Are you trying to rebuild a bad credit score? It takes a long time, patience, discipline, and hard work to turn a very bad score into an excellent score. Many people don’t even try to rebuild their scores because they don’t know where to begin. If you have been struggling with a bad credit score, you have come to the right place.

In this article, I am going to give you the ultimate guide to rebuilding a bad credit score.

What is a credit score?

Most people don’t know what a credit score is and they learn about it when their mortgage applications are rejected.

So, what is a credit score?

A credit score a.k.a FICO score is a number that ranges from 300 to 850. This number summarizes your borrowing habits, how you use the money you borrowed, and more importantly, how you pay it off. Moneylenders such as banks, credit unions, and other private lending institutions use this number to determine your creditworthiness.

If your score is bad, it will be difficult for your to qualify for a loan or a mortgage. A bad credit score means that you are not a responsible borrower, and therefore, you should not be trusted with money. If you borrowed money in the past and failed to pay it off, why would lenders trust you now? You see, your score is so important that you may not be able to qualify for a loan until you rebuilt it.

Moneylenders prefer borrowers with a good credit score. What is considered a good score will differ depending on the types of businesses you are dealing with. This is why it is difficult to say that one number is good enough and that is what you should shoot for when rebuilding your credit score. The closer you get to 800 the better.

The point here is that 300 is the lowest score you can have. With this score, you cannot qualify for anything. Even a homeless with zero education cannot lend you money. That is how crazy it gets with credit scores.

On the other hand, the highest score you can get is 850 and it is considered a perfect score. If yours is not 850, do not beat yourself up. Only a handful of individuals have this score. As reported by NASDAQ, only 1.2% of Americans have a perfect score (850). This shows you that it is almost impossible to get a perfect score, and therefore, it should not be your focus when rebuilding your score.

Learn More: What is a credit score and how does it work?

What is a good credit score?

To understand the meaning of a good credit score, we need to know how credit scores are grouped. To make it easy, credit score ranges are grouped into smaller ranges. A combination of all credit score ranges from the credit score chart.

If you want to learn more about credit score ranges in detail, refer to the following article.

Related article: Credit score chart

The following are credit score ranges.

- Very bad: 300-579

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Exceptional: 800-850

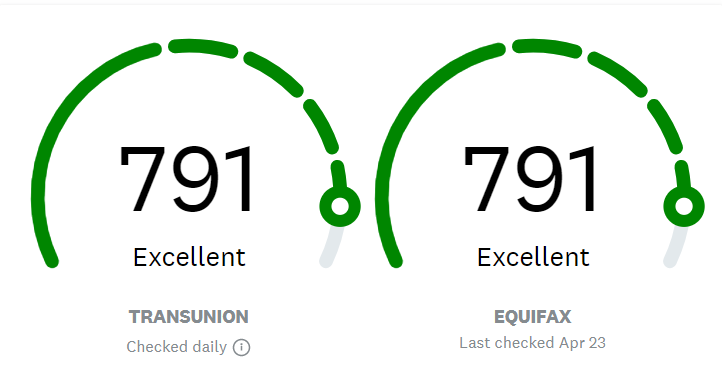

Keep in mind that these ranges vary from one reporting company to another. There are three many credit reporting companies (Equifax, TransUnion, and Experian) in the USA. Since they use different algorithms and give different weights to different aspects of your financial activities, your score will differ from one reporting company to another. For example, TransUnion and Equifax show the same score for this person.

