Having a good credit score is essential to getting approved for a mortgage. Credit score affects mortgage rate due to its role in demonstrating the risk of lending you money. Lenders use your credit score to assess your creditworthiness, which is a measure of your ability and willingness to repay your debts. Generally, a good credit score indicates a history of managing your financial obligations well, implying a lower risk for the lender. As a result, lenders offer you a lower mortgage rate.

A bad credit score, on the other hand, indicates a higher risk of lending you money. To offset this risk, lenders charge you a higher mortgage rate. Besides affecting the interest rate you pay on your mortgage, your credit score is also used to determine your eligibility for the loan. For example, you need at least a 620 credit score to qualify for a conventional loan. To secure a lower mortgage rate, you need at least a 740 credit score when you apply for a home loan.

Here is everything you need to know on how credit score affects your mortgage rate.

What is a credit score?

A credit score is a three-digit number that ranges from 300-850. The higher your credit score is in this range, the lower the interest on your mortgage will be. On the other hand, the lower your credit score gets, the higher the mortgage rate you will pay.

Credit score affects your mortgage rate as it is used to assess your creditworthiness. Your credit score represents a summary of your past and current credit account activities which sheds light on your financial habits. That is why lenders look at your credit score when you apply for a mortgage.

Related: How to get an 800 credit score the easy way?

What is a mortgage?

Before I show you how credit score affects your mortgage rate, let’s cover the basics of mortgages.

In summary, a mortgage is a legal agreement between you and your lender.

The agreement states that the lender has given you money in exchange for a lien on your property. Also, the loan balance must be paid in full including interest charges and applicable fees.

Lenders use your credit score to determine your mortgage rate. If you have a good credit score or better(700+ credit score), you will qualify for a lower mortgage rate. Having an excellent credit score(800 and higher) makes you a prime borrower, and therefore, qualify for the lowest interest on your loan.

You can get a mortgage from your local bank, credit union, or online lending institutions. A mortgage is an installment loan which means you make equal monthly payments based on your amortization schedules. Most mortgages come with a 30-year fixed rate or a 15-year fixed term. Some lenders, however, have options for a 20-year fixed rate or a 10-year fixed-rate mortgage. You can also have an option for an adjustable-rate mortgage which means the interest you pay will increase or decrease based on market rates.

Failure to pay your mortgage leads to default and eventually foreclosure if you don’t take action. Similar to other loans, you can refinance your mortgage to get better rates especially after rates have gone lower or after improving your credit. ‘

Related: How to get approved for a mortgage?

What is a mortgage rate?

A mortgage rate is the interest rate a loan company charges you on a home loan. Mortgage rates can either be fixed where the interest you pay is fixed for the duration of the loan or variable which means the interest you pay changes over time.

Most consumers choose a fixed interest rate as it allows them to predict their monthly payments for the duration of the loan. To determine your mortgage rate, the lender uses many factors mainly your credit score. Market rates also affect the interest you pay on your loans. Even if you have a perfect credit score, the lender will not approve you for a mortgage rate lower than market rates. Having such an excellent score, however, will make you a prime borrower and you will qualify for the lowest interest rate.

The principal, interest, tax, and insurance make up your monthly payment with the interest taking up the biggest chunk of your payment in the first few years. The interest starts higher and gets lower over time through amortization schedules.

As of March 25th, 2024, according to Bankrate, the national average mortgage rate for a 30-fixed rate is 6.96% while the 20-year mortgage rate is 6.82%. The 15-year fixed rate is 6.47% while the 10-year fixed rate is 6.40%.

Mortgage rates fluctuate over time based on market rates set by the Federal government in response to economic conditions.

How does a credit score affect your mortgage rate?

The credit score affects your mortgage rate, the amount you qualify for, and your approval rate. Having a good credit score qualifies you for a lower mortgage rate while a lower credit score comes with a higher interest rate. As your credit score goes lower, your approval rate also diminishes to a level where you cannot qualify for a loan until you have improved your credit.

Credit score requirements usually defer from one type of loan to another. Some loans require a higher credit score while others are lenient on their credit score requirements.

For example, if you want a conventional mortgage, you will need a minimum credit score of 620 and a down payment of 20%, according to Rocketmortgage. If you don’t have the 20% down payment, you must purchase private mortgage insurance(MPI). You will not qualify for a conventional loan if you don’t have a 620 credit score. In this case, you can either rebuild your credit or try other forms of loans such as an FHA loan, VA loan, or USDA loan. These loans come with a much lower credit score and are easy to qualify for.

For example, FHA loans require a 580 credit score if you only have a 3.5% down payment or a 500-570 credit score if you have a 10% down payment.

Extra credit score tips:

- 13 things to do if you get denied a personal loan

- How to Raise Your Credit Score in 30 Days?

- What factor has the biggest impact on credit score?

Example of how the credit score will affect a mortgage rate.

