Learning about personal finance and mastering the subject requires understanding the most used financial terms and how they relate to your daily financial decisions. Whether you want to manage your finances better or have a career in finance, knowing essential personal finance terms and vocabulary can help you understand the subject better and manage your money effectively. This list of the most used personal finance terms can help you make educated investing decisions, improve communication with co-workers and clients, avoid common financial pitfalls, pay off debt, and build wealth quickly.

In this post, I will cover the 243 most used financial terms and vocabulary with definitions and examples(where necessary) to help you master finance subjects, improve your finances, and reach financial independence.

What are the benefits of learning the most used financial terms?

Learning personal finance can be tricky, especially if you are starting. The best way to get started is to master essential personal finance terms vital to helping you manage your finances better, make educated financial decisions, and avoid common financial mistakes.

Here are examples of ways learning the most used financial terms can benefit you daily.

When taking out loans/mortgages

Unless you plan to use cash for the rest of your life, taking out loans for expensive purchases such as a car and a house will be inevitable. Lack of financial knowledge, however, often leads to taking out bad loans, which can lead to long-term financial stress and hardships. According to Ramsey Solutions, the total American household debt was $17.5 trillion in the 4th quarter of 2023. This debt is broken down to $1.6 trillion in student loans, $1.13 trillion in credit card debt, $12.25 trillion in mortgage debt, and $1.6 trillion in auto loan debts.

The report also shows that about 77% of American households have debts, with the average debt per adult being $66,772. These numbers indicate that debt will play a significant factor in your life. While millions of Americans are struggling with debt, you don’t have to struggle like they do. For example, the average household credit card debt is $19,825, according to the same report. Carrying that much credit card debt is absurd, given the higher interest and APR associated with credit cards. According to LendingTree, people are paying as much as 24.92% APRs on average on their credit cards. To avoid accumulating bad debt like credit card debt, learn the basics of personal finance terms and how debt works.

For example, knowing how interest works, the benefits of having a good credit score, and why having a decent down payment is essential when taking out loans can help you avoid bad loans, pay lower rates, and save money on purchases.

When helping your clients and colleagues

Suppose you have a career in finance, are studying finance, or offer some form of financial services. In that case, you must learn these financial terms to improve your communications with clients and colleagues or perform better in school. Knowing these personal finance vocabularies will help you appear knowledgeable, which is essential to building confidence with your clients and long-term relationships. These financial terms can also come in handy when helping your co-workers, friends, and family members.

The truth is that most people are not financially literate. According to a report from the World Economic Forum, about 50% of Americans are financially illiterate, and the European Union(EU) is also underperforming. In other words, people don’t know about saving, investing, budgeting, managing debts, setting goals, financial planning, etc. That is why most people have no money saved, are struggling with debt, have empty retirement savings accounts, etc.

Learning the most used financial terms can improve your life and those around you. In a country where half of the population lacks financial education, you can imagine how much difference you can make. You can help your loved ones, friends, family, and co-workers make better financial choices with their money.

When making financial decisions

Knowing the most commonly used financial terms will be helpful when making financial decisions, even if you are not in finance. For example, if you are meeting your financial advisor, knowing financial terms, such as portfolio, investing, asset allocation, retirement planning, financial planning, risk management, asset, debt, etc., can help you communicate better. You don’t want to sound clueless and leave the decision-making to your advisor without your input simply because you don’t know.

This list of essential financial terms and vocabularies will come in handy when you manage your day-to-day life. For example, your job may come with retirement benefits such as retirement and healthcare benefits. Knowing the basics of 401(k) plans, tax deductions, contribution limits, HSA, HDHP, insurance policies, co-pay, co-insurance, deductibles, etc., will help maximize your benefits.

If you manage your investments, this list of financial terms will help you even better. To maximize your return on investment and minimize risks, you must learn about the types of investments available, diversification, value investing, goal setting, loss management, types of portfolios, risk tolerance, etc.

Without further ado, here is a list of the 243 most used financial terms and vocabularies to know.

You might also like:

- 53 personal finance terms you need to know

- 180+ most used real estate terms and vocabularies you should know

Glossary of the most used personal finance vocabulary and terms to know

1. 529 savings plan

A 529 plan is a tax-advantaged savings account designed specifically for its beneficiary’s education expenses. The money can be used for college-related expenses, including tuition, student loan prepayments, etc. The owner of the 529 plan maintains the ownership of the account until the money is withdrawn.

2. 529 prepaid tuition plan

The prepaid tuition plan is a state-sponsored college savings plan that allows you to save for college tuition and fees at an accredited post-secondary institution such as a college or university. You can also use the money for books, dorms, study equipment, etc. The money is invested and grows tax-free. You also need to designate the beneficiary’s information.

3. 401(k) plan

A 401(k) plan is a retirement savings plan where qualified employees contribute a portion of their paychecks toward retirement through their employers. The IRS establishes yearly contribution limits, and some employers match employees’ contributions up to a certain percentage, such as 6% of employees’ gross incomes.

A

4. Annual return

The annual return is the return on investment over a year or 12 months expressed as a percentage of the initial investment. A positive annual return represents a gain, while a negative return represents a loss.

5. Appreciation

Appreciation is a term used when the value of an asset or investment goes higher beyond its original purchase price. For example, if a stock you purchased for $10 per share is now $25, your investment would have appreciated by $15 a share. Appreciation can be expressed as a percentage. In this case, your appreciation rate from this investment will be 250%.

6. APR(Annual percentage rate)

The annual percentage rate, or APR, is the total cost of borrowing money expressed as a percentage. APR includes interest rates, fees, discount points, and other fees. As a consumer, you must avoid products and services with higher APRs to lower the cost of your loan.

7. Asset

An asset is anything you own with a monetary value that earns you money. Assets can be financial, tangible, or intangible. Examples of assets include but are not limited to land, rental properties, cash, gold, silver, stock, money in a checking account, etc. All assets depreciate except land because it cannot physically deteriorate and has an indefinite useful life.

8. Asset allocation

Asset allocation is an act of buying and holding different investments and assets in your portfolio, such as bonds, stocks, and real estate. As an investor, you decide the best percentage of each asset you should own. Factors to consider when allocating assets include time horizon, risk tolerance, and financial goals.

9. ATM (automated teller machine)

An ATM is an automated machine that serves essential functions you would get from a bank teller at your local bank. With an ATM, you can deposit or withdraw money, check your account balance, deposit checks, etc.

10. Direct deposit

Direct deposit happens when your paycheck is electronically deposited into your bank account without a traditional physical check. You can also use direct deposit for your tax refunds and Social Security benefits, where the money can be directly deposited into your savings or checking accounts.

11. Amortization

Amortization is a process that involves paying off your debts in equal installments, usually paid monthly. A portion of your payment goes toward the principal amount, while the other covers interest. Examples of loans where amortization is used include mortgages and car loans.

12. Annuity

An annuity is a contract between you and a financial institution, usually an insurance company, where you pay premiums in exchange for a regular series of payments in the future. Annuities are suitable for retirement savings as they provide regular payments during retirement. Types of annuities include fixed-income annuities, deferred annuities, indexed annuities, immediate annuities, and variable annuities.

13. Adjustable mortgage rate(ARM)

An adjustable-rate mortgage(ARM), or variable-rate mortgage, is a home loan whose interest rate changes over the loan’s lifetime. ARMs start with a low fixed interest rate for a few years, usually five years before the lender adjusts it based on market rates.

14. Annual percentage yield(APY)

Annual percentage yield, or APY, is the total interest you earn on your investment over a year. APYs include the interest rate and compounding effect for 365 days.

15. Adjusted gross income

The adjusted gross income is the total gross income from all sources minus certain deductions such as educator expenses, alimony payments, student loan interest, and retirement contributions.

