If you are struggling with debt or your debt never seems to go away, you have come to the right place. Millions of people are struggling with their debt and have no idea how to get out of it. According to Shift, 80% of Americans have consumer debts, and 13% expect to be in debt their entire lives. You can see that pretty much everyone is in debt in this land of opportunities.

Why are so many people in debt and struggling with it? That is what we are going to discuss in this article.

I had a lot of conversations with my friends and random people about debt. One thing I learned about them is that they are struggling with debt.

Debt is real and it is destroying families. If you are not struggling with student loans, a mortgage is weighing you down. Those without student loans or mortgages are having big trouble with car loans, or credit card debts.

I started wondering why many people are struggling with debt. Even those who are educated are not left behind no matter how hard they try to pay it off.

- People do not understand what debt is and

- People underestimate the impact of interest rates especially compound interest on the principal amount

If you are struggling with debt it is because you don’t understand what debt is or you underestimated the power of the interest rate.

If you knew what debt was, you would not have accumulated so much of it. Keep in mind that I am not blaming consumers. Instead, I am saying that the system is built in a way that millions of people get into debt, and yet, few resources are spent to educate them. In the end, you have millions of people struggling with debt and one to help them. They don’t even know what is hitting them.

In this article, I will explain why millions of people are struggling with debt. I will focus on the top 4 popular debts that are destroying families.

Without further ado, let’s get started.

1. Credit card debts

Credit card debts are some of the most common debts consumers are struggling with nowadays. It is like every person owes banks and lending institutions money. Even children are getting into debt through credit cards. It is not a typo. People who are under 18 can use credit cards. Although they will not have the card under their names, they can be added as authorized users of adults’ credit cards. According to Value Penguin, some card providers allow anyone to be an authorized user whereas others have a 15 or 18 years age minimum requirement.

Companies are recruiting an army of borrowers who have no clue of what debt means and with no financial literacy. A survey conducted by Nerd Wallet shows that 55% of Americans do know when they start paying interest on credit card purchases. Also, more than 54% do not know that carrying a credit balance affects their credit score and costs them money. The same survey concludes that only 8% of Americans know that late payments on credit cards affect their credit scores.

So, adults have no idea of what they are dealing with, and yet, companies are allowing their kids to be authorized users!

If more people have no clue about how credit cards work, why are companies spending millions of dollars encouraging everyone to get these cards? If you recently visited your favorite grocery stores, you saw that they ask you to sign up for credit cards. In return, they promise you discounts on certain purchases which encourage you to spend more money.

Well, that is how they make money. The lesser you know, the more money they will make from you.

Financial literacy can help us understand why people are struggling with debt

The most important topic I will talk about is compound interest.

Compound interest is a fancy term institutions use to say that the money you owe them will grow exponentially if you don’t pay attention. I guess you would not get a credit card if your bank tells you that the card will grow your debt exponentially. What if they told you that a credit card marked the beginning of your financial collapse? Would you still have it?

Forget about all the good stuff you will buy with your credit card. Let’s focus on the real issue here. Do you know what the annual percentage rate (APR) means? Well, this is the interest you pay on the outstanding balance expressed as a yearly percentage.

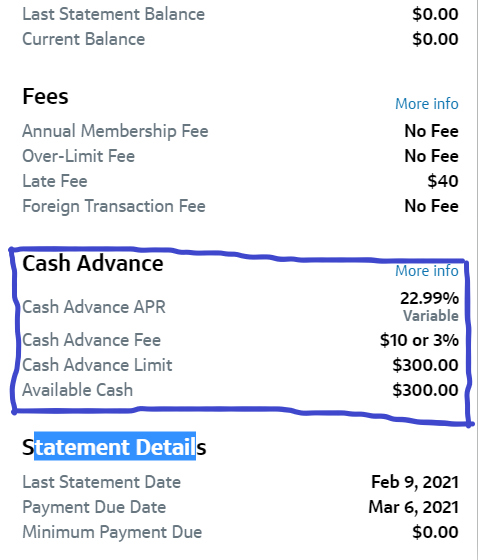

Now that you know what APR is, let’s see how much yours is. According to Credit Cards, the average APR in the US is a whopping 16.12%. This means that if you have a credit card, your APR is either 16.12% or close to it. If you are paying less than this percentage, good job. Some people are paying more than 20% in APR, especially those who use cash advance services.

People with bad credit pay a much higher interest rate. So, if you are paying more than the average in the nation, you are getting yourself in trouble.

Why does the APR matter? Lending institutions including your bank you love so much let you spend their money with a string attached.

- They make sure that your line of credit (credit limit) is as small as possible until you prove yourself worthy.

