Do you want to achieve financial independence and live a happy life? If so, you have come to the right place. In order to master your money and make it work for you, there are financial habits you should start. These habits will help you navigate in the right direction and lifted you up when you hit the bottom.

The financial habits you are going to learn in this article will make you a better version of yourself and help you achieve that financial freedom you have been waiting for. Some of these financial habits may seem difficult, however, you can achieve them one step at a time.

Without further ado, the following are the top 16 financial habits you should start today.

1. Paying off all your bills on time

One of the most important financial habits you should start today is to pay off all your bills on time. Every bill you have will affect you differently if not paid off on time. For example, your credit card bills will affect your credit score and credit history if you are late on your payments.

On the other hand, missing your mortgage payments can lead to eviction, foreclosure, wrecking your credit score, and much more. We all have bills. Paying off yours on time will help you financially.

On top of helping you financially, paying off your bills on time will help you build a sense of responsibility which will come in handy moving forward. Whether it is your phone bills, utility bills, revolving payments on credit cards, loans, mortgages, etc., make sure that you pay all of them in full and on time. This is the only way you will be able to manage your finances and achieve financial freedom.

Do you need help with your bills and how to get out of debt? The following articles were designed just to help you.

- How to pay off debt? 11 Tips you can use

- How to pay off credit card debt? 10 tips I used

- Struggling with debt? This is why people struggle with debt

- How to pay off a student loan: 16 easy tips to use

2. Financial Habits: Learning how to budget your money

You cannot talk about good financial habits without talking about budgeting. Budgeting is the process of evaluating your income, expenses, projects, and documenting every dollar that comes into or out of your life. This is very important as it helps you understand where you are spending more money than you are supposed to.

In addition, budgeting will show you where you can cut when making adjustments and allocate your funds elsewhere. So, if you have been ignoring budgeting or have not been doing it right, consider learning how to properly create a budget.

I have written a step-by-step guide to budgeting. If you want to learn more about budgeting, please, check the following article.

Related: How to make a budget: Step-by-Step

3. Tracking your progress

Every financial step you make should be recorded and checked. That is the only way you will know if you are heading in the right direction or not. Having a track record of your expenses, income, etc, will be one of the most important financial habits you should start today.

To track your records and progress you can use software or put everything in your notebook. As long as you have it written somewhere, it does not matter how you do it. For example, putting everything you do in Excel will be a good idea.

Tracking your progress will also help you know where you need to make adjustments. For example, if it is difficult to meet your goals, you can decide to save more money and reduce your expenses in one area. For this reason, tracking your progress should be a financial habit you need to start today.

4. Doing research before an expensive purchase

It is fine to have impulse purchases when what you are buying does not cost a fortune. However, it is never OK to buy an expensive item on an impulse. Before you buy an expensive item, you should do enough research and consult experts if necessary.

For example, if you are buying or selling a house, you should use a real estate agent to help you navigate the complexity of home shopping. What mistakes do some homebuyers or sellers make? Well, they try to save the 6% commission and end up with scams or get themselves into legal battles that cost them ten times what they were trying to save.

Other examples include but are not limited to buying cars, expensive electronics, etc. So, make research one of your financial habits. The research will help you know the market, the proper value of the asset you want to buy, and the proper steps to be taken to avoid losing money on the property or ending up in a legal battle with the seller.

Always make it a financial habit to do your research before purchasing expensive items.

5. Stop buying more than you can afford

Just like doing your research when buying expensive items, you should also avoid purchasing things you cannot afford. This is when the budget comes into the equation. Your budget will help you understand where you stand financially and whether you can afford the item or not.

If something seems expensive compared to your budget, then you don’t need it. For this reason, you should not buy it. Expensive items will cost you more money compared to how much you make. Many people end up borrowing money just to buy the newest iPhone or car. Responsible people always know how much they can financially afford to spend.

If you want to become financially independent, try to avoid buying things you cannot afford. Try to save a lot of money by living frugally.

If you want to know how to live frugally, read the following article. It has every tip and hacks you need to successfully live a frugal life.

Related article: Frugal Living: 19 tips that will save you money

6. Financial Habits: Learning how to save money

Achieving financial independence, financial freedom, or whatever you call it, will require you to save money. Saving money is not easy even if it sounds like it is. Why is it so difficult to save money?