16. Authorized user

An authorized user of a credit card is a person who gets permission to use someone else account. As an unauthorized user, you can use the credit card as your own, just like a regular credit card. The primary account holder is still responsible for all account activities, including making payments and keeping the account in good standing.

B

17. Bank

A bank is a financial institution that offers money services such as deposits, loans, transfers, etc. Banks are regulated by the Office of the Comptroller of the Currency (OCC), the Federal Reserve Board, and the Federal Deposit Insurance Corporation (FDIC) to ensure transparency in their business activities.

18. Bankruptcy

Bankruptcy is when individuals and institutions unable to repay their debts seek relief from some or all of their debts. Borrowers petition in federal courts and cases are handled under rules outlined in the U.S. Bankruptcy Code. According to the U.S. Courts, common types of bankruptcy include Chapter 7, Chapter 9, Chapter 11, Chapter 12, Chapter 13, and Chapter 15.

19. Bank statement

A bank statement is a detailed document you receive from a bank or credit union showing all transactions that happened in a given time, usually monthly.

20. Balance sheet

In financial reporting, a balance sheet is a financial statement that details the company’s assets, liabilities, and shareholder equity at any given time. A balance sheet can help individuals and businesses understand their short-term debt obligations, net worth, financial goals, financial structures, etc.

21. Beneficiary

A beneficiary is a person you designate to receive a portion of your asset. For example, if you have an insurance policy, a retirement savings account, or an investment, your beneficiary will receive a percentage of your assets/investments when you pass away.

22. Bear market

A bear market is a market with a prolonged decline of 20% or more. For example, if the S&P 500 declines 20% or more from its previous high, it is considered a bear market. Causes of bear markets include a weakening economy, widespread investors’ fear about the economy, and massive sales/liquidation of securities.

23. Bull market

A bull market is the opposite of a bear market. A market is considered a bull market when prices are rising or expected to rise 20% or more. For example, stocks are in a bull market when the S&P 500 increases by 20% or more from its previous low.

24. Balance transfer

The balance transfer refers to moving your credit card balance to a different card, usually from a different provider. Some benefits of transferring your balance include saving money on interest, consolidating your debts, and paying off your debts faster.

25. Bond

A bond, also known as debt security, is a financial instrument where an investor lends money to a corporation, government, or similar organization. In return, the investor receives regular interest payments until the bond matures and the original investment is received. Corporations, the government, or municipalities can issue bonds. You can buy government bonds directly from the Treasury Direct website.

26. Borrower

A borrower is a person or an organization that takes money from a lender in exchange for paying it back with interest at a given time.

27. Bid price

Simply put, a bid is the highest price a buyer will pay for a product or service. For the stock market, a bid price or bid is the highest price a buyer is willing to pay to buy a specific number of shares or option contracts at a given time. The bid is usually lower than the offer or ask price, the lowest price a seller will take for products such as stocks.

28. Budget

A budget is a financial plan that details how much money you make, where you spend that money and any savings you have. A budget is essential in financial planning as it prevents mishaps such as overspending, running out of money, and bad debt. It also guides you in making smart financial choices.

29. Book value

The book value of a company is the net worth of a company based on its balance sheet. You can also define the book value as the total amount of money all shareholders would receive if the company is liquidated. The book value is different than the market value, which is the total value of the company share outstanding, also known as market capitalization or market cap for short.

30. Budgeting

Budgeting is the process of creating a budget. This means you write down details of how much money you earn, where you plan to spend it, and potential savings. For example, if you want to lower your expenses to save for a down payment for a home purchase, you can boost your savings through budgeting.

31. Buying power

Buying power, also known as purchase power, is the amount of money you have that can be used to buy goods and services at a given time. Think of purchasing power as how much goods and services you can buy with your money.

32. Business

A business is an organization that is engaged in the sales of goods and services to make a profit. Business activities can be personal, commercial, or industry. The goal of a business is to solve a problem by offering a solution to make a profit.

33. Buyer’s agent

A buyer’s agent is a licensed real estate person representing a buyer in a real estate sale/ transaction. Buyer’s agents help with buying processes, including house hunting, showings, guidance, comparative analysis, and overseeing closing.

C

34. Capital gain

Capital gain represents an increase in an asset value that is realized once the asset is sold. For example, if you bought a share of XYZ company for $5 and it goes to $15, you will have an unrealized capital gain of $10 before selling it. After selling the stock for $15, your actual capital gains will be $10.

35. Capital gains tax

Capital gains tax is the tax you pay on the profit you make from selling an investment. Short-term capital gains are taxed as ordinary income, whereas long-term gains are taxed at 0%, 15%, or 20%, depending on your income. Investors lower their capital gains by buying long-term investments, concentrating on tax-deferred investments, selling lossy investments to offset gains, picking cost basis, etc.

36. Capital loss

You incur a capital loss when you buy an asset, such as a stock, and later sell it for less than you bought it. Capital loss is a term used to represent a loss of money on an investment. Capital losses from investments are tax-deductible up to a certain amount. However, capital loss from selling personal property such as a car, home, or boat is not tax-deductible.

37. Cash flow

Cash flows represent the flow of money in and out of a company. The cash flow statement illustrates how a company makes and spends its money in a given time. In personal finance, cash flow shows all your sources of income and where you spend the money you make. A budget can quickly help illustrate your cash flow instead of creating a cash flow statement for your finances.

38. Cashback credit card

A cashback credit card is a reward card that gives you a small percentage of the purchase price or points whenever you make qualifying purchases. Some credit card issuers give you a flat 1% on all purchases and up to 5% for specific purchases. Ways of redeeming your cashback include using it to make a purchase or payment, depositing it into your account, or as a statement credit.

You might also like Cashback vs. points and miles

39. Career

A career is a profession or occupation that usually requires studying or training for someone’s life work. Some high-paying careers include surgeon, Physician, Neurosurgeon, cardiologist, engineer, IT manager, etc.

40. Card replacement fee

The card replacement fee is the charge some card issuers charge you if your card is damaged or stolen.

41. Cash

Cash, also known as liquid cash, is currency or coins used to purchase goods and services immediately. It can also represent assets that can be converted into cash.

42. Certificate of deposit(CD)

A certificate of deposit, or CD, is an interest-bearing deposit account you can open from a bank or a credit union. CDs offer fixed interest that is usually higher than savings accounts for a fixed term in exchange for not touching the money until maturity. You typically pay a penalty when you withdraw money before the CD matures. Common types of CDs include but are not limited to IRA, Add-on, Callable, Jumbo, Traditional, No-penalty, etc.

Learn more: How Do CDs Work: Learn How To Save And Earn Smarter

43. Checking account

A checking account is a deposit account that allows you to make daily transactions, including deposits and withdrawals, to cover your daily expenses. Unlike savings accounts that earn small interest, checking accounts do not pay you interest due to unlimited access to your money. You can deposit money into your checking account at an ATM, inside the local branch, online by scanning a physical check, or transferring money into the account from an external account.

44. Contingencies

In real estate, contingencies are terms defined in an agreement between a buyer and a seller that must be met before closing the sale. For example, the buyer can include inspection contingencies in the offer. If the inspection shows the property has expensive damages or needs rehab, the buyer can cancel the offer or renegotiate the price.

45. Collateral

A collateral is something of value, such as a car, house, or an investment you give to the lender as a guarantee of repayment. If you fail to repay the loan balance, the lender can legally sell the asset in auction to recover the unpaid balance.

46. Commission

In simple terms, commission is money you pay a salesperson for every successful sale. Commissions can be a flat rate or a percentage of the sale. For example, in the stock market, commissions for certain transactions range between $5-$10; in real estate, on the other hand, the commission is usually 5% to 6% of the sales price.

