What is debt-to-equity ratio?

The debt to equity ratio a.k.a debt-equity ratio or risk ratio is a leverage ratio that measures the weight of total financial liability with the total shareholder’s equity, according to the corporate finance institute (CFI).

The D/E ratio is a very important ratio in finance and it is reported on the balance sheet. Investors use this ratio to evaluate the companies’ leverage. A good question investors asked themselves besides profitability is whether a company will be able to pay off its debt during an economic slowdown.

If a company has more debt compared to its assets, it could be difficult to pay off this debt. Many investors will not lend money to companies that have accumulated debt without a business structure to justify the debt.

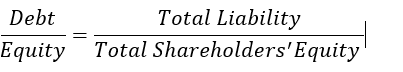

How to calculate the debt-to-equity ratio (D/E)?

The debt-to-equity ratio is calculated by dividing the company’s total assets with its total shareholder’s liabilities, according to Investopedia.

When the ratio is greater than 1, it means that the company has more debt compared to its assets. More debts imply that the company may not be able to pay off the debt especially in an economic slowdown.

In other words, the company has more assets than liabilities. Therefore, it will be much easier to pay off its outstanding debt in any economic condition. In addition, companies with less debt achieve profitability faster than the ones with a lot of debt.

In other words, the company has equal amount of assets and liabilities.

What are the benefits of a high D/E ratio?

- The D/E ratio will help investors in understanding the general health of the company

- A D/E ratio plays an important role when a company is looking for more loans. A high D/E could push away creditors.

- The D/E ratio may be used to determine the profitability of the company. For example, an enormous debt could directly affect the interest rate. More debt comes with more interest charges of the loan which in turn affects the profitability. As a result, the company will not be able to issue enough dividends to its shareholders.