- They charge you the highest interest possible

It is like stealing money from you. Giving you the lowest amount possible and charging you the highest interest in the lending industry? That is harsh.

On top of that, if you don’t pay them on time, you will end up paying interest on both the principal and the interest. This makes your debt grow exponentially if you don’t take charge of your finances. That is the power of compound interest.

How does compound interest work?

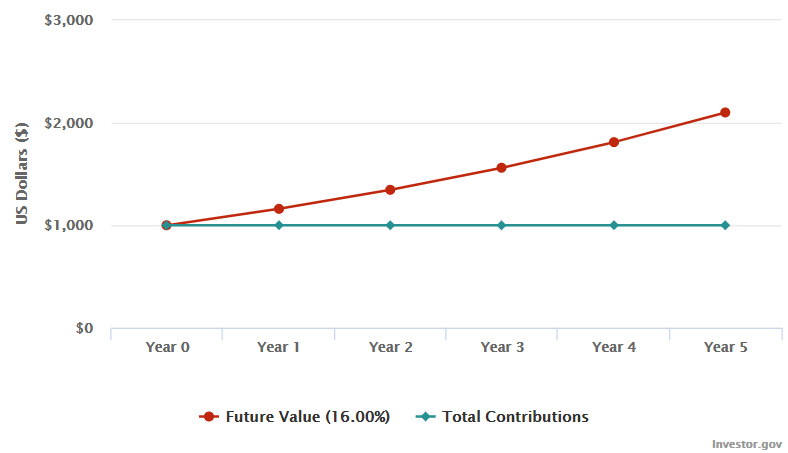

Let’s assume that you owe your bank $1,000 and your APR is 16% per year. If you do not pay this amount off, you will be charged around $160 per year which translates to almost $13.34 a month. This amount will be added to your principal for the second month. For the following month, you will pay a 16% APR of $1,013.34. Which is $13.52. Your new principal will become $1026.86. This process will continue until you take action. You can see that the principal amount is growing as unpaid interest is added to it. How much do you think you will owe your bank after 5 years?

The graph below illustrates these numbers.

After 5 years, you will owe the bank $2,100.34. Your debt grew exponentially even if you did not borrow more money. A simple $1,000 debt became $2,100.34 in just 5 years! What if you owed dozens of thousands of dollars and the time frame is longer?

The problem gets worse for millions of people out there. They keep borrowing more money and rack in dozens of thousands in credit card debts. As a result, a manageable debt becomes impossible to pay off.

What if we flip the coin and make you an investor?

The problem with compound interest is that it only benefits the person who is getting it. If you were getting that percentage on your investments, you could grow your portfolio exponentially over time. Hence, getting rich faster and safely.

Let’s assume that you want to invest your money in compounding interest. How much do you think you would get? A quick search for the highest annual percentage yield (APY) with compound interest shows heartbreaking numbers. For example, Bankrate shows that the best APY savings account comes at 0.6% in 2021.

When you borrow money, you pay a much higher interest. However, when you invest the same money, they pay you almost nothing. That is how banks rip you off.

Here is a question for you? Why would you agree to pay the highest interest rate to a bank that would not give you the same returns if you invested your money with the same bank?

The banks would go out of business if they give those returns to their clients. The lesson here: You should follow in their footsteps.

If you know what credit card debts mean and the power of compound interest on your balance, avoid accumulating more debt. Those who have already accumulated a lot of credit card debts should pay them off as fast as they can. Otherwise, they will work hard only to give their hard-earned money to corporations.

Bonus: If you choose to use credit cards, swear to yourself that you will NEVER carry an outstanding balance month to month. That is you should pay off all the money you have spent by the due date. Do not get a credit card if you cannot follow this rule.

The following tips can help you lower your credit card debts.

- 11 easy ways to reduce credit card debt

- 9 Things to know before getting a credit card

- How to choose my first credit card?

- How to pay off debt? 11 Tips you can use

- How to pay off credit card debt? 10 tips I used

2. Student loans

Let’s talk about student loans. Loans that every American knows about. Even toddlers know about student loans. Why is this true?

Well, their parents have accumulated hundreds of thousands in student loans and now cannot afford their kid’s video games, party contributions, gym memberships, kids’ sports subscriptions, fresh and healthy food, etc.

When their kids ask them about soccer game contributions, they tell their kids that they cannot afford them. Their kids then ask them why is it expensive if they work every day. The parents answer: We have student loans that we are trying to pay off. It is been hard, but we promise you we will afford it next year. Next year, the story is the same. It gets to a point where the kids think that their kids are liars.

Why are student loans so bad and alarming? According to Student Loan Hero, 44.7 million Americans have student loans, 69% of the class of 2019 took student loans and graduated with $29,900 in loans on average. Their parents used $37,200 in federal parent PLUS on average.