47. Comparative analysis

Comparative analysis is the process of analyzing different assets to figure out their similarities and differences. In real estate, agents use comparative market analysis(CMA) to estimate home prices based on similar homes recently sold in the same area.

48. Coin

A coin is a small round metal with its value stamped on it, and it is used in many countries as a form of currency. In cryptocurrency, a coin represents a digital asset native to its blockchain and has its network where it operates. Examples of digital coins include Bitcoin(BTC), Ethereum(ETH), Solana, USDT, TON, and XRP.

49. Claim

A claim is a request for repayment for something due. In the insurance sector, a claim is a formal request for a repayment made to an insurance company for damages or loss of capital covered under your insurance policy. For example, suppose you have full coverage on your auto insurance and get into an accident. In that case, you can file a claim to your insurance company asking them to cover the damages to the car and the involved properties.

50. Collection

Collection or debt collection is the process of pursuing an unpaid balance by a debt collector owed to a lender such as a bank, credit union, or loan company. Debt collectors can be businesses, individuals, or lawyers. When your debt is in the collection, the collecting agency tries to pursue unpaid balance through all legal means necessary.

51. Charge-offs

Charge-off refers to when a lender writes off a debt as a loss. Reasons a loan can be written off include payments being many months late, when settlements are not being met, or if there is an agreement to collect only a certain amount. Most loans get written off when your payments are 90 to 120 days past due.

52. Consumer Price Index(CPI)

The Consumer Price Index, or CPI for short, measures the average changes in prices consumers pay to acquire an equivalent of one basket of goods and services. The Bureau of Labor Statistics(BLS) calculates the CPI every month, and it helps policymakers evaluate the health of the U.S. economy. Items included in the CPI calculations include, but are not limited to, food, rent, and automobiles.

53. Cash advance

A cash advance is a service that allows you to withdraw cash from your credit card. Cash advance interest is usually higher than regular interest on your credit card, which starts compounding the day the money is withdrawn.

54. Compound interest

Compound interest is an interest calculated on the initial principal and accumulated interest on the loan. Compounding interest is one of the best ways to make money, as it allows you to accumulate wealth exponentially over time.

55. Coinsurance

Coinsurance refers to the percentage of the health care cost you cover after meeting your deductibles. Usually, the coinsurance is expressed as a percentage of the total service cost allowed, such as 20%.

56. Cosigner

A cosigner is a person who helps you qualify for a loan and agrees to take responsibility to repay the loan when you fail to pay it back. For example, if you want to buy a car but cannot qualify due to having bad credit, you can use a cosigner to get the money. If you fail to make payments or default on the loan, the cosigner will be legally responsible for paying back the loan amount and underlying fees.

57. Copayment or copay

For consumers with healthcare coverage, a copy is a fixed amount they pay for certain healthcare services such as a doctor’s visit, overstaying, lab test, etc. For example, the insurance company can require that you pay $30 for all lab tests and doctor visits. The copay is usually paid during service, while the remaining charge is billed to the insurance company.

58. Credit

Credit refers to your ability to qualify for loans with a promise to make payments in the future. “creditworthiness” is commonly used when assessing consumers’ ability to repay the loans. Your credit score, DTI ratio, and income are some of the factors lenders use to determine your creditworthiness.

59. Creditor

A creditor is a person or a company that lends you money.

60. Credit card

A credit card is a payment card usually offered by a bank, credit union, or other financial institution that allows you to purchase goods and services on credit. Just like regular loans, activities on credit cards are reported to major credit reporting agencies(Equifax, TransUnion, and Experian). For this reason, credit cards can hurt your credit score if you don’t use them correctly.

61. Credit card statement

A credit card statement is a detailed document illustrating all account activities in a payment period.

62. Credit report

A credit report is a detailed document showing all your account activities, including all your debts and loans, credit cards, how much you owe, payment activities, credit history, etc. Credit bureaus use the information they collect from your lenders to establish credit reports. Some information from credit reports, such as payment history, credit utilization, and age of credit, is used to calculate your credit score.

63. Credit union

Unlike banks, credit unions are financial institutions that offer similar services to banks but are not-for-profit. Credit unions are cooperatives that strive for the success of their members, families, and communities.

64. Credit score

A credit score is a number that summarizes your credit history and account activities. Lenders use your credit score to assess your creditworthiness, which measures how likely you are to repay the loan. There are two major types of credit score: FICO score and VantageScore. Credit score numbers are calculated based on information from credit reports. The higher the score, the easier it is to qualify for loans at lower interest rates and better terms.

65. Credit Repair

Credit repair refers to restoring your credit score and improving your credit history. You can repair your credit or hire a credit repair company. Some tips to repair your credit include cleaning up your credit reports, paying your bills on time, maintaining a lower credit utilization, getting credit repair loans, etc.

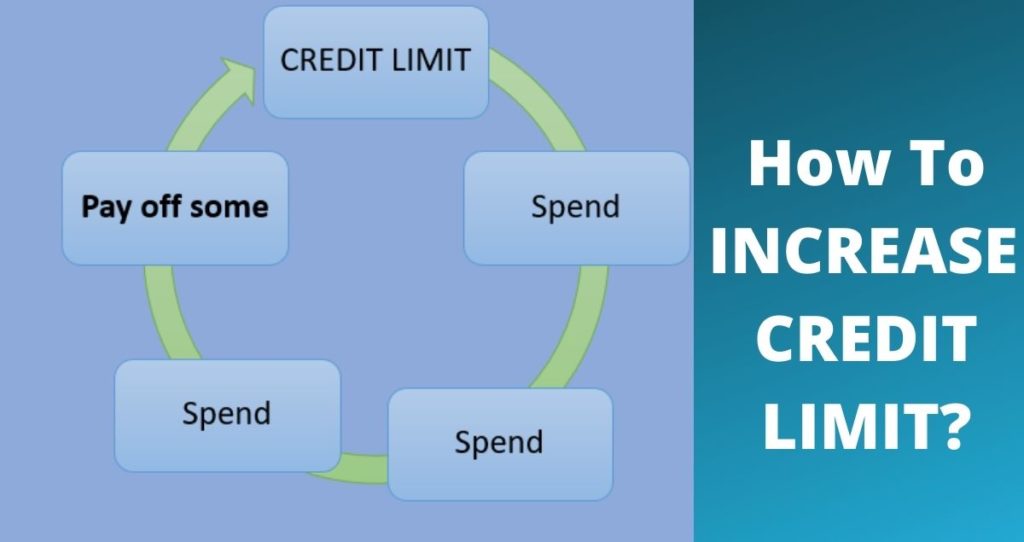

66. Credit utilization

Credit utilization represents the amount spent on revolving credit accounts such as credit cards compared to your total credit limits. For example, if your credit limit is $1,000 and you have spent $600, your credit utilization will be 60%. Maintaining a credit utilization under 5% is essential to get an 800 credit score.

67. Credit reporting agency

A credit reporting agency is a company that collects information from your lender, establishes credit reports, and calculates credit scores. The three biggest credit reporting agencies include Equifax, TransUnion, and Experian. These three agencies calculate consumer’s VantageScores.

68. Creditworthiness

Creditworthiness is a measure lenders use to assess how likely you are to repay the loan under the agreed-upon terms and conditions. Lenders use your credit score to evaluate your creditworthiness.

69. Cost-effective

A product is cost-effective when it gives you great value compared to the money you paid.

70. Cost of living

The cost of living is a term used to describe how much money you need to sustain your standard of living by affording essential needs such as food, shelter, water, healthcare, and taxes. The inflation rate usually drives the cost of living higher as it increases the prices of goods and services. Without increasing your income to beat the inflation rate, most consumers find it difficult to afford a decent standard of living.

