When it comes to making and spending money, there is a big difference between rich and poor people. Both poor and rich people spend money. However, their approaches toward money make all the difference. Poor people stay poor due to a lack of understanding of how money works and the bad money habits they develop.

A common habit among poor people is that they spend first and invest after all their expenses are paid. What makes this strategy risky is that there is usually nothing left to invest which prevents poor people from building wealth and getting out of poverty. This spending first habit gets passed on from one generation to another which keeps the whole family poor for decades.

On the contrary, rich people invest first and spend what is left. This small change in financial decision makes a huge difference when it comes to building wealth and getting out of poverty. Investing first allows rich people to take advantage of all tax benefits, grow wealth, and maintain long-term financial success.

This is just one example. In this article, I will go over different reasons why poor people stay poor and how you can break out of poverty to build wealth like rich people do.

Rich people vs. poor people on payday

The first thing a poor person does when he/she gets paid is to pay bills and go shopping with the remaining amount. This results in a paycheck-to-paycheck lifestyle with no savings. What rich people do when they get paid is invest their money, protect their money from taxes, and pay bills later. This habit helps them build wealth even when they are sleeping.

Not only that poor people do not make enough money, but they also spend it poorly. At the end of the day, poor people stay poor and pass down poverty to their descendants. With a poor mindset, their kids grow up with the same mindset. This is why children born in poverty are more likely to be poor and kids born in rich families tend to be rich.

Of course, other factors contribute to these points such as access to resources, education, training, jobs, infrastructure, etc. But, mindset plays an important role in why poor people stay poor.

This article will show you exactly why poor people stay poor and never find a way out of poverty.

Related: 7 important steps to get out of poverty

1. Poor people buy expensive houses

When it comes to house hunting, most people end up with houses that are too big to handle both physically and financially. There is nothing wrong with buying a large house if you can afford it and you have a large family to live in.

A big mistake poor people make when buying houses is that they purchase houses that are too expensive compared to their incomes. Buying an expensive house means they get expensive mortgages and end up with large monthly payments due to interest, principal, insurance, and property tax. That 30-year fixed-rate mortgage means that the bank has legal access to your income and will take the house once the link is broken.

This exhausts their finances and makes it difficult to afford anything else. At the same time, financial decisions that can help them build wealth cannot be achieved because every dollar they make is designed to be spent.

For example, it is almost impossible for poor people to contribute to their 401K retirement accounts if the money they make does not even cover all their expenses. They are always falling behind on their payments. This is why people stay poor.

A smart way to buy a house is to have a large down payment and buy a house that you can afford to pay off. It would not be a good idea to buy a $600,000 house on a $50,000 salary.

Related: How to save for a down payment?

2. Poor people buy designer clothes, and brand-name products, and drive expensive cars

Poor people remain poor due to showing off habits. That is right. The problem with showing off is that you cannot put on cheap clothes, drive a very cheap car, and say, “Here I am.”

You will need to have expensive clothes, put on brand-name products, and on top of that, drive a new and expensive car. That is how poor people do it.

Designer clothes are very expensive. Brand-name products cost more than generic products. In addition, new cars are costly.

Let’s take a look at why it is never a good idea to buy a brand-new car even if you have cash for it.

- A new car loses more than 50% of its value in the first five years

- you will pay interest on the amount you borrowed

- The insurance will be expensive and you must purchase a full coverage

- Since it is a new and expensive car, your tabs will be expensive, the gas could be premium as well.

What are you doing with the car? Driving to and back from work. Then over the weekend, you visit your friends or go out. Is it worth it? Should you go through all the hustle just to impress your friends?

What you can do is save a few thousand dollars and buy a used car with cash. You will still go to work, visit your friends, and achieve everything else with the car.

What rich people do when it comes to cars is: Buy income-generating assets and use the cash flow from those assets to cover the car. That is how it works. Their assets cover their cars, designer clothes, and other expensive things they buy.

Rich people do not bust their butts at work so that they can pay off their cars. Their assets do that job. That is the difference between rich people and poor people.

3. Poor people upgrade to the latest electronics

We are living in a world where new technologies are being invented every day and trashed the next day. Companies are releasing new gadgets every single year and sometimes twice a year.

The problem is that poor people end up upgrading to new ones every year. If a new iPhone or a smartwatch is out, they get it. So, they pay thousands of dollars to have a new model of the same phone just because it came out.

You ask them: Why did you pay $1,500 to buy a new phone if the one you have from last year is still working? The answer: The new phone has an extra camera.

Why do you need another camera? They say: I don’t know.

That is how the conversation goes. They are spending money but they don’t know why they are doing it. People in poverty remain there because they get stuck in the idea of owning new things.

They think that the things they own will bring them happiness and make them powerful. What they don’t know, however, is that they are trading their lives and souls for those things. On top of that, there are no benefits of owning extra stuff.

Related articles

- How to think like a millionaire: 9 ways to have a rich mindset

- 20 clever ways to reduce expenses and increase savings

4. Poor people stay poor due to the lack of savings

Telling a poor person to save is like an insult. You only live once, they say. How can you save if there is a flashy car that just came on the market? And how can you save if Apple releases a new iPhone?

