Your payment activities are some of the most important factors lenders consider when evaluating your creditworthiness. If you borrow money but can’t pay it back, you are automatically a risky borrower. That is why missed payments or late payments affect your credit score greatly. A late payment can drop your credit score by as much as 110 points. Late payments also stay on your credit reports for 7 years. The effect of late payments or missed payments on your credit score fades over time.

This article will walk you through how late payments affect your credit score and tips you can use to keep your credit history healthy.

How Late Payments Affect Your Credit Score?

Your payment history is the biggest factor that affects your credit score. Lenders consider this factor to be important because missing payments or late payments lead to defaults, foreclosures, collections, and bankruptcies. All these negative events affect both lenders and borrowers financially. That is why your payment history is the biggest factor that affects your credit score. Credit scoring models (FICO Score Model, VantangageScore Model, etc) put more weight on your payment history.

One late payment on your credit report can ding your credit score as much as 110 points. Those with a low credit score tend to lose fewer points compared to people with high credit scores.

Your lenders won’t report late payments to major credit reporting bureaus(Equifax, TransUnion, and Experian) until they are 30 days past due. And the longer you avoid paying it off after 30 days from the due date, the more it affects your score.

There are many reasons you might miss a payment such as having financial difficulties, busy schedules, life events, having too many accounts, losing a job, or simply forgetting. These events are sometimes inevitable. What you can do is keep up with your credit accounts and meet their requirements as much as you can.

If you recently missed a payment, try to pay it off within 30 days after the due date. You might have to pay some fees and interest charges such as the annual percentage rate(APR) to your lenders based on the terms of your loans. But, a late payment will not affect your FiCO score or Vantage Score if you pay it off before it is reported to major credit reporting agencies.

When is a payment considered late and reported to major credit reporting bureaus?

A credit card or other credit payment is considered late and reported to credit reporting bureaus only when it is 30 days past the due date. That is when a late payment can affect your credit score. Keep in mind that there are two parties involved in your payments.

- Your lenders. If you miss a payment you might pay late fees and interest charges based on the terms of your loans. These fees and charges are established based on the financial products you have such as a loan, credit card, car loan, mortgage, personal loan, etc. Most lenders charge fees when you don’t make payments by the due date. This fee has nothing to do with your credit score or credit reports.

- Credit reporting bureaus. Credit reporting bureaus put together your credit reports based on the information received from your lenders and other companies that manage your credit accounts. When a missed payment passes 30 days, your lender will report it to credit bureaus who will then update your credit reports with this new credit information. After your reports are updated, the new changes will be reflected on your credit report. A late payment on your credit report lowers your credit score by as much as 110 points. Until a late payment is reported to major credit bureaus, it will not affect your credit score.

How do missed and late payments affect your credit score over time?

A one-day late payment won’t hurt your credit score since it will not be reported to major credit bureaus. However, as days go by, it will get to a point where your credit score will be affected by missed payments. The following are some of the most important due dates you should keep in mind when it comes to missed and late payments on your credit accounts.

- 1- 30 days late payments. Any payment you missed won’t hurt your score if you manage to pay it off within this 30 days window. The earlier you pay it off the better. That is delaying your payments to the last day of this window is risky because some of your lenders might have longer payment processing times.

- 30 – 60 days late payments. Most lenders will report late payments to major credit bureaus after 30 days past due. At this time, your credit score will go lower since the late payment will be reported on your credit report. Any late payments between 30 to 60 days are easier to recover from. The longer you delay paying it off, the further late payments damage your credit score and affect the health of your credit. What you can do at this point is to pay off any late payments or missed payments as soon as possible. You will still lose points on your credit score but things will get worse if you delay it any further.

- 90 days late payments. Most lenders will disqualify you for loans when you have an outstanding late payment of 90 days on your records. At this time, missed payments can become charge-offs and your accounts will move into the collection phase. Which is where collection agencies will attempt to recover the money you did not pay.

Although there are many dates to consider when it comes to late payments; a late payment will stay on your credit report for 7 years.

How do I know if there is missed payment on my credit report?

The easiest way to know if there is a late payment on your credit report is to get a copy of your credit report. You can easily get a free copy of your annual credit report from all three major reporting agencies. Each agency will give you a copy of your annual credit report for free once in 12 months.