71. Consumer Financial Protection Bureau(CFPB)

The Consumer Financial Protection Bureau is an independent government agency responsible for the protection of consumers in the financial sector. In doing so, CFPB supervises lenders and large non-bank entities, such as debt collection companies, credit reporting agencies, and banks. This agency is also responsible for making sure these institutions are transparent in their reporting by enforcing them to provide disclosures to consumers and educate them about their rights.

D

72. Debt

Debt is money or anything of value you owe someone or an organization, like a bank. Consumers use debt to buy assets they cannot afford using only their money. Accumulating too much debt leads to financial hardships as the interest on the balance makes it harder to pay off the loan. When you cannot pay off your debt, the lender usually takes your property through foreclosure or repossession.

73. Debtor

A debtor is a personal or an organization that owes money. For example, borrowing $30,000 to buy a house makes you a debtor. In short terms, a debtor is also known as a borrower.

74. Deed

A deed is a legal document that transfers a property’s ownership from one part to another. In real estate, for example, the grantor(seller of the property) signs the deed, which allows the buyer(grantee) to take possession of the property legally.

75. Deed-in-lieu of foreclosure(DIL)

If you are having trouble paying off your mortgage, you can take advantage of a deed-in-lieu of foreclosure to get out of the contract and prevent foreclosure. A deed-in-lieu of foreclosure is a legal agreement that allows you to voluntarily transfer the property’s title to the lender to avoid foreclosure. A DIL is a great option when you cannot afford your monthly payments or don’t have a lot of equity in the property.

76. Debit card

A debit card, also known as a check card, is a payment card from the bank or credit union that allows you to deduct money from your checking account when you make purchases. You can use a debit card to buy goods and services or withdraw cash from an ATM.

77. Debt consolidation

Debt consolidation is a debt management strategy that allows you to combine multiple debts, such as student loans, car loans, or credit cards, into a single debt with one monthly payment. When you consolidate your debts, all your debts are combined into a new loan with a single monthly payment. Debt consolidation can help you get out of debt faster, effectively manage your debts, and save you money in interest charges.

78. Deductible

The term deductible has multiple meanings. An insurance deductible represents the amount an insurance policyholder must pay before the insurance company pays for expenses covered by the policy. In a tax filing, a deductible represents an item or expense that can lower the amount of tax you owe in a given year. All tax-deductible items, like contributions to pre-tax 401(k) plans, are subtracted from your taxable income, potentially lowering your tax liability in a year.

79. Deposit account

A deposit account is a bank account open from a bank, credit union, or other financial institution that allows you to deposit money and make withdrawals. Some deposit accounts also allow you to transfer to external accounts, and you might earn interest on your savings.

80. Direct deposit

Like the name hints, direct deposit refers to depositing money into your bank account, like a savings or checking account, without using a physical paycheck.

81. Depreciation

Depreciation represents a reduction in the value of a fixed-income asset, such as a car or a home, in a given time. The depreciation rate is another term used to quantify how much an asset has depreciated over time. For example, if your car was worth $25,000 on Jan 1st and by Dec 31st is worth $20,000, it would have depreciated $5,000. This amount represents a depreciation rate of 20% of its original value.

82. Delinquent

The term delinquent describes an overdue financial obligation, such as a monthly payment. A delinquent payment results in late fees and sometimes penalties. Delinquent accounts can also become defaults when the account is not brought to its current state by the date specified in the loan terms.

83. Dividend

A dividend is a portion of a company’s profit paid to its shareholders for holding its stocks. The company’s board of directors determines how much dividends the company will pay its shareholders and when to pay it. Usually, dividends are paid quarterly or annually. Typical forms of dividends include cash and stocks. Companies pay dividends to show financial stability and attract long-term investors. Your dividends depend on the dividend payout ratio and the number of shares you have. For example, if a company is paying $1 per share and you hold 1,000 shares, you will receive $1,000 dividends for holding these shares.

Learn more: Dividend investing: How to pick the best dividend stocks?

84. Down payment

A down payment is an upfront payment you make at closing when buying an asset such as a home or a car. It is also known as a deposit, guarantee, earnest, or security. The down payment is usually a percentage of the total cost of the property, such as 20%. After purchasing the asset on credit, the remaining balance is paid over time based on the loan terms.

85. Debt management

Debt management is a strategy that helps borrowers take control of their debts and pay them off. This strategy involves making plans, organizing your debts, and paying them off in the most cost-effective possible while meeting other financial responsibilities. For example, you can organize and pay your debts, starting with the highest-interest debts first. Other debt management strategies include refinancing your loans, balance transfer, debt consolidation, debt negotiation, using a debt counseling agency, etc.

86. Default

A default is when you fail to make payments on your loan, such as a car loan or a mortgage, based on the loan terms. Consumers default on their loans for many reasons, including expensive medical bills, job losses, or bad money habits, such as excessive spending and lack of savings. Most loans consider your loan to be in default after they are 30 days past due. However, some loans have more extended periods before they are defaulted. For example, according to the Consumer Financial Protection Bureau (CFPB), your federal student loan defaults 270 days without making a payment.

E

87. Earned income

Earned income is the total income realized from all sources, including salaries, wages, and tips. Portfolio incomes such as interest, dividends, and similar passive incomes are considered unearned income because they require little time and work to acquire them. For an income to qualify as earned, it must be taxable. For example, your 401(k) contributions are not earned since they are not taxable until you take distributions.

88. Early withdrawal penalty

An early withdrawal penalty is a 10% penalty you pay for taking money out of your retirement savings accounts, such as IRAs and 401(k), before turning 59½. It can also represent a penalty you pay when you take money out of your particular investment before maturity. For example, withdrawing cash from a CD before maturity triggers an early CD withdrawal penalty, usually several days or months of interest on the account.

89. Emergency fund

An emergency fund is money you put aside for unexpected emergencies such as a job loss, home repairs, medical expenses, or a car repair. Your emergency fund should have at least 3 to 6 months of your monthly expenses to be safe. High-yield savings accounts are some of the best places to keep your emergency fund because they bear a high yield while allowing you access to your money.

90. Equity

Your equity in a property represents the amount of the property’s value you own. For example, if your home is worth $300,000 and you still owe the bank $200,000, your equity in the property will be $100,000. If you were to sell the house, you would give the bank $200,000 and pocket the net proceeds (the amount left after all sales deductions are taken out).

91. FICO score

A FICO score is a credit score calculated by the Fair Isaac Corporation, a data analytics company that pioneered the credit scoring model in 1989. Your FICO score ranges from 300 to 850, and lenders use it to assess your creditworthiness. A higher FICO score allows you to qualify for loans with lower interest rates and favorable terms. Factors affecting your FICO score include payment history, credit utilization, length of your credit history, credit mix, and new account activities.

92. Entrepreneur

An entrepreneur is an individual who creates new businesses, taking all the risks but also getting most of the rewards once the business starts making money. Common qualities of entrepreneurs include creativity, confidence, passion, curiosity, discipline, hard work, and willingness to take risks.

93. EIN (Employer Identification Number)

An Employer Identification Number, or federal identification number, is a 9-digit number the IRS assigns to represent a business entity. The easiest way to apply for an EIN is to apply from the IRS website, where you get the EIN immediately after the information is verified and approved by the IRS.

Learn more: How do I get EIN for my business?

94. Estate tax

An estate tax is a federal or state tax on inherited property such as a house, cash, or land after the original owner dies. The tax applies only when the inheritance exceeds the exemption amount. According to Investopedia, inheritance taxes start in single digits and can be as much as 18%.

