What is debt to income ratio?

The debt to income ratio or DTI for short is the ratio between your monthly debt expenses and your gross monthly income. Moneylenders use this ratio to determine how much your expenses are and your likelihood to pay off your debts.

Your DTI increases as your debt increases. In order words, there is a threshold value where your income cannot be able to pay off your expenses. This is why borrowers with high DTI ratios are considered risker by moneylenders.

If your DTI is equal to 1 or 100%, it means that your gross income is equal to your monthly debt expenses which implies that you are not saving any money at all. In addition, you are more likely to get into financial trouble if you don’t improve your financial situations. To improve your DTI ratio, you would need to reduce your debt and increase your income.

>> MORE: How To Get A Raise Or A Promotion At Work?

A debt to income ratio that is less than one implies that you are making more money than your monthly debt expenses. It is always a good idea to spend less than you make. Financially independent individuals always spend less than they make. The extra money is used for saving or for investments.

When your DTI is greater than one, you are already in financial trouble. This means that you are spending more money than you make. As a result, it will be difficult for you to get approved for loans and mortgages.

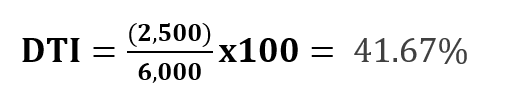

Formula of debt to income ratio

Where,

DTI = Debt to income ratio

To use the DTI formula, you can use the following steps.

Step 1: Calculate your total debt expenses which will include but not limited to the following:

- Total rent or mortgage payment

- Other loans such as car loans, tuition, etc.

- Credit card payments, etc.

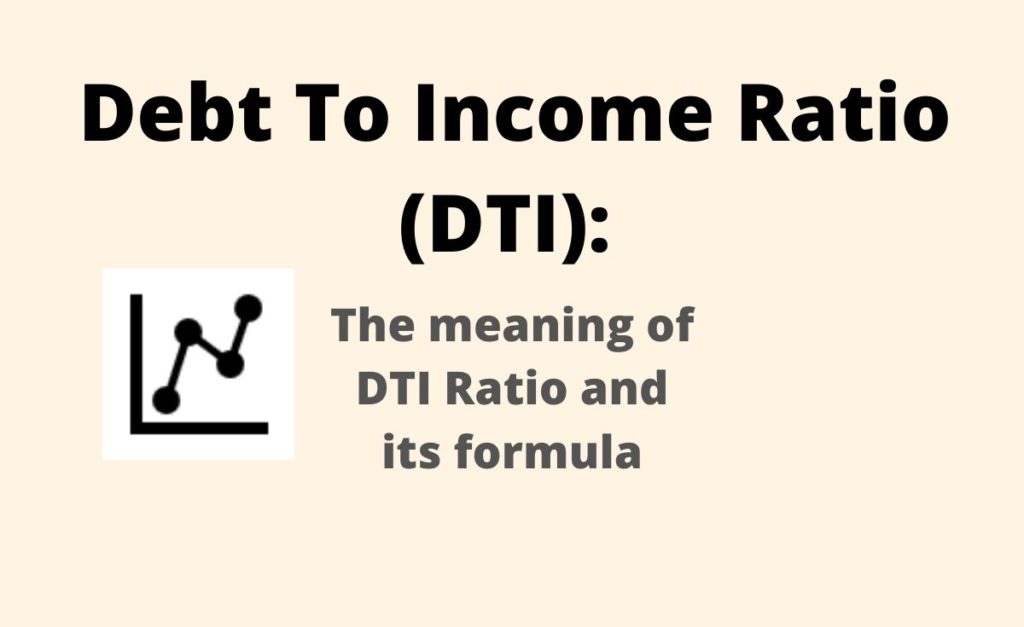

Let’s assume that your total monthly debt payment is equal to $2,500. Now we will move to the next step.

Step 2: Let’s find your monthly gross income. Your total monthly gross income will be the sum of all your incomes before taxes. Let’s assume that your gross income is equal to $6,000.

Step 3: Divide the number you find in step 1 by the number in step 2 and then multiply by 100, to calculate your DTI.

In our example, the