Is the Credit Karma score accurate? How reliable is Credit Karma’s credit score? If you want to know your credit score before applying for a car loan or a mortgage, you can check your credit score for free from Credit Karma’s website or app. But, how accurate is Credit Karma? Can you use your Credit Karma score to get a loan?

Here is the quick answer.

- Credit Karma does not calculate credit scores or get information from your lenders.

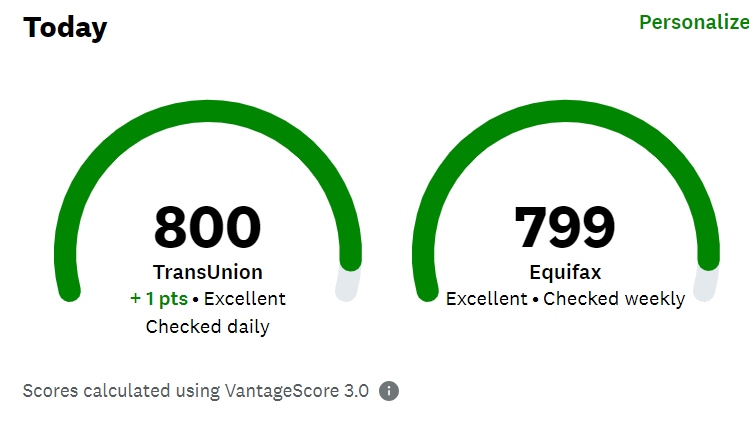

- Instead, Credit Karma shows free credit scores that it pulls directly from Equifax and TransUnion.

- So, your Credit Karma credit scores are accurate vantage scores reported by Equifax and TransUnion.

- The Credit Karma score from Equifax is usually different from the Credit Karma score from TransUnion due to different scoring algorithms, different information on your credit reports, or errors in your credit reports.

- Your payment history, credit usage, credit mix, age of your credit, hard inquiries, and derogatory marks affect your Credit Karma credit score.

- Your FICO score is more accurate than your vantage score as over 90% of lenders use the FICO score when applying for loans, mortgages, and credit cards

In this article, we will look into Credit Karma’s credit score, how accurate the score is, and how to check your credit score from Credit Karma.

What is Credit Karma?

Before we evaluate whether Credit Karma score is accurate, let’s talk about what Credit Karma is. Many websites offer free information about your credit score and Credit Karma is one of them.

Credit Karma is a leading website offering free credit score information. With Credit Karma, you can check your credit scores from TransUnion and Equifax. Credit Karma’s credit score is a Vantage Score as it is calculated using the VantageScore 3.0, a credit scoring model.

There are many scoring models including the FICO score model used by myFICO. But, in this post, we will only focus on Credit Karma’s credit score and how accurate the score is compared to the score your lenders will use when applying for loans.

You might also like: What is a credit score and how does it work?

Is the Credit Karma score accurate?

Is your credit score from Credit Karma accurate? Let’s see what Credit Karma says about its credit scores. ” The credit scores and credit reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. They should accurately reflect your credit information as reported by those bureaus — but they may not match other reports and scores out there”.

Credit Karma also says that the score and credit information you see on their website is, ” are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating… and Credit Karma isn’t a credit bureau or a credit-reporting agency”.

What does this tell us about the accuracy of Credit Karma’s score? The short answer is, yes Karma’s scores are accurate credit scores as they are calculated by TransUnion and Equifax which are two of the biggest credit reporting agencies.

Asking whether Credit Karma’s credit score is accurate, is like asking if Equifax and TransUnion’s credit scores are accurate. This is because what is calculated by these two credit bureaus is what gets reported by Credit Karma.

You might also like:

- Why is having a high credit score better than a low one?

- What debt to pay off first to raise your credit score?

Do lenders use Credit Karma score?

While you can see your credit score for free from Credit Karma, your lender will more likely use a different credit score. This does not mean your Credit Karma score is not accurate. The score on Credit Karma is a VantageScore pulled directly from TransUnion and Equifax and accurately represents your financial health.

Does that mean your lender will use your Credit Karma credit score to qualify you for loans? The answer is no.

