How to grow a small trading account? Are you interested in trading stocks and don’t have a lot of money to start with? If so, this article was written with you in my mind. The truth is that you don’t need to start trading with a lot of money.

Matter of fact, new traders should always start with small accounts. This is because most people lose their money in the first few years of trading. As noted by Tradeciety, 80% of traders quit within the first two years and 40% of them only trade for one month.

Why is this statistic so eye-opening? Well, most traders do not have what it takes to make money in the stock market by the time they start.

It takes a lot of learning, time, patient, experience to make it in the stock market. The first few years are the hardest for new investors and traders.

This is the time people mess up while learning how to play the game. Unfortunately, 80% of new traders test the depth of the water with both feet.

Those who end up surviving the rough of the market, prioritize learning over gains. Yes, new people should focus on learning instead of making money. This is the foundation of success in the stock market.

The necessary skills you will learn will help you grow your small trading account. Always remember that you can grow your account as long as you are patient and know the proper techniques.

In this article, you will learn everything you need to do in order to grow your small account.

What is a small trading account?

Before I tell you how to grow a small account, I am going to give you a general idea of what a small account is. So, what is a small account?

A small trading account is one that allows you to learn how to trade with less exposure to market risks. That is you can only take a small position size with the account. Hence, reducing your risks related to market volatility.

A small account will vary from one person to another. For example, a person who has $100,000 can consider $5,000 as a small account. On the other hand, a person with only $5,000 without extra funds available can consider $5,000 as a huge account.

Your risk tolerance will help you define what a small account means. Risk tolerance is the amount you are comfortably able to spend without affecting you financially or psychologically. Even if you have $5,000 laying down, it does not mean that you are willing to spend it on the stock market.

What if you have only $500 or $1,000? How can you grow an account this small? This article will give you tips and hacks you can use to grow a small account

Benefits of trading with a small trading account

Although a small account will not make your rick overnight, it will help you navigate the trading maze with an ease.

The following are some of the benefits of trading with a small account.

- Less risk: A small account minimizes your exposure to market volatility. As a result, you lose less money in the market when prices move in the direction you did not anticipate.

- A chance to mess up: The best way to learn in the stock market is to make mistakes. I am not telling you to go out there and throw your money away. I am only telling you to trade and learn from your mistakes. Making mistakes in the stock market only means one thing: Losing money in the market. Since you will not be too exposed to risk, you will have a chance to make mistakes and increase your experience without losing too much money.

- A proof that you can manage a big account: Although this is not necessarily true, being able to manage a small account could be an indication that you are able to manage a big account. If you cannot manage a small account, you will never be able to manage a big account.

- You will be forced to trade less: Day trading is the process of buying and selling the same security or stock within the same trading day. Traders with less than $25,000 in their accounts can only have three-day trades within five consecutive trading days. This rule prevents inexperienced people from trading excessively. Hence, protecting them from major losses.

Learn more about day trading from the following article.

>> Related: What Is Day Trading? Day Trading Strategies

Limitation of small trading account

- Minimal return: A small trading account will never make you rich overnight. That is with a small account, you will be able to take a small position size. For example, if your account is only 500, you can only trade 1 share of ZM. In order for you to make $50 or 10% on this trade, ZM will have to jump 10% in the upsize. Large-cap stocks do not make such moves on normal trading days. More importantly, even if it goes up that much percentage, it is most likely that you will not capture the whole percentage gain. For this reason, it is hard to make a meaningful profit on a small account when trading large caps.

- Cannot survive on it: You cannot quit your job in order to trade a small account. A few dollars you will make(if you are lucky) cannot replace your income.

- It takes longer to build a small account: With a small account, you should expect your growth to take a very long time. In other words, it can take you many years to grow your account based on your trading strategies.

- Few trading options: Traders with small trading accounts have less trading options. For example, many brokers will not let you short stocks with a tiny account (depending on the size of your account). You can only take long positions until you bring your account to the acceptable level required by your broker.

- PDT rule will hold you down: Due to risk associated with the stock market, brokers limit the number of traders individuals came to make if their brokerage accounts are under $25,000. This rule limits the number of day trades to 3 trades within 5 trading days. This is known as pattern day trading or PDT rule and penalties are applied when a trader violates this rule. As reported by FINRA, individuals who violate this rule can risk having their accounts blocked for 90 days.

The following article can help you learn more about PDT rule.

