Are you struggling with debt and wondering how to pay it off? Paying off debt is not easy and some people attempt to get rid of the cheapest debt first. However, it is a bad idea to pay off the cheapest debt first. In this article, I will tell you all about it.

Should you pay off the smallest debt first?

Millions of people are struggling with debt and have no idea where to start. If you thought about paying off the smallest debt first, you are probably thinking backward. Some people argue that paying off the cheapest debt or smallest will increase your confidence and motivate you to continue paying them off.

It is true that you will have one less debt after the smallest debt is gone. With one debt gone, you can focus your entire effort on other debts(the big ones or the most expensive ones). In the end, you will not have multiple debts pulling you apart. The most expensive debt can be overwhelming and it does not go down faster enough. Getting rid of the smaller ones can give you a sense of relief.

Some people get stuck with their big debt and find peace by getting rid of the cheapest ones first.

The question is: Does it really help to pay off the cheapest debt first?

When you borrow the money, there will be two parts to pay off. The first part of your loan/mortgage is the principal amount. Everyone knows about this part.

The second part is the interest rate. Almost everyone knows about his part too. That is whenever you borrow money, you end up paying back the money you borrowed together with the interest. The interest is the cost of borrowing. In addition, there are charges and fees you pay upfront or during the duration of your loan.

The biggest part we are going to consider is the interest rate. Most people know that they will pay interest rates. However, they have no idea of how the interest rate will affect their debt as a whole.

To understand how the interest affects your debt, we need to learn different types of interest. There are two different types of interests.

- Simple interest (I=(P(1+rt)): The simple interest is a constant percentage of the total amount you borrowed that is paid every payment period usually every month. Your monthly payments will include a portion of the principal and the interest. This interest stays the same for the duration of the loan.

- Compound interest: Compound interest Is an interest that accrues and gets added to the principal amount. That is if you do not pay off your debt fast, the compound interest will grow your debt exponentially. Hence, making it difficult to pay it off.

Whether you have a simple interest or a compounded interest, the principal amount will affect how much you pay in interest. The higher the principal the more you will pay in interest.

For example, a 15% interest on credit cards will increase your debt much faster than a 2% interest on a car loan (assuming that you owe the same amount from both lenders). Again, the principal amount will play a role here. If your car loan is $50,000 and you only have $500 in credit card debts, you can see that your car will grow your debt faster. This is because 2%($1,000) of $50,000 is greater than 15%($75) of $500.

In this case, paying off the debt with the highest interest rate will not reduce your debt. Instead, paying off the debt with the highest principal will help you reduce your debt much faster. In our example, the car loan will be the most expensive debt. If it makes sense for you to pay off that few hundreds of dollars you owe in credit cards, please, do so. You just need to know that it will not make that much of a difference.

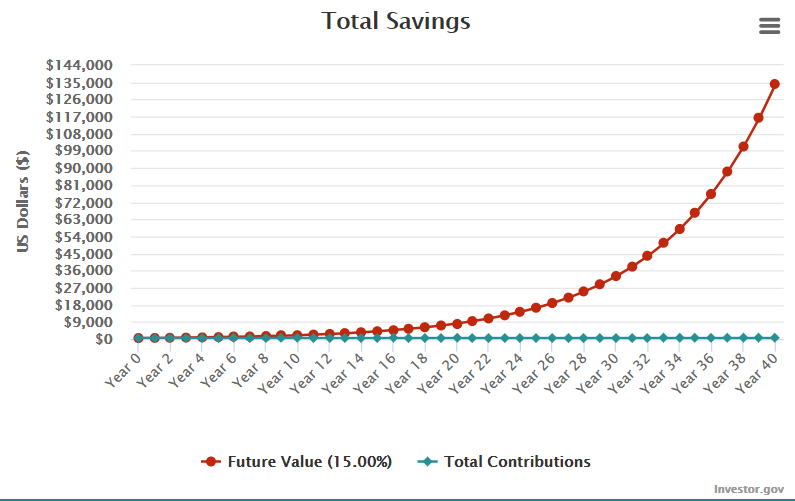

Keep in mind that the type of interest rate you have will determine how fast your debt grows. Simple interest will grow your debt at a constant rate whereas compound interest will grow your debt exponentially. If we assume that your car loan is simple interest and credit card debt interest is compounded, that $500 will become bigger than $50,000 after a very long time. This is because the $500 will grow faster than the $50,000 due to compound interest.