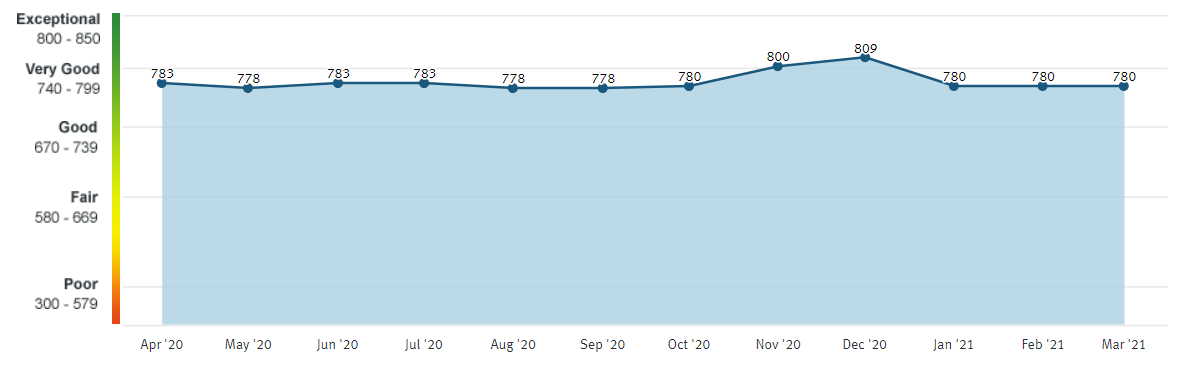

On the other hand, the credit score reported by another company is different for the same person. The following chart (from Discover) shows how our candidate score is different compared to the above score reported by Equifax and TransUnion.

Even if the credit score seams different depending on the provider, the numbers are always close enough.

In my opinion, the difference between credit score numbers does not matter. What matters is whether you are in the correct range or not.

If you have decided to rebuild your score, I would encourage you to shoot for at least the VERY GOOD range. A credit score in this range will get you access to almost every financial service out there. If you have a very good credit score and get denied for a mortgage, for example, it will not be due to a credit score. It will be something else. Matter of fact, most conventional mortgages require a credit score of 620 which is well below 740.

Who gets a credit score? or Do I have a credit score?

Are you wondering whether you have a credit score or not? Well, don’t worry. I will help you found out. A credit score is a number used to measure how a particular individual dealt with credit. That is if you borrowed money of any kind, and your credit utilization has been reported to at least of the reporting companies, then you have a credit score.

Have you got a credit card? Then you have a credit score.

Have you ever borrowed money in the form of mortgages, loans of any kind(student loans, car loans, whatever loans)? Then, you have a credit score. Furthermore, if your landlord or utility company reported your payment history, you will also have a credit score.

Every financial decision you have made with your credit will be represented by a credit score. Be careful next time you decide to miss your credit card payment because you want to buy the latest iPhone. Missing a payment will negatively affect your credit score and it will be difficult to rebuild it. Before your credit score is calculated, credit reporting companies will put together your credit report.

What is a credit report?

I have mentioned that every financial decision you make on your credit(s) will be reported to credit reporting companies. I also mentioned that there are three credit reporting companies (Equifax, Experian, and TransUnion) in the USA.

Let’s assume that you have a credit card and use it to buy all the stuff you buy. You are the only one who knows what you spend your money on. At the end of the month, your credit card provider will require you to pay a minimum payment. Let’s assume that you are a good borrower and make at least this payment.

So, all these activities will be reported to at least one, some, or all reporting companies. Other businesses you deal with financially will do the same. That is everything you do financially with your credit will be reported to credit reporting companies.

After receiving everything about you, credit reporting companies will compile a report. This report is what is known as a credit report. Basically, the report shows all credits you have, credit providers, your payment history, how long you owned credit, how many open accounts you have, etc. This report will tell investors, lenders, and other financial institutions where you have been, decisions you have made, and more importantly, where you are standing right now financially. The credit report will help institutions to judge whether you can qualify for more loans or if you are a total loser who deserves no money.

To learn more about credit reports, what is included in them, how to deal with issues in your report, please, use the following article.