Millions of people are financially illiterate. Due to this reason, most people are in debt. So, being the one person who saves money while everyone else is laughing at you, is very difficult. Having guidance about saving money is also difficult for many people. So, they stick to what they know: Spending everything they make.

If you really want to succeed in life, you must start learning new financial habits. These are saving money habits and you should learn these habits as much as you can and at all costs. The truth is: Without saving money, you will never achieve financial independence.

If you need to learn how to properly save money, use the following articles.

- How to save money: Step By Step

- 44 things you should stop buying to save money

- 15 ways to make money while traveling

- 8 Reasons you are struggling with money

- How to save for a down payment?

- 33 ways to save money while traveling

- 11 Easy ways to save money on flights

- 11 ways to save money on hotels

- 16 ways to save money on utility bills

- How to save money on car insurance? 20 Tips

- 16 tips you can use to save money in college

- 45 Ways to save money on groceries

- How to save money on gas? 9 Tips to use

- How to save money on books? 10 tips you can use

- 17 Best Long term saving tips

7. Having a retirement account

Are you planning to retire? If you have not thought about it, you should. The strength and courage you have now will one day run out. There will come a day when you will not be able to get up and go to work. When this happens, you will only rely on the money you have saved for your retirement.

This is why your retirement account should be a priority on your list. How long will the money in your retirement account last? It will all depend on: (1)how much you have saved, (2) when you started saving for your retirement, and (3) the amount you draw out from your retirement account.

To avoid running out of money during your retirement, start saving money in your account NOW. If you have a company that contributes to your 401K, make sure that you take advantage of it. You can also open an Individual Retirement Account (IRA). So, there is no excuse for not having a retirement account. From now on make building your retirement account is one of your most important financial habits.

8. Financial Habits: Learning how to invest money

You have probably heard of investing and how many people have lost most of their investments. Well, that is true. The hard truth that none talks about is that those who are financially independent did so through investing. The game is dangerous and those who can successfully play it become rich.

What kills some makes others rich. Investing is the only route you will need to take to achieve financial freedom. I am a champion of investing and you should do.

The first step you need to take when it comes to investing is knowing the kind of investment you need to make. You will then start learning about that investment and related ones.

What is investing, anyways? I define investing as the process of making your money grow. This is as simple as it can get. If you have been dreaming about financial independence, know that you will only achieve it through investments.

To learn more about investing and the kinds of investments you can pursue, use the following articles.

- Where to invest money: An Investment guide

- How To Invest In Real Estate?

- 51 tips you can use to become successful

- 8 Reasons you are struggling with money

- How to grow a small trading account?

- 14 Reasons people lose money in Stock market

9. Knowing the difference between assets and liabilities

Although these two terms seem simple, they are actually complicated. Millions are struggling with their finances because they don’t understand the difference between an asset and a liability. Here are the simplest definitions of an asset and liability.

An asset is anything you own that makes you money. On the other hand, a liability is an item you own that costs you money. Keep in mind that we are not defining assets and liabilities like businesses do. This is because when it comes to building wealth, you must think differently.

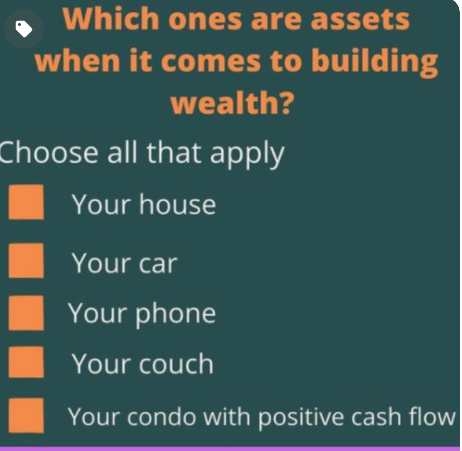

Here it is a quick quiz. When it comes to building wealth, which ones do you think are assets among the following?

The answer to this question is your condo with a positive cash flow.

This means that your car, phone, couch, even your home are all liabilities. This is because they all cost you money compared to how much they make for you.

In order to achieve financial independence, you must learn the difference between assets and liabilities. Mastering their differences will be one of the most important financial habits you will ever master. Wealthy people accumulated more assets and got rid of their liabilities. You should do the same if you want to achieve the same results.

To learn more about assets and liabilities, refer to the following articles.

Related article: Difference between asset and liability: For building wealth

10. Avoiding emotions when making financial decisions

This may sound silly but it is the biggest barrier for millions of people out there when it comes to financial independence. The biggest factor that influences the decisions humans make is emotions. We are all affected by emotions and those who can manage theirs tend to do well financially and in life.

