A cash advance is the process of using a credit card to withdraw cash against your credit limit. You can take cash advances from a credit card at a bank, ATM, over the phone, with a convenience check, or when making purchases at qualifying stores. The amount of cash you can take from a credit card is usually limited to a small percentage of your available credit limit. Most credit card issuers cap your cash advance to 20% to 50% of your available credit card limit. Keep in mind that each credit card comes with its specific cash advance limit and annual percental rate(APR). For this reason, you may not be able to get cash out of your credit card if the amount you are trying to withdraw is higher than your limit.

In this article, we will dive into everything you need to know about getting a cash advance from your credit card. We will also cover the cash advance fees and interest rates, alternatives to getting a cash advance from a credit card, how you can withdraw money from a credit card at an ATM, and strategies to repay your cash advance balance.

Without further ado, let’s get started.

Before you get cash from your credit card

While a cash advance from your credit card may seem like an easy solution, it is important to understand the potential pitfalls that come along with it. Unlike using a credit card for a normal purchase which does not come with interest charges unless you carry a balance; cash advance interest starts accruing immediately after getting cash from your credit card.

Additionally, you will pay an extra cash advance fee of 3% to 5% of the amount you withdraw or $10 whichever is greater. Furthermore, other fees such as ATM fees also make this transaction unfavorable for many consumers.

What is a cash advance?

If you are considering getting cash from your credit card, it is essential to understand what you’re getting into. In essence, a cash advance is when you borrow cash against your credit card limit. Withdrawing cash from a credit card is similar to getting cash from your cash account at an ATM. The only difference is that instead of taking money from your checking or savings account, you are borrowing against your credit line.

Most credit card companies allow cash advances up to a certain limit, which is typically a percentage of your credit limit. The interest rates and fees associated with cash advances can be significantly higher than those for regular purchases, and they can vary depending on your credit card company and the amount you borrow.

How does a cash advance differ from a normal credit card purchase?

Many consumers make a big financial mistake by assuming that getting cash from a credit card is similar to making a purchase with a credit card. This is not true. A cash advance is not the same as making a purchase with your credit card.

With a credit card purchase:

- You pay for the product or service with your available credit limit.

- The interest and charges only apply to the balance you carry on your credit card

- There are no additional fees associated with the purchase except when processing fees are required for the purchase.

On the other hand, with a cash advance:

- The money you withdraw is a loan you take against your credit limit. In other words, you are taking a loan from your credit card and will need to pay it back with interest. For example, if your credit limit is $1,000 and you get a cash advance from your credit card of $200, this cash will be considered as a loan you are taking against your credit limit of $1,000. For this reason, you will pay a cash advance interest, fees, and charges. The cash advance APR is usually higher than your normal credit card APR.

- The interest charges start accruing right after the purchase

- You will also pay additional fees such as cash advance fees and ATM fees

How to get a cash advance from a credit card?

If you have decided that a cash advance is the right option for your financial needs, the next step is to request it. Start by checking your credit card’s terms and conditions to understand the specific process for requesting a cash advance. Some credit card issuers require you to call customer service or visit a bank to request a cash advance, while others may allow you to do it online or over get cash back when making purchases.

Once you know the process, you will need to decide how much to request. Keep in mind that cash advances usually come with additional fees and higher interest rates than regular purchases. So, only request what you absolutely need.

4 ways to get cash from a credit card

If you are ready to take cash out of your credit card, use one of the following options.

- Request a cash advance from a credit card at your bank. When requesting a cash advance from a bank, be prepared to provide the following information:

- Your credit card number

- The amount you want to request

- Your personal identification information, such as your name and address

- Your bank account information, if you’re requesting the cash advance to be deposited directly into your account.

Once your request has been approved, the funds will usually be available immediately or within a few days, depending on your credit card issuer’s policies.

- Withdraw cash from a credit card at an ATM. With this option, you will need to insert your credit card into the ATM, enter your PIN, and select the amount you want to withdraw. You should get the cash you want from your credit card if your request is not higher than the acceptable cash advance limit.

- Get a cash advance with a check. If your credit card issuer gave you checks also known as convenience checks, you can complete your check and name yourself as a payee. According to CapitalOne, you can then deposit your check at a bank or cash it per your credit card terms.

- Get a cash advance from a credit card as cash back when making purchases. Some credit cards allow you to get cash advances when paying with a credit card just like a normal debit card. For example, your card issuer might allow you to get cash back from your credit card at the cash register from retail stores.

