Peer-to-peer lending is a great way to make passive income by lending your money. You can also borrow money through Peer-to-Peer lending with fewer restrictions compared to conventional ways of borrowing. If you are getting started with Peer-to-Peer lending, however, it can be difficult to pick the best platform.

This article has the 7 best peer-to-peer lending websites to help you maximize your return on investments (ROI) or borrow money. The qualification requirements are less strict compared to what other lending institutions such as banks and credit unions require. P2P lending is great for personal loans, Home Equity Line Of Credit (HELOC), Debt consolidation, small purchases, etc.

What is peer-to-peer lending?

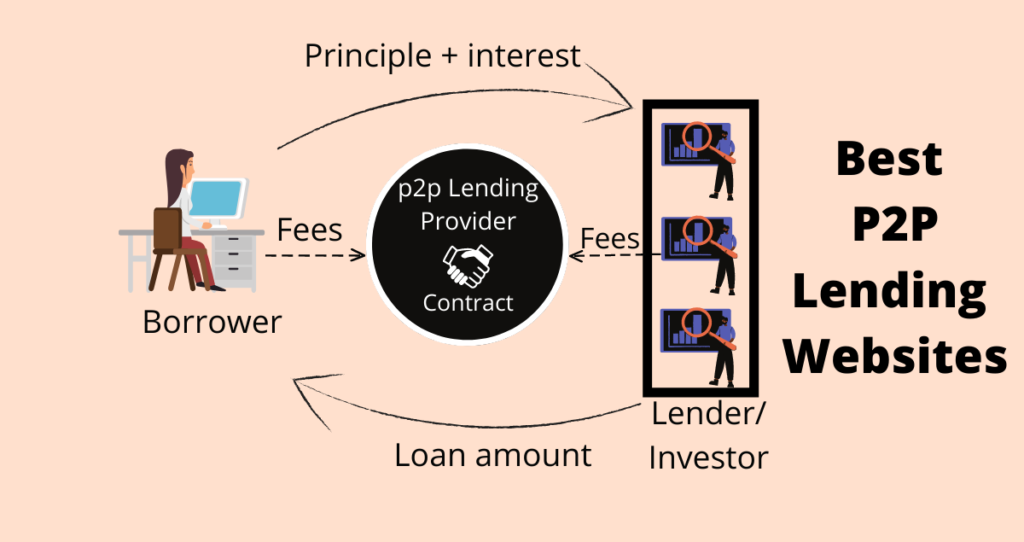

P2P lending or peer-to-peer lending is a lending practice that matches borrowers and lenders through online platforms. Lenders are usually individual investors who lend their own money to prospective borrowers. A short, a borrower creates a profile and provides a full description of why they want the money and their financial standing and credit history. Individual investors will then decide if they want to lend you the money based on the information you provided.

This system is different from traditional lending.

With traditional lending, you would go to the bank or a loan provider and apply. Once you are approved, the lender will then give you the money.

When it comes to peer-to-peer lending, however, the process is completely different. The borrower does not meet the lender directly. A peer-to-peer lending platform serves as a middleman between the borrower and the lender. The agreement is signed through the platform and once everything is in place, the borrower gets the money.

Please, refer to the following visual representation of how the p2p lending process works.

The borrowers and lenders create profiles on the platform and all businesses are conducted there. There is usually a minimum and a maximum amount you can borrow. At the same time, some platforms have a minimum amount you can invest at any given time. According to Lenditfintec, Lending Club requires a minimum of $25 per loan that an investor can give at any given time.

In this article you will find;

1. Prosper

When it comes to personal loans and peer-to-peer lending, Prosper is a major player. Over 1 million loans have been given through Proper which makes it one of the most peer-to-peer lending platforms available.

Prosper offers different loans and loan-related services.

The following are loans you would expect the get from the platform.