95. Exchange-traded fund (ETF)

An ETF is a fund that seeks to mimic its underlying index that trades on exchange. Buying an ETF means purchasing many assets in the fund, enabling you to diversify your portfolio and minimize your risk.

96. Expected return

The expected return from an investment or a portfolio is the average return on investment you expect to generate over some time, such as a year. Several investments, such as fixed-income assets, require a less expected return, while risky investments, such as equities, require a higher return to balance the risk.

97. Exchange

An exchange is an open financial market for stocks, securities, derivations, commodities, and similar products sold and bought by investors. Market exchange can be physical, such as the New York Stock Exchange in Manhattan, or electronic, such as the Nasdaq stock market.

F

98. Federal income tax

A federal income tax is a tax you pay to the federal government imposed on all taxable incomes, such as wages, bonuses, salaries, commissions, interest, tips, etc, for any given year.

99. FAFSA – Free Application for Federal Student Aid

The Free Application for Federal Student Aid, also known as the FAFSA, is a free online application you must complete when applying for federal financial aid. Some of the federal aid you can use include, but are not limited to, student loans, grants, federal work-study, and scholarships. To get started with your FAFSA form, follow this link.

100. Federal minimum wage

Set by the Fair Labor Standards Act (FLSA) in the U.S., the federal minimum wage is the lowest hourly wage employers can pay their employees. The current federal minimum wage is $7.25, established in 2009.

101. Federal Work-Study(FWS)

Federal Work-Study(FWS) program enables students with financial needs to work part-time jobs related to their studies or community services. The money helps students pay for their post-secondary education, and the amount of work depends on each student’s financial needs at the time of application. Work-study programs limit the number of hours to 20 hours per week.

102. Federal Insurance Contributions Act (FICA)

FICA, or Federal Insurance Contributions Act, is a federal payroll tax paid by employees and employers. The money is used to fund employees’ Social Security and Medicare. According to the Social Security Administration(SSA), 6.2% of employees’ gross wages go to Social Security tax, while 1.45% of employees’ gross income goes toward Medicare tax. In other words, employees pay 7.65% of their wages in Medicare and Social Security taxes, and employers match that amount for a total contribution of $15.3%.

103. Federal Student Loans

Federal Student Loans are loans you take from the federal government to help fund your education needs, such as tuition, books, and fees. The money is then repaid with interest, but you get a six-month grace period after graduation. If you have private student loans, you might get a six-month grace period as well, but most lenders require payments as soon as the money is dispersed.

There are four categories of federal student loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans.

104. Financial Aid

Financial Aid is money and other resources that help students pay for their education and financial needs. This aid comes in many forms, including work study, stipends, student loans, grants, paid employment, etc. Organizations such as nonprofits, colleges, high schools, foundations, federal and state agencies, etc., make financial aid programs available to students with financial needs.

105. Financial hardships

Financial hardship occurs when you cannot meet your financial obligations, such as debt repayment, rent payment, food purchases, healthcare coverage, and other living necessities. Common reasons millions of consumers experience financial hardships include, but are not limited to, too much debt, medical bills, job loss, high cost of living, car repairs, and bad money habits.

Check out why you cannot save money

106. Financial independence

Financial independence refers to your ability to meet all your financial needs and reach your goals without relying on income from work. You are financially independent when you have enough cash, investments, and assets to cover all your expenses and live comfortably without relying on a paycheck.

107. Financial freedom

Financial freedom is having enough resources to cover your desired lifestyle without working. Many people confuse financial freedom with financial independence, but they are not the same. Financial independence focuses on having enough money, savings, and investments to afford your financial needs, while financial freedom is living your desired lifestyle without ever working again.

108. FIRE

The FIRE movement, or Financial Independence Retire Early, is a financial movement where people who practice it engage in extreme saving and investing strategies to retire earlier than traditional retirement ages. The FIRE movement followers use the rule of 4% to determine their fire number, which is the amount of money needed to reach financial independence.

According to the rule of 4%, FIRE movement followers must save 25 times their annual expenses to become financially independent. For example, if your yearly expenses are $50,000, you must save and invest $1.25 million to reach financial independence. In this case, $1.25 million will be your FIRE number. The 4% in FIRE movement means you can maintain your current lifestyle by withdrawing 4% from your investment for 30 years.

109. Fixed income assets

Fixed-income assets are investments that return a fixed return on investment in dividends and interest, usually periodically. Bonds, dividend stocks, and high-yield deposit accounts are examples of fixed-income assets because they pay interest or dividends(for stocks) in pre-determined periods.

110. Fixed expenses

Fixed expenses are expenses that remain the same from month to month. Usually, fixed expenses are negotiated through contracts between involved parties for a given time. For example, if you are a renter, your monthly rent payment will remain the same for the duration of the lease. While the landlord could increase rent, most states prevent landlords from raising your rent in the middle of the lease unless the lease explicitly states that.

For month-to-month leases, your landlord could increase the rent, but your landlord must give you a notice before increasing the lease. But, in most cases, rent remains fixed until the end of the lease.

111. Foreclosure

A foreclosure is when the lender, such as a bank, takes back the house when you cannot repay the mortgage as previously agreed. Most lenders initiate foreclosure after 120 days past due. You can avoid foreclosure by selling the property through a regular or short sale, a deed-in-lieu of foreclosure, refinancing the loan, negotiating a debt repayment plan, etc.

112. Fraud

Fraud occurs when someone intentionally fakes their identity and information to gain access to money and valuable information by deceiving others. Typical forms of theft include identity theft, fake charity donation solicitations, social engineering scams, prize and award-winning notifications, etc.

113. Foreign exchange(FOREX)

Foreign exchange is converting a country’s currency into another currency based on the laws of supply and demand. Forex trading refers to the buying and selling of currencies in the global foreign currency market under the assumption that one currency will increase or decrease.

114. Form W-4: Employee’s Withholding Allowance Certificate

According to the Internal Revenue Service (IRS), Form W-4 is a tax form that shows an employee’s filing status, such as married, single, or married filing jointly, the amount of income, deductions, etc., to help compute the federal income tax and withholding from each paycheck.

115. Form W-2

Form W-2 is a tax form from your employer that contains essential information you need to complete your tax returns. Some information on your Form W-2 includes but is not limited to, your total wages for the year, pre-tax contributions to 401(k) plans, total wages, and federal, state, and other taxes withheld, such as Social Security tax.

116. FDIC (Federal Deposit Insurance Corporation)

Depositing money in a bank comes with the risk of losing your money in the event the bank fails. To minimize these risks, FDIC was established to protect depositors’ funds when banks fail. In summary, the FDIC is an independent government agency of the U.S. that protects depositors’ funds if their FIDC-insured bank fails. FDIC insures each depositor up to $250,000 per depositor, per bank, and account category.

Read more about FDIC coverage here.

117. Fundamental analysis

Many investors use fundamental analysis to determine the intrinsic values of assets and securities. This strategy relies on macroeconomic and microeconomic factors to determine profitable investments suitable for investors’ portfolios.

Macroeconomic factors focus on analyzing economic performances, inflation, foreign exchange rates, interest rates, etc. On the other hand, microeconomics focuses on how businesses make decisions on allocating resources and their interaction with other companies. As an investor, you must analyze individual companies, their financial reports, their sectors, and how they compare with the industry’s competition before making an investment decision.

118. Flexible Spending Account(FSA)

A flexible Spending Account(FSA) is an account where you put in a portion of your pre-tax paycheck to help you cover some of your out-of-pocket medical expenses. One of the benefits of an FSA account includes lowering your taxable income and saving for medical expenses. Unlike Health Savings Accounts(HSA), where you need to be enrolled in a High Deductible Health Plan(HDHP), you do not need to be enrolled in an HDHP or have a health plan with your company to contribute to an FSA account.