How much can I withdraw from my credit card?

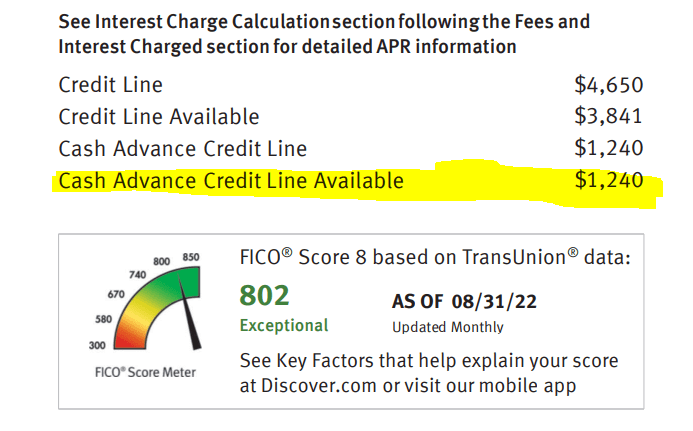

The amount of cash you can withdraw from your credit card will depend on your specific credit card’s cash advance limit. To find out how much you can withdraw, ask your card issuer, check your credit card statement, or read your credit card terms.

Example of cash advance limit on a monthly statement

What are cash advance fees and interest rates?

Before requesting a cash advance, it is important to understand the fees and interest rates associated with this type of transaction.

- Cash advance fees. Cash advance fees are typically either a flat rate or a percentage of the amount you withdraw. According to Experian, the typical cash advance fee structure is 5% of the cash advance amount or $10 whichever is greater. Keep in mind that some credit card issuers can charge more than these rates or less.

- Cash advance APR. In addition to the fee, your credit card issuer will also charge you interest on the amount you withdraw. This interest rate is usually higher than your regular credit card interest rate and can start accruing immediately, meaning you will pay interest from the day you take out the cash advance. According to WalletHub, the average cash advance APR is currently 24.22% while the average credit card APR is 22.15%. Keep in mind that cash advance APR can go as high as 36%.

- Cash advance ATM fees. You will also pay ATM fees that can be as high as $3.50 per transaction or higher when withdrawing money from your credit card at a non-bank ATM.

Cash advance example

Now that you understand common cash advance fees and interest rates, let’s use a typical example to evaluate how much a cash advance will cost you.

Let’s assume that you want to withdraw $1,000 from your credit card with a cash advance fee of 5% and an interest rate(cash advance APR) of 25%. With this transaction, you will pay a $50 fee based on that 5% cash advance fee. Additionally, you will pay interest of $0.68 per day compounded daily based on the 25% APR.

Since cash advance interest is usually compounded daily, your cash advance interest charges will be added to the principal and the interest will be recalculated daily. In order words, your principal amount will be $1000.68 on the following day and the new interest charge for that day will be $0.69. This process will continue as long as you owe a cash advance balance on your credit card.

If you withdrew the money at an ATM, you might also be charged an ATM fee of up to $3.50.

What are alternatives to cash advances?

Before withdrawing cash from your credit card, it is worth exploring some alternatives that may be a better fit for your financial situation. One option could be to borrow from a family member or friend. While this may not be an option for everyone, it’s worth considering if it’s available to you. If you go this route, it is critical to establish clear terms and a repayment plan to avoid any potential strain on your relationship.

Another alternative is to utilize a personal loan. Personal loans typically have lower interest rates than cash advances and can provide you with a lump sum of cash that you can use for your expenses. However, it is important to consider the terms and fees associated with personal loans before committing to one. Traditional loans also come with simple interest which makes them cheaper than withdrawing cash from a credit card.

If you’re facing a financial emergency, it may be worth reaching out to your creditors or service providers to see if they can offer any payment arrangements or deferred payment options. You can also qualify for a loan modification structure such as a lower interest rate or changing your loan term to a longer term for lower monthly payments. Again, many companies are willing to work with their customers to find a solution that works for both parties.

You can also work extra hours at your current job or get a part-time job to meet your current financial liabilities.

How to withdraw money from a credit card at an ATM?

The process of withdrawing cash from a credit card at an ATM is quick and straightforward. Before you proceed, though, make sure to check the fees and interest rates associated with the cash advance.

