A credit score that is above 700 is essential as it allows you to qualify for many different loans with better terms and lock in lower rates. Additionally, having a 700 credit score or higher makes your finances easier and saves you money on different financial products and services. For example, some landlords and utility companies might waive a deposit due to having a 700 credit score or higher. Getting a 700 credit score, however, seems like a complicated process and can take longer if you don’t have to right strategy.

Luckily, I have put together 7 tips you can start today to achieve a 700 credit score fast without paying thousands of dollars to credit repair companies.

Whether you’re just starting to build credit or looking to improve your current score, this guide will give you the roadmap to get a 700 credit score and beyond. The same strategies will also easily help you reach an 800 credit score if you don’t deviate from them.

Understanding Credit Scores

To truly achieve a 700 credit score, it’s critical to understand how credit scores work.

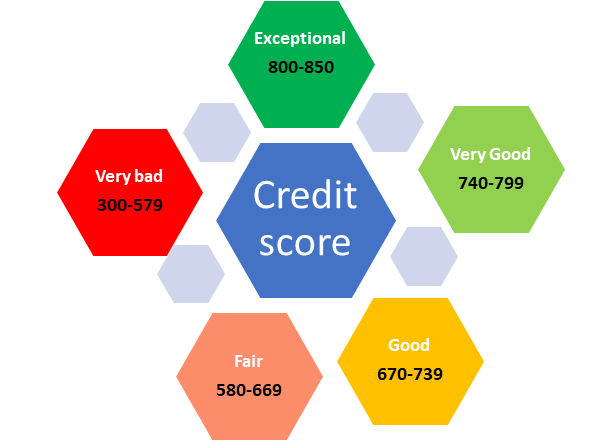

Your credit score is a three-digit number that is used to assess your creditworthiness. Common credit scores range between 300 and 850. Credit reporting agencies calculate your credit score from information in your credit reports such as payment history, utilization ratio, negative items in your report, and many more.

The entire credit score range is also divided into different credit score ranges that determine the health of your credit. Here are different credit score ranges. Keep in mind that these ranges can change based on industry and reporting agencies.

- Exceptional credit score: 800-850

- Very good credit score: 740-799

- Good credit score: 670-739

- Fair credit score: 580-669

- Very bad credit score: 300-579

When building your credit score to 700 and above, the key is not to reach a particular number. Instead, you need to reach a particular range because rates and terms are usually similar for people in the same range. For example, if you have an 805 credit score, you will pretty much qualify for similar rates and terms with someone that has an 825 credit score because both of you have exceptional credit scores.

Types of credit scores

There are many credit scores but the two most popular credit scores are the FICO score and the VantageScore.

- FICO score. Your FICO score is calculated by the Fair Isaac Corporation and it ranges from 300 to 850. This score is preferred by most lenders as it provides a more accurate assessment of borrowers’ creditworthiness. According to Experian, your FICO score requires at least one credit account that is six months old and six months of credit activities to be generated.

- VantageScore. Similar to your FiCO score, your VantageScore also ranges from 300 to 850 and it is calculated based on information from your credit reports. Unlike your FICO score which requires at least six months of activities to be generated, VantageScore only requires you to have an open account. Your VantageScore is a generic score that can be used by many industries which is why many consumers think it is not accurate and usually higher than your FICO score. However, it is a great indicator of the health of your credit and offers a great view of your current credit health.

FICO score is considered more accurate by many lenders as different FICO models can be used on information on your credit report depending on the type of loan industry. For example, common FICO models include the FICO bankcard Score and the FICO Auto Score. These two models put more weight on your previous auto loan and credit card activities.

Factors affecting your credit score

Before we cover strategies to get a 700 credit score, it is important to understand the factors that affect your credit score. Here are the factors on which your credit score is based.