Related article: Credit Report Overview

Rebuild a bad credit: Know your credit score and what it means

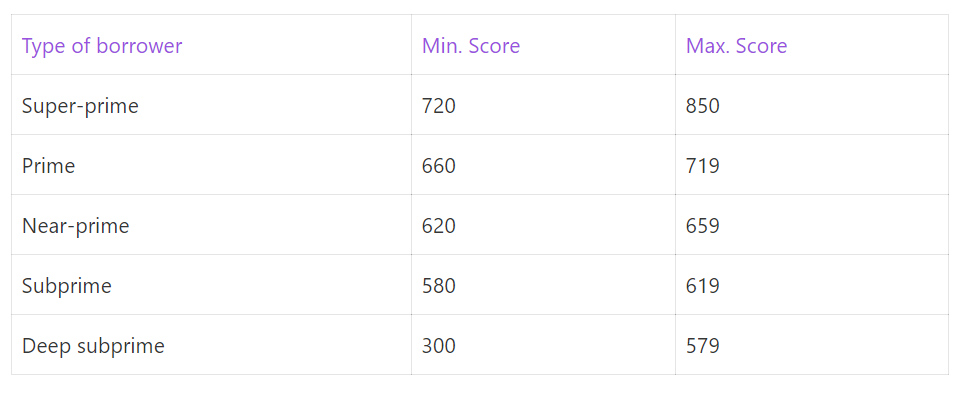

Earlier, I pointed out that the credit score range is divided into smaller ranges and these ranges differ from one reporting company to another. The benefit of these ranges is that they help lenders to classify borrowers in different categories. That is a borrower who has a very bad credit score will be classified in a different category than a person with an excellent credit score.

The following table shows borrowers’ categories based on their credit scores. Some lenders call these categories types. That is when you go to a bank, the lender will need to know if you are a risky borrower or a non-risky borrower.

These score types are not fixed, and therefore, differ from one company to another. But, if your score is bad, expect to be classified as a risky borrower. The higher your credit score gets, the more of a good borrower you become.

The best type of borrower is a super-prime borrower. This is like an elite category of borrowers, and therefore, being in this category should be your primary concern. Being a super-prime borrower means that you can qualify for any type of loan/mortgage out there. In addition, you will qualify for the lowest interest rate possible on the market. That is lenders will fight to give you money because they have high confidence in your ability to pay it off with interest, charges, and all fees.

On the other side of the spectrum, you have a deep-subprime. These borrowers are so bad that moneylenders are no even willing to look at their applications. Instead of giving you the money, they can throw it in the trash and forget about it. Being in this category means that your odds of qualifying for a mortgage/loan are slim. Of course, you can always use government-supported services that require no credit scores or ask for the lowest score possible.

For example, an FHA loan can take as low as 500! But, keep in mind that your interest rate will be higher, and you may be required to purchase mortgage insurance. You see, qualifying for a service does not mean that your life has gotten better.

When rebuilding your credit score, you should shoot for the highest class of borrowers. That is the super-prime where you will qualify for any loan/mortgage out there and pay the lowest interest rate possible. When you hear that the interest rate on mortgages is 2.75%, do you dream about qualifying for that rate if your score is wrecked? I hate to break it to you. People with bad credit scores CANNOT qualify for a low interest rate. This low-interest rate is for someone with a high credit score who also meets other financial requirements. There are many parts that come into play and you should try to meet all of them to qualify for a low-interest rate.

Depending on your current credit score, you can classify yourself in one of the above categories of borrowers. The truth is that if you are trying to rebuild your credit score, you are among the deep-prime or subprime. Being in these two groups is not fun and you should get out of them as fast as you can.

Subprime and housing market crash!

You are probably saying: Well, I am in subprime and I am fine or close to being fine. Well, if you remember not too long ago, we experienced a housing market crash. I am talking about the one in 2008 that sent millions of homeowners to the streets around the country and brought major companies to their knees. If you did not lose a house, your family member, friend, or neighbor lost theirs. Yes, a lot of people lost their homes in foreclosures.

Many companies went bankrupt and one particular company is still talked about even today. If you guessed Lehman Brothers Holdings, INC, you are right. This company went bankrupt and the world shook from hearing the news.

But did you know why it went bankrupt and many others closed their doors? Well, it was because of lending money to subprime borrowers. Yes, you heard me right. Companies extend billions of dollars to subprime borrowers (borrowers with bad credits or risky borrowers) and later realized that they cannot pay them back. The result was catastrophic.

So, next time you get denied a loan/mortgage due to bad credit or credit score, do not have a cranky face. They deny you money to protect themselves and their clients. When you fail to pay them back, you can go to leave on the street, but the business will close its doors. So, you get the point.

The good news is that I have spent countless hours putting this article together to help you rebuild your credit score. Yes, after reading this article, you should have all resources you need to go from a very bad credit score to a very good credit score. I am assuming that you will follow all guides, tips, and other resources I am including in this article.

Rebuild a bad credit: How can I check my credit score for free?

If you heard about a credit score and do not know how to check yours, consider using the following tips. The first and easy way to check your score is to use your credit card provider. Most credit card providers offer credit score information for free.