- Personal Loans

- Home equity line of credit(HELOC)

- Debt consolidation

- Home Improvements

- Healthcare financing

- Car purchases

Prosper also offers other loan services that are not covered in this list.

Account Verification

Like any other financial institution whether online or offline, Prosper must verify your account information to prevent money laundering or funding bad organizations. Before you can lend or borrow money through Prosper, your account information must be verified.

The following is the information you must provide for an account and identity verification. Keep in mind that other documents could be required depending on the credibility of the information you provided.

- Full name

- Address

- Date of birth

- Other information that will help identify you

Other information you should expect to provide includes but is not limited to a driver’s license, other state-issued ID, etc.

Pros and cons of Prosper

Just like any other institution, Prosper has its pros and cons. The following are some of Prosper’s pros and cons, according to WalletHub.

Pros of Prosper:

- The institution offers prequalification

- You can get up to $40,000 in personal loans

- In many cases, you can get up to $100,000 in Home Equity Loans

Cons of Prosper:

- Prosper is not available in many states

- Has a 2.5 out of 5 rating among users (this is an average rating)

Eligibility and interest rates

When it comes to borrowing and lending, there is one factor that makes it all happen. The interest rate. By lending you money, the lender is taking risks. To leverage that risk, the lender will apply interest charges on the money you borrow.

In short, the interest rate is the cost of borrowing.

When it comes to Prosper, the interest you pay ranges from 7.95% to 35.99%, and the length of the loans is between 36 to 60 months. This interest is known as the Annual Percentage Rate (APR). According to Prosper, all personal loans are made possible through WebBank, a member of FIDC.

Your qualifications and the interest you pay depend on your creditworthiness.

The terms of your loans, APR, and the monthly payment will depend on:

- Information you provided

- Historical data analysis of Prosper between Oct. 1, 2021, and Oct. 31, 2021. Keep in mind that this information is only valid at the time of writing of this article and can be subjected to changes.

On top of the APR, you also pay a loan origination fee that ranges from 2.41% to 5%. An origination fee is a fee you will be charged by money lenders to process your loan.

How much can you make on Prosper as an investor?

If you use Prosper for investing rather than borrowing, you would expect to make some money through this platform. The average historical return through Prosper was 5.7% at the time this article was being written. As a person looking to diversify your portfolio, this could be a great return. The return is much higher than safer investments such as Certificates of Deposit or Savings Accounts.

How to qualify for loans when borrowing through Prosper?

Just like any lending institution, you must meet the institution’s requirements before you are given the money. According to USNews, the following are some of the requirements you must meet to qualify for loans through Prosper.

- At least 640 credit score

- Your debt-to-income ratio must be at most 50%

- Must have less than 5 credit Bureau inquiries in the previous 6 months

- You need to have three forms of credit on your credit report

- An income is a must and you cannot qualify if you had a bankruptcy within 12 months period.

Other requirements could also apply depending on the borrower’s credit history and financial standing.

2. LendingClub

LendingClub is one of the best peer-to-peer lending websites available. This online credit marketplace has over 3.8 million members and $10.1B to $10.3B total loan origination for 2021. LendingClub is a game-changer in the industry. If you are looking for ways to make a passive income or simply borrow money through peer-to-peer lending, LendingClub could be your choice.

The following are some of the main points to get you started with LendingClub.

Account Verification

Before you start using LendingClub, your account will have to be verified. The following is some information you can expect for your account verification.

- Business Tax returns (for businesses)

- IRS 4506-C form

- Proof of personal income

- Proof of identity and address for you or your business

- Full name

- Address

- Photo IDs

If more information is necessary, you will be contacted through your phone or email.

Pros and cons of LendingClub

Every lender has pros and cons. The only difference is about their severity to a borrower or an investor. The following are the pros and cons of LendingClub according to NexAdvisor.