- Your payment history. Payment history is the biggest factor in your credit score calculation as it affects 35% of your FICO score and 40% of your VantageScore. Lenders want to see a consistent pattern of on-time payments, as it demonstrates your reliability and responsibility as a borrower. Late payments or delinquencies can significantly lower your credit score, while a solid track record of timely payments can help boost it.

- The amount of debt you owe(credit utilization): How much you owe compared to your available overall credit limit is another crucial factor in determining your credit score. It’s important to keep this ratio as low as possible, ideally below 30%. High credit card balances or maxed-out credit limits can signal financial strain and significantly lower your credit score. Your credit utilization affects 30% of your FICO score and 20% of your VantageScore.

- The length of your credit history. How long you have been using credit helps lenders determine your reliability and discipline when it comes to borrowing. Generally, a longer credit history is seen as more favorable, as it provides lenders with a more comprehensive view of your borrowing habits. If you are new to credit or have a thin credit file, it may take time to build up a strong credit score. However, responsible use of credit over time can help establish a solid foundation. The age of your credit affects 15% of your FICO score while a combination of your credit age and credit mix affects 21% of your VantageScore.

- New credit accounts. Opening multiple credit accounts within a short period of time can signal to lenders that you are in a financially precarious situation. Additionally, each time you apply for credit, a credit check is performed which results in a hard inquiry on your credit reports and slightly lowers your credit score. It’s important to be selective when applying for new credit and to only do so when necessary. New credit accounts affect 10% of your FICO score.

- Credit mix. Credit mix is another factor in your credit score. A good credit mix is made of revolving credit accounts such as credit cards, personal lines of credit, etc, and installment loans such as car loans, mortgages, and student loans. Lenders prefer borrowers with good credit mixes as it shows their abilities to responsibly manage different kinds of credit accounts. Credit mix affects 10% of your FICO score.

How to get a 700 credit score?

Now that you understand the factors that affect your credit score, how do you get a 700 credit score? Getting a 700 credit score is actually easy if you follow the right strategy. If you want to get a much higher credit score such as an 800 credit score, however, it will take time as the age of your credit contributes 15% of your credit score.

In order to raise your credit score to 700 and above, there are credit-building strategies you need to use and this article has all the details on each strategy.

Here is a step-by-step guide to boost your credit score to 700 and beyond.

1. Prioritize making timely payments on all your credit accounts

Payment history has a significant impact on your credit score, so consistently paying your bills on time is essential. Set up automatic payments or use reminders to ensure you never miss a due date. By demonstrating responsible payment behavior, you show lenders that you can be trusted with credit. This will allow you to gradually increase your credit score to 700 and beyond.

2. Keep your credit utilization low

Your credit utilization ratio plays a significant role in determining your credit score. To get a 700 credit score, aim to keep your credit utilization ratio below 30%. For maximum impact on your credit score, do not carry more than 10% in credit utilization. It is even better to pay off all your credit card balances in full at the end of each month as it does not make sense to carry any balance due to higher rates. Carrying a balance on your credit cards also increases the risk of debt accumulation. So, the less balance you carry, the better.

A few strategies to lower your credit utilization and get a 700 credit score are to pay down existing debt, ask for credit limit increases, or even open a new credit account if it makes sense for your financial situation.

3. Pay down your debts

Do you have a lot of debts that are making it harder to raise your credit score to 700? If so, pay off these debts as soon as you can. For example, if you have a lot of revolving debts, allocate most of your funds toward these debts.

Paying off debt also help keeps you in good financial standing by improving your debt-to-income ratio. The lesser debt you carry, the lesser the chance you will miss a payment, default on your loan, or suffer from financial stress.

You might also like:

- 6 effective ways to pay off credit card debt

- How to use the debt avalanche method to pay off debt?

- How to use the debt snowball method to pay off debt?

4. Clean your credit reports

Cleaning up your credit reports is an essential step to getting a 700 credit score. Since your credit score is calculated using information from your credit reports, it is essential to make sure that information in your credit reports is accurate and updated.