You can see that most Americans graduate with a huge amount of loans.

Let’s analyze student loans, to clarify why millions are struggling with debt

You are already in the negative if you graduated with student loans.

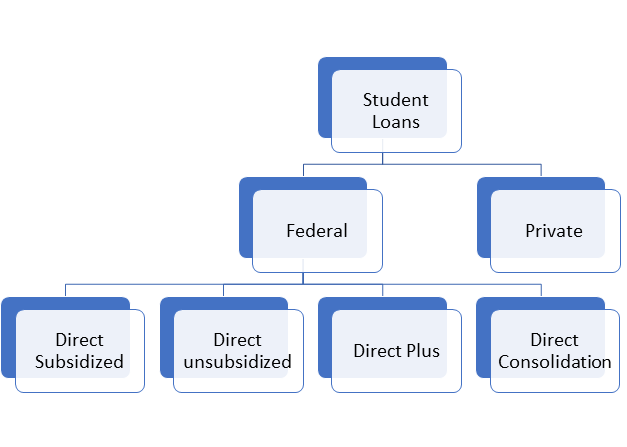

If you financed your school with loans, you have one or more of these types of loans. The types of loans you have do not matter. What matters is what they have in common.

What do you think all these loans have in common? If you guessed the interest rate, you are right. Whether the interest charges start the day you signed up for the money or after the grace period, it is an interest charge and it will make you sweat.

Many people who go to college using student loans do not consider the impact of the interest rate on the money they borrow. They just think of an interest rate as that extra money you pay on top of the principal amount.

However, if not dealt with carefully, the interest rate could cost you more than what you borrowed.

Most students and their parents do not understand the power of interest charges on the principal

The question is how many of these students understand how the interest rate is calculated? Or how many understand the power of compound interest on the principal? They all flock to borrow money, and later on, struggle to pay it off.

Just like any other loan, there is an interest that is added to the principal. According to the Student Loan Hero, the interest paid on federal student loans does not change for the duration of the loan. However, those who take the money from private lenders usually pay compound interest. From the discussions above, we have seen that compound interest will grow your debt exponentially. Unless of course, you pay it off faster.

Why do some students end up in huge debt?

When I was in college, some of my classmates used to tell me how they were going to school using government money. What they meant was that they were using student loans for every expense they had. That is they used student loans on:

- Tuition

- Books

- Housing

- Medical insurance

- Food

- Other related expenses that were covered by the loan

What is wrong with this method?

The basic principle of debt is that the more money you borrow, the more it costs you to pay it off and it gets harder over time. By borrowing money for every college expense, they risk increasing their debt. Hence, making it harder to pay it off. By the time they learn about this, it is already too late. This is why people who go to an average school will tell you that they have $200,000 in student loans. Or some people will tell you that they can’t pay off their student loans and it has been 20 years since they graduated.

If they understand what debt is, the impact of interest on their debt, and more importantly, what it takes to pay it off, they would borrow less money.

Yes, it is possible to go to school the smart way. That is avoid taking out loans or borrowing less if you have to.

For example, a student can borrow money to cover tuition and work a part-time or full-time job to cover books, living expenses, food, medical insurance, etc.

If you want to know how you can go to school with no loans or pay off your student loans, read the following articles.

- College without a student loan

- 16 easy tips to pay off student loans

- 16 tips to save money in college

- How to save money on books? 10 tips you can use

3. Car Loans

Car loans are one of the most common loans many people accumulate. According to Statista, the analysis of Finder of the data from the Federal Reserve of New York showed that over 100 million Americans had auto loans by the end of 2017. The same data shows that Americans have borrowed on average $31,099 for new cars. These numbers are eye-opening and alarming.

Why are so many people accumulating auto loans?

There are many reasons. You know humans. Many people do not want to buy used cars. They like flashy stuff. Understandably, most of us need cars to go to work.

Is it a good idea to borrow money for a new car? The answer: It is never a good idea.

Why do many people struggle with debt due to buying new cars?

It is never a good idea to buy a new car whether you are paying full cash or borrowing money. The following are the reasons you should always avoid buying new cars.

- New cars cost more money: You will pay a premium price for a brand-new car

- The interest rate will increase the cost of the car

- Cars depreciate fast: If you buy a brand-new car and try to sell it to someone else the same day, you will not receive the same amount you paid for it! The irony is that the dealership that sold it to you cannot take it back at the same price. Maybe 10% less if you are lucky.

- You will pay premium insurance and you must have full coverage: The insurance company will charge you more money to cover your brand-new car. This is because the insurance will pay a lot of money to replace or fix a brand-new car. In addition, it would be foolish to have a liability on a new car. So, your insurance will be in hundreds of dollars.