G

119. Gig

A gig is a temporary job that usually lasts for a given time, such as a few months or weeks. Good examples of gigs include freelance jobs, part-time jobs, independent contracting jobs, or project-based jobs such as construction jobs.

120. Generational wealth

Generational wealth refers to the wealth you can pass down to your descendants, such as property, business, money, investments, collectibles, and loyalties. To break out of the poverty cycle, you must focus on accumulating assets that can last more than one generation as they allow your family to prosper even after you are gone.

121. Goods

The term goods represents anything such as merchandise, finished products, or raw materials that are sold to buyers. The price of goods is usually determined by supply and demand principles. By default, a higher demand drives the prices of goods and services higher, while a lower demand reduces the prices of goods sold.

122. Government benefits card

The government benefit card is a prepaid debit card that federal government agencies and some states use to distribute benefits to its recipients. The government uses these cards as they are more secure, easier to distribute than cash, and offer other benefits such as cash withdrawals. Some government benefits where prepaid cards are issued include but are not limited to child support, Social Security benefits, unemployment benefits, and many more.

123. Grace period

The grace period is a period after the due date in which you can still make your payments without facing the cancelation of services. For example, federal student loans have a six-month grace period between graduation and the start of employment. Credit cards usually have a 20 to 30-day grace period, which is a time between the billing cycle and the due date. The grace period can also apply when investing money. For example, after your CD matures, you will be given a few day’s grace period to decide if you want to cash out a CD, renew it, or use the money to purchase a different CD.

124. Gross income

An individual’s gross income is the total earnings/income from all sources, including wages, interest payments, bonuses, commissions, etc., before taxes and deductions.

H

125. Home Equity Line of Credit(HELOC)

A home equity line of credit, also known as HELOC, is a loan you take against the equity in your house that allows you to fund expensive projects such as a home repair or use the funds as needed and pay it back. The equity in your house is used as collateral, and the lender can take it if you default on the loan. Most HELOCs come with lower interest rates than conventional personal loans.

However, like traditional loans, HELOCs come with extra costs, such as closing costs(2-3% of the total loan). Your HELOC might also have hidden costs, including annual fees, prepayment penalties, or minimal withdrawal requirements.

126. Health Savings Account (HSA)

A health savings account(HSA) is a personal savings account you can set up to help you pay for qualified health-related expenses. To qualify for an HSA, you must be enrolled in a High Deductible Health Plan(HDHP). The money in your HSA is tax deductible, which can help lower your taxable income. The amount you can contribute changes each year, and for 2024, you can contribute up to $4,150 for a single person or $8,300 for a family.

127. Homeowner’s Insurance

Just like car insurance, owning a home also means you need home insurance, which is known as homeowner’s insurance. Homeowner’s insurance protects your home and belongings against fire, hurricanes, floods, etc.

Depending on locations and zones, people usually get homeowners insurance based on the types of disasters they expect to happen. Since fire can happen everywhere, covering your home against fire is necessary. If you live in locations where floods and hurricanes are frequent, such as Florida, insuring your home against floods and hurricanes will be a smart idea.

128. Home Owner’s Association(HOA)

A homeowner’s Association(HOA) is an organization that governs a community or homes and sets rules for those communities. Homeowners pay an HOA fee to help cover the organization’s amenities and services, including landscaping, snow removal, pool, gym, etc. Condos and townhouses always have HOA fees; some single-family homes in certain communities also come with HOA fees.

As a homeowner, you must consider HOA fees in your home purchase budget. These fees will increase your monthly payments and can make your home unaffordable.

129. High-yield savings account (HYSA)

A high-yield savings account(HYSA) is a type of savings account that pays a higher interest yield, usually 10 to 20 times more than traditional savings accounts. Paying a higher interest rate means you will earn more money on your deposit and grow your net worth faster. Generally, the accounts come with an interest rate and an annual percentage yield(APY).

The APY is the total earnings on your deposit over a year expressed as a percentage. HYSAs are great for storing emergency funds or saving for financial goals such as a home purchase. You can also use a high-yield savings account to diversify your investments.

130. HDHP (High Deductible Health Plan)

A high-deductible health plan(HDHP) is a type of health insurance where you pay a higher deductible in exchange for a lower monthly premium. The deductible is the amount you must pay for a covered expense before the insurance company starts paying. With an HDHP, your out-of-pocket cost is higher than regular insurance. Having an HDPH allows you to open a Health Saving Account(HSA) to save for healthcare expenses and lower your tax liabilities.

I

131. Impulse purchase

An impulse purchase is when you decide to buy something without planning or considering how purchasing the item will affect your financial situation. Impulse purchases are some of the leading causes of money mismanagement, inability to stick to budgets, and financial hardships among consumers.

132. Interest rate

The interest rate estimates how expensive it is to borrow money from a lender or how much you can earn if you invest your money with an institution that pays it. For example, if you get a 30-year fixed-rate mortgage at 5%, you will pay a fixed interest of 5% every year for 30 years on top of paying the principal.

When investing, the interest rate becomes the money you get paid, estimated as the yearly percentage of the principal. For example, investing $10,000 in bonds at 5% means the bond issuer will pay you 5% yearly until maturity. In simple terms, the interest is what you pay when borrowing or earn when investing.

133. Income

Income refers to the money you earn as compensation for your labor or service. For example, working in a company for a year can earn you $60,000. This money represents the value you provided to the company for a year. People who give more value to the company earn a higher income than those who don’t.

134. Income tax

An income tax is a tax that people and businesses pay to the government. States and the federal government use income taxes to finance public infrastructures such as schools, hospitals, and roads and fund wars. Tax brackets ranging from 10% to 37% determine your tax liabilities based on your income and filing status.

135. Individual retirement account (IRA)

An individual retirement account, or IRA, is a popular retirement savings account with tax benefits that you can open from a bank or a brokerage firm. There are two types of IRAs: the Roth IRA and the Traditional IRA. For the Roth IRA, you make contributions with after-tax money, grow the account free of tax, and pay no taxes on qualified distributions during retirement.

For the Traditional IRA, on the other hand, your contributions can be tax deductible; you grow the account on a tax-deferred basis and pay applicable tax during retirement. Both IRAs have the same contribution limits, and for 2024, you can contribute a maximum of $7,000 or $8,000 if you are 50 or older.

Learn more: 6 steps to open a Roth IRA

136. Inflation

Inflation is the loss of a currency’s purchasing power reflected by the rise of goods and services over time. Higher inflation lowers a currency’s purchasing power, weakens economies, increases the cost of living, and erodes prices of goods and services. When inflation does not stop going higher, the country’s currency becomes worthless, and the economy fails. The federal government maintains inflation low by influencing interest rates.

137. Inactivity fee

An inactivity fee is a charge a financial institution applies to your account when it has been a long time without account activities. This term also refers to dormant fees and helps financial institutions cover the cost of maintaining dormant accounts. Inactivity fees can apply to several accounts, including brokerage accounts, savings accounts, and checking accounts.

138. Insurance

Insurance is a contract between you and an insurance company to protect your property, assets, or investments against potential losses related to specific events. For example, car insurance can cover you when you get into a car accident. A homeowner’s insurance can protect your home against fire and natural disasters.

139. Investing

Investing refers to increasing your money by offering services, buying assets, or holding investments in expectation of a return. Common investment types include real estate, stock market, bonds, foreign equities, land, and precious metals. Your investment choices depend on your risk tolerance, what you want to gain, and your time horizon.