Your emotions can be your greatest asset or liability depending on how they are used. Let me give you a good example that almost every person faces when investing. This is how it goes: You buy a stock, then the market tanks 10%. Your response: panic and sell to stock so that you can breathe. After selling the stock at a 10% loss or more, the market rebounds and passes your purchasing price. Your reaction: Look, they came back up. I wish I did not sell. Your response: Buy more shares at premium prices. Then the market tanks again. This cycle continues until you start saying that the market is rigged.

What is really going on here? Emotions are driving you to make impulse investing decisions. A lot of emotions prevent you from seeing and learning how markets work. As a result, you fail to stomach the volatility and sell when you should have been buying.

In order to make better financial decisions in life, you must learn how to manage your emotions. Make this habit one of the greatest financial habits you will ever tackle. This is because everything else will depend on it. The better you manage your emotions, the better decisions you will make in your life.

11. Financial Habits: Having an Emergency fund

You will never know when an emergency will occur in your life. What if you are driving right now and end up in an accident, get a heart attack, or lose your job? It will be unfortunate and I wish it will never happen to you or anyone else.

This is possible and we cannot stop it from happening. Even if we behave, other people around us will not. For example, you can still get into a car accident even if you follow the rules more than 100%. You can’t stop it or prevent it. Since you cannot be able to predict when emergencies happen or prevent them, it is really important to have an emergency fund.

One of the greatest financial habits you should start today is building your emergency fund. The fund will help you cover unexpected emergencies when they occur.

The key is to have money available that will be used to cover your emergency expenses such as accidents, unexpected medical bills, loss of a job, etc. It is always recommended to have the amount that can cover you for at least three months without working. My emergency fund advice is to have money that can support all your expenses for at least six months. The more the better. One unexpected expense can send your entire financial world into a deep hole. So, you should be prepared.

12. Stoping your gambling habits

Do you like having an adrenaline rush through gambling? If so, you should stop. Gambling creates addictions and all addictions are not good.

You do not have to go to Las Vegas to be a gambler. Anything you buy without an educated decision hoping to rip a huge profit is a gamble. For example, you will be gambling if you decide to go into the stock market and buy random stocks. To make sure that you protect yourself and your finances, make sure that you avoid gambling. Gambling destroys marriages, families, and lives.

13. Financial Habits: Having your financial literacy

Your ability to understand money and everything around it will determine your success in life. Financial independence depends on how much you know and what you do with your knowledge.

You should put financial literacy on top of your list. Why is that? Because financial literacy will give you a chance to save money, make money, invest money, and deal with all odds that will come with every step you will take.

The majority of people who are struggling financially are financially illiterate. So, to avoid ending up like them, you must do what they are not doing. That is you must learn as much as you can about money, how to manage it, and make it. Financial education will be one of the greatest financial habits you will ever take on.

14. Becoming friends with people who are smarter and richer than you

If you want to achieve something you never achieved before, you must do things you have never done before. The people you hang out with can be used to define your financial success. Why is that? Well, poor people do not like financial challenges. Some of them think that money is evil, rich people are evil, etc.

How much education do you think you can get from people like these ones? Well, the answer is none. So, to avoid becoming poor, you must start hanging out with people who are richer than you. These people will always challenge you to become a better version of yourself. These people always have a positive attitude about problems and the environment around them. They will also guide you in the right direction when you are failing.

Now you see why it is important to get rid of your bad friends and start hanging out with people who are smarter and better than you. From today, make this a financial habit and work on it every single day. Always remember that people who are at the same level as you or lower than you will never challenge you to grow. Instead, they will pull you down.

15. Educating others on what you know

There is a saying that the best way to learn is to teach others what you know or a subject you want to learn. Why is this true? Well, the feeling that you have to teach others about something pushes you to do enough research. The more research you do, the more you excel in the subject.

So, if there is a subject you want to master, start teaching it to others. This is the only way you will become the master of the subject, and hence, financially independent. Do you want financial habits that can guide you through your wealth-building journey? Start teaching others what you know or want to learn.

16. Financial Habits: Learning a new skill

If you are not learning a new skill, you are losing one. In other words, the world is changing every day and the only way to stay on top is to continuously learn as much as possible. Those who are not learning are falling behind.

For this reason, you must make learning new skills one of your greatest financial habits to start.