A shared habit among poor people is their spending habit. When they get paid, they become uncomfortable. The only way to be stable and create balance is to spend the money they just made. That is how poor people who win millions of dollars in lotteries end up homeless a few years later. Money pushes them outside of their comfort zones. In response to this new and uncomfortable reality, they spend all of it on drugs, women, alcohol, gambling, etc.

Poor people live their lives without savings. Most people living in poverty spend their money before they earn it. With spending addictions, they end up maximizing their credit cards and taking out personal loans that do not justify their incomes.

Most poor people count the days at which they get paid. Today is a payday. When you ask them what they will do with the money, they say, “I will use my money to pay off my bills and use the rest for shopping.” Instead of saving, they choose shopping. That is how poor people spend their money.

Related post: 17 best long-term saving tips to build wealth

5. Poor people do not invest

When it comes to investing, it is another story. Poor people do not even know what investing means or how to invest money.

Financial literacy is none existent for people. This does not mean they are not educated. There are a ton of people who are poor with bachelor’s degrees or higher education. It is not about what you learned in school, it is about how you use what you learned to navigate real-life challenges.

The current school system also does not prepare students on how to be good with money. It is about turning young people into good employees. You can invest your money if the school never prepared you for it and you have no willingness to learn.

Most poor people do not have investment accounts such as brokerage accounts or retirement accounts. The only way to get out of poverty and build wealth is to take advantage of the investment options available and build wealth one step at a time. Without investing, poor people stay poor.

Related: Where to invest money: An Investment Guide

6. They never create budgets

A budget is a tool that helps people who are serious about their money and want to take action. The budget helps you organize your finances, know how much you are making, and manage your expenses based on your income and lifestyle.

In addition, by organizing your expenses in a budget, you can be able to cut down some of your expenses to increase your savings. All these money moves become possible due to a well-designed budget.

Poor people, on the other hand, don’t make budgets. They say: I know how much I made and where it is spent. The truth is that a dollar that is not budgeted finds its way out of your pocket. That is how it works. Poor people think they are in charge without knowing that their money is in charge.

That is how they end up buying impulse products, spending without budgeting, and later on running their accounts dry.

If you want to learn more about budgeting and taking control of your money, start with the following articles.

- 6 tips to be good with money in 2022

- 6 important tips to create a balanced budget in 2022

- What is budgeting and how does it work?

- 8 Budgeting Mistakes you need to avoid at all cost

- How to make a budget: Step-by-Step

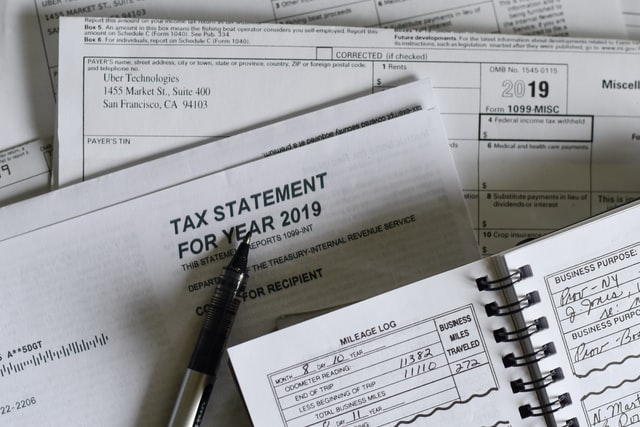

7. Poor people stay poor due to paying high taxes

If you are living paycheck to paycheck, you are technically poor regardless of your income level. Poor people pay higher taxes considering how much they make. When you are poor, you cannot afford to reduce your taxable income.

The smartest way to pay less tax is to reduce your taxable income. That is how rich people end up paying little tax when poor people are paying a ton of money in taxes.

Let’s see how you can reduce your taxable income and save money on taxes, according to the IRS.

- Max on your 401K contribution: $20,500 contribution limit in 2022.

- Contribute to your HSA: $3,650 for an individual and $7,300 for families, in 2022

- Get tax credits

- Start a business

- Put the money in long-term investments (prevents you from paying tax on capital gain), etc.

All these options are possible only if you can afford to put your money away for a while. For example, the money in your 401k cannot be touched until you are in your retirement if you want to avoid a hefty penalty.

Every dollar poor people make is counted for something. They can’t wait to get paid due to expenses that keep them on their toes. For this reason, they cannot afford to give up a portion of their money for long-term investments, retirements, etc. That is why poor people stay poor their entire lives.

More: 8 ways to legally pay less tax: Save on tax

8. They accumulate too many debts

Debt is not necessarily bad. It all depends on the way you are using it. If you borrow money to finance your cars, houses, trips, and other liabilities, debt will be bad for you. On the other hand, if you are borrowing money to buy assets, debt will be good for you. In other words, you are using someone else money to make more money.

A common habit for people is that they borrow money to go to school, then borrow to buy houses, get loans for their cars, max their credit cards, and on top of that, get personal loans.

Each one of these debts comes with interests, charges, fees, etc. But their incomes stay the same. In the end, their debt-to-income ratios become so high that every dollar they make must be used to cover their monthly payments on these debts. This makes it hard for them to get ahead. For this reason, debt is one of the biggest reasons poor people stay poor.