After having your report, read it and make sure that the information you have there is current and correct. Any missed or late payments will be on your report with their corresponding lenders.

You can also know if you have late payments on your credit report by checking your credit score. The easiest place to start is from your lender or credit account issuers such as credit card providers.

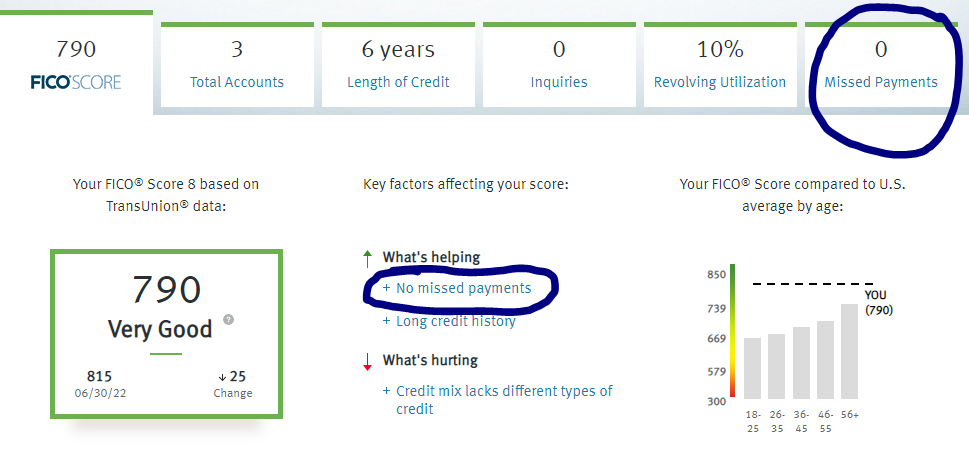

The image above shows that this particular account has zero missed payments. If there were any missed payments on the report, they would also be listed on this account profile.

How long do late payments stay on the credit report?

Late payments stay on your credit report for 7 years from the original due date of the balance. Even if you covered your delinquencies, late payments will still show on your report. Some accounts and negative information might stay on your credit report even longer than 7 years. For example, a bankruptcy can stay on your credit report for up to 10 years whereas collections or charge-offs will stay on your report for 7 years.

How to avoid late payments on your credit report?

- Make your payments on time. The first and most important step to avoiding late payments on your credit reports is to make your payments on time all the time. This is the only way you can safely move forward with your accounts and keep your credit history healthy.

- Make your payments before the 30 days window expires. If you missed a payment due to financial setbacks, try to pay it off before it is 30 days past due. Your lenders might charge you fees but, that payment will not be on your credit report if you catch it in that time frame.

- Organize your accounts by due dates and set up reminders. Most people miss payments not because they don’t have the money to pay. Instead, they do not organize their accounts. If you have many credit accounts, organize them by due dates and put them in your calendar. This will help you pay off every single account on time.

- Move your due dates to the same date. One effective method to avoid late payments is to have same-day due dates. For example, you can choose the 15th of each month to be the day you pay off all your accounts. Some lenders and creditors might allow you to change your dates if that is what works for you. Note: Paying off all your bills on the same date could be hard if you don’t have enough cash in your bank account.

- Make more money. If you are missing payments due to having no money at all, a second job can help you meet your financial obligations.

- Use cash only. If you can’t manage your spending behavior, switch to cash only. For example, you can use cash instead of credit cards. This way, you’ll never have to worry about missing a payment if you don’t have balances on your credit cards.

- Do not spend more than you can afford to pay off. Leaving below your means is a strategy that most people use to manage their debts and avoid late payments. Spend according to your financial situation not based on your desires.

The bottom line

A missed payment or late payment will lower your credit score up to 110 points and will stay on your credit report for 7 years. A one-day late payment will not affect your score. Lenders do not report late payments until they are 30 days from the due date.

So, if you missed a payment, try to catch it before the 30 days window elapses. The longer you delay paying off late payment balances, the further they affect your credit score and hurt your credit. Most lenders will not approve you for loans if you have more than 90 days of late payment on your credit reports.

Living below your means is a simple way to avoid late payments. If you have many credit accounts, consider setting up reminders, putting them in your calendar, or having the same-day due date to avoid late payments.