What Is Technical Analysis?

Technical analysis is a field that focuses on analyzing and predicting the future performance of stocks and other securities using historical data, trading volume, chart history, etc.

This is completely different from fundamental analysis. In fundamental analysis, investors attempt to predict future performances of companies based on financial reports, earnings, ratios, etc.

Technical analysis does not take into account fundamentals. It only focuses on statistical analysis, chart movement, and volume of past data.

Areas of focus in technical analysis

Trading using technical analysis is not an easy task. There is so much to learn and it is difficult to learn all of it. The good news is that you don’t necessarily need to know everything in technical analysis to become a successful trader.

The following are six main sections of technical analysis.

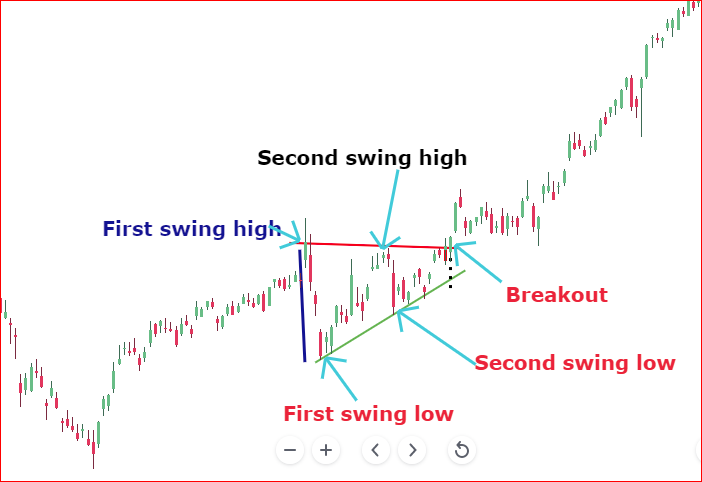

1. Chart Patterns

Short term and long term traders and investors use chart patterns to predict the future direction of stocks and other tradable securities. As the price fluctuates over time, traders identify formation on the chart by drawing lines that connect different price levels. From there, they can identify the possible direction of the stock.

2. Moving Averages

Moving averages are statistical methods used to smooth data points by creating a series of averages from the main data set. This method is highly used in the stock market to help traders in understanding the stock price movements.

There are many types of moving averages such as Simple Moving Average(SMA), Exponential Moving Averages(EMA), Weighted Moving Averages(WMA), etc. Traders use them based on their trading needs and strategies.

3. Support and resistance levels

In technical analysis, support levels and resistance levels are some of the most used and talked about. They are confusing and hard to spot on a trading chart. They also change based on the time frame a trader is using. Basically a support level that exists on an hourly chart may not be there on a weekly chart.

In short, they act as barriers to securities’ prices. That is, they prevent a price from breaking above or below a particular level.

The support level will prevent a stock price from breaking below it. On the contrary, a resistance level will prevent the stock from breaking above it.

4. Volume and momentum indicators

The trading volume is used by all kinds of traders regardless of their trading strategies. Whether you are day trading, swing trading, or buying for the long term, the trading volume will help you when forecasting the future price of the stock.

By understanding the number of shares bought or sold at a particular time, you will be able to predict the next stock movement.

For example, if the buying volume and momentum increase on good news; you will know that the price has a higher chance of moving up. Based on this information, you can trade this stock using your favorite trading strategies. In other words, you can either take a long position in the stock or cover your short sell position to prevent losses.

5. Price trends

The price trends indicate directions in the price of stocks and other assets. If a company is not doing well, for example, its stock price will decline over time. During this period, we will say that the price has a downward trend.

The same thing could happen if a company is doing well financially. The price can increase over time. In this case, we will say that the price has an uptrend.

6. Oscillators

In technical analysis, oscillators are indicators that draw bands between the highest and lowest price levels. At the same time, oscillators build a trendline that stays between these bands. Traders can make sense of the stock movements based on how the trendline is behaving between these levels.