What is PITI?

PITI stands for principal, interest, taxes, and insurance, according to Personal Capital. The combination of these four elements makes up the total monthly mortgage payment. Other elements that could be added to your mortgage payments are HOA fees and mortgage insurance.

Some mortgage lenders do not include all these elements on the monthly payments. For example, the HOA fees, property insurance could be paid separately.

This is what PITI stands for.

- P: Principal amount before interest

- I: Interest

- T: Taxes

- I: Insurance

Example of PITI

Your lender will calculate your PITI for you before you qualify for the mortgage. The estimated value will depend on the terms of the mortgage and underlying factors.

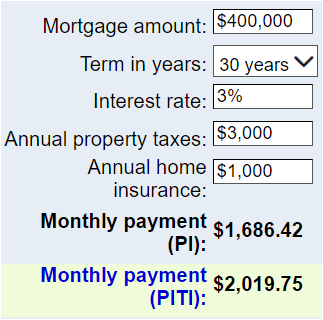

Let’s assume that you are buying a house for $400,000 on a 30-year fixed-rate mortgage with a 3% interest rate. We can also assume that your annual property tax on the property is $3,000. For simplicity, we will use yearly property insurance of $1,000. Once these numbers are inserted into a PITI online calculator, the following results were computed.

Your estimated monthly principal interest(PI) =$1,686.42

Your estimated monthly PITI = $2,019.75

Principal

The principal amount is the total amount of mortgage your lender will give you. This amount does not include the interest on the mortgage. For example, if you buy a house for $500,000 with a 30% down payment, you will need to borrow $350,000. In other words, the $350,000 will be your principal amount. Note that we did not include the interest you will pay on this mortgage.

Interest

The interest is a percentage of the principal amount that you will pay the lender for using their money. The interest rate will depend on many factors. However, the biggest one is your credit score and the interest will be added to your monthly payments.

Taxes

You will also pay a monthly property tax. This amount is sometimes calculated in your monthly payments to make sure that you do not fall behind on your payments. At the end of the day, you are using the lender’s money and it is their job to make sure that you make your payments.

The tax amount will mostly depend on the size of the house, condition, and its location.

Insurance

A homeowner’s insurance must be paid every month to make sure that you are covered. For example, the insurance will protect you from lightning, falling objects, fire, theft, etc. Other coverages such as hurricane and flood must be included or purchased separately if the house is located in these locations.

Why do the PITI numbers matter?

The PITI numbers are used by moneylenders to estimate how much money they can lend you. Your lender will not qualify you for a random number. For this reason, the lender will make sure that you can afford the money you are being approved for.

Your current financial situation, credit history, credit score, etc. will be used to check your creditworthiness. Other factors that will be used to check whether you can afford the mortgage or not is your debt to income ratio. This ratio will estimate how much debt you have compared to your income.

As your debt increases, you will get to a point where you cannot afford to pay them off. This is why a lower DTI ratio is important when determining your approval rate and the amount you qualify for.

Borrowers can use the PITI when deciding how much of a house they can afford. With this value in mind, borrowers can then make a budget.