Pros of LendingClub:

- No application fees

- LendingClub is available in all states except Iowa

- You can use a co-borrower

- Loans are funded faster (in matters of days)

- Has better customer reviews with Better Business Bureau (BBB)

- All rates can be checked without an impact on credit score

Cons of LendingClub:

- Late fees are applied after 15 days

- APRs for LendingClub are higher than other peer-to-toor lending institutions

- Services are not available in Iowa state

- LendingClub competitors have faster funding times such as the same day or the next day delivery

- Just like its competitors, there is an origination fee for each loan

Eligibility for loans through LendingClub

To qualify for loans through LendingClub, there are terms and conditions that a borrower must meet. Some of these conditions vary from other online peer-to-peer lending institutions. Here are the factors that will determine your eligibility for the loans through LendingClub.

- A good credit score of 670 and higher. A lower credit score could be accepted at a higher interest rate.

- Solid payment history

- Proof of income: You must have a stable job with consistent income

- Your Debt to income(DTI) ratio must be under 40%

- You must be at least 18 years old

- Must be a US citizen or a permanent resident

- You need a verifiable bank account

When it comes to borrowing, most lenders and investors will prefer someone with excellent qualifications. That is having a much higher credit score and a lower DTI ratio will increase your chances to get funding from investors.

Interest charges on LendingClub

All loans have one thing in common which is the interest rate and LendingClub is not immune to this rule. When you borrow money through LendingClub, the following are the interests and fees you would expect to pay.

- APR ranges from 7.04% to 35.89% and is determined at the time of the application

- The origination fee ranges from 3% to 6%

Borrowers with excellent credits can qualify for lower interest rates. So, before you borrow, spend time rebuilding your credit and credit score.

How much can you make on LendingClub?

According to Goodfinancialcents, investors would expect to get rates of return that are between 5.06% and 8.74%. If you are interested in making a passive income through peer-to-peer lending, start looking into LendingClub.

Some people might argue that peer-to-peer lending is not a great way to make passive income. However, I think that it is always a good idea to put your money in investment vehicles that at least beat inflation. With inflation currently around 7.5% according to data from the U.S inflation calculator, you would need to make returns higher or close to this rate.

The returns you get from Lendingclub will get you close to beating this inflation and hopefully put some money in your pocket. If inflation increases much higher soon and beyond, the returns you get from LendingClub will not be enough to justify your investments. But, it might still be better to keep your money in these investment vehicles as opposed to their alternatives such as CDs or savings accounts where the ROI you get is a fraction of a percentage.

How much can you borrow through LendingClub?

There is a limit to how much you can borrow through LendingClub. You can borrow up to $40,000 in personal loans. However, if you end up borrowing more money, your total loans cannot exceed $50,000.

3. Peerform

Peerform is a great place where you can invest or borrow money. This platform offers a wide range of personalized personal loans and investment options that can help you meet your daily financial needs.

Pros and cons of Peerform

Peerform has pros and cons just like any other lending institution. Whether it is enormous fees, charges, APR, etc, investors and borrowers always find something they like and don’t like all the time.

The following are the pros and cons of Peerform

Pros of Peerform

- There is no prepayment penalty

- Peerform offers consolidation loans for credit cards with high APRs

Cons of Peerform:

- The platform has a lot of fees that range from

- Unsuccessful payment

- Check processing

- Late fee

- The origination fee will be subtracted from the loan

- Smaller loans (under $4,000) are not offered. You must borrow at least $4,000

- Higher than $25,000 in personal loans are not available.

Eligibility and interest rates

- Interest rates: Vary by Peerform grades (AAA to DDD) and range from 5.32 % to 29.99 %

- Origination fee: Paid based on Peerform grade and ranges from 1% to 5%

- Unsuccessful Payment Fee: A fee of $15 or less is charged for each unsuccessful payment and varies by state laws.

- Late fee: $15 or 5% whichever is greater is charged for each payment that is late for 15 days or more

- Check processing fee: $15 for each payment

How much can you make on Peerform as an investor?