Start by getting a free copy of your credit report from each credit bureau and read them line by line. If you see inaccurate information, fraudulent activities, outdated account info, or removable negative items, get that information updated or removed from your credit reports. You can either dispute information in your credit report to credit bureaus, to the company that reported that information, or both.

One of the most effective ways to get a 700 credit score is to become an authorized user of a credit card account. For example, if you have a thin credit file or are attempting to rebuild your credit, get added to a credit account with excellent credit activities.

When you become a user of a credit card account, you directly benefit from positive activities on that credit account. Meaning that all payment activities, account usage, low credit utilization, etc also get reported to your credit reports. Hence, boosting your credit score.

Before you sign up for any credit card account, make sure that the card provider reports authorized users’ activities to credit bureaus. Getting added to an account that does not report your activities to credit reporting agencies will not do you good.

Read more: What is an authorized user on a credit card?

6. Avoid excessive borrowing

Getting an excellent credit score requires a lot of discipline and caution in your borrowing behavior. Every time you apply for a credit account such as a loan or a credit card, the lender runs a credit check which causes a hard inquiry on your credit report and lowers your score by 5 to 6 points on average.

By submitting too many credit applications in a short period of time, you risk wrecking your score even more due to hard inquiries. So, if you want to get a 700 or 800 credit score, avoid excessive borrowing. Stay disciplined and apply for credit accounts only when it is needed and borrow what you can afford to pay off.

You might also like: Manage your money better in 11 simple steps

7. Do not close old accounts

One of the biggest mistakes a lot of consumers make is to close old accounts or accounts they don’t use very often thinking that it will help them build credit. While this can help you take control of your finances, closing an old credit account might hurt your credit score. This is because that account contributes to the age of your credit which is an essential factor in your credit score calculation.

Additionally, if you close an old account such as a credit card, you will lose that credit limit which in turn might increase your credit utilization ratio and lower your credit score.

Instead of closing the account, put on it a small recurring payment such as a streaming monthly bill. This will keep the account open while maintaining a low utilization.

How long does it take to get a 700 credit score?

The time it takes to reach a 700 credit score can vary depending on your starting point and individual circumstances. For some people, it may take as little as six months to a year to get a 700 credit score by consistently practicing good credit habits, such as making timely payments and keeping credit utilization low. Others may need more time to build a solid credit history and demonstrate responsible credit management.

The most important thing to remember is that credit building is a gradual process, and it requires patience, persistence, and consistency. It’s critical to establish a positive credit history over time, as this demonstrates to lenders that you are a responsible borrower. Length of credit history is a crucial factor in calculating credit scores, and the longer you have a history of responsible credit use, the better it reflects on your creditworthiness.

Another important aspect to consider is the impact of negative marks on your credit report. If you have any late payments, collections, bankruptcy, foreclosure, or other negative items, it can take longer to improve your credit score since most of these negative items stay on your credit report for 7 years.

Related: 13 common negative items on a credit report

How much can I borrow with a 700 credit score?

Your credit score has a significant impact on your borrowing power. Lenders use credit scores as a metric to assess your creditworthiness and determine the interest rates and loan terms they can offer you. A 700 credit score is considered a good score, and therefore, you might qualify for most loans available.

While your credit score is used to assess your creditworthiness and the interest you pay on the loan, it is not the only factor used when determining how much you can borrow. Having an 800 credit score, for example, won’t get you approved for a $1 million dollar mortgage if your income does not justify your monthly payment obligations.

The exact loan amount you can borrow with a 700 credit score will vary depending on other factors, such as your income and debt-to-income ratio, other assets, etc. So, having a 700 credit score puts you in a favorable position assuming that you have met other debt and income requirements from your lender.

With a higher credit score, lenders are more likely to approve your loan applications and offer you more attractive interest rates. This means you can potentially borrow larger amounts of money for various purposes, such as buying a car, purchasing a home, financing a major renovation project, or refinancing your existing loan.