For example, if you use Discover, Capital One, etc., you could easily find information about your credit score in your account. All you have to do is to log into your account and check it out.

There are other methods you can use to check your credit score for free. Many companies out there are willing to give you this information for free. One company that you can use is CreditKarma. You just need to create an account with them and check your score. Keep in mind that they will have privacy, terms of use, and other stuff you have to comply with. You should check those out first and make sure that they align with goals and security purposes.

Understand why it is important to rebuild your score

Your credit score is bad because of a lot of bad financial decisions you have made in the past. So, before you take a step toward rebuilding your credit score, you must know why it went down in the first place.

In order to cure a disease, you must know how you got it. Before you start working on pain reduction steps, you must know why you are having pain. If you need a long-lasting solution, you must understand the problem you are trying to solve.

Your credit score is not different. If your score is as low as it can get, you must know how you wrecked it. Have you been denied a mortgage when your dream house was on the market? Or have you been denied a second credit card because your score is not worth their time and money?

Well, you are not alone. I have been there and it sucks to be that guy. That is why taking proper steps to rebuild your score could be one of the most important decisions you ever made.

Even if you don’t need a mortgage or a loan right now, you should take action. It takes a long time to rebuild a credit score and repair your credit. So, giving yourself enough time will reduce the stress and give you a chance to navigate that crazy learning curve.

You will be making a huge mistake if you choose to start later. You need to get ready before the real thing starts. Do you think you can start rebuilding your credit score when you are ready to buy a house? That is a very bad idea and it will never work.

This is like being a soldier and start training only when the battle has already started. You can’t win. So, you need to be ready and prepared to fight before the battle begins. Starting the training only when the battle has started is the fastest way to lose a battle.

I hate to break it to you. Your credit score will take months if not years to get it to where you feel comfortable sharing it. Of course, it will all depend on the meaningful steps you take toward rebuilding it. The stricter the steps, the faster you can rebuild your credit score.

Rebuild a bad credit: Know what affects your credit score

I promised you that I will give you the steps you need to take to rebuild a bad credit score. Yes, I will give you those steps. But before I give you a step-by-step you need to take to rebuild your credit score, I think you need to know what can possible affect your credit score. This way, you will know where to start when rebuilding it.

There are many factors that will affect your credit score. These factors will have different weights depending on how important they are. For example, a borrower who never makes their payments on time or at all will most likely be considered a bad borrower compared to someone who has a bad credit score due to a low credit age. Why could this be true? Well, If you have proven that you cannot pay off the money you have borrowed, you are already a bad borrower and cannot be trusted. That is you proved your true nature.

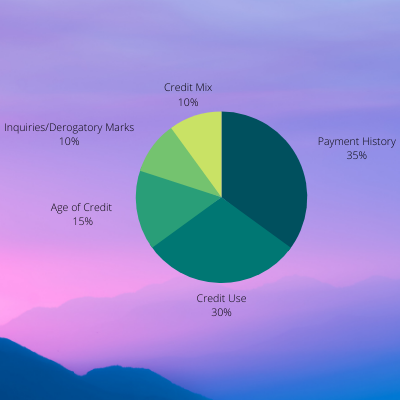

The following are factors on which your credit score is based on.

| Payment history | 35% |

| Credit utilization(debt) | 30% |

| Credit age | 15% |

| Derogatory Marks /hard inquiry | 10% |

| Credit mix | 10% |

From the table above, you can see that your payment history will take more than 1/3 of your credit score calculation. The reason is simple. Failing to pay off the money you borrowed based on the terms and conditions of your contract automatically makes you a very risky borrower.

If you cannot pay the money you borrowed, why would anyone give you money? Would you lend your hard-earned money to your friend who has historically proven to not pay back and use money irresponsibly? I don’t think you can do that. If you can, you may need to reevaluate your friendship. I think you get the idea.

Your payment history will heavily affect your credit score. For this reason, your payment history should be your primary concern when rebuilding your credit score. Millions of people have bad credit scores due to missing payments.

