What is the payables turnover ratio?

The payables turnover ratio is a financial metric that measures how efficiently a company pays its accounts receivable during a particular period of time. A higher ratio shows that a company is efficient whereas a lower ratio shows the opposite.

What are accounts payable?

Accounts payable are money that a business owes its suppliers or vendors. A company can pay its suppliers and vendors using two methods: (1) paying with cash and (2) or credit.

- (1) Cash: When a company makes a full payment with cash, the sale will be final. That is there are no further dealings between the business and the vendor about that transaction unless the business gets into extra purchase agreements with the vendor.

- (2) Credit: If a company decides to pay in the future, the vendor will extend credit to the business. The vendor will then record this future payment on its balance sheet as an asset under the accounts receivable section. The business that purchased products from the vendor on credit will record this credit as account payable under the liabilities section of its balance sheet.

This means that the company must pay this amount at a pre-determined date. In addition, the terms and conditions that govern the sale must be followed to avoid fees and charges. Furthermore, if the company fails to pay its accounts payable to its vendors, the balance can be sent to a collection firm.

The ratio at which a company pays off its accounts payable is called the payables turnover ratio a.k.a accounts payable turnover ratio.

How to calculate the accounts payable turnover ratio?

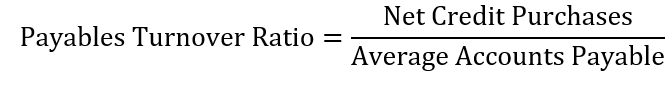

The payables turnover ratio is calculated by dividing the net credit purchases by the average accounts payable [Credit: Accounting Tools].

In this formula,

Net Credit Purchases = Total purchases made -(discounts received + returned goods+ allowences made) [Credit: Wiki Accounting]

Average accounts payables = Accounts that are expected to be paid within an operating cycle, usually one year.

Example of payables turnover ratio

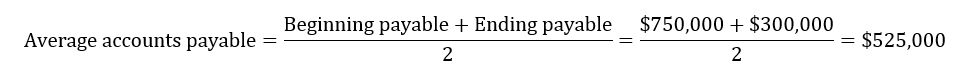

Let’s assume that XYZ company reported $750,000 and $300,000 beginning and ending accounts payable respectively. At the same time, the company reported $3,000,000 in net credit sales. What is the payables turnover ratio?

To answer this question, we will use the following steps.

Step 1: Available data

- Beginning accounts payable = $750,000

- Ending accounts payable = $300,000

- Net credit purchases = $3,000,000

If you don’t know how to calculate the average, please, refer to the following related article.

>>Related article: Average: What Is The Meaning Of Average?

Step 2: Calculate the average accounts payable

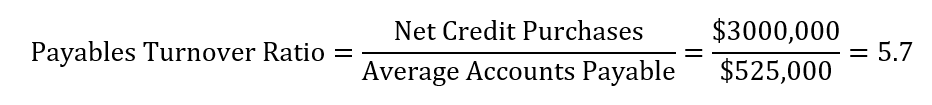

Step 3: Calculate the payables turnover ratio

At this time, we have all numbers we need to calculate the ratio.

From our calculations, we can conclude that the accounts payable turnover ratio of XYZ company is 5.7. In other words, the company paid its accounts payables 5.7 times during its operating cycle.

How to interpret the payables turnover ratio?

The accounts payable turnover ratio represents the number of times a company paid its accounts payable within an operating cycle. The operating cycle is usually one year for many businesses.

A higher ratio indicates that the company paid its suppliers with efficiency. On the contrary, a lower ratio indicates that the company was not efficient in covering its accounts payables.

This ratio plays an important role when suppliers and vendors are estimating how risky a company is.

You can compare this ratio to a credit score for consumers. Before moneylenders approve you for a loan, they will need to know if you will be able to pay them back. This is why the lender will want to know your credit history and credit score.

The same happens for businesses. A supplier will not let a business take its products on credit unless he knows that the business will be able to make full payment no later than the due date. A payables turnover ratio can be used to estimate a company’s creditworthiness. The higher the ratio, the less risky a company becomes.

More learning resources

- Receivables Turnover Ratio Definition

- Price To Earnings (P/E) Ratio: What Is P/E Ratio?

- Price-To-Sales (P/S) Ratio: What Is P/S Ratio?

- Price-To-Book (P/B) Ratio: What Is P/B Ratio?

- Dividend Payout Ratio And How It Works

- What Is Asset Turnover Ratio? How Does It Work?

- What Is Inventory Turnover Ratio?

- Quick Ratio: What Is Quick Ratio?

- Debt To Income Ratio (DTI): What Is DTI?

- Current Ratio: What Is The Current Ratio?