Extended hours trading happens when investors buy or sell securities after or before normal market trading hours. Normal market hours in the United States are between 9:30 AM to 4:00 PM EST. After or before these hours, trading activities continue electronically for a few hours.

Trading activities that take place after the market closes are considered aftermarket tradings. Furthermore, trading activities that happen before normal market hours are considered premarket trading.

How long can I trade during extended hours?

Extended trading hours do not last as long as normal trading hours. The trading activities last a short period of time. However, savvy investors can still take advantage of these hours to make big profits. The aftermarket hours last longer than the premarket hours.

The following is an illustration of market hours in the United States.

- Pre-market hours: Run for 30 minutes before the market opens form 9:00 AM to 9:30 AM EST. After this trading session, the normal market hours start.

- After-market hours: They last for 2 hours from the time the normal market hours closes. That is aftermarket hours are between 4:00 PM – 6:00 PM EST

- Normal Market Hours: Take a place between 9:30 AM – 4:00 PM EST.

How do extended hours of trading work?

Trading activities can also happen during extended hours. Some investors like to trade during extended market hours because of many reasons.

Maybe their work schedules do not allow them to trade during the daytime. Regardless of the reasons, investors have always a chance to trade during extended hours.

Extended market hours offer investors an opportunity to make quick trades based on the news in the market or about particular securities.

Market movements in extended hours play a big role in how the markets will react in normal trading hours.

Stocks can be bought and sold at NYSE and Electronic Communication Networks(ECN) during normal market hours. However, pre-market trading activities take place only on ECNs: Source: smartasset

Although many brokerage companies offer extended market hours, their rules are different. For example, some brokers offer longer aftermarket hours whereas others offer as less as 1 hour after normal market hours close. You should work with your broker to learn their requirements and hours of operation.

The liquidity during extended market hours is very low. For this reason, most brokerages require investors to place their buying and selling orders as limit orders instead of market orders.

Market orders are very risky during extended hours.

It is important to know that most activities during extended hours happen right after the market closes.

This is because companies that announce earnings or news do it right after the market closes. Therefore, investors react to this news as soon as it is released.

What are the benefits of extended-hours trading?

There are many benefits associated with extended hours. The following are some of the many advantages of extended-hours trading sessions.

- Taking advantage of earning releases and news in the market: Companies announce earnings in extended market hours. That is after the normal market hours close or before the normal market opens. During this time, a stock you own could gain a huge percentage. By trading during these hours, you will be able to scale down or get out of your positions entirely and take advantage of these big gains. This is because your stock could lose all its gains by the time the normal market hours open.

- You get chances to react to foreign markets: The word has been connected in a way that something that happened in foreign markets directly affects other markets around the world. Since market hours for foreign trading activities are different from those in the USA, you can quickly react to foreign market activities. For example, if the Asian markets or European markets gained due to political agreements between few nations; the USA market will react to this news the same way. The market can jump during the pre-market or aftermarket. Therefore, you can lock in gains by trading in extended hours.

- Protect your account from major losses due to bad news in the market or in a company: If the company you own has really bad news, you can sell your shares in extended hours to protect your portfolio. For example, let us assume that you own a stock and it missed on earnings expectations. You can quickly exit your position after learning this news. It is possible that investors will react negatively to this news and heavily sell the stock. The sell-off would not affect you because you would have exited your positions.

What are the disadvantages of extended-hours trading?

- Lack of liquidity in the market: During the extended hours, there are not many people buying or selling stocks and other securities. This slow in the market reduces the number of securities available to trade. In order words, the trading volume is very low during extended hours and securities are more volatile. In the end, it is difficult to sell or buy securities in the extended market hours.

- Your orders sometimes cannot be filled: Why would order not be filled? Because they’re not enough people selling the number of shares you want to buy in a particular security. Low volume can indicate a lack of market activities and therefore, your order may not be filled.

- Capturing small gains on very bullish security: It is possible that you can lockin a small gain than you could get if you waited. For example, let us say that you own a stock and it jumped 20% in the aftermarket on good news and decided to sell it at a 20% return. On the next trading day, the stock rises to 150%. In this case, you could have waited and sold at a much higher percentage.

- Order restrictions: Due to high volatility and lack of liquidity in the market, brokerage companies restrict the types of orders you can make on your trades.