When you’re ready to withdraw, start by checking your credit card’s PIN number, which is required for ATM transactions. Forgetting your PIN number can lead to your transaction being declined or even your card being blocked. If you don’t have a PIN number, you can request one from your credit card issuer.

Once you have your PIN number, find an ATM that accepts your credit card. You can do this by checking your issuer’s website or by contacting customer service. Keep in mind that while most ATMs accept major credit cards, some may only accept certain types or brands. When you’re at the ATM, follow the prompts on the screen to withdraw cash from your credit card.

- First, insert your credit card into the ATM

- Provide your credit card PIN

- You will be given different options to withdraw money. Select the cash advance option

- If you are provided with checking, saving, and credit options, select a credit option

- You will then be asked to enter the amount you want to withdraw. So, enter the amount and keep your value under an acceptable cash advance limit for your credit card.

- You will then be asked to acknowledge fees associated with cash advance transactions such as ATM fees. So, acknowledge these fees and continue.

- Complete the transaction

- Collect your cash

- Make sure that you get your credit card back and be aware of your surrounding for safety purposes.

Can I go to a bank to get a cash advance on a credit card?

If you find that withdrawing cash from an ATM isn’t an option or if you need to withdraw a larger sum of money, you may be wondering if you can go to a bank to get a cash advance on your credit card. Yes, you can go to a bank to get cash from a credit card.

To get a cash advance from a bank, you will need to visit a physical branch. Once at the bank, inform the teller that you want to withdraw cash from your credit card. While it is possible to get a cash advance from a bank, it is important to note that the process may differ from getting one from an ATM. For example, you will be required to verify your account by providing personal information such as your social security number, confirming your full name, showing your ID, and verifying your address.

Does a cash advance hurt your credit?

Are considering taking out a cash advance from a credit card and wondering how it will affect your credit score? The answer is less obvious and depends on a few factors. Let’s evaluate how taking out a cash advance can impact your credit score.

- A cash advance will affect your credit utilization rate. Taking out a cash advance can increase your credit utilization, which is the amount of credit you are using compared to your total credit limit. A high credit utilization can negatively impact your credit score. However, if you pay off the cash advance quickly, it can also improve your credit utilization ratio which in turn can boost your credit score.

- Higher credit card balance. Withdrawing money from a credit card will lead to an increased credit card balance. Unless you pay off your cash advance fast, the accrued interest charges and fees can lead to the accumulation of too much debt and possibly having a late payment on your credit report. A single late payment can lower your credit score by as much as 120 points or more and will stay on your credit report for 7 years.

Overall, cash advances from a credit card will affect your credit score only if it affects factors that affect your credit score. If getting cash from your credit card dramatically increases your credit utilization or causes you to miss payments, then, your credit score will be hurt. But, if you keep your credit utilization low and pay off the cash advance as soon as possible, you will avoid a negative impact from the cash advance on your credit score. This is because cash advance transactions are reported as an addition to your normal credit card balance, according to Opploans.

How much of a cash advance can I get on my credit card?

When you are considering taking out a cash advance from your credit card, it is important to understand how much you can get. The amount of cash you can withdraw from a credit card depends on your credit limit and cash advance limit. Typically, credit card companies will allow you to withdraw a percentage of your credit limit, which usually ranges from 20% to 50%. However, keep in mind that there may be a limit on the amount of cash you can withdraw, even if it is a percentage of your credit limit.

For example, if your credit limit is $5,000 and your cash advance caps at 20%, the maximum you can withdraw in cash advance will be $1,000.

What are transactions that can be considered cash advances?

Besides withdrawing cash from your credit card at an ATM or at a bank, there are other transactions that can be treated as cash advances. According to CapitalOne, the following are transactions that could qualify as cash advances.

- Wire transfers

- Money orders

- Lottery tickets

- Foreign currency exchanges

- Money transfers

- Traveler’s checks

- Paying bills or debt with a credit card, and

- peer-to-peer(P2P) money transfers via different apps like Venmo, MoneyGram, and PayPal.

How can I get a cash advance from my credit card without a PIN?

When it comes to getting a cash advance from your credit card at an ATM, having a PIN is typically required. However, if you don’t have a PIN or have forgotten it, there are still a few options available to get cash from a credit card without a PIN.

The most reliable way to get cash advances from a credit card without a PIN is to visit a physical branch of your bank or a company that conducts business with your card issuer. You can then ask a teller for a cash advance by presenting your credit card and a government-issued ID.

As I mentioned earlier, getting cash from a credit card in person requires account verification. So, be prepared to answer all questions related to your account such as address, social security number, phone number, etc.