>> Related: Pattern Day Trading (PDT) Rule And How To Get Around It

At this point, you have a general idea of what a small account is and what to expect from it.

It is now a time to answer the most important question you have been waiting for: How can you grow a small trading account?

The following few sections will go over steps and tricks you can use to grow a mall trading account.

1. Focus on learning instead of earning

It is not easy to grow a small account. This is because you will have a limited gain for every trade you make. Therefore, the only way to keep your account on an uptrend is to be consistent.

Yes, consistency is important. The small gains you make will add to a big gain. However, you must continue to make them.

In order to be consistent, you must have a plan and understand what you are doing.

If you are starting out with a small account, focus on learning rather than earnings. You can always earn money later once you know how to trade.

Learn how to read candlesticks and candlesticks formations. Always remember that a trading chart is made of candlesticks. If you don’t understand candlesticks and how to read them, you will not understand the meaning of the price movements on the chart.

>>Related: Top 13 Best Candlestick Formations

After knowing how to read candlesticks, you will then move to other trading methods such indicators, patterns, momentum, volume, how to place orders, what orders to place, support and resistance levels, etc. Mastering these methods will be crucial to your success.

Also, learn the basic terminology of the stock market such as ticker, volume, stocks, IPO, common stocks, preferred stocks, margin account, cash account, bid-ask spread, bear market, bull market, recession, correction, etc.

You must also learn about markets and the impact of the news on stock prices. All these methods will help you get started, stay consistent, and more importantly, establish a winning plan for your particular situation.

The following article covers the best day trading strategies you can use to maximize your profits.

>>Related: 9 Day Trading Strategies (For Beginners)

2. You must have a plan in order to grow a small trading account

Having a plan is important when it comes to trading and growing a small account. Even people with big accounts rely on their plans.

A trading plan includes what stock to trade, under what conditions, where to enter, exit, stop losses, profit-taking, number of shares to buy, etc.

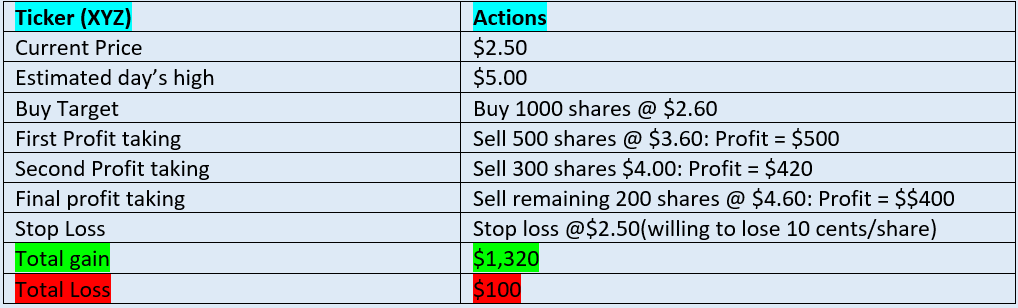

The following tables gives you an idea of how a simple trading plan will look like.

Although the stock will not follow this exact plan, it will give you an idea of what to do in any situation.

3. How to grow a small trading account: Be Patient

Growing a small account is like raising a baby. I don’t think you would expect your baby to start walking, doing chores, and going to school in the first year.

In order to raise a strong baby, each step and decision must be meticulously taken. The more time and energy you put into raising your baby, the stronger and smarter your baby will become.

The same concept can be followed when it comes to growing a small account. With a small account, your profits will be minimal. The only way you can increase the account without adding more money is to have consistent returns no matter how small they are. Those small gains will turn into bigger returns over time.

4. Avoid emotions in order to grow a small trading account

Your emotions will be your greatest enemy. Many people lose money in the stock market not because they choose the wrong stocks. Instead, because they trade with emotions.

Your emotions will convince you to do some of the following:

- Take a position when you were not supposed to

- Average down on a losing trade

- Selling at the bottom (when going long)

- Avoiding to lock in profits

- Taking positions right before a reversal

- Running away after seeing a pullback

- Investing more than you can afford to lose

- and much more.

By managing your emotions, you will be able to get in and out of stocks at the right time. Hence, increasing your profits and growing your account.

5. Lock in profits

Your primary job as a trader is to lock in profits. Your profits will be realized only after selling your shares.

After taking a position, start locking in profits as the stock goes up until you are completely out. If the price tanks, you would have made some money.

Let’s assume that you invested $500 in stock and now you are making $50 in profit. Do you think it is a good idea to sell all or some of your shares?