The amount you owe lenders will be the second most important factor affecting your credit score. That is borrowing too much money increases your chances of failing to pay it off. Due to this risk, your score will go down. That is why if you have credit cards and have used most of your credit limit, you need to find a way to pay it off and free that limit. Experts say that a credit use of at most 30% is good. If you have a $10,000 credit limit, for example, it is safe to use no more than $3,000. However, I still think that 30% is still a lot of money. My golden rule is to use no more than 10% of your credit limit. For each card you have, you should stay under 10% credit utilization.

This will make it easy for you to pay each one of them off. In addition, it will keep your total credit usage under 10%. The lower you use the better.

There are factors you cannot control. For example, your credit age cannot be improved. The number of years you have owned credit cannot be increased automatically. The only thing you can do is sit tight and let time pass. Other factors such as hard inquiries, bankruptcy, foreclosures, and credit mix will all affect your credit score. The effect of these factors fades away over time. For example, a recent credit card application will trigger a hard inquiry on your report. This action will knock off a few points from your credit score. However, its effect will disappear over time and will not affect your score after 12 months. Keep in mind that a hard inquiry show on your report for two years.

After knowing everything that affects your credit score, have you recognized the reasons why yours has plummeted? Which of the main factors we discussed in this section contributed to the apocalypse of your credit score? Whatever the reason is, I promise you that you can get back in control and rebuild your credit score from scratch.

You just need to know what it is you are dealing with and take action from there.

How to rebuild a bad credit score?

Now, you have reached the moment you have been waiting for. How can you possibly rebuild your credit score? Do you think it is possible to rebuild your credit score? Do you think your credit score has been damaged to a level where you just want to find a rock that will hold you forever? A place where nobody will ever see you?

The truth is that you can rebuild your credit score and the steps you will need are not that complicated (if you choose to see it that way). You see, debt is something that can ruin your entire life. Debt can crush your dreams and make you live a miserable life until you join your creator. The good news is that debt can also be paid off as long as you follow proper procedures.

In this article, I have dedicated my time to give you tips you can use to rebuild a bad credit score. The following tips will be your complete guide on rebuilding a bad credit score.

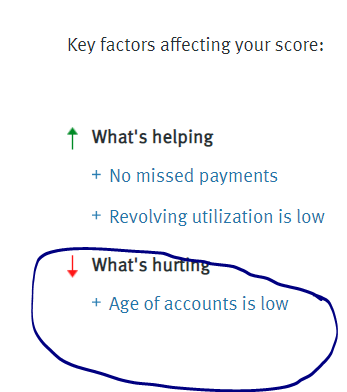

1. Know your credit score and what is hurting it

Before you solve a problem, you need to know what the problem is. You cannot find a solution to a problem you don’t understand. For this reason, the first step to rebuilding a bad credit score is to know your credit score and why it is so bad that it needs some work.

Knowing your score will help you make proper adjustments to your finances and budget wisely. For example, if your score is 500, you will know that you have a very difficult road a head of you compared to someone with a score of 650. Most credit card providers offer free information about credit scores. If yours does not have this services, you can use free online services such as Credit Karma. There are other websites that can help you find your credit score for free. You just need to do a little bit of a homework.

After finding out your score, evaluate how it is being affected. Among the factors I explained above, one or more factors will be the cause. Once you know what is wrecking your credit score, you can then decide how to rebuild it.

2. Check your credit report

Your credit report will show you everything you need to know about all open accounts you have and the decisions you made on them. That is the report will show your payment history, credit use, age of credit, and much more.

The reason you need to check your report is to make sure that all information reported is consistent with your activities. One mistake on the report can tank your credit score. If you find mistakes on your report, you can dispute them to the credit reporting bureaus that compiled your report. Fixing the mistakes on the report will help you rebuild a bad credit score.

If there is no mistake on the report, you will then move to other bad credit score rebuilding tips found in this post.

To learn more about credit report, use the following article.

Related: Credit Report Overview

3. Open a credit account

Opening a new credit account will help you build your credit file. Since your score is not good already, you should avoid opening an account that could put you in more trouble. So, consider having credit card accounts with no annual fee. This will help you use the cards without paying interest on the balance until the actual APR kicks in.

