Day trading is one of the fastest ways to make money in the stock market. This means that traders buy and sell all shares of stock on the same trading day. Traders who use proper day trading strategies find day trading quick, efficient, and profitable. The downside is that day trading stocks can be the fastest way to lose money in the market.

According to Medium, 80% of day traders lose money in the stock market. As you can see, day trading is not for everyone. Although the fail percentage is high, you can still find yourself among 20% of day traders who succeed.

So, how can you start day trading and make money in a market where most people lose? The answer: You must think and trade like the 20% who succeed.

Who should use this day trading guide?

Trading stocks requires developing a strategy and sticking to it for a while. The right psychology is also important when day trading. This guide will benefit you if you are among the following groups of traders and investors.

- You have never traded before

- You are an investor but traded a little in the past

- Day trading is a passion for you, and you want to do it as a full-time job

- You have been day trading but have been losing money in the market.

This article is designed to help you navigate the day trading challenges that destroy novice day traders and experienced ones who never get it right.

Speaking of losing money, I thought you might be interested in learning why most people lose money in the stock market.

Without further ado, the following are the top 9-day trading strategies for beginners and tips for starting to trade stocks.

1. Learn, learn, and learn

Knowledge is the key to success in stock trading. If you are new to trading and want to make money in the stock market, you must learn the basics. There is so much that goes into the stock market, and learning how the market moves, the ins and outs of the stock market, and trading strategies are essential to making money.

As a new day trader, learning the following tips will help you make money trading stocks.

- Learn how to create the right brokerage account

- What stock to trade and why

- Different types of orders (market order, limit order, etc.)

- Learn the basics of technical analysis, including support levels, resistance levels, and how to read candlesticks. Furthermore, you should know the basics of trading indicators, patterns, volume, and momentum trading.

- Basics on fundamental analysis: Terms such as earnings reports, earnings per share (EPS), conference calls, IPOs, secondary offerings, common stock, preferred stocks, financial ratios, etc., come in handy when day trading. This is because markets behave a little differently during earning seasons. Therefore, knowing how stocks behave could increase your chances of succeeding as a day trader.

Learning the basics will not make you a professional day trader. But they will help you get started. For this reason, one of the best day trading strategies is to continue learning and improving your trading methods as you go. The more you learn, the better.

>>Related: How To Buy A Stock Step-By-Step

2. Keep up with news

I hate to tell you this, but trading stocks differs from investing in the stock market. Traders rely on big shifts in investors’ feelings about the market or a stock to make money during trading. A change in investors’ sentiment about the stock means the stock can go up or down depending on what was reported. For example, if a stock company loses a $2B contract, its stock will likely go lower. In this case, shorting the stock would make sense. Or if a small-cap stock came up with a new medication that has received a green light to start production, that stock will go from $2 to $100 in a few months. As a day trader, you must keep up with this information in the market.

Successful day traders keep up with the news in the market, sectors, and particular stocks. Your news focus will depend on your trading strategies. For example, a person who likes to trade gapers (gap up and gap down) can scan for pre-market gapers.

Wake up early and use a pre-market screener.

Regardless of your trading methods, you should always scan stocks and be prepared before the market opens. Stock screeners are important for day trading, and beginners should learn how to use them. Almost every trading platform offers pre-market screening options.

Gapping up does not necessarily mean the stock will rally once the market opens. This is why a trader should know why the stock is gapping up. If the news is good enough, there is a chance that it will rally. Otherwise, the stock can experience a major sell-off once the market opens. This is usually caused by bag holders selling many shares of a losing position after a stock experiences positive news, leading to a major sell-off.

Scan the entire market before the market opens.

Knowing how the market will behave after the opening bell is helpful. Stock market futures are excellent indicators of the general direction of the next day’s trading. For example, if major indexes lost 2% points, you would expect the market to experience significant sell-offs after the opening.

NOTE: Although futures indicate how the market will likely behave, the market does not necessarily follow the same trend.

To successfully trade stocks, you must also keep up with news in a particular sector and market in general. That is why reading leading financial newspapers such as the Wall Street Journal, Yahoo Finance, etc., can give you a general idea of what to expect when the market opens. For example, a major agreement between OPEC members could cause oil and energy stocks to rally. So, knowing this information during the pre-market hours can increase your chances of making money trading energy and oil stocks.

Note: You should get news from the most trusted and reliable sources. Tips from friends, random social media, etc., should not be official news about a particular stock or market.

3. To day trade stocks, start small as it minimizes the risk of losing all your eggs

Starting small is one of the most important day trading strategies you must stick to. As a new trader, you don’t understand how markets work, what moves stocks, and how some events affect the market direction. Limited experience is one of the biggest reasons traders lose money.

Starting small does not mean you will need to start with $100 or $500. So, how much is small enough to start with?

The starting amount will vary from one trader to another. For example, $5,000 could be small enough for a person with a solid savings account, whereas it can be too much for someone with debts or without savings.

Since there is no exact amount you can start with, consider using your risk tolerance when deciding how much to start with.