- New cars are too demanding in terms of maintenance

- You can see that a brand-new car will cost you more money from day one.

Why do people buy new cars if it is not a good idea? People do not wrap their minds around the true cost of owning a brand-new car. In other words, they do not understand what car loans mean to their financial standing. Their eagerness, pride, and desires get the best of them.

Do you want to learn how you can reduce your car insurance or save money on gas? Read the following article.

4. Mortgages

Finally, one of the most common types of debt that almost every person is dying to put on their belts.

Mortgages are a great way to have a place you can call your own: A home. Without mortgages, only a fraction of the population could be able to afford and own homes.

Well, the government together with big guys figured out a way to give almost everyone a chance to own a house. Even those who are not qualified under normal conditions can walk outside there and get a mortgage.

Why is it so easy to qualify for a mortgage? Well, you just need to understand how mortgages work.

You see when you borrow money from your favorite bank, the bank sells that mortgage to other institutions such as Fannie Mae and Freddy Mac. These institutions bundle those mortgages into other mortgage-backed securities (MBS) and sell them to other investment institutions. You can see that there are invisible hands that contribute to the mortgage industry.

As long as the government supports these institutions, they will buy mortgages from qualified lenders. With a guarantee to get rid of the mortgage, lending institutions will easily give you money. In other words, the government takes the risks to keep the mortgage industry alive.

This is what makes it easy to qualify for mortgages. Yes, many people are struggling with debt because it is easy to qualify for mortgages.

Why is this a problem and how are many people struggling with debt because of it?

People end up buying houses they cannot afford to pay off. You see, like any other loan, there will be an interest rate on the money you borrow from the bank.

Every month you will make payments that will cover your principal and interest. A huge chunk will go toward the interest and a small amount will cover your principal. Over time, the money toward the principal will increase as the portion of interest goes lower. This is known as amortization.

Most homebuyers are irresponsible when it comes to buying homes. The greatest and most important way to save money on a property is to have a large down payment. A down payment that is at least 20% is considered good. The more the better. Not only that you lower the interest charges on the house, but it also gives you a chance to pay it off much faster.

How many people do you think put down at least 20%?

According to Zillow, only 40% of home buyers put down 20%. In other words, 60% of home buyers put down less than 20%. You can see how low this percentage is.

Many people think about buying a house but they don’t understand the true cost of buying a house. In other words, home buyers do not understand the meaning of mortgages and the interest rate on their finances.

Do you have friends who bought big houses, and later on, struggled to pay them off? It happens every day and sometimes the same people repeat the same mistake.

The best strategy when it comes to buying a house is to:

- Put down a huge down payment of at least 20% (the higher the better)

- Secure the lowest interest rate: This will depend on your credit score and credit history and some other factors

- Have an income that can help you pay off the house much faster

The above strategies and many more will prevent you from joining the list of people who are struggling with debt.

If you want to learn more about how you can smartly buy a house, consider using the following related articles.

- How to save for a down payment?

- How does a credit score affect a mortgage rate?

- Top 13 reasons you are not ready to buy a house

- 18 mistakes to avoid when buying a house

Struggling with debt: Final words

This article intended to examine why the majority of people are struggling with debt. We have seen that it is very easy to accumulate debt but hard to pay it off.

The system is built in a way that lenders make as much money as possible from consumers. Why do lenders succeed? Consumers do not have financial literacy and lenders love it. Consumers do not understand what debt is and its impact on their financial standings. Those who think they understand debt, make one mistake: Underestimate the impact of interest rates especially compound interest on the principal amount.

We have also examined how compound interest is one of the greatest weapons moneylenders use to suck money out of consumers’ pockets. Without financial literacy, strategies, and discipline, consumers continue to accumulate debt.

Everyone learns about this harsh reality when it is already too late (when they are already struggling with debt). At that time, the debt grows much higher until some consumers become bankrupt. I can tell you that if consumers fully understand the complexity of debt with associated interest, they would not accumulate as much debt as they are currently amassing.

If you are thinking about getting a credit card, student loan, car loan, mortgage, or other forms of debt, think twice. Consider learning first. Understand how these loans will affect you shortly and in the long term. Know what you are getting yourself into and make sure that you are aware of all hidden fees associated with the loan. The more you know, the better you will protect yourself from a financial downfall.

More learning resources

- How to pay off debt? 11 Tips you can use

- How to pay off credit card debt? 10 tips I used

- 11 easy ways to reduce credit card debt

- How to save for a down payment?

- How does payment history affect credit score?

- 33 ways to save money while traveling

- How to save money on car insurance? 20 Tips

- Frugal Living: 19 tips that will save you money

- 18 tips To end your struggle with money and achieve financial independence

- 8 Reasons you are struggling with money