What is a sale to list ratio?

The sale to list ratio is the ratio between the sale price and the final list or asking price expressed in percentage. This ratio helps sellers and buyers to understand home prices are being negotiated in a particular market. From this information, buyers and sellers will know how to approach the market.

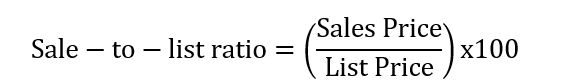

How to calculate the sale to list ratio?

The sale to list ratio is calculated by dividing the final sale price by the last asking price and then multiply by 100.

- If the sale to list ratio > 100%: The house was sold for more than it was listed for. There are two reasons for a higher sale to list ratio. The first reason has something to do with a seller’s market. In a seller’s market, homes tend to sell for more than their asking prices. This is because there is not enough inventory to satisfy buyers on the market. As a result, the high demand creates competition among buyers who outbid each other. As a result, buyers will end up paying houses at much higher prices than the asking prices. The second reason could be related to a motivated buyer. For example, if someone finds a house that checks all the boxes, he/she could pay higher than the asking price in order to own the house.

>>MORE: Seller’s Market Definition

- If the sale to list ratio < 100%: This means that the price was negotiated lower than the asking price. That is the house was sold for lower than the seller listed it for. There are also two main reasons for a lower sale to list ratio. The first reason could be the buyer’s market. The buyer’s market creates competition among sellers due to a high supply than demand. As a result, sellers negotiate prices lower than asking prices.

>>MORE: Buyer’s Market: What Is A Buyer’s Market?

- If the sale to list ratio = 100%: This means that the house was sold at the asking price.

Why the sale to list ratio should not be the only metric used in the market?

To answer this question, we must understand the mindset of buyers and sellers. Sellers always want to get the highest price possible on their properties depending on the market. At the same time, sellers know that buyers tend to negotiate on prices even the property is not negotiable.

For this reason, sellers always list their properties above the market value of the property. The idea is that sellers hope to find uneducated or motivated buyers who can pay much higher than the market value. If this idea fails, sellers then negotiate the price toward the market value of the property. In the end, sellers win under normal market conditions.

>>MORE: Market Value/Open Market Valuation

On the other hand, buyers want to spend the lowest amount possible on the best property. For this reason, buyers start their offers at a lower value and negotiate the price toward the market value of the property.

You can see that all decisions made in real estate transactions are driven by emotions and market conditions.

This is why home buyers and sellers cannot rely on the sale to list ratios when making a buying or selling decision. This ratio does not give a clear picture of the market.

Instead, home buyers and sellers must use other metrics when making real estate decisions. Other reliable metrics to use are comparative market analysis, assessment of available inventory, absorption rate, months of supply, etc.

All these methods can help buyers and sellers to understand the current market conditions.

It is also important to use real estate agents (buyer’s agent and seller’s agent). These agents have enough experience and resources that make homebuyer and selling processes very smooth.