If you said no, you are probably being greedy. That $50 represents a 10% return on this trade. So, this percentage is not bad, unless you are certain that the price will most likely go up. Which is a difficult conclusion to come to.

A small realized profit is better than a huge unrealized gain you made and lost.

Again, growing a small account requires patients and small profits add to a big gain.

6. Keep your losses tight

Keeping your losses small will be uttermost important. This is because your gains on a small trading account will be small. For this reason, your losses must be much smaller than your gains.

In order to make sure that you are buying and selling your shares at the right prices; consider perfecting the following three trading orders.

- Avoid market orders: Placing a market order is like telling your broker that you don’t care about the price. You just need to get shares. This will fill your order. However, your shares could be filled at a much higher price than you are willing to pay. Hence, increasing your chances of losing money on the trade. To avoid this issue, you must avoid market orders at all costs. The same happens when you are selling. Your shares can be sold at a much lower price than you are willing to take due to volatility.

- Only use limit orders: A limit order tells your broker that you are willing to buy or sell a specific number of shares only at a price you specified or better. If the price does not reach your limit price, however, your order will not be filled. Also, if the price reaches there, you may not buy or sell all shares you want. The good news is that you can always trade if there is money to trade with. Remember, it is not how many times you trade, but how many winning trades you make.

- Always use stop-loss orders: A stop-loss order will kick you out of the market at a price you specified when the price goes against you. In order to protect your small account, you must become a friend with a stop-loss order. The downside of a stop-loss order is that once triggered, your order will become a market order to sell the number of shares you specified. That is your shares will be sold at the best market price possible. If the volatility is higher, your shares could be sold at a much lower price than you wanted. Hence, locking in a huge loss.

In order to succeed in the stock market, you must avoid mistakes the majority of traders and investors make. The following article can help you understand in detail why people lose money in the stock market.

>>Related: 14 Reasons People Lose Money In Stock Market

7. Do not add to losing positions

One of the biggest mistakes novice traders makes is to average down or averaging up on a losing trades.

Averaging down is a strategy that helps traders to lower their average cost per share. For example, let’s say that you bought 50 shares of XYZ stock at $4 each. Then, the stock went down and reached $2 per share.

After doing your research, you bought 200 more shares from the same stock at $2 per share. Now let’s see how much you spent on average per share. By purchasing 200 more shares, your average cost became $2.4 per share.

This means that as soon as the price reaches $2.4, you will recover your money. Anything above this price will be your profit. If you did not average down, you would recover your money only if the price reaches $4 per share.

The downside of this method is that your position size will go up as you buy more shares. If the price continues to go down, you will take a huge loss on this trade. Averaging up is used for short positions. Instead of bringing the cost down, you are trying to increase the average sale price.

To avoid losing money using in the stock market, you should avoid averaging down and averaging down until you have enough experience.

You can learn more about averaging up and averaging down in details using the following articles.

>>Related: Averaging Down Definition

>>Related: Averaging Up Definition

8. How to grow a small trading account: Use leverage

Leverage is a technique that lets traders make trades that they could otherwise not afford. That is instead of relying on your own money, you can use someone else money and boost your investment capital.

This technique helps many traders when shorting stocks, trading options, and warrants. If these methods sound great for you, it does not hurt to try them out.

Keep in mind that it is very risky to trade using borrowed money. The risks are exponential and it is possible to lose more than the value of your entire portfolio. Brokers have extra requirements for people interested in these risky methods. Some of these requirements include but not limited to having a margin account, have a minimum amount required in an account, etc.

Learn more about Margin account using the following article.

>>Related: Margin Account Definition

9. Trade stocks with catalyst and focus on small cap stocks

Small-cap stocks are more volatile compared to large-caps. That is small-cap stocks have a low float and therefore, it takes fewer shares to move their price higher or lower. Keep in mind that the more volatile a stock gets, the higher the risks.

What it takes is a good news or a bad news for a small-cap stock to double its price or cut in half.

As a trader with a small account, you need to focus your attention on small-cap stocks and take advantage of their volatilities. You can easily double your account by trading small-cap stocks on a good trading day.

By using stock screeners, you can tell what stocks have good news or bad. That is look for pre-market gapers (gaper up and gap down). These stocks usually have news such as FDA approval, a positive result from a medical test, merging, etc. Once the market opens, some of these stocks can double or triple in value. Hence, giving you a chance to grow your account faster.

You can use the following article to learn more about gappers.