140. Index Fund

An index fund is a mutual fund or an exchange-traded fund(ETF) that tracks a specific index. Index fund managers buy shares of all publicly traded companies within the index. For example, an index fund that tracks the S&P 500 holds shares of all 500 companies in the S&P 500. Index funds are excellent investment choices because they are well-diversified and carry less risk than individual stocks. You can buy index funds from a brokerage company just like you do for stocks, mutual funds, or ETFs.

141. Income statement /profit and loss(P&L) statement

In business, an income statement is a financial report that shows a company’s earnings and expenses over a given time, such as a year. These reports can also be prepared monthly, quarterly, or every six months. An income statement shows whether a company made a profit or lost money during a specific period. The formula for calculating the income statement is simple.

Net income = Revenues-expenses.

The company would have lost money if the net income was negative, and vice versa. The company calculates net income using a three-step strategy.

- First step: The company calculates the gross profit by subtracting the cost of goods sold from the total revenues.

- Second step: Use the gross income to calculate the operating income by subtracting the operating expenses from the gross income.

- Third step: The company calculates the net income by subtracting non-operating expenses from the operating income.

J

142. Job Opportunity

You probably heard people say, “There are no job opportunities” in developing countries or within a company. ” Job opportunity” refers to one’s chance to secure employment in a given area or career advancement within a company. A lack of job opportunities leads to a high unemployment rate, which can easily lead to chaos and the collapse of an economy.

143. Jobs

I think you know what a job is, but I will define it for the sake of this list of the most used personal finance words. A job means an occupation in a particular industry. Some jobs can be completed online, while others can’t. For example, freelance jobs such as proofreading can be completed entirely online. But, if you work as an assembler in a manufacturing plant, you must complete your job in person.

144. Online jobs

Online jobs are types of jobs you can complete entirely over the internet. Most people who have online jobs work from home. However, you can also work from anywhere, with access to the internet, such as in a coffee shop or library.

L

145. Liability

Liability is one of the most critical personal finance terms you must know as a consumer. In simple terms, liability represents anything of value, such as money, goods, and services that a business owes. In personal finances, liability represents anything that costs you money or simply what you owe. For example, if you owe the bank $200,000, this amount is your liability since you have to pay it back. Liability comes in handy when you are calculating your net worth. Net worth = asset-liabilities. The more assets you have, the more financially stable you become.

146. Liquidity

Liquidity refers to a company’s ability to convert its assets into cash or acquire loans to cover its short-term liabilities. In personal finance, liquidity refers to the amount of money you have or the ability to convert some of your assets to cover your short-term financial needs.

For example, if you have money in a high-yield savings account and want to pay for a major car repair, how fast can you convert the money into cash to make the payment? This process will be faster as you must transfer money from your savings account to a checking account to pay for the car repair. What if you have investments such as stocks and need to pay for the car repair? In this case, you need to sell your stocks, and if it is on weekends, you have to wait until Monday to sell the stocks. Then, wait 3 to 4 business days before the money can settle in the account. Then, transfer it to your checking account, which will take a few more days before you can pay for a car repair.

Based on these two examples, the money in your savings account is more liquid than the money you hold in stocks, as it will take longer to convert your investments into cash.

147. Lender

A lender is an individual or a company that provides a loan to cover expensive purchases such as a home or car or fund school in exchange for interest and paying back the principal. Examples of lenders include banks, credit unions, online loan companies, or individual lenders.

148. Loan

A loan is a sum of money you take from a lending institution such as a bank, credit union, or online lending company to cover expensive items such as a home purchase, medical bill, a car purchase, etc. Each loan comes with a contract that states the terms of the loan. As a borrower, you must repay the loan balance with interest in a specified time frame.

149. Long-term goals

Long-term goals are objectives you want to achieve in the future, usually in years. Setting up long-term goals is essential as they help shape your mental focus and bring stability to your life, decision-making, career choice, and life path you take with your life. Common long-term goals include retirement savings, buying a house, travel goals, starting a business, getting a promotion, paying off debt, investing, returning to school, etc.

M

150. Maturity date

The maturity date is when all interest and principal are paid to the lender, ending the relationship between a borrower and a lender. Maturity dates apply to many financial products, such as mortgages, loans, bonds, and CDs.

For CDs, the maturity date is when the bank or credit union pays you the last interest and returns the original investment. After the maturity date, the CD does not earn interest, and the terms of the CD no longer apply.

For bonds, the maturity date is when the bond issuer pays you the last interest, and you receive the face value. After this date, the bond no longer earns interest.

For loans, the maturity date is when you make a final payment and fully pay all interest and principal to the lender. After this payment, all loan terms end, and the lender can no longer claim your asset.

151. Medicaid

Medicaid is a public health insurance that covers people with limited incomes or those with different needs, such as people with disabilities, pregnant women, and children. States and the federal government work together to implement this system, and the type of services and requirements vary by state. If you are enrolled in Medicaid, your healthcare services are funded by the federal, state, or municipality.

152. Money market account (MMA)

A money market account, or MMA for short, is a deposit account you open from a bank or credit union that earns you higher interest than a traditional savings account while giving you access to your funds. MMAs combine the features of a traditional savings account and a checking account, making them ideal places to save money for future goals. While you could earn a higher APY if you put money in a CD, CDs lock your money in an account until maturity.

153. Money order

A money order is a paper like a check used to make payments or transfer money. The money printed on the face of the money order is usually paid in advance using cash or other means of payment. Many businesses, such as landlords, accept money orders for rent payments. You can buy money from companies that offer money services, like grocery chains.

154. Mutual fund

A mutual fund is a company that pools money from different investors and invests it in several investments, including stocks, bonds, real estate, and short-term debt. Mutual funds are usually managed by a professional manager who oversees the portfolio. As an investor, you can buy shares of a mutual fund just like a regular stock from a brokerage company.

155. Mobile baking

Mobile banking refers to completing banking transactions on your mobile phone. Activities can include making check deposits, moving money from checking to savings, or transferring money to another bank or internationally.

156. Mortgage

A mortgage is a loan offered by banks, credit unions, and similar companies to buy a house in exchange for paying interest and repaying the entire loan balance at a predetermined time. Mortgages usually come with a fixed or variable interest rate. Common mortgage terms include 15-year and 30-year fixed-rate mortgages.

N

157. Net income

If you look at your paycheck, you will notice that your gross income is higher than your net income. This is because different deductions, such as tax, retirement contributions, and insurance premiums, get taken out of your gross income before you are paid. Your net income or take home is the amount you take home after all deductions and taxes are removed from your gross income.

158. Net proceeds

Net proceeds are the amount left after subtracting all expenses and costs related to the sale of a product. In real estate, for example, the net proceeds are the money you receive after paying closing costs and commissions associated with a real estate sale.

159. Net worth

Net worth represents the difference between what you own and what you owe. In order words, net worth is calculated by subtracting your total liability from your assets. As a consumer, you must accumulate more assets than liabilities to increase your net worth.

160. Non-fungible tokens (NFTs)

An NFT is a token based on blockchain that represents a specific asset, such as art or similar digital content like media. It is an absolute digital certificate of ownership of a digital or physical asset, such as art, tokenized via blockchain.

161. NCUA(National Credit Union Administration)

The National Credit Union Administration(NCUA) is a government-backed insurance agency that provides insurance for credit unions to cover depositors in case the insured credit union goes out of business. NCUA operates the same way as the Federal Deposit Insurance Corporation(FDIC), which insures consumer deposits from banks covered by the FDIC. The NCUA insures your credit union deposit up to $250,000 per depositor, per credit union, and account category.

O

162. Online banking

Online banking is a way of banking where you access your accounts and conduct different transactions such as depositing money, money transfers, and investing using the Internet. Other banking services available through online banking include checking your account balances, paying your bills, and updating your account information.