For example, the minimum credit score for a conventional mortgage is 620. This means that having a 700 credit score puts you way above the threshold and gives you more bargaining power.

What are the benefits of having a 700+ credit score?

Having a 700+ credit score is essential as it becomes an integral part of your financial wellness. One area where your credit score becomes especially important is mortgage lending. Many lenders consider 700 to be a threshold for qualifying for favorable mortgage terms. With a 700 credit score, you have a better chance of being approved for a mortgage and accessing lower interest rates, which can save you thousands of dollars over the length of your loan.

Having a 700 credit score can also benefit you when seeking other types of loans, such as personal loans or auto loans. Lenders will view you as a trustworthy borrower and may be more likely to offer you larger loan amounts with competitive interest rates. This gives you more flexibility and negotiating power when it comes to major financial decisions.

Additionally, a good credit score allows you to have discounts on many financial products and services. For example, with a 700 credit score, many landlords might waive a down payment or give you a discount on your rent. Utility companies can also waive a down payment due to having a good credit score. Finally, some employers might hire you for particular jobs because a 700 credit score shows that you are a financially responsible person.

How to raise your credit score from 500 to 700

If you have a 500 credit score, it might take a little bit of work to get to a 700 credit score and above. But, it will all depend on the reason your score is this bad. For example, if your score is bad only because of a high utilization ratio, your score can go up fast as soon as you improve your utilization rate.

On the other hand, if you have a 500 credit score due to having negative items on your credit reports such as foreclosure, collections, and bankruptcy, it might take many months or years to raise your credit score from 500 to 700 and above. This is because these negative items affect your credit for 7 years or more.

You might also like: How long does information stay on your credit report?

Here are tips to raise your credit score from 500 to 700.

The first step to raising a credit score in the 500s is to obtain a copy of your credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion. Carefully review the reports for any errors or discrepancies, as these can negatively impact your credit score. If you find any inaccuracies, such as accounts you don’t recognize or incorrect payment information, be sure to dispute them with the respective credit bureaus.

Next, it’s essential to pay off any outstanding debts. Focus on tackling high-interest debts first, as these can have a more significant impact on your credit score by increasing your credit utilization. Consider setting up automatic payments or creating a budget to ensure you’re consistently making on-time payments. Timely payments are one of the most crucial factors that contribute to a good credit score.

To further improve your score, you may want to consider becoming an authorized user on someone else’s credit card. If you have a trusted family member or friend with a good credit history, they can add you as an authorized user to their account. This allows their positive credit history to be reflected on your credit report, potentially boosting your credit score.

Another effective strategy to raise your credit score from 500 to 700 is to maintain a low credit utilization ratio. This ratio represents the amount of credit you’re using compared to your total available credit. Aim to keep your utilization ratio below 10% for maximum benefits. You can achieve this by paying down your balances and avoiding unnecessary credit card spending.

Additionally, it’s important to refrain from opening new credit accounts while you’re actively working on building your credit. Applying for multiple credit cards or loans within a short period can raise red flags and negatively impact your score. Instead, focus on using and maintaining your existing credit accounts responsibly.

Final words

Achieving a 700 credit score is not an unattainable goal; it’s within your reach with the right credit-building strategies. Start by paying your bills on time, watching your credit spending, and avoiding excessive borrowing. This will allow you to build credit gradually and eventually reach a 700 credit score. Depending on your current credit situation and how serious you are in building your credit, it might take as little as six months to one year to raise your credit score to 700.

Since your credit score is a reflection of the health of your credit it is essential to take measures and maintain a good credit score. Not only that a 700 credit score will help you qualify for many kinds of loans, but you will also qualify for better rates which will help you save money on interest charges.

More credit tips

How to Raise Your Credit Score in 30 Days?

Will my credit score go up if I pay off my car?