What is cash ratio?

The cash ratio is a financial ratio that measures the company’s ability to pay off its short-term liabilities using only the most liquid assets. The most liquid assets count for cash and marketable securities that can be converted into cash in a matter of days.

How to calculate the cash ratio?

As the name suggests, you will need available cash, marketable securities, and current liabilities. In other words, the cash ratio is the ratio of cash and marketable securities to the total liabilities.

In this formula,

Marketable Securities = Assets that can be converted to cash the fastest. Example of marketable securities includes but not limited to common stocks, proffered stocks, bonds, short-term bonds, etc. [Credit: Investopedia].

It is important to not confuse cash ratio with similar ratios such as quick ratio and current ratio. All these ratios measure the company’s ability to cover its current liabilities. The only difference comes from assets used in their computations.

Quick ratio: Uses the sum of cash, marketable securities, and accounts receivable. The sum is then divided by current liabilities. That is the only difference between these two ratios is that the quick ratio uses accounts receivables. Receivables are considered quick assets since they can be converted into cash fast usually within a year. However, they (receivables) cannot be liquidated as fast as marketable securities.

Current Ratio: Current Ratio uses the sum of cash, marketable securities, accounts receivables, and unsold inventory. The sum is then divided by current liabilities. You can see that the only difference between the two ratios is that the current ratio includes receivables and unsold inventory. These two variables are less liquid.

Example

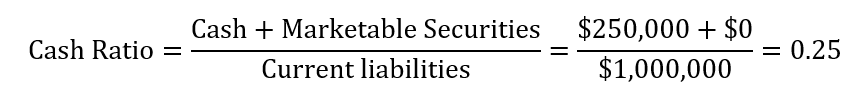

Let’s assume that XYZ reported a cash reserve of $250,000 and has no marketable securities. Also, the company’s current liabilities equal to $1,000,000. What is the cash ratio for XYZ company?

To answer this question, we will use the following steps.

Step 1: Available data

- Cash = $250,000

- Marketable securities = $0

- Current liabilities = $1,000,000

Step2: Calculate the ratio using the formula above

From our calculations, we can conclude that XYZ company has cash that can cover 1/4 of its current liabilities. That is the company must find other financing options to cover $750,000 of current liabilities.

How to interpret cash ratio?

This shows the company’s ability to cover its current liabilities. The more cash a company has, the easier it will be to cover these financial obligations. For this reason, the higher ratio the better.

A low ratio like the one we calculated in our example, will indicate that the company does not have enough cash to cover its short-term liabilities. This could be detrimental based on the nature of these liabilities.

A mediocre ratio can also prevent a company from raising more capital. This is because investors and business institutions lend money to companies with the highest chance of paying it back. If a company is struggling to cover its current debt, why would lenders take a chance on it?

More learning resources

- Payables Turnover Ratio Definition

- Receivables Turnover Ratio Definition

- Price To Earnings (P/E) Ratio: What Is P/E Ratio?

- Price-To-Book (P/B) Ratio: What Is P/B Ratio?

- Dividend Payout Ratio And How It Works

- What Is Asset Turnover Ratio? How Does It Work?

- Price-To-Sales (P/S) Ratio: What Is P/S Ratio?

- What Is Inventory Turnover Ratio?

- Quick Ratio: What Is Quick Ratio?

- Current Ratio: What Is The Current Ratio?