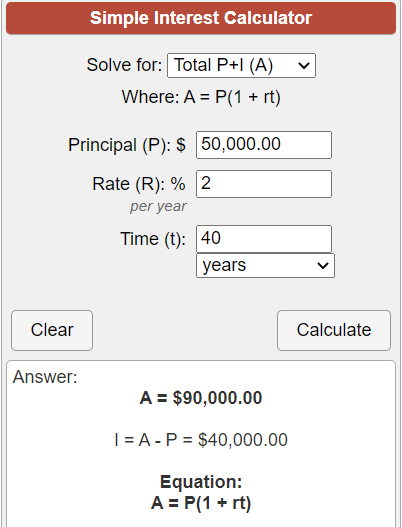

If you stop making payments on your $500 credit card debts that are compounded, you will awe the lender at $133,931.77. What about our $50,000 car loan that has a simple interest? Let’s see what happens to it after 40 years of a 2% simple interest.

If you do not pay your dealership, your $50,000 car loan will become $90,000. That is because you are owing them only $1,000 every year and that money is not being added to the principal. If this was compounded, we would be having a different conversation.

Clearly, you can see that the kind of interest you are paying affects your debt directly.

If you were going to avoid paying off your credit card debts, it would grow and become bigger than the car loan depicted above.

Most credit card debts are compounded. Compound interest grows your debt exponentially if not paid off fast. That is why when paying off debt, you should be strategic and make a wise choice as to which debt you pay off first.

What if you decided to pay off the cheapest debt first from our examples?

We have seen that the cheapest debt in our example was the credit card debt and it cost you $75 in interest. The most expensive debt will cost you $1,000. This makes your credit card debts cheaper than your car loan.

By paying off the credit card debts first will help you get rid of $75/year while costing you $1,000. This is not financially viable. Your debt will be growing by $925/year. As we saw in our example, you should not keep your credit card debts for a long time. The compound interest will grow much faster than other debts. Hence, making it the most expensive.

The best way to pay off debt is to pay off the most expensive first and meet at least monthly minimum requirements on others

Which debt should you start with? When you have a lot of debt to deal with, you should always start with the most expensive debt.

In this context, the most expensive debt is not the one that costs you the highest interest rate. Instead, I am referring to the debt that affects your financial standing the most. A debt that costs you more interest rate, grows your debt exponentially or harms your credit will be your most expensive debt.

As we have seen above, a credit card debt with 15% on a $500 will be much cheaper than a 2% interest on a $50,000 car loan. Yes, getting rid of that credit card debt first will give you confidence and reduce the number of debts you will worry about.

However, this strategy will not help you pay off your debt faster. Your debt will increase instead of going down. In the end, you will not find the peace, confidence, and courage you were looking for.

By paying off the most expensive debt, you will be able to reduce the principal amount at a fast rate. This will reduce the amount you pay in interest and reduce your debt faster.

Bonus: The most expensive debt is a debt that causes more harm to your financial standing. The most expensive debt will affect you in many ways. However, the following are more common:

- Expensive debt will grow your debt exponentially: If you owe a lender a large amount of money and pay compound interest, your debt will grow exponentially. Hence, making it difficult to pay it off. So, this debt should be paid off as fast as you can. Otherwise, you will go bankrupt.

- Expensive debt will harm your credit history and credit score: Your financial history and credit score are directly affected by how you use debt. If you have debt that will wreck your credit score and credit history, consider this an expensive debt.

- A debt that has more interest rate is expensive: Although the interest you pay may not be compounded, there are chances that you will owe the lender dozens of thousands of dollars on simple interest. This will happens when you owe the lender a lot of money. In the end, those thousands of dollars will add up to a large sum. So, high simple interest on a big loan will make it hard to pay off your debt.