You are probably thinking that having more credit cards will reduce your credit score. In a short term, you will most likely lose a few points due to a hard inquiry on your report. However, the inquiry will not affect your score for more than 12 months. In the long term, you will have more active accounts that will help you improve your credit score faster. More open and active accounts show lenders that you are responsible for borrowing money and managing debt. Having a good credit mix will help you tremendously.

Of course, you should use your cards wisely to earn this title. If you have only one account that is open, consider opening more and make sure that you mix them up. Having revolving and none revolving accounts will help you better.

A new credit account will also increase your credit limit. A boost in credit limit will reduce your credit usage. For example, if you have used $800 out of a $1,000, your credit usage is 80%. If you get another credit card with a credit limit of $1,500, your new credit limit will become $2,500. Assuming that you did not use your credit cards since our first calculation, your new credit usage will be 32%. This reduction in credit usage will boost your credit score.

NOTE: If your credit score is low due to irresponsibility, you should avoid getting more credit cards or more credit of any kind. Opening more accounts will not help you build your credit score, in this case. You will end up spending more money, which will put you in more debt, and destroy your credit score even more. Instead, consider getting back on track with what you have already. Become responsible first, then think about more accounts.

4. Make a payment budget

Finally, the steps you probably don’t want to hear about: Budgeting. Budgeting is the foundation of any financial decision you will make. Rebuilding a wrecked credit score will be one of the biggest finance journeys you will make.

Your credit score is bad probably due to overusing your credit cards, violating the terms of your lenders, and not paying them off on time. If you fell behind on your payments, you will need to restructure your finances.

There is no way you will achieve this step without creating a budget. A budget will show you how much money you make, your expenses, savings, leftover, etc. In addition, you will know how much you can safely allocate toward paying off your credit card debts every month, year, etc. The money you will pay every month will depend on how much you owe the lender and what you can afford.

Should you want to cut on your expenses and increase your payments? The budget will help you see where you can cut and how much. A budget is not bad after all.

If you are having trouble creating a budget, use the following article. It will walk you through the steps you need in order to have a successful budget.

Related: How to make a budget: Step-by-Step

5. Make ALL your payments on time

This is probably the most important step you will ever take to rebuild a bad credit score. Your payment history covers 35% of your credit score calculation. So, focusing on this single element will help you boost your score much faster than anything else you can do.

Have you been missing your payments? If so, start paying each and every credit card balance on time and in full. If you cannot pay it off in full, it will mean that you have been spending more than you were supposed to. At least try to meet the minimum monthly payments on each card. This rule applies to other loans and credits you have. Your payment should be submitted before the due date. Those with multiple credit cards will have different due days. So, having a calendar that tracks when each card’s due date is will be vital to avoid late payments. You should follow the same steps whether or not you are paying off student loans, mortgages, car loans, etc.

If you have accumulated a lot of credit card debts, it will be difficult to pay them off. But, it is not impossible. As long as you are motivated and really want to rebuild your score, you can do it. Having a structure and a plan that works will take you there.

The following article will give you extra guidance on how to pay off your card debts.

Related: 11 easy ways to reduce credit card debt

6. Rebuild a bad credit score: Reduce your credit utilization

Your credit utilization is the second most important factor that affects your credit score calculation. Credit utilization refers to how much you have spent out of your total credit limit. A credit limit is a total amount your lender allows you to spend on each card. For example, if you have a credit card with a credit limit of $1,000, you can only spend up to $1,000. Once you reach your limit, you must pay some of it off before using the card again.

Why is it a bad idea to use most of your credit limit? Well, even if your lender gave you $1,000 on your card, he doesn’t want you to rely on it. Spending a huge percentage of your credit limit shows lenders that you do not have other sources of income that could help you cover your expenses. That is you are either not financially stable or financially responsible, and therefore, you are a risky borrower.

Being a risky borrower is the worst thing you can be. Lenders will not trust you with their money and those who do will charge you the highest interest rate.

To stay on the safe side, it is recommended that you spend no more than 30% on your total credit limit on each card. For example, if your credit limit is $1,000, you should not spend more than $300.

My point when it comes to credit utilization is different. I think $30% is too much. I recommend spending at most 10% on each card. This will make it easy for you to pay it off. Should something comes up, you will still be fine since you did not spend too much on your credit card limits. In addition, using your credit cards less will give you a chance to pay off other debts you already accumulated.