- Competing with pros: Many people who trade in extended hours have more experience. Rules of the game change during extended hours. Only the pros succeed during extended market hours. Regular investors trade during normal market hours. Those who trade in the extended hours are pros with a ton of experience and access to information than regular traders. For this reason, beginners find it difficult to succeed.

- Issues with unlinked markets: Order placed during the extended markets can be filled at a much higher or lower due to unlinked markets

- Wider spreads: The spread refers to the difference in price between the lowest ask price and the highest bid price. With high volatility in extended hours, the spread is relatively high.

- You can be caught in news announcements: Trading in the extended hours is risky because if a company you are trading announces bad news; its stock could tank quickly. As a result, you will not be able to sell your shares due to low demand.

How to successfully trade in extended hours?

Before placing an order during the extended market hours, you must know that risks are exponential. This is due to high volatility, low volume, and a big spread.

The order you placed might not be filled at the prices you want or could not be filled at all. To protect yourself against major losses, you must have rules and stick to them. The following are a few tips to help you succeed in extended hours.

- Use limit orders: Yes, a limit order will help you buy securities and stocks at prices you want. They will also protect you from high volatility in the market. Did you place your order and did not get filled? That is fine. You did not lose anything. You would rather not be filled instead of getting filled at a price much higher than what you want to pay.

- Do not take a big position: It could be risky to take a big position size when the market is highly volatile. Having a small position size will protect you from downturns. Even if your profit will not be big on small position sizes, your losses will be minimal. This technique gives you a chance to easily average down or average up to minimize your losses.

- Use technical analysis: If you are trying to trade in extended hours, you are most likely day trading or swing trading. If so, you must treat these trades more seriously. You may probably pay more attention during extended hours than you do in normal trading hours. One way to help you succeed is through the use of technical analysis. By looking at the chart formations and applying proper trading indicators and patterns, you will be able to minimize your losses and maximize your gains.

- Learn about the news that is causing the movement in the market. This applies the same way in normal trading hours. If a stock jumps 100% all of a sudden, for example, you need to know the cause of this jump. Knowing this information will help you assess whether it will go much higher or lower. From your conclusions and use of technical analysis, you can choose to take a long position or short sell the stock.

Strategies to use when trading in extended market hours

There are many strategies traders use in extended market hours. The following are a few of them.

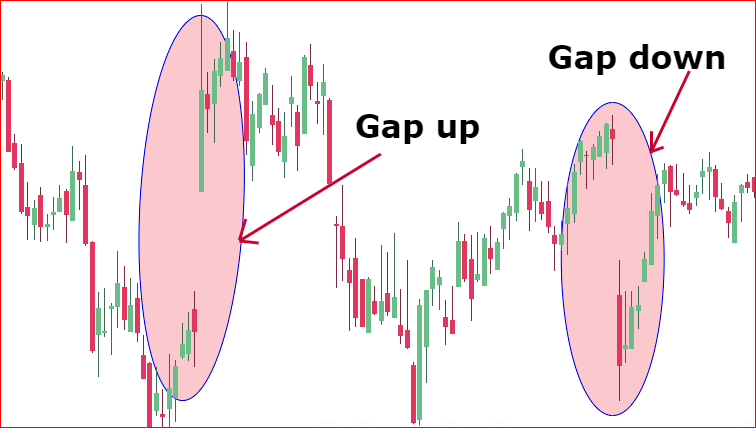

- Playing the gap: Gappers happen when securities’ prices jump higher or lower sharply without any trading activities in between. Traders use these gaps to make successful trades. Gappers normally follow the direction of the trend. If it opens higher, for example, traders expect the price to go much higher and exit their trades if the opposite happens.

- Arbitrage: Arbitrage is a technique traders use by simultaneously buying and selling a security that has different prices in different markets. Traders buy the security where the price is low and sell it where the price is higher. The purpose is to cash in the difference between purchase and selling prices. The profit per share is small. For this reason, traders must trade a huge number of shares to make a big profit.

Is trading in after-hours good? Should I trade in extended market hours?

Your trading schedule and needs will depend on your goals. If you have enough experience and have access to news, then trading in extended hours could be good for you.

However, if you are starting out and learning what goes on in the market; stay away from extended hours. You could wreck your portfolio in a matter of minutes.

Instead of trading in extended market hours, try to learn and improve your experience. You can join the club once you understand the rules of the game and how tides change during extended hours.

Happy trading!