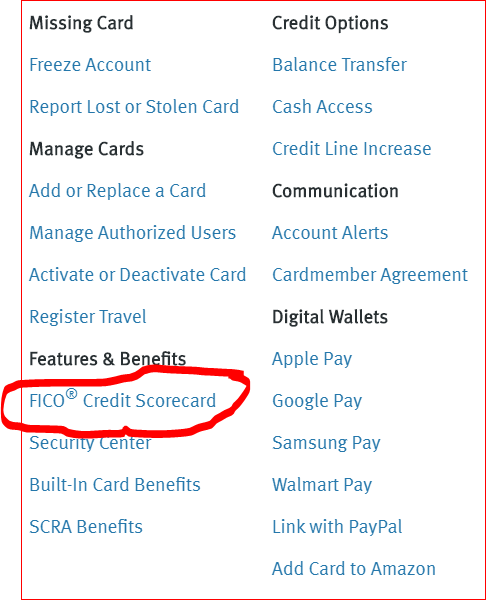

After logging into your account, click on Manage. Under Features & Benefits, click on FICO Credit ScoreCard.

This will take you to your credit score page where you will learn how your financial activities have been affecting your credit score.

If you do not use Discover, you can follow the steps provided by your credit card provider in your account.

Note: Not all banks and financial institutions provide this information to their customers. If they do, they may charge you a fee in order to access this information. Always check with your company and learn how its terms and conditions will affect you when you check your credit score.

3. Purchase your credit score from one of the 3 major credit reporting companies

There are three main credit reporting companies and they are listed below.

Each of these companies will give you a free copy of your credit report once in 12 months, according to the Federal Trade Commission (FTC).

Your credit report will summarize your financial activities as they are reported by businesses you interacted with. For example, if you had a mortgage, a car loan, a credit card, etc; your payment history or missed payments will be in the report.

If you find errors in your report, you can dispute them and have them corrected.

Please, learn more about credit reports and how you can apply for one from the following related article.

Related article: Credit Report Overview

You must understand that your free report will not include your credit score. This service is not included.

However, you can buy a copy of your credit score from these companies. It is possible that you can get a free score from these companies if you decide to become a member.

Your membership on one of the reporting companies may include a free copy of your credit score.

Make sure that you read and understand what is covered before you sign up for their memberships.

4. You can use free online credit score service websites

Last but not least, there are some websites that provide free credit score information to their members or anyone who can create an account with them.

A good example is CreditKarma. You do not have to buy memberships or pay fees to access your credit score information. The only thing you need to do is create an account.

There are other websites that provide free credit scores. You just need to do your homework.