What is dead cat bounce?

A dead cat bounce is a term used when asset prices bounce for a short period of time after a long downtrend before continuing in the downtrend. The bounce is not big but some investors and traders can recover some of their lost funds and exit the market. Traders can use this trading pattern to take positions in the stock since it is a continuation pattern.

The small bounce in the prices happens very often when an asset price is in a long declining trend. Investors use technical analysis to evaluate areas where prices will reverse. As a result, they take long positions at these levels and create temporally rallies. These rallies do not last long due to a big selloff wave of the in the stock.

Prolonged downtrends happen to securities for many reasons. Some of these reasons include but not limited to the following:

- The company is not longer profitable

- The market sector is not doing well. Most securities in that sector will experience a long downtrend.

- The economic conditions are not good

- There is bad news in the market

- Political instabilities around the world

- Natural disasters, etc.

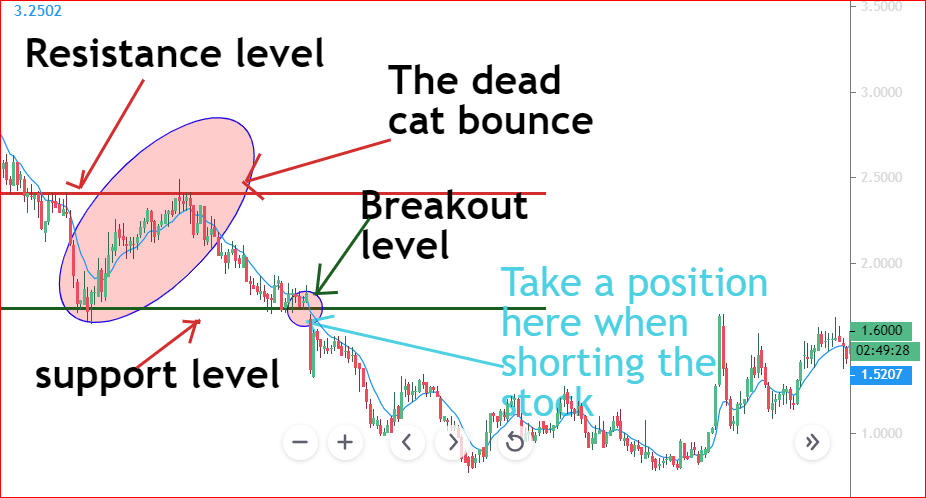

Example of a dead cat bounce on a chart

From the chart depicted above, you can see how the price had a temporally reversal in the trend. The bounce was brief as expected because sellers of the stock took over and the price continued the downtrend.

There are other smaller bounces on the chart. These are common in the market. As people buy and sell the asset, its price fluctuates. The price seems cheaper after a sell-off which attracts more buyers who then push the price up before sellers take over again.

How to use a dead cat bounce pattern?

A dead cat bounce pattern is a continuation pattern. In other words, indicates that what seems to be a reversal is a trap. Traders use this pattern to trade stocks and other tradable securities.

Please refer to the following Figure 2 for added trading information.

a. Taking a long position on the stock

If you are going long, you will get ready to take a position when you see that the price is not breaking below the support level indicated by the green line on the chart.

That consolidation can last a few days or weeks. You will then take a position after the green candlestick breaks above the consolidation level on high trading volume.

Where to put a stock loss?

Since this is a risky trade due to the fact that the stock is plummeting, you must use a stop-loss order. Of course, you have to use stop losses for every trade you make.

The order will kick you out of the market if the price keeps going down. Your stop loss will be at the lowest price reached by the stock around that support level.

If the price breaks below this level, it will be an indication of a further decline in the price. For this reason, it would no longer be profitable to stay in the stock on a long position.

How to exit the trade?

You will keep your long position until you see signs of reversal in the trend. Usually, stocks experience a pullback at resistance levels.

A resistance level is a level where a price is not able to break above. The past resistance levels can be used to predict future resistance levels on the stock price.

In our example, the previous resistance level was around $2.40 per share. As a trader, you would expect the stock to consolidate at this level or experience a pullback.

If you are trading this pattern, you must sell your shares right after you see a halt in the uptrend movement. We know the pattern is a continuation pattern. This means that the stock is indeed going to reverse and continue the downward trend.

b. How to short using a dead cat bounce pattern?

To short this stock, you will need a confirmation that the stock is going to continue its downtrend. You will have a confirmation when the stock breaks below the previous low.

In other words, if the stock breaks below the support level and makes a new low, it will be an indication of a further decline in the price. Also, the stock must breakout on a high trading volume.

You would take a short position at the breakout level indicated by a small circle in Figure 3 below.

Some traders take a short position when they see a consolidation at the resistance level shown by a red line on the chart. This helps them maximize their returns on this trade. They take short positions at the resistance because they know that the pattern is a continuation pattern. They think it is going to go back down and continue in the downtrend.

If you end up taking a short position at the resistance level, you will need to put your stop-loss order a little above the resistance level. Breaking above the resistance level on high volume will be an indication that the price is going much higher. Therefore, you will lose money if you keep your short position in the stock.

Where to put a stop loss?

If you have been trading for a while, you know that there are times when a stock experiences a false breakout. This could happen at any time. For this reason, you would put a stop loss a little above the support level depending on your risk tolerance.

If the stock goes back above the support on high volume, it may be an indication of an uptrend. In other words, the stock can make a double bottom pattern and go back up. For this reason, it will no longer be profitable to keep your short position in the stock.

How to exit the trade?

If the stock goes down indeed, you would keep your short position and get ready to exit before or at the next support level. It could go down much further or reverse the trend when it reaches the next support.

By reducing your position size, you will lock in some profit. Should the stock go back up? No problem. You have some profit already. The only thing left is buying the remaining shares and get out quickly.

Final words

Trading and investment activities are associated with a high level of risks. When you are trading with this pattern or other patterns and trading techniques, you must use loss prevention methods. It is possible that you can lose all even more than the money you invested in the market.

To avoid major losses, use stock loss orders, and avoid using market orders in your trading practices. In addition, know when to cut your losses before it is too late.

Having small position sizes can help you minimize your losses. Do not put all your eggs in one basket. Someone said that.

Happy trading and investing !