Peerform is a great place to invest as it offers compelling risk-adjusted returns and a monthly cash flow that is deposited in the investor’s account. According to Supermoney, the average return on investment is around 9.88% and a minimum of $50,000 is needed to open an investment account on Peerform. Keep in mind that these returns can vary from time to time.

How much money can you borrow through Peerform?

Peerform offers great loan amounts and borrowers can qualify for between $4,000 to $25,000. The fixed APR rates for these loans range from 5.99% for AAA loans to 29.99% for DDD loans.

The application process for personal loans is simple. The following are steps you will go through to get your loans.

- Registration

- Selection of your loan

- Listing your loan on the platform for potential investors

- Account and identity verification for security and fighting fraud

4. Funding Circle

Funding Circle is a peer-to-peer lending website that specializes in funding small businesses and it has written a name for itself. Since 2010 a total of $13bn has been loaned to more than 120,000 businesses through Funding Circle. The following are products Funding Circle offers via p2p lending.

- Business Term Loan: This is a long-term loan with no capital upfront and has a low monthly payment. You can get approved in 24 hours and receive funds in 3 days.

- SBA 7(a) Loan: This loan requires collateral and it can help you fund long-term business growth.

- Business Line of Credit: This is a business revolving line of credit

How long does it take to qualify for a loan through Funding Circle?

Applications for loans through Funding Circle are fast and easy. You can get approved in as little as 24 hours.

How much can you borrow through Funding Circle?

The amount you can borrow through Funding Circle varies based on the type of loan you are getting.

- Business Term Loan allows you to borrow up to $500,000 with fixed rates and the length of the loans ranges from 6 months to 5 years.

- SBA 7(a) Loan allows you to borrow between $75,000 to $5M and the length of the term can go up to 10 years.

- Business Line of Credit allows you to borrow up to $150,000 and the interest is paid only on the money you use.

Pros and cons of Funding Circle

Any business loan you will take out will have its pros and cons no matter how big or small. According to Invoice Factoring, the following are the pros and cons of Funding Circle.

Pros of Funding Circle:

- The application is fast and the approval time is short

- All loans given are secured

- You have flexibility as to what you can do with your funds in your business

- This p2p lending website is backed by Who’s Who

- All terms are transparent

- Can qualify for a large sum to help you achieve your business financial goals

Cons of Funding Circle:

- You need to provide a personal guarantee and a lien is applied to your business assets

- High late payment charges of 5% are applied

- There is no accounts receivable factoring

- You may not qualify for smaller amounts for some of the loans provided

5. Upstart

Upstart is one of the best peer-to-peer lending websites in this industry. The services are fast and the rates are 10% lower than its competitors. This platform partners with banks and credit unions to provide personal loans to consumers using artificial intelligence (AI) technology.

How to get money on Upstart?

The process of getting money through Upstart is simple. There are three main steps you must follow when borrowing money on Upstart.

(1) Check your rate: Go to its (Upstart) website and fill out an application to check your rates. This process takes a few minutes.

(2) Verify your information: The second step is to verify your information. Once this process is complete, you will get approved or denied. Upstart reports that most borrowers get approved instantly.

(3) Get your money: After you have been approved for a loan and accepted it, you will then get the money. Almost every personal loan (99%) is sent out 1 business day after signing the contract.

How much money can you borrow through Upstart?

Upstart will let you borrow any amount between $1,000 and $50,000. If you had another loan with Upstart, the following conditions must be met before you can borrow extra money.

- You had on-time payments in the last 6 months

- Have no due payment at the time you apply

- You do not have more than one outstanding loan with Upstart

- You do not have more than $50,000 of outstanding principles through Upstart

What kind of loans can you get through Upstart?

The loans you can qualify for on Upstart include but are not limited to the following.

- Debt consolidation

- Car refinancing

- Paying off credit card debts

- Other loans can include paying off student loans, vacations, medical bills, weddings, etc.