You need to know the answer to the following questions.

- How much money am I willing to lose?

- Would my financial situation go south if I started with $500 and lost everything?

- What about $1,000, or $5,000?

The amount you can afford to lose will become your appropriate account size. Even if you have a lot of money you want to start with, consider starting with a small percentage balance and increasing it as you gain more experience and confidence. Again, the goal of trading stocks is to make money.

For example, if you have $50,000 you want to day trade with, you can start with 10% ($5,000) and increase it as you go.

Starting with a small account means your losses will be minimal while you learn to play the game.

4. Day trading strategies for beginners: Manage your losses

What do I mean by managing your losses? Well, after buying a stock, one of the following three things will happen: (1) the price will go up, (2) the price will stay the same, or (3) the price will go down.

- (1) The price increases. This will be what you have been waiting for. That is, you will be making money. So you don’t have to worry about it. The only thing to do next is lock in profits by selling a portion of your shares or all of them.

- (2) Price stays the same. If the price had not changed, you would have bought less liquid stock (less supply and demand). That is, a few shares are being bought and sold. Therefore, predicting the price’s trend is hard because indicators, patterns, and trading methods will not give you a proper analysis.

For this reason, you will likely lose money on these trades.

- (3)The Price goes down. If the price drops, you will lose money (assuming you take a long position). So, what would you do?

Are you going to freeze and assume that it will come back up?

Or will you sell at some point and get out with a manageable loss?

You will not manage your losses if you stay in a losing stock. This is not a good day trading strategy. The only way to save your account is to exit losing trades with the most negligible loss possible. Hence, the term managing your losses. Before you trade any stock, you must establish where you will cut your losses if the stock goes lower and where to make a profit if it goes up.

So, how well can you manage your losses when day trading?

This is where loss management methods come in.

Your risk tolerance will help you know when to sell if the stock price moves in the direction you did not anticipate.

Quick Definition: Your risk tolerance is the level of loss you can comfortably take without affecting you financially, psychologically, or both.

How much money are you willing to lose on each trade? Before taking any trade, you must include this amount in your day trading strategies. Know when and where to cut your losses.

You can start with the following loss prevention methods when day trading.

- Never use market orders. A market order means you are willing to buy a stock at whatever price it currently trades. This strategy gives the position size you want faster than any other order. The downside is that your orders could be filled at a much higher price (a losing price). Paying a premium price prepares you to fail as a day trader.

- Only use limit orders. With a limit order, you decide how much you want to pay per share. Your order will not be filled out if the price does not reach your limit. This protects you from paying more than you are supposed to. The downside of this method is that there are chances your order will not be filled, and if they do, you may not get all the shares you want.

- Use stop-loss orders. A stock loss order kicks you out of the market when the price goes against you and reaches the limit you set. Should the stock continue to tank? This order protects you from a major loss when trading stocks. The downside is that your stop loss will become a market order to sell your shares once triggered. In other words, your shares can be filled at a much lower price than you wanted. Hence locking in a huge loss.

Before you trade any stock, you must know how much you will pay and lose per share. This technique will help you place orders using appropriate order types and manage your losses.

After mastering the basics of loss prevention methods, you will move on to more advanced ones, such as trailing-stop and stop-limit orders.

It is important that you learn how to reduce your losses before you invest too much money in the stock market.

From Estradinglife: If you lose less, you always have money to trade with. However, once all your money is lost, you cannot make more trades.

5. Have a good trading platform

Day trading strategies are different from investment strategies. People who invest in stocks for the long term focus on fundamental analysis instead of technical analysis. Long-term investors analyze companies’ financial reports, competitors, sectors, economic conditions, etc.

On the other hand, day traders focus on price movement and use technical analysis techniques. Trading indicators, patterns, and other methods, such as support and resistance levels, volume, trend, etc., are useful when day trading stocks.

All these methods allow you to get in and out of stocks in seconds, minutes, or a few hours without losing money. You need a platform designed for day trading to achieve this trading speed.

The following are some of the best brokerage companies with day trading platforms.

- TD Ameritrade

- TradeStation

- Interactive Brokers

- Fidelity

- E*Trade

Before investing too much money in day trading, you must also master your trading platform. It is possible to lose thousands of dollars in one second, so learn the platform first and know what to do at any time. For example, if a stock is going down and you want to get out immediately, knowing where the sell button is will help you get out of the market faster.

6. Have a stock trading plan and stick to it

A plan is like a blueprint of your trades. Each trading plan should include the stock you will trade (Ticker), position size, how much you will pay per share, and exit strategy. In addition, profit-taking strategies, stopping loss, and much more should be included in the plan.