163. Opportunity cost

Opportunity cost is one of the most essential personal finance terms that governs the daily decisions of individuals and businesses alike. In simple terms, opportunity cost represents the value of an option not taken when making a specific decision. For example, if you have decided to buy a single-family property instead of a duplex, the opportunity cost would be the rent you will not collect due to not purchasing a duplex.

164. Out-of-pocket cost

Out-of-pocket costs are costs that are not covered by your insurance plan. Examples include coinsurance, copayments, non-covered services, and deductibles.

165. Overdraft fee

When you make a transaction without having enough cash to cover the transaction, your bank account goes below zero. When this happens, your bank lends you the difference and charges you an overdraft fee. An overdraft fee is a fee a banking institution charges you when you make a transaction without having enough funds in the account, resulting in a negative balance. Usually, the bank lends you the difference you must pay back with an overdraft fee. Most banks charge between $25 and $50 in overdraft fees.

166. Open-loop prepaid card

An open-looking prepaid card is a card that can be used anywhere where they accept that card or brand. To know if your card is open-loop, check if it displays a network logo, such as Discover, MasterCard, American Express, or Visa. You can get an open-loop card from banks, financial institutions, etc. Open-look cards are the opposite of closed-look cards, which can only be used for a specific business, such as a grocery store, gas station, or online shopping site. An excellent example of closed-loop cards is gift cards.

167. Operating income

Operating income is the company’s profit after subtracting operating costs from its gross income. It is also known as earnings before interest and taxes (EBIT) or operating profit.

P

168. Pay period

The pay period represents how long you have to work before you get paid for that period. Most pay periods are weekly, bi-weekly, semi-monthly, or monthly. For example, if your company has a bi-weekly pay period, you must work for two weeks before receiving a paycheck. Payroll might be delayed a week or two as your hours have to be submitted, processed, and a paycheck generated. Pay periods are usually decided by an employer and are fixed and periodic for all employees within the company.

169. Paycheck to paycheck

Paycheck to paycheck means you have no savings or money left after paying your expenses. In other words, the paycheck is good enough to cover all their monthly living expenses but not big enough to save or invest. When you live paycheck to paycheck, you risk losing everything if an expensive emergency such as a medical bill, a car repair, or a job loss happens.

170. Poverty

Poverty means having limited financial means and resources to have a flourishing condition of life. The absence of financial means leads to deprived lives without adequate food, shelter, medicine, clothing, and water. Anybody, including individuals, government, households, or communities, can experience poverty. For example, third-world countries are poor for many reasons, including low production rates, inadequate labor market, lack of education, poor infrastructure, corruption, political instabilities, weaponized debts, etc.

171. Payroll tax

Payroll taxes are taxes an employer and employees pay on employees’ salaries, wages, and bonuses. They include state, federal, and FICA taxes, which finance Social Security and Medicare.

172. Phishing scam

Phishing scams are online scams where the scammer sends you a test, chat, or email to obtain your personal information. These scams are intended to steal your money or identity when you reveal your passwords, bank account details, credit card information, etc.

173. Paper check

Until recently, when electronic payment gained momentum, paper checks were a big thing. A paper check is a form of payment that draws money directly from your checking account and puts it into the account where it is deposited. The person issuing a check(payer) writes down essential details such as the amount paid and the payee and signs the check. Paper checks are still in use but are slowly losing ground due to the rise of debit cards, credit cards, and other forms of payment.

174. Policy

A policy is a legal contract between you and an insurance company that details the level of coverage in case of a loss. The policy details the insurance company’s responsibility and what you must do in case of a loss. For example, many auto policies specify the level of coverage and require you to contact your agency immediately after you get into a car accident.

175. Policyholder

A policyholder is a person who purchases and owns an insurance policy. This means the policy will protect you under the terms detailed in the policy. You can add more people to the policy, such as loved ones, if you wish to do so.

176. Prepaid card

Prepaid cards, also known as prepaid debit cards, are payment cards that are not linked to any bank or credit union. To use the card, money is pre-loaded to the card from the bank, and you cannot spend more than what is loaded on the card. For example, a $50 prepaid debit card means the maximum you can spend on the card is $50. You can use a prepaid card to make purchases, pay bills, or withdraw cash from an ATM if the card is accepted at the ATM and its issuer allows ATM transactions.

177. Premium

Premiums are the policyholder’s regular payments to the insurance company to keep protection in force. They can be paid monthly, quarterly, every six months, etc. For example, if you have car insurance, your premiums will be your monthly payments. If you fail to pay your premiums, the insurance company may cancel the policy, and you will lose protection.

178. Principal

The term principal is regularly used in the investing and loan industry. The principal is the initial amount you invested or borrowed before interest, losses, and gains are considered. For example, if you purchase a $300,000 house and put down $60,000, your principal will be $240,000 since it is the total amount you are borrowing. This amount must be paid together with interest. Or if you purchased a $10,000 CD, this amount is your principal, and it must be returned to you by the bank when your CD matures.

179. Profit

Profit refers to the amount you gain when you sell something for more than you bought it for. For example, if you purchased ten shares of XYZ company stock for $20 each and later sold them for $24 each, your profit would be $40.

180. Promotion

You get promoted when you move to a higher position in the same company. After being promoted, you have more responsibility, are paid more money, and are respected more. Some strategies to get promoted faster include demonstrating leadership, investing in your development, increasing your value in the company, building connections, and being a positive influence. Getting a higher education or certification can also help you get promoted faster.

181. Private mortgage insurance(PMI)

Private mortgage insurance, or PMI for short, is a type of insurance you might be required to purchase when buying a house if you don’t have a 20% down payment for a conventional loan. Most lenders cancel the MPI after building more than 20% equity in your house.

182. Property tax

Being a homeowner comes with the responsibility of paying property tax. Property tax is a tax imposed on your property by the state that helps fund various projects, including schools, hospitals, roads, libraries, fire and police departments, etc. Property tax usually includes local and state taxes, where local tax funds local services, while state property tax is used to maintain public schools and infrastructure.

R

183. Rate of return

Your rate of return is the amount you gain or lose from your investment over time, such as a year, expressed as a percentage.

184. Raise

Also known as a pay raise, it is the amount you get paid on top of your regular compensation to increase your earnings. Raises can be a percentage of your pay, like 3% of your existing income, or a flat amount, such as $4,000 per year. Employers use different factors to determine employees’ raises, including performance, years of service, company performance, and cost of living.

185. Return on investment(ROI)

When investing, you can either make money or lose it. Calculating your return on investment (ROI) can help you understand how well you are doing. ROI is a profitability metric that enables you to compare your gains or losses with the cost of investments. To calculate your ROI, divide your net gain or loss by the cost of investments and then multiply the result by 100 to express the ratio as a percentage. For example, if you purchased a share of XYZ stock for $10 and sold it for $5, your ROI will be -50%. Meaning you lost $50% of your original investment.

186. RMD(Required Minimum Distributions)

Requirement minimum distributions(RMDs) are the minimum amounts you must withdraw from certain retirement accounts every year when you reach a certain age. Some of the retirement saving plans that require RMDs include employer-sponsored plans like pre-tax 401(k)s, 403(b), and 457(b)s, SIMPLE IRAs, SEP, etc. For 2024, RMDs are required when you turn 73 years old.

187. Rebate

A rebate is a partial refund of the cost of an item or service you receive when you purchase it. Many businesses offer rebates as incentives to encourage customers to do business with them.

188. Retirement savings

Retirement saving refers to putting a small amount aside to be spent during retirement. Many retirement savings accounts, including employer-sponsored plans like a 401(k) plan or Individual retirement accounts(IRAs), can help you save for retirement.

189. Risk management