Should I get a credit card? Is it a good idea to have credit cards? Credit cards are widely used around the world and financial institutions are recruiting an army of credit card users. Everything that moves is getting these cards. If you have not got yours, it is not too late. The question is: should you get a credit card? Is a credit card good right for you? These are some of the questions we will explore in this article.

Deciding whether you should get a credit card is not an easy task. Having a credit card will mark your first step into a new financial realm. A world of borrowing to spend not borrowing to invest. Many people no longer worry about what credit cards are or their impacts on personal finances. They think that credit cards are just like any other card that lets you spend some money you did not work for.

After spending the money, they realize that it must be paid back. The problem is some borrowers do not have incomes that support their credit card expenditures. That is why millions of people are stuck with their debts.

Not everyone is in debt, though. There are responsible borrowers who take good care of their finances and get the most out of credit cards.

What is a credit card, anyway?

A credit card is a card that financial institutions give to their borrowers and let them spend up to a predetermined amount. That is your lender will give you a limited amount you can spend on the card. Once you have spent all the money you have been approved for, you must pay off some of it in order to use the card again.

The money you are allowed to spend on the card is known as a credit limit or line of credit. For example, if you have a card with $2,000, you can spend up to $2,000. Once you have spent all of it, you will not be able to use the card again (by default) until some of it is paid off.

If you make your payments on time and fulfill the terms and conditions of the card, your credit limit can be increased by the lender automatically. You can also request a credit limit increase online or by calling your lender. Keep in mind that your lender will evaluate the way you used your existing card before you are approved for more money.

Learn more: How to increase credit limit? Credit line increase

How to get a credit card?

There are many ways you can get a credit card. The first and easy way to get a credit card is to visit your current bank and ask them that you want to get a credit card. The bank will evaluate your income, credit history, and credit score if you have one, etc. The bank will then try to find answers to some or more of the following questions.

- Whether or not you are qualified for the card

- What card you are qualified for

- Your starting credit limit

- The annual percentage rate (APR) you must pay on the card

- and other factors.

Once you have gone through these steps, you will be approved or denied right on spot. You can also apply online by going to the website of your bank. You just look for the card you want and submit an application. Your bank will later respond to your request with an approval or a denial letter.

What if you don’t want to use your bank?

Well, there are other institutions that offer credit cards. You can go online and look for the perfect credit card for your current situation. For example, if you travel a lot, it would be a good idea to look for the best travel credit cards. On the other hand, if you are a student, you can search for the best student credit cards. Once you have found a card you want, you will then submit your online application. The lender will then review our profile and approve or deny you.

What should I do before applying for a credit card?

Applying for a credit card is like applying for a loan. So, you are sending an application to the lender to borrow the money in a form of revolving credit. Like any other loans, you will go through a serious judging process where the lender will decide if you are worth the money. Having a good credit score (if you have one) and credit history will increase your chances of being approved.

Should you get a credit card? If you are still confused about getting a credit card, the following few tips will help you get ready for a credit card.

A few tips to help you get the right card

- know why you need a credit card: Why are you interested in credit cards in the first place. Do you need to build your credit or repair one? Do you need to increase your credit score? What about just shopping or travel? All these questions will help you know exactly why you need a credit card. Furthermore, the answer to these questions will help you pick the right credit card. For example, if you want shopping you will focus on credit cards with the highest cash rewards and lowest APR. A person who wants to travel would focus on a card that offers the highest travel benefits such as mile points, etc.

- Understand the risk associated with credit cards: Just like any other loan, credit cards come with risk. Matter of fact, credit cards are some of the riskiest loans out there due to a few factors: (1) the highest interest rate known as annual percentage rate (APR), (2) compounding that interest, (3) highest charges when it comes to a cash advance and other services, (4) people get addicted to them faster, and (5) a limited financial literacy. Before you sent in your application, educate yourself of the risks associated with credit cards and make your decisions based on that.

- Know the card you want: Knowing the card you want will help you balance risks and rewards. Do your homework and avoid getting a card just because its name sounds cute.

More tips

- Work on your credit score: If you want your application to be approved, get the lowest interest rate, receive the highest credit limit, and other benefits, work on your credit score. Your credit score will help lenders during the evaluation of your creditworthiness. If you have borrowed money before and used it responsibly, you will most likely have a good credit score. This will increase creditors’ confidence in lending you money. That is lenders will compete to give you a good deal as a way to not lose you. If you never had credit before or any form of business dealings where your activities were submitted to credit reporting companies(Experian, TransUnion, Equifax), you will not have a credit score. That is OK. You are just getting started.

- Prepare all your documents: Getting all your documents ready will help you a lot during your application process. All lenders will need to know who you are. So, having a government-issued ID, proof of address, mailing address, social security number, will be helpful.

- Apply for the card: Once you know what card you want and have made up your mind, apply for the card.