While your Credit Karma VantageScore might be accurate, most lenders use the FICO score for their loan applications. According to myFICO, over 90% of lenders use FICO scores to make lending decisions. The FICO score makes it easy for lenders to judge borrowers’ creditworthiness, making it the most accurate credit score and reliable when taking out loans.

Other lenders in some industries might have different scoring models tailored to their specific needs while a small percentage of lenders use VantageScores.

You might also like:

How many points is Credit Karma off compared to the FICO score?

When you view your credit score from Credit Karma, what you see is your vantage score calculated with the VantageScore 3.0 model. Equifax and TransUnion calculate your Credit Karma score. The FICO score, on the other, hand is calculated by the the Fair Isaac Corporation(FICO), a pioneer in calculating credit scores using information collected by credit reporting agencies, according to the Consumer Financial Protection Bureau(CFPB).

Typically, your Credit Karma credit score is off by a few points compared to your FICO score. According to EMERALD Credit Union, the VantageScore is usually off by 20 to 25 points. The difference between your FICO and Vantage scores usually comes from how agencies use your information to calculate your credit score.

For example, your payment history and credit utilization account for 40% and 20% of your vantage score respectively, while the same factors account for 35% and 30% of your FICO score.

Is credit karma or Experian more accurate?

Both Credit Karma and Experian give you information about your credit score. However, these two agencies are different. Experian is a credit reporting agency among TransUnion and Equifax. On the other hand, Credit Karma partners with TransUnion and Equifax to give you Free information about your credit scores.

This means two things:

- Only credit reporting agencies collect information from lenders, compile your credit reports, and calculate your credit score using credit scoring algorithms.

- Credit Karma is not a reporting agency. For this reason, it does not get information from lenders, compile credit reports, or calculate your credit scores.

What does this mean? Is Credit Karma more accurate than Experian? The quick answer is No. Credit Karma shows you free credit scores calculated by Equifax and TransUnion which might differ from your Experian credit score. However, all these credit scores are accurate.

Simply put, credit reporting agencies calculate your credit score and Credit Karma shows it to you for free. For this reason, the Credit Karma score is an accurate vantage score since it is pulled directly from Reporting agencies.

Is Credit karma score more accurate than TransUnion credit score?

Just like Experian, TransUnion is another credit reporting agency. This means TransUnion collects information from different lenders, compiles your credit report, and calculates your TransUnion credit score. Then, Credit Karma partners with TransUnion to give you access to your TransUnion credit score for free.

As a recap, Kredit Karma does not calculate your TransUnion or Equifax credit scores. Instead, Credit Karma credit scores are calculated by TransUnion and Equifax and Credit Karma shows them to you for free.

For this reason, the TransUnion credit score you see on Credit Karma is the same as the score you get directly from TransUnion.

Similarly, the Equifax credit score from Credit Karma is the same as the score you get from Equifax’s website.

However, Experian’s credit score might not be the same as your Equifax or TransUnion scores due to different algorithms, different information reported to each bureau, or errors in your credit reports.

How do you check your Credit Karma credit score?

If you want to check your credit score for free, Credit Karma is a great website to get this information. To check your Credit Karma credit score, follow the following steps.

- Go to: https://www.creditkarma.com/

- If you have an account already, click Login. Otherwise, click signup to create a brand new account. When creating a new account, you will need basic information about yourself such as full legal name, address, etc.

- In the new window that opens, enter your email address and password. Then, click log in.

- Once logged in, you should see both Credit Karma credit scores from TransUnion and Equifax. If you are not on the main page, click on the Intuit Credit Karma tab to view your scores.

- Click on each score for more details. When you click on each score(TransUnion score, Equifax score), you see details such as how many points you gained, and factors affecting your credit score such as hard inquiries, payment history, etc.

- Log out. After viewing your free credit score from Credit Karma, log out of the account especially when using a public computer.

Why are my Credit Karma scores different?

When you log into your Credit Karma account, you will notice that you have two different credit scores. These scores come from two credit bureaus: TransUnion and Equifax. So, which Credit Karma score is more accurate? Is the TransUnion credit score more accurate than the Equifax credit score?

Both credit scores are accurate as they are calculated based on information each credit reporting bureau collected from your lenders. However, the difference comes from a few factors such as algorithms used to calculate your credit score. While TransUnion and Equifax use the VantageScore 3.0 model to calculate your credit score, the algorithms will not be 100% the same for both Bureaus due to factors such as applying different weights on information in your credit reports.

