What is quick ratio?

The quick ratio measures a company’s ability to cover its near-term liabilities using its most liquid assets. Near-term liabilities are those due within a year. A company’s liquid assets include cash and cash equivalents.

How to calculate quick ratio?

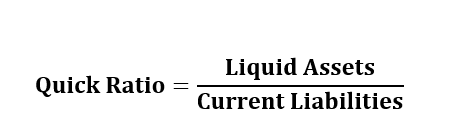

The quick ratio is calculated by dividing the liquid assets with current liabilities, according to Value Penguin.

Where,

Liquid Assets = The sum of cash and cash equivalents

As noted by Value Penguin, cash equivalents include the following:

- Certificate of Deposits (CDs)

- Savings Accounts

- Marketable securities

- Money market accounts

- Treasury bills maturing in 90 days

Current liabilities = All liabilities that must be paid within a year

Interpretation of quick ratio

If the QR = 1, the company’s liquid assets are equal to its current liabilities. In other words, the company can successfully cover its near-term debt.

If the QR> 1, it will imply that the company has more cash than its current liabilities. For this reason, the company will face no problem covering its current liabilities. Companies must be aware of the value of liquid assets they keep. Too much cash sitting down will imply that the company is not adequately using its cash.

Finally, a QR<1 means that the company does not have enough liquid assets to cover its near-term liabilities. Companies that are unable to cover their current liabilities get into more debts which affects their growth and survival.

What are liquid assets?

Liquid assets are cash or any other assets that can quickly be converted to cash without affecting their market value.

Liquidation of assets can sometimes be complex or easy depending on the nature of assets and other factors. As noted by Brex, the liquidity of assets can be influenced by:

- Ownership transfer process

- Liquidation time

- The quality of an established market

Benefits of quick ratio

This ratio is very important to investors and businesses. This ratio shows that the company is able to cover its short-term liabilities.

Without having enough cash or cash equivalent a company can find it difficult to cover its near-term debts. As a result, penalties such as interest and charges can make it difficult for a company to get out of debt. Small companies usually run out of cash and this affects their profitability and future growth.

Depending on the industry, investors watch this ratio carefully. If a company is in an industry where cash flows and revenues are unpredictable, the ratio will be vital. On the other hand, a quick ratio may not affect the business if its revenues are more predictable such as in the retail sector.

What is a good quick ratio?

The quality of a quick ratio will depend on the industry. However, it is always important to have enough liquid assets to cover near-term obligations. As noted by AZ Central, a quick ratio of 1:1 is considered good since it shows that a company can meet its current liabilities.