If you need to know much more about credit cards in detail before sending in your application, read the following article. It will guide you through the most important things you should consider before getting a credit card.

Related: 9 Things to know before getting a credit card

Is it a good idea to get credit cards?

Now comes the most important question of the day. Is it a good idea to get a credit card? The answer to this question will depend on many things. Some of which you have learned in this article already.

Before you get a credit card, consider reviewing your financial standing and your projected future income. At the end of the day, a credit card is a debt and your ability to use it responsibly and pay it off will make all the difference.

A credit card has a lot of benefits over a debt card. For example, a credit card will help you improve your credit score, build a credit history, and give you experience in the real world. It is also convenient to use these cards when you don’t have cash on your debit card or cash at all. So, credit cards are helpful. If your paycheck hasn’t come yet, you can still cover your expenses using a credit card.

All that sounds sweet. If you are convinced already that you need a credit card, hang on a second. Credit cards come at a cost. They are loans and every loan has its downside.

Here are the top factors to consider before you submit an application

- Annual percentage rate (APR): Although you will be bribed with a 0% APR for the first year, for example, you should expect to pay APR that is in double digits. Yes, credit card APRs are one of the highest in the lending industry. These rates make it difficult to pay off your debt once you accumulated so much of it.

- Compounding Interest: Compound interest makes your debt grow. Once you have racked in a lot of credit card debts, it will be impossible to pay them off due to compound interest. Not only that you are paying interest on the principal amount, but you also pay interest on the unpaid interest. This makes your debt grow much faster than you can pay it off.

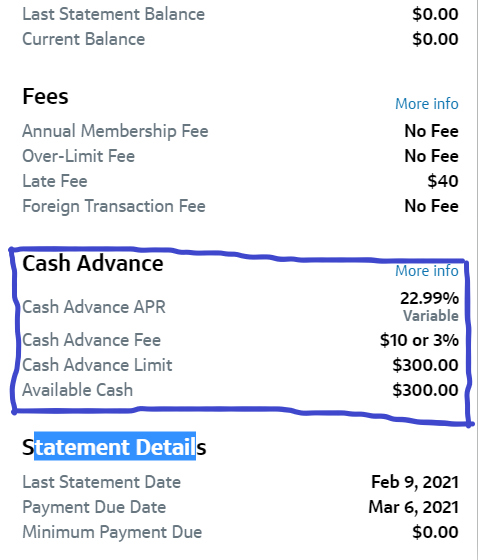

- High fees on some services: Lending institutions give you money and services with a string attached. Most credit cards will let you withdraw cash from them. This is known as a cash advance. Cash advance comes with very high APRs. Besides this service has other fees and charges.

- Very addictive, affect your credit history, and credit score: Many people do not know how credit cards work. Besides they have no financial educations which makes the matter much worse. That is why millions of people are drowning in credit card debts. Companies do not even provide educational resources and warnings to borrowers. Instead, they encourage them to borrow and spend more. Things get complicated when you cannot pay off your debts. Just like any other debt, your credit card will directly impact your credit history and credit score. If used well, credit cards can help you build a very solid credit history and improve your credit score. If not used correctly, your credit cards will put you in a financial crisis that will last for a very long time. So, be careful about credit cards.

After considering these factors, let’s see if a credit card is right for you

Are you getting a credit card so that you can just go shopping? If that is all you need it for and have no intention on cash backs or other forms of rewards and benefits such as building a credit score; then a credit card is not right for you. This is because a debit card will help you achieve all of that without getting into debt.

Are you financially stable or have the means to pay off your credit cards? If that is the case, then you can have a credit card. As long as you can keep up with the payments, it will not hurt to get a card. If your income is not good enough and you think that you will rely on credit cards to do your dealings, stay away from credit cards. Your life will be ruined much worst and faster than you anticipated.

More reasons credit cards could be right for you

Are you good at managing money and have control of your finances? Then credit cards are right for you. The lender gives you money to spend. However, spending all of it will put you in red. You should stay under 30% of credit usage. The lesser the better. I recommend staying under 10%. A small percentage is easy to pay off and does not affect your score much. So, if you can control how much you spend, then a credit card will be right for you.

Credit cards can help you rebuild your credit and repair your credit score. If this is the case for you, a credit card with no interest rate can help you pay off other debts faster. That is you can stop using credit cards with APR and use a new one with 0%APR. This can help you pay off what you already accumulated and get back on your feet.

More learning resources

- Struggling with debt? This is why people struggle with debt

- Debt to income ratio (DTI): What is DTI?

- 11 easy ways to reduce credit card debt

- How to pay off debt? 11 Tips you can use

- How to pay off credit card debt? 10 tips I used

- 4 steps to become wealthy: Number 4 is the hardest

- Difference between a debit card and a credit card