What Is Simple Interest?

Simple interest is an interest paid on a borrowed money a.k.a a loan. Borrowers only pay interest on the principal and the interest is usually paid every month. Lenders may apply charges on late or missed payments.

This is opposed to compound interest where the borrowers pay interest on both the principal and accrued interest.

How to calculate simple interest?

To calculate the simple interest, you will multiply the principal, the daily rate, and the number of time elapsed between payments.

Simple Interest = PxRxN

Where,

P = The principal

R = The daily rate

N = The number of days elapsed or days between payments

If you have a mortgage, you will have to pay all your charges in full. After making your payment, the monthly payment will be subtracted from it right away to avoid an accumulation of charges.

Most of us are familiar with this kind of interest because it is the most used on many types of loans such as car loans, and other short term loans and mortgages.

Example of simple interest

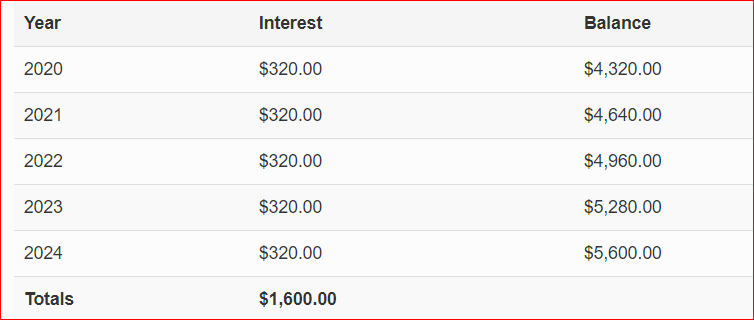

Let us say that you bought a motorcycle for $5,000 and have a loan of $4,000 on it. If the annual rate is 8% and you paid it off in 5 years, you would expect to pay a total of $5600. You can check how the money increases every year from the table below.

It is important to pay your loan on time to avoid charges and take advantage of constant rates. If you don’t pay on time, penalties will be applied.

Advantages

You can benefit by taking action earlier and playing it smarter. The following are a few of its benefits.

- It is clear what you will be paying all the time

- You do not pay interest on an interest

- It is possible to finish your payments earlier especially if you have smaller loans

- You can reduce your charges. Since your charges depend on the money you owe your lender, you can make a big payment to reduce the loan value. This will reduce your charges in return.

Disadvantages

Since there is no compounding involved with simple interest, debtors make extra money by charging borrowers on late or missed payments. If you are late on your payment, you will pay charges for it.

Some lenders charge one sum whereas others charge you every day you are late. Terms and conditions are different from one lender to another.