You can also get cash advances as cash back from purchases you make at qualified stores. For example, you might be able to get cash from your credit card when you pay for groceries at your local store.

What to do when you don’t remember your credit card PIN?

If you forgot your credit card PIN, try calling your credit card company and requesting a PIN. They may be able to provide you with one over the phone. Alternatively, you could request a PIN via mail, but this may take a few days to arrive. You can also visit your bank’s local office to request a new PIN.

Drawbacks of cash advance on your credit card

Before taking a cash advance on your credit card, it is important to consider the potential downsides. While it may seem like a quick fix to your financial problems, there are several reasons to think twice before going this route.

- Higher cash advance APR and fees. Cash advances typically come with 3% to 5% fees and higher interest rates known as cash advance APR, often much higher than your standard credit card rate. This means you will end up paying a significant amount of money in fees and interest, potentially outweighing the benefits of the cash advance. Additionally, you might pay extra fees such as ATM fees that can be as high as $3.50 per transaction or higher when withdrawing cash from a credit card at a non-bank ATM.

- A cash advance may affect your credit score. Taking a cash advance from your credit card may negatively impact your credit score. This is because the amount you borrow is added to your credit card balance, which can increase your credit utilization ratio and lower your credit score.

- A cash advance can lead to debt accumulation. Relying on cash advances can lead to a cycle of debt and financial instability. If you find yourself needing to take out a cash advance frequently, it may be a sign that you need to reevaluate your spending habits and financial situation.

Is it a good idea to get a cash advance?

While getting a cash advance from your credit card can provide you with quick access to funds, it is not the most cost-effective way to borrow money. A cash advance typically comes with high fees and interest rates, making it an expensive way to borrow money. Additionally, if you can’t repay the advance quickly, it can lead to a cycle of debt and financial instability.

Before deciding to take out a cash advance, it is a good idea to carefully consider your other options. Can you borrow money from a friend or family member? Can you cut back on expenses to free up some cash? Are there other, less expensive forms of credit available to you?

If you do decide to get a cash advance, be sure to read the terms of your credit card carefully and understand all of the associated fees. Calculate the total cost of the advance, including any interest and fees, to ensure that it is a cost-effective solution for your needs.

How to pay a cash advance balance on a credit card?

After getting a cash advance from a credit card, it is important to start thinking about a repayment plan as the interest on the cash advance starts accruing right away. If possible, pay off the entire cash advance balance as soon as possible to avoid accumulating more debt.

Most lenders require that you pay a minimum payment on your credit card each month. While this sounds attractive to those with tight budgets or living on meager incomes, carrying a balance on your credit cards is not a good financial decision due to interest charges.

As with any other credit card payment, you can make payments towards the cash advance through your card’s online portal, over the phone, or by mailing a check.

What to do after taking a cash advance on a credit card?

After taking a cash advance on your credit card, it is crucial to take some steps to avoid falling into a never-ending cycle of debt. The first thing you should do is create a repayment plan and stick to it. As mentioned earlier, cash advance interest rates are exorbitant, and falling behind on your payments will only make matters worse.

Another important thing to do is to avoid using your credit card for any more purchases until you have paid off the cash advance, or at least until you have a handle on your finances. This will prevent further accumulation of debt and help you focus on repaying the existing debt.

Additionally, review your monthly budget and see where you can cut back on expenses. Even the smallest savings can add up, and the money you save can be directed towards paying off the cash advance. Consider things like subscription services you don’t use, takeout food, and other non-essential purchases.

In case you are struggling to meet your debt payment obligations, contact your lenders and negotiate a different payment plan before defaulting on your loan. Depending on your current financial situation, you might qualify for a payment postponement, deferment, a different payment plan, a lower interest rate, or a longer term.

The bottom line

A cash advance allows you to take a loan against your available credit limit without submitting a loan application. You can withdraw cash from a credit card by visiting your local bank, at an ATM, or at a company that conducts business with your credit card issuer such as a grocery store.

While a credit card cash advance may seem like a quick solution to your financial troubles, it is important to remember that it comes with fees, high-interest rates, and the potential to accumulate debt. Before getting a cash advance from your credit card, make sure you understand the terms and conditions of this service and explore alternative options if possible.

The interest rates on a cash advance are compounded daily and start accruing right away. For this reason, you should pay off your cash advance balance as soon as possible to avoid debt accumulation.