Are you looking for ways to increase the credit limit on your credit cards? If so, you have come to the right place. Being stuck with a small credit line is not fun especially if you conduct a lot of activities that could bring you cash backs.

Even if you may not spend all your credit limit, it gives you a sense of security knowing that you have money that could be used when needed. There are many strategies you can use to increase your line of credit. These strategies will cost you nothing and take no time at all.

Before we discuss ways to increase your credit limit, let’s see what a credit limit is.

What is a credit limit?

A credit limit is money the card provider(lender) will allow you to spend on a credit card. For example, a credit card with a $1,200 limit means that you can spend at most $1,200. After spending this amount, you must pay some of it off before you can use the card again.

Credit limits vary from one card to another and from one borrower to another. That is a person who used cards before with a good credit history and credit score could qualify for a high limit than a new borrower.

Your credit limit will be fixed for a while as the lender evaluates how trustworthy you are. Your payment history and credit usage will play the most important role when judging you. Other financial factors such as bankruptcy, foreclosure, applying for more loans, age of credit, etc. will affect your lender’s judgment.

After some time, you will be qualified for a credit limit increase. If you do not submit a request about the increase, some card providers will increase your line of credit automatically.

In this article, you are going to learn ways you can use to increase your credit limit.

How to increase credit limit?

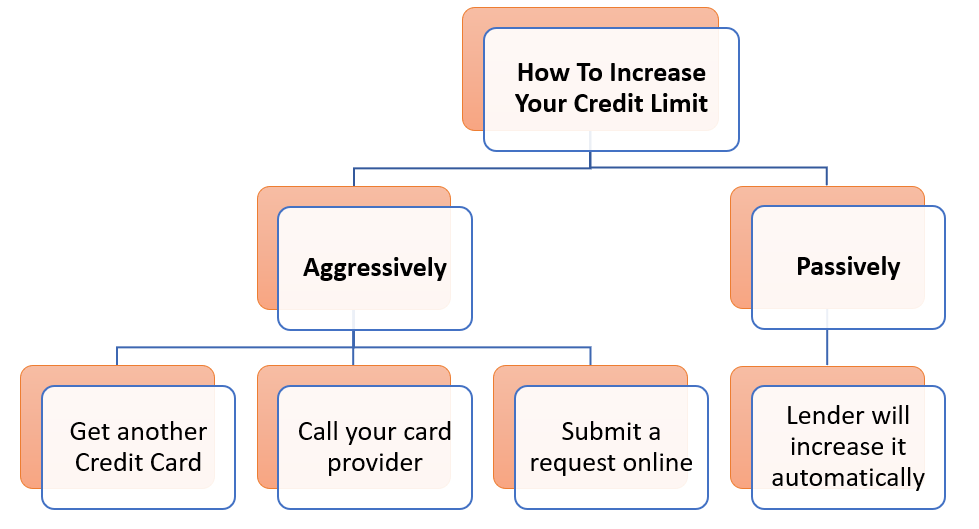

When it comes to increasing your credit limit, there is a number of strategies you can use to make it happen. These strategies can either be passive or active.

A passive increase is nothing other than playing the long game. With this strategy, you sit tight and do nothing. After using your credit cards for a while, your lender will evaluate how effectively you use them and your payment habits. If you have been a good borrower, the lender will automatically increase your credit limit.

An active strategy is when you take matters into your own hands. Instead of waiting for the card provider to increase your credit limit, you ask your lender to increase your limit.

The following chart summarizes tips you can use to increase credit card limit

- Call your card provider: The fastest way you can get a credit limit increase is by calling your card provider. The card provider will let you know if you are qualified for a limit increase or not. More importantly, you will know how much your new limit is going to be without waiting. In case you get denied a line of credit increase, you can ask them what you must do to qualify.

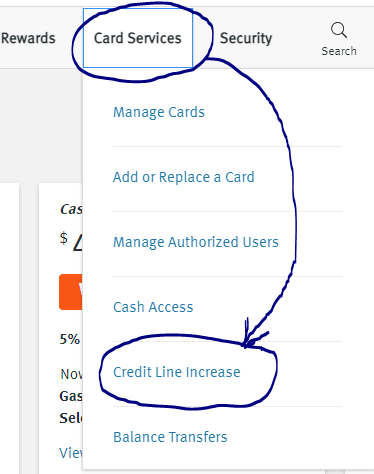

- Submit a request online: Most credit card providers have a service where a borrower can request a credit limit increase. You just need to log into your account and follow the credit limit increase steps. The process is simple, straightforward, and you can usually find it under Card Services for most lenders. Yours could be found under a different tab depending on the design of the website.

- Get a new card: A new card will come with its own credit limit which will add to what you already have. Hence, increasing your credit limit. Keep in mind that applying for a new card will end up in a hard inquiry. A hard inquiry will lower your credit score by a few points.

- The lender will increase your limit automatically: After proving that you are a responsible and trustworthy borrower, you will more likely receive an automatic credit card limit increase. It takes a while for lenders to automatically increase your credit limit.

Related: 9 Things to know before getting a credit card

Things to consider before applying for a credit limit increase

Borrowing more money comes with more responsibilities. To avoid getting into more debt, you should consider evaluating your income and spending habits. Credit cards are some of the worst debts anyone can accumulate.

This is because they come with an interest known as the annual percentage rate (APR) expressed as a percentage. Credit cards APRs are some of the highest in the lending industry. As noted by Wallethub, the average APR for new users is 17.87% which is too much compared to other industries. So, borrowing more money from your card provider could put you in more debt quicker than you anticipated. So, before increasing your credit limit, think twice.

The following tips can help you know if you are ready for more debt.

- Check your income: Make sure that you make enough money to cover all debts you are accumulating.

- Make a budget: Have a monthly budget that will help you pay your credit card balance. The best way to use credit cards is to pay off all credit balances before the due date. This will prevent you from paying an APR on the outstanding balance.

- Do not increase your limit if you can’t manage your spending habits: Credit cards are not good for people who spend a lot. If you cannot manage your spending, avoid getting more credit cards or a credit limit increase. Millions of people are in debt because of credit cards. If you are not in debt already, good job and don’t get in it. If you are in debt already, it is not too late. Instead of focusing on how to increase your credit limit, focus on how to paid off what you already spent.