In technical analysis, a support level is defined as a level at which a stock price or a security price cannot break below. By applying the concept of supply and demand, the demand increases as the price reach that support level. The increase in demand pushes the price back up.

Meaning of support levels

Support levels are usually formed at a level where a stock seems cheap after big a decline from its previous high. Once the stock or security reaches this level, a wave of buyers rushes into the markets to buy the stock.

In simple words, the competition among buyers is created whenever we have more buyers than sellers. As a result, the price will increase.

At this level where the stock price struggled to go lower, is called support level. Usually, the stock consolidates at this level before it goes back up or down.

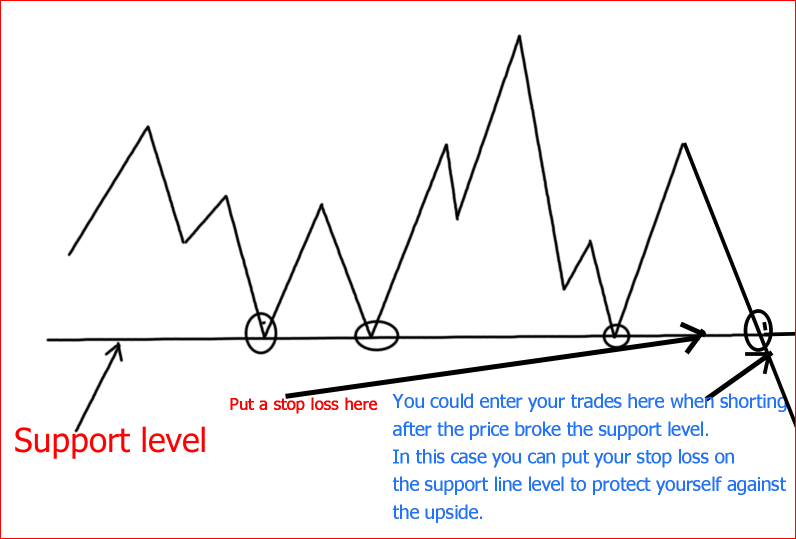

Traders usually find these levels using other technical analysis methods. However, the simplest way to find these levels is to draw a horizontal line that connects the main levels where the stock price did not break below.

Support levels can be used when taking long positions or when short selling securities.

How to use support levels when trading

Support levels can help investors and traders to monitor the movement of stocks and determine their future directions.

Going long

When the stock price rejects the support level, it is a possible indication of an upward trend. Therefore, you could take a position in the stock once you have a confirmation that the stock is going back up.

This level can also help you detect other trading patterns. For example, the double bottom patterns are formed at a support level.

If you want to trade a double bottom pattern, you only need to find where your support levels are and wait for the stock price to reach there. You can take a position once you have confirmation of a trend reversal.

Shorting

You can use support levels to time your entry when shorting stocks. You would need to wait and see where the price goes. If it drops under the support line, it could be an indication of a downtrend continuation.

After you have your shares, you would need to put a stop loss at the support level or a little above it. This is for your own protection in case the stock moves back up in an uptrend.

If the stock continues in a downtrend, you would buy all your shorted shares or most of them at the next support level to lock in profit.