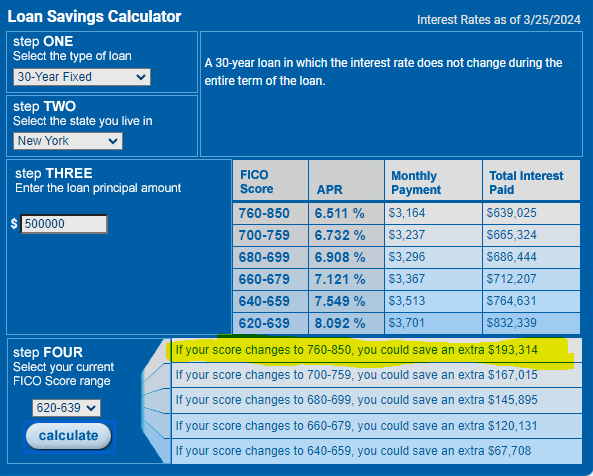

Let’s assume that you want to borrow $500,000 to buy a house and reside in New York. With a simple online calculator, I will show you how having different credit scores will impact the mortgage rate on your loan. I will also assume a 30-year fixed-rate mortgage since it is the most common mortgage term on the market.

The table below will show you how your mortgage rate will change based on different credit scores. These calculations were compiled using myFICO calculator.

From this example, let’s see how your credit score affects your mortgage rate and how much the extra interest rate will cost you. We will assume your credit score is between 620-639 and see how much your savings will be if your credit score goes higher.

If your credit score is between 620-639. The mortgage rate will be 8.092% which is too high compared to the national average rate of 6.96%. Due to this high mortgage rate, your monthly payment will be high due to higher interest charges.

How does having different credit scores affect your mortgage rate?

How will your mortgage rate change and how much will your savings be?

If your credit score increases to 660 and 679, the mortgage rate will drop to 7.121% which is a reduction of about 1%. This is a huge rate reduction and you will save $120,131 during the duration of the loan term.

If your credit score increases between 700-759, your mortgage rate will drop to 6.732% and you will save $167,016 in interest charges. Instead of paying $832,339, the home will cost you $665,324.

What if you could increase your credit score and reach 760 to 850? In this case, your mortgage rate will drop to 6.511%. With this mortgage rate, you will save over$193,314 in interest charges. Instead of costing you $832,339, the house will cost you $639,025. By increasing your credit score, you can save almost $200,000 in mortgage interest charges.

How does a higher credit score lower your mortgage rate?

Since all lenders worry about losing money due to loan defaults, you pay a higher interest rate when you have a low credit score. With a low credit score, the risk of defaulting on your loan increases. As a result, lenders charge you a higher interest rate to offset the risk.

On the other hand, a high credit score indicates that you are responsible, pay your bills on time, and respect the terms of your loans. A high score also shows that you don’t have too much debt. For this reason, the risk of lending you money goes lower. As a result, you get rewarded for having a good credit score as lenders compete to lend you money.

The credit score and interest rate move in opposite directions. As your credit score goes higher, the risk of lending you money goes lower and lenders compete to lend you money. On the contrary, the mortgage rate you pay increases as your credit score goes lower until you cannot qualify for a loan.

How does my credit score affect getting a mortgage?

Simply put, your credit score reflects a summary of your credit history and financial reliability. Most lenders use credit scores as a screening factor on loan applications. Your credit score can determine if you can get approved for a mortgage. If your score is too low, lenders will deny your mortgage application due to carrying too much risk.

If you have a higher credit score usually above 740, your loan application gets approved easily and for better mortgage rates. By paying a lower interest rate, your monthly payment decreases which saves you thousands of dollars in interest charges.

Besides being a deciding factor in your loan approval process, your credit score can also impact the amount you can borrow. Some lenders use your credit score to set up the loan limit. A higher credit score can lead to a bigger loan, while a lower score might restrict how much money you can borrow.

You might also like: Why does your credit score go down when you pay off a loan?

What is a good credit score to buy a house?

While different types of mortgages come with different credit score requirements, having a good credit score when buying a house gives you a competitive advantage. To qualify for a lower interest rate and get approved for a mortgage fast, have a 740 credit score or better. Why 740? Being in the mid and upper 700 credit score puts you in the second-best range of borrower. Most lenders expect you to be in this range if you want to be approved faster and qualify for a lower rate.

If you don’t have a 740 credit score, you can still get approved for a loan but you might pay a higher interest rate. Most loans require credit scores as low as 620 except for jumbo loans which usually require at least a 640 credit score.

You might also like: Get a 700 credit score in 7 simple steps

How much will your credit score go down after buying a house?

When you buy a house, your credit score goes lower in the short term due to hard inquiry and extra debt on your credit profile which increases your debt-to-income ratio. A hard inquiry appears on your credit reports when a lender views your credit profile which lowers your score by 5 to 6 points on average.

After buying a house, more debt will be reported on your credit report. An increased debt means your creditworthiness has also gone lower. As a result, your credit score might drop by a few points. Additionally, getting a mortgage might lower the age of your credit which accounts for 15% of your credit score.

Summing all these factors together, your credit score can easily drop about 15 points after buying a house. According to a new study by LendingTree, your score can slide as many as 40 points after buying a house.

More credit score tips

How to get an 800 credit score the easy way?

Get a 700 credit score in 7 simple steps

Will my credit score go down when I make the minimum payments?

How can I add a link to my website from a Joomla website?

Thank you for stopping by. Please, refer to the following link on how you can add a link from Joomla to your website.

Link: https://estradinglife.com/how-to-add-a-link-from-another-website-to-my-blog-post-in-wordpress/