What is a trading pattern?

Trading patterns are formations that are identified on charts by connecting lines at specific points of a security price such as open, close, etc. These lines are drawn on a chart based on the historic movement of the price. Patterns are used as a way to predict the future price movement of a stock or tradable security.

Understanding trading patterns

Trading patterns happen all the time. There are a lot of patterns in any security you can think of. Depending on the time frame you are looking at such as minutes, hours, days, weeks, or months; you will have patterns in each.

Patterns you see on a one minute or hourly chart may not be seen on a daily chart or weekly chart. This is because once you increase the time from minutes, hours, to days and weeks, information gets condensed. Therefore, you lose little details.

For example, each candlestick represents an entire day for a daily chart. However, you can dig deeper and find more details on that day. Instead of having one candlestick, you can have 8 candlesticks each representing one hour. In this case, you will have an hourly chart. The chart will show you more details about what happened for each hour of the day.

You can zoom in more and have 30 minutes, or even one minute chart. These charts will include every little detail on the chart. It will be difficult to effectively use a shorter time frame when predicting the future price of a stock. Patterns will not be effective due to volatility and outliers.

This is a confirmation that trading patterns you see depend on the time frame you are looking at.

However, the more time frame you have, the more accurate your predictions will be. This is because you will have enough data to support your predictions. Outliers’ data will not affect your calculation. This will lead you to more accurate information.

Some of the popular trading patterns in the stock market.

There are a ton of trading patterns in the stock market. As a trader, you will need to choose what works for you. The more you know the better. This is because you will be able to predict any movement happening at a particular stock you want to trade.

The following are a few of many trading patterns out there. Feel free to click on the ones with links to learn more in details about them.

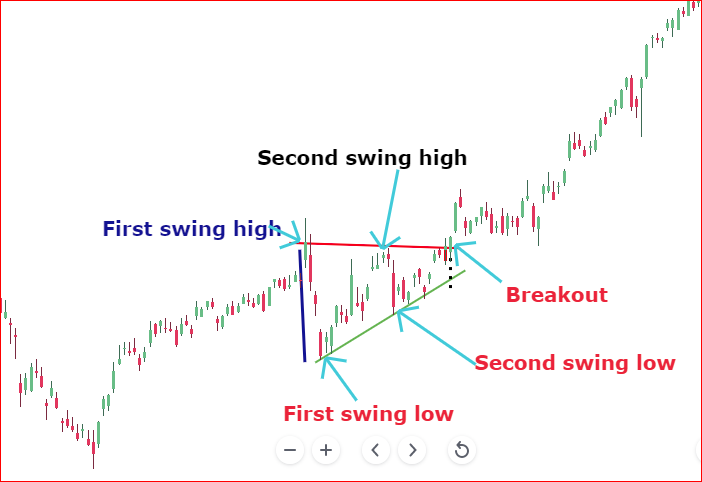

- Ascending triangle pattern

- Descending triangle pattern

- A cup and handle pattern

- A head and shoulders pattern

- Double top pattern

- Double bottom pattern

- Wedges

- Flags or pennant

- Symmetrical triangle

- Rounding bottom pattern

Benefits of trading patterns

Trading patterns are some of the most important elements in technical analysis. Without them, it would be hard to predict future price movements of stocks and other securities.

The chart itself will not help you with what is going on on the stock. By drawing a pattern on the chart, you will be able to know the possible price movement of the stock. You know how to take a position once the price exits the pattern.

For this reason, trading patterns show investors and traders how to take a position in a security or a stock, where to enter, where to exit, how long to hold the stock, etc.

Final words

If you are a trader who wants to be successful, you must learn trading patterns. They are formed every day and they help millions of traders to succeed regardless of markets they are involved in.

You must use a combination of other technical analysis techniques such as indicators, trading volume, etc. to validate the pattern. There are times when a pattern forms and fail because of events in the market.

As Always, happy trading !