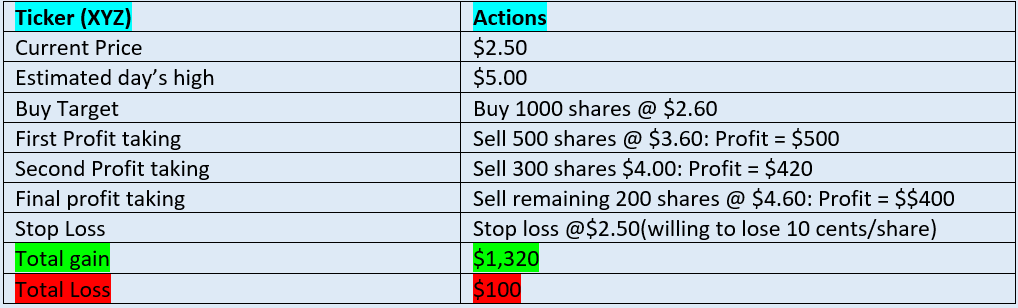

To clarify this strategy, we are going to use an example. Let’s assume that a company (sticker: XYZ) has positive news and is expected to increase. Due to trading activities in the pre-market, the stock gapped up, and it is currently trading at $2.50.

Given the quality of the news, you estimate the price will reach $5.00 or higher. Since you are unsure, you want to get in and out before the stock reaches your estimated high value.

The following is a simple illustration of this day’s trade.

From the table above, you can see that we have included important details about this trade. We know how much we are willing to lose on this trade and our entrance and exit strategies. We plan to win at most $1,320 if the stock goes up and lose $100 if the price drops.

Keep in mind that the stock may not follow our predictions. For this reason, you must stick to the plan and adjust it as you go. For example, if your indicators show the stock will not reach your estimated high, you can start taking your profits much earlier.

7. Avoiding penny stocks is one of the most important day trading strategies

Penny stocks are stocks that trade under $5 by default. They are usually small-cap and respond to market changes faster than mid-cap and large-cap stocks. The following are some of the characteristics of penny stocks.

- Trade under 5 dollars

- Low market capitalization (market-cap)

- High bid-ask spread

- Highly volatility

- Less liquidity

- Highly sensitive to news

- Poor management

- Susceptible to manipilation

All these characteristics make penny stocks the riskiest stocks you can day trade.

Good news can send a penny stock to the moon. This could double or triple your return on investment. On the other hand, bad news on a penny stock can bring it to almost zero. That is, you could lose your investment in a single trade.

Traders who are not experienced should avoid penny stocks. Instead, start with mid-cap and large-cap stocks. As a starter, your primary goal is to know how to make money day trading, and that starts with learning and mastering your strategy. You can’t survive long enough if you start with risky stocks.

Large-cap stocks are less volatile, less affected by the news, well managed, and, therefore, less risky.

You might also like to learn about different types of stocks to buy.

8. Start with paper money

One of the best day trading strategies for beginners is to start with paper money. Paper money accounts let you make trades using fake money, and the investments in these accounts mimic real trades. This technique allows you to build the experience you need without losing money.

Furthermore, a paper account allows you to make mistakes and correct them without using your hard-earned money.

Websites like Investopedia provide free paper accounts. In addition, some brokerage accounts offer an option to trade with paper money.

>>Related: Brokerage Account: Everything you need to know

9. Day trading strategies: Avoid emotions

Here comes your greatest day-trading enemy: Emotions. Many people lose money not because they bought losing stocks.

Instead, they trade with many emotions, resulting in them losing too much money in the stock market.

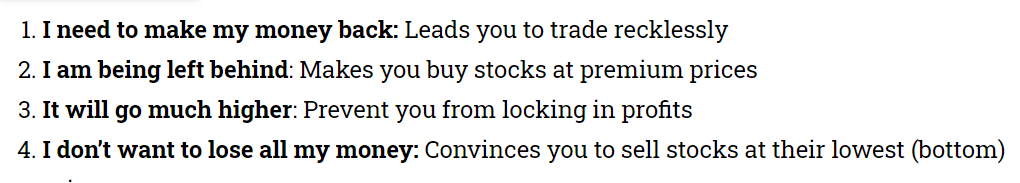

The following are some of the emotions you will face when day trading.

These emotions hinder your ability to make profits.

This is how it goes. After buying a stock, a panic attack kicks in, and people start sweating. Then, they start thinking about losing money on a trade, making more than they thought, etc.

These thoughts come into their minds.

- I can make a ton of money if it continues to go up. So, they stay in a position and end up losing gains they already had.

- I just lost my gains, but I know it will go back up. So, they continue to hold the stock even if it loses them money. The longer they hold it, the more money they lose.

- If I buy more shares, I will make a ton. So, they increase their position sizes and put an entire portfolio in one stock. It sounds like the fastest way to go bankrupt.

- I can no longer bear the pain. After losing about 70% of their positions, they sell. Who sells at a 70% loss? Only losers do. Yes, they hit the SELL button after a stock hits the bottom. Hence locking a huge loss.

- I will stay in and sell it tomorrow since it went down today. I know for sure it will go up tomorrow. What happens the next day? The stock plunges more. A losing day trade turns into a disastrous swing trade.

One of beginners’ most important day trading strategies is to avoid emotions. With fewer emotions, you can take a position at the right time, lock in profit, and, more importantly, manage your losses.