What is fixed asset turnover ratio?

A fixed asset turnover ratio is a financial ratio that measures a business’s ability to generate sales from its fixed assets, according to The balance. Fixed assets are tangible, mobile, or static and include properties, plants, or equipment such as cars and heavy machinery.

A higher ratio means that the company uses its fixed asset to generate revenues. A lower ratio, on the other hand, shows that the company does not use its fixed assets wisely to generals sales. As a result, this could be a red flag for investors.

It is possible that a company can put too much money into acquiring fixed assets which in turn lowers its short-term fixed asset turnover ratio.

How to calculate the fixed asset turnover ratio?

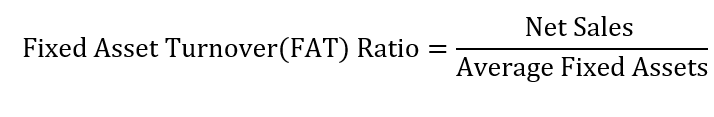

This ratio compares sales in relation to fixed assets. In other words, to calculate the fixed asset turnover ratio, you will divide the net sales by the average fixed assets, according to the Strategic CFO.

Investors must understand that all assets (except land) experience depreciation over time. For this reason, the depreciation factor must be considered when calculating the value of assets.

Example

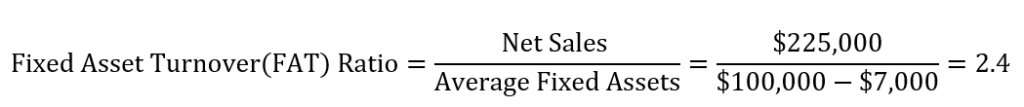

Let’s assume that company XY reported net sales of $225,000 on its income statement. At the same time, it reported an average fixed asset of $100,000 and a depreciation of $7,000. What is the fixed asset turnover ratio?

To answer this question, we will use the following steps.

Step 1: Available data:

- Depreciation: $7,000

- Net sales = $225,000

- Average Fixed Assets = $100,000

Step 2: Calculate the ratio

From our calculations, we can conclude that for every dollar the company invested in fixed assets, it generates $2.4 in net sales.

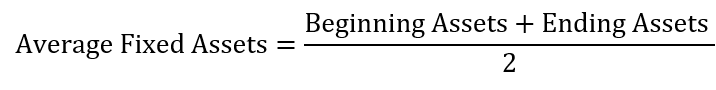

The average fixed assets can be computed using the beginning and ending assets balances.

If you want to learn how to calculate average, please, refer to the following article.

>> MORE: Average: What Is The Meaning Of Average?

Why does the fixed asset turnover ratio matter?

This ratio tells investors how efficiently a business allocated its fixed assets to generate more sales. The more sales a company makes from its fixed assets the better.

For example, if a business spent millions of dollars to acquire an industrial plant, investors will expect a meaningful return on investment from the purchase.

A higher return on assets shows that the management team uses the company’s fixed assets to optimize sales. On the other hand, a lower ratio signal troubles and potential loss of capital on these assets.

Furthermore, investors use this ratio to compare companies in the same sector. That is a company that generates more sales from its fixed assets will stand out from competitors with mediocre ratios.