This difference in proprietary algorithms used to calculate your credit score results in different credit scores across all credit reporting agencies.

Additionally, not every lender reports to all credit bureaus. If one of your lenders reports to one bureau but not the other, the credit score you get from both bureaus will be different. If you have a hard inquiry reported to TransUnion but not Equifax, your Credit Karma score from TransUnion might be slightly lower than the Credit Karma score from Equifax.

What affects my Credit Karma Credit score?

While Equifax and TransUnion calculate your Credit Karma score using information from your credit reports, not everything in your credit report is used to calculate your credit score. Only information related to your credit account activities is used to calculate your Credit Karma score.

Here are the factors Equifax and TransUnion use to calculate your Credit Karma credit score.

Payment history

On-time payment history shows lenders that you are responsible and can reliably make payments. One late payment can hurt your credit score. But longer late payments will affect your credit score more. For example, a 30 to 60-day late payment will affect your credit score less than a 120-day late payment as the latter can become a charge-off.

Read more: How does payment history affect credit score?

Credit usage

This is how much you have spent compared to your total credit limit on revolving credit accounts such as credit cards. Keeping your credit utilization under 7% improves your credit score faster.

Read more: What is a credit utilization rate and how does it work?

Derogatory marks

Derogatory marks are negative items on your credit reports such as collection, foreclosure, charge-offs, bankruptcies, etc. Each negative item can stay on your credit report for 7-10 years. You should avoid these items to keep your credit intact. Also, if you have trouble paying your debts, negotiate with your lenders to minimize or dispute renovate items to credit bureaus to maintain good credit.

Read more:

Age of your credit

The age of your credit refers to how long you have been using credit accounts. The longer the age of your credit, the better your credit score. To maintain a higher credit age, avoid excessive borrowing and keep your account open and in good standing.

Total accounts

The total accounts you have open are factored into your credit score calculations. Lenders usually favor borrowers with a good variety of accounts including installment loans such as car loans and mortgages and revolving accounts such as credit cards, HELOCs, and personal lines of credit.

Hard inquiries

Hard inquiries usually appear on your credit report when you apply for credit and they can stay on your credit report for 2 years. Since your credit score drops 5-6 points from each hard inquiry, you should maintain no more than 1 inquiry in 12 months to minimize their impact on your credit score.

Read more: How long do hard inquiries stay on a credit report?

Is the TransUnion score more accurate than the Experian score?

Have you noticed that your Experian score is not always the same as your TransUnion credit score? Is the Experian score more accurate than the TransUnion one? While your TransUnion and Experian credit scores might not be the same, all of them are accurate as they reflect information in your credit reports.

If both scores are accurate, why are they different?

There are three major reasons why you have different credit scores.

- Different algorithms. Credit reporting agencies use information from your credit reports to calculate your credit score. However, each company has its proprietary algorithm for calculating your credit score. Different algorithms result in different credit scores.

- Some lenders don’t report to all credit reporting agencies. Credit bureaus use information collected from your lenders to calculate your credit score. But, some lenders don’t report to all credit bureaus. This means that one or two of the 3 reporting agencies might have more information in your credit reports than the others, resulting in different credit scores.

- Errors on your credit reports. Lenders submit your credit account activities to some or all credit bureaus. Credit reporting bureaus then compile your credit reports and calculate your credit scores. During this process, it is easy for someone to make a mistake which could result in inaccurate or different credit scores from credit bureaus.

Is Equifax better than Credit Karma?

The credit score you get from Credit Karma should be the same as the Equifax score as long as they were calculated using the same version of the credit scoring model. For example, if Equifax uses the VantageScore 3.0 model but Credit Karma shows you the Equifax credit score from VantageScore 2.0, both scores will not be the same.

The good news is that Credit Karma usually shows you the Equifax and TransUnion scores from the latest version of their scoring models.

In order words, Credit Karma shows you the credit score calculated by Equifax and the score from TransUnion. However, these scores might not be the same due to different algorithms from each credit bureau and the fact that some lenders might not report to each bureau.

More credit score tips

How to get an 800 credit score the easy way?

What is a soft inquiry on a credit report and how to remove it?