What is receivables turnover ratio?

The receivables turnover ratio is a financial ratio that measures how efficiently a business collects its accounts receivable during a particular period of time, according to NetSuite. A lower ratio shows that the company issues and collects its accounts from customers with efficiency.

What are accounts receivable?

Accounts receivable are payments due in the future that a company has not realized yet. Companies sell their products to customers either for cash or credits. If a customer does not pay with cash, the company will extend credits to the customer. This credit must be paid in full at agreed-upon terms and dates.

The payment is not realized until the customer pays the full agreed-upon price. The company will then record this future payment on its balance sheet as an account receivable.

In other words, an account receivable is a future payment a company will receive from its customer at a pre-determined due date.

The extended credit will have terms and conditions that bind the business and the customer.

If a customer fails to pay the company, fees and charges could be applied to the outstanding balance. In addition, a collection entity can be used to recover funds the customer did not pay on time.

A receivable turnover can be summarized as the number of times a company issues and collects credit from its customers.

How to calculate the receivables turnover ratio?

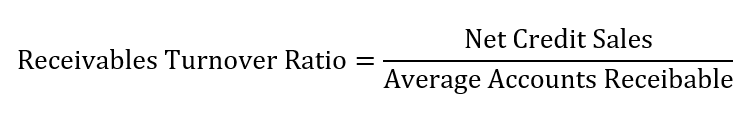

To calculate the receivables turnover ratio, you will divide the company’s net credit sales by the average accounts receivable.

In this formula,

Net Credit Sales = Net sales generated by a company after deducting all returns and sales allowances [Credit: Accounting Tools]

>>Related: Average: What Is The Meaning Of Average?

Example of receivables turnover ratio

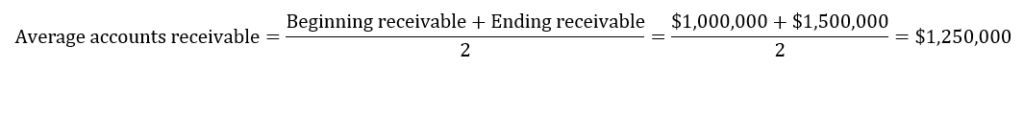

Let’s assume that a company XYZ had the beginning and ending accounts receivable of $1,000,000 and $1,500,000 consecutively. At the same time, the company reported net credit sales of $15,000,000. What is the receivables turnover ratio?

To answer this question, we will use the following steps.

Step 1: Available data

- Net Credit sales = $15,000,000

- Beginning accounts receivable = $1,000,000

- Ending accounts receivable = $1,500,000

Step 2: Calculate the average accounts receivable

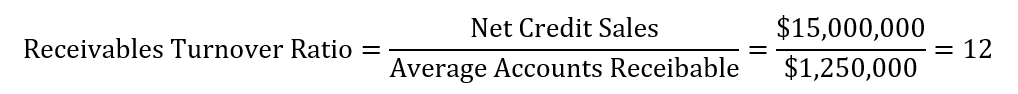

Step 3: Calculate the receivables turnover ratio

From our calculations, we can conclude that the receivables turnover ratio of XYZ company is 12.

How to interpret a receivables turnover ratio?

A lower ratio indicates that a company is efficient at extending credits and collecting its receivables. On the other hand, a higher ratio will indicate that the company does not have a system in place that makes it easy to collect its receivables.

This ratio can also be used to compare a company in relation to its sector. Furthermore, this ratio can also help investors to compare two or more companies in the same sector. For example, let’s assume that three competing companies have the following ratios:

Company A’s Ratio = 5

Company B’s Ratio = 10

And company C’s Ratio = 20

If you want to choose a company with the strongest accounts receivables turnover ratio between A, B, and C; you would go with A. That is Company A does a better job at collecting its receivables. Hence, having a lower ratio.