How much does Upstart charge in interest and fees?

Upstart charges a wide range of fees but the following are the main ones.

- Origination fee: 0% to 8% of the borrowed amount and this is a one-time payment

- Late payment fee: $15 or 5% of the monthly past due whichever is greater

- ACH return or check return fee: $15 per occurrence

- Paper copies: $10 upon request

The APR for Upstart varies from one person to another and by state. However, the average APR ranges between 3.22% to 35.99 %.

Pros and cons of Upstart

Just like any other peer-to-peer lending platform, Upstart has pros and cons you should know and I have listed them below.

Upstart Pros:

- You can change your payment date

- Funds are offered one day after the loan offer is accepted by the borrower

- Borrowers who never had credit before are also accepted

- Fast processing

Upstart Cons:

- There are only two repayment plans available (3 years and 5 years)

- An origination fee could apply (0-8%)

- Other fees are also applied such as late fees, check return fees, etc.

6. Solo Funds

Solo Funds a.k.a SOLO is an exception peer-to-peer lending institution that helps thousands of people, especially in underserved communities. This platform connects investors and borrowers and the average funding time is currently 30 minutes. Over the years, SOLO has helped over 55,290 individuals. That is a lot of people.

What is the average return on Investment from SOLO?

According to Finder, the average return on investment through SOLO is between 3% to 10%. Keep in mind that there is no guarantee for these returns, and more importantly, there is no guarantee that the borrower will repay the loan.

This is why most people prefer to purchase the SOLO’s Lender Protection Services where the principal is reimbursed in case of defaults.

Like other peer-to-peer lending websites, you can borrow or lend money through the SOLO platform. However, this platform is new compared to its competitors. It was founded in 2018 as a community and generosity-based platform that connects investors and borrowers in need.

Pros and Cons of SOLO Funds

The following are some of the pros and cons of SOLO Funds.

Pros of SOLO:

- It is a community-based platform

- Those who borrow can set up their affordable tips

- Options for small loans are available ($50-$1,000)

- Lenders can purchase protection for an additional fee

- The application gets approved fast

Cons of SOLO:

- Repayment periods are short (14-30 days) compared to its competitors

- No guarantee that the borrower will pay you back

- It is possible that you might not find someone to invest in your project

7. Kiva

KIVA is a microloan platform that connects lenders and borrowers online and supports people from all over the world. This P2P lending website does not support personal loans. Only business loans are provided. As opposed to other peer-to-peer lending websites we have seen, this platform specializes in small loans.

Kiva was founded in 2005 in San Francisco and its mission is to”expand financial access to help underserved communities thrive.” This non-profit organization uses crowdfunding methods which enables it to support numerous people worldwide such as students for school expenses, farmers, women in business, etc.

How much can you borrow through the Kiva lending website?

There is a limit to how much money you can qualify for through KIVA. You can borrow between $1,000 to $10,000 with no interest. You will then have 6 months to 3 years to pay off this loan.

How to qualify for a loan on KIVA?

If you go to the bank to borrow money, the first thing the bank will look for is your income, credit score, credit history, and other debts you have. This makes it difficult for many people to borrow money for their businesses and projects. Moneylenders focus on these factors because they need to make a profit from lending you money.

That is how they get rich.

KIVA has a different mission. Instead of worrying about your credit history, credit score, income, other loans you have, how long you have been in the business, etc; KIVA focuses on you as a business owner and the impact the money will make.

For these reasons, there will be no minimum credit score and other financial factors will have minimal impacts on your creditworthiness. Investors themselves and the support you have from the community will play a major role in funding your business.

With that being said, some requirements must be met to qualify for a loan.

The following are some of the requirements to qualify for a loan through KIVA.

- You must be 18 years old and the business must conduct legal activities

- Your business cannot be a multilevel marketing business and you should not be in financial distress such as bankruptcy.

- In addition, you and your business need to be based in the USA.