Always remember that it is easier to spend money than it is to pay it off. So, focus your attention on how to spend less.

7. Rebuild a bad credit score by Paying off off Revolving Account Balance

If you have fallen behind on your payments, make a drastic plan that will help you catch up on your payments. Pay off your revolving balances as fast as you can. Keep in mind that credit card interests are the highest in the lending industry. So, every penny you do not pay off makes your debt grow due to compound interest. So, to avoid this issue, make sure that all revolving account balances are fully paid off.

The following article can help you understand why millions of people are struggling with debt and what you can do differently.

Related article: The real reason many people are struggling with debt

8. Do not apply for cards very often

Avoid sending in credit card applications very often. The idea is that for each application you send in, the lender will evaluate your creditworthiness. By doing so, the lender will run a hard pull on your credit profile. This will appear on your credit profile as a hard inquiry. Hard inquiry knocks off a few points from your credit score. But, you can regain these points fast as long as you continue to use your credit cards wisely.

A hard inquiry will stay on your credit score for up to two years. However, it will not affect your credit score after 12 months. If you send in applications for new cards very often, you will end up wrecking your credit score instead of building it.

Lear more in details about hard inquiries/hard pulls and how they affect your credit score

9. Rebuild a bad credit score: Ask your friends for help

There are times when you will no longer handle the pain. You log into your account and realized that your score only moved from 500 to 505. You will feel like you are not doing anything and all your efforts are in vain.

If you want to rebuild a bad credit fast, you could ask your friends to jump in with you. You never know until you ask. You can borrow money from the people you trust and pay them back later instead of having your debt growing exponentially.

10. Rebuild a bad credit: Have discipline and patience

Rebuilding a bad credit score is not going to be easy. It will not happen overnight either. For this reason, you are going to fight a never-ending emotional battle with yourself. You will feel frustrated over and over again.

When you hit this level, always remember that good things come at a cost. It took you many months or years to destroy your credit and credit score. It will take you an equal amount of time or more to rebuild it. So, hang on tight and continues making your payments, minimizing your credit card usage, etc.

Remember that your credit score and credit history will get better over time. If you recently opened an account, you should not expect to have a perfect score or anything close to it. This is because the age of your credit affects your score. You need a track record of using credit to have really good credit and credit score. That is how lenders will judge you. If you have been a very good borrower for a very long time, lenders will expect you to continue on that path. So, sit tight.

What should you do after rebuilding your bad credit score?

After rebuilding your credit score, you should always avoid going back where you came from. You don’t want to build your score all the way to 800 only to go back to 500 one year later.

Being smart about money, knowing what affects your credit score, and making decisions accordingly will help you keep your score on top. You should also continue learning and make yourself a better and responsible person. The more you learn and understand, the easier you will navigate your financial journey.

BONUS: Always remember that it is easy to drop your credit score from 800 to 500 than building it from 500 to 800.

How long does it take to rebuild a bad credit score?

Rebuilding a bad credit score will take time. Factors that will influence your speed will depend on three main points.

- The reason your score is in bad shape: Before you start the journey to rebuilding your credit score, you must know why it is down in the first place. Knowing where you are getting hurt will help you know how to fix the problem. For example, if your score is bad due to missed payments and overuse of your credit cards, you must start paying on time and reduce your credit usage. If you owe several thousands of dollars, it will take you a long time to pay them off. Hence, extending the time it takes you to rebuild your credit score.

- Measures you have taken to rebuild it: These will be a set of rules and execution plans you set in place to help you rebuild your bad credit score. If your measures are strict enough, you will rebuild a bad credit score in no time. On the other hand, if you did not make an effective plan, you may find it difficult or impossible to rebuild your score.

- How effective are you in following your own rules: Having effective plans and rules does not mean that your job is done. After all, your ability to respect and follow your own rules will make all the difference. There are a lot of people who say they want to rebuild their credit scores. So, they make plans, talk about, and start paying. A few months later, you hear them saying, I can’t do it, it is difficult, I cannot afford it, etc. If you can’t discipline yourself, you can rebuild a bad credit score.

From these three points, we can simply conclude that the time it takes to rebuild a bad credit score varies from one person to another. What you should do is get started and discipline yourself throughout the process.