The intrinsic value is the measure of the actual value of an asset, according to IG. This value is different from the current trading value of assets such as stocks and it is calculated using complex mathematic models or objective calculations.

Investors who rely on fundamental analysis especially value investors use intrinsic values to buy stocks and other securities at low prices or when the markets are down.

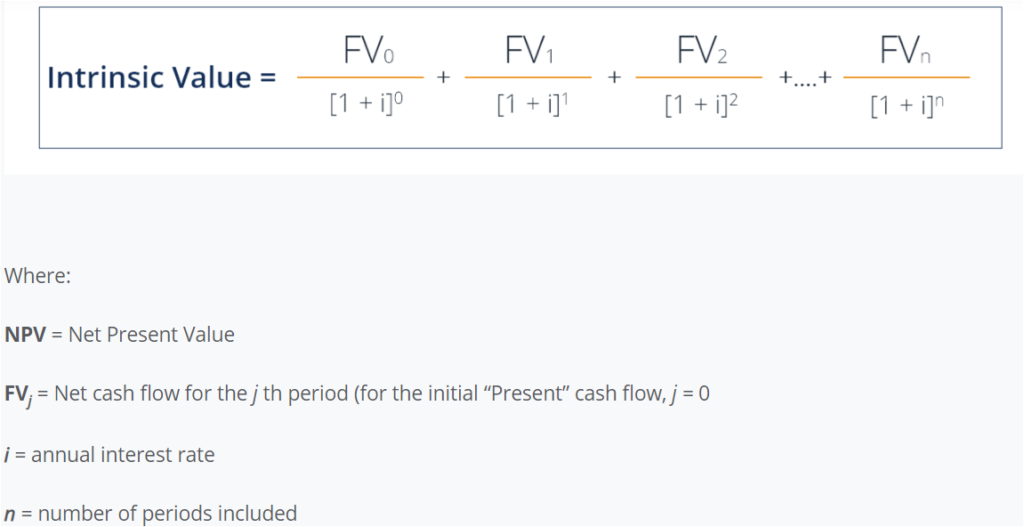

How to calculate the intrinsic value

In this formula, the net present value is the difference between the cash inflow and cash outflows calculated over a particular time.

There are other methods to calculate the intrinsic values of securities. Investors use different methods based on what works for them and their investment strategies.

The benefits of intrinsic value

The goal of every investor is to make profits from their investments. The returns on their investments depend on how much they spent to acquire the security, how long they held it, and more importantly how high its price went after the purchase.

One way to make sure that investors spend less on securities they want to acquire is to calculate their true values.

For example, a bear market can mess up the entire economy to a level where companies lose values as they default on their loans, etc. However, there are those that continue to do fine even if markets are not looking well.

Value investors can assess dozens of companies to select good ones that are being sold at a discount.

This is where the intrinsic value comes in. By using the intrinsic value of the company, investors will know how much to buy the company for and more importantly how much return to expect from their investments.