Saving for retirement is one of the most important financial decisions you will make as it secures a comfortable retirement. No matter your age, education, or income level, it is essential to start saving for retirement as soon as possible if you have not started yet. Even if you live on a low income and have a tight budget, you can still boost retirement savings with these ten practical retirement savings tips I will show you.

Whether you want to start saving for retirement or boost your retirement savings, you have come to the right place. In this article, I will give you ten practical tips to save for retirement to help you grow your nest egg fast.

Do not ignore compound interest.

The best time to start saving for retirement was yesterday. The next best time is today. Waiting any longer prevents you from building generational wealth and reaching financial independence. Compounding interest makes all the difference when saving for retirement and investing your hard-earned wages for the future.

Compound interest is the ultimate secret of retirement savings and growing wealth. However, you must start early to take full advantage of compounding interest. Every dollar you allocate toward retirement savings gets compounded and helps you grow your savings faster.

The secret to retirement savings is not about how much you save. Instead, it is about how early you can start, the expected return on investment from your savings, and the tax benefits you get. That is why, to boost your retirement savings, you need to focus on investment vehicles that generate more cash flow and reduce your tax liability at the same time.

If you are ready to take your retirement savings to the next level, here are the ten practical tips to boost your retirement savings.

1. Know your retirement savings goals

The first and most crucial tip to save for retirement is to know how much you need to retire. This will allow you to break down your retirement savings strategies and allocate funds to investment securities that meet your specific retirement saving goals.

The amount you need to retire will depend on the lifestyle you will have and your life expectancy. Additionally, you must know the age at which you want to retire. For example, a person planning to retire at 60 will need more savings than someone planning to retire at 75. This is because early retirement equates to more years without working. Hence, it requires more savings and more passive income.

The most popular retirement withdrawal formula is the rule of 4%. This rule suggests you can withdraw 4% of your retirement savings every year and live comfortably for 30 years. For example, if you have saved $1,200,000 toward retirement and withdraw 4%($48,000) yearly, you can fund 30 years in retirement adjusted to inflation.

This formula does not include retirement earnings such as passive income from other sources such as capital gains, rental income, interest payment, and loyalty.

Related: How much do I need to retire: Save for retirement

2. Start now

Some people confuse retirement savings and investing. Saving for retirement is completely different from investing, but both follow the same principles.

Investing is an essential step to grow your retirement savings accounts. Also, you must open a retirement savings account early enough and start making contributions. When you start early, you get to invest your money and take full advantage of compounding interest. Compound interest allows you to earn interest on earnings and principal simultaneously.

By reinvesting your earnings over some time, your portfolio grows exponentially.

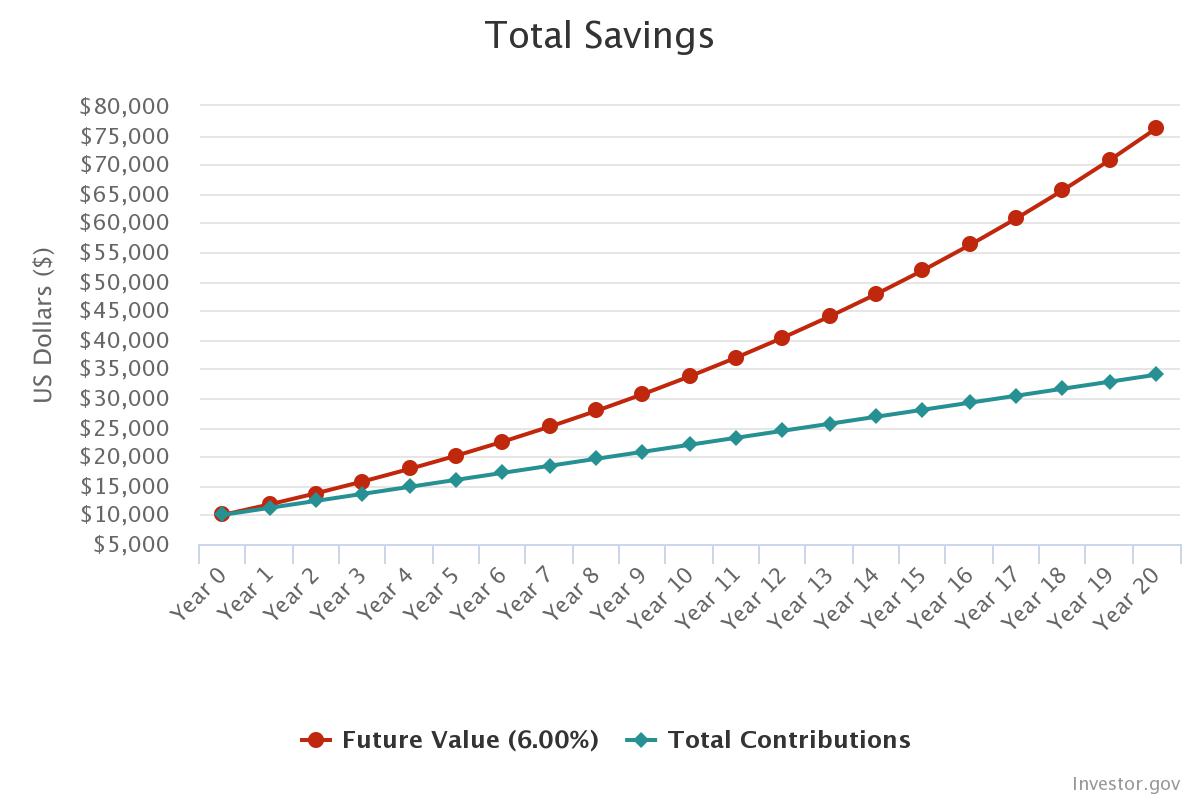

Look at the following hypothetical example of the effect of compounding interest on your retirement savings.

Example of compounding interest on your retirement savings account

Let’s assume you started saving for retirement when you were 45, with an initial savings of $10,000. In addition, you contributed $100 every month. That is $50 per paycheck or every two weeks for a bi-weekly pay period. We can also assume a 6% return on investment(ROI), and all earnings are reinvested. How much will you have in your retirement savings account at 65? Let’s see how compounding interest will boost your retirement savings in only 20 years.

After 20 years, your retirement savings account will reflect the following numbers.

- Total contribution = $34,000

- Total portfolio value = $76,214.06

This is more than $42,000 in profit. Your profit is more than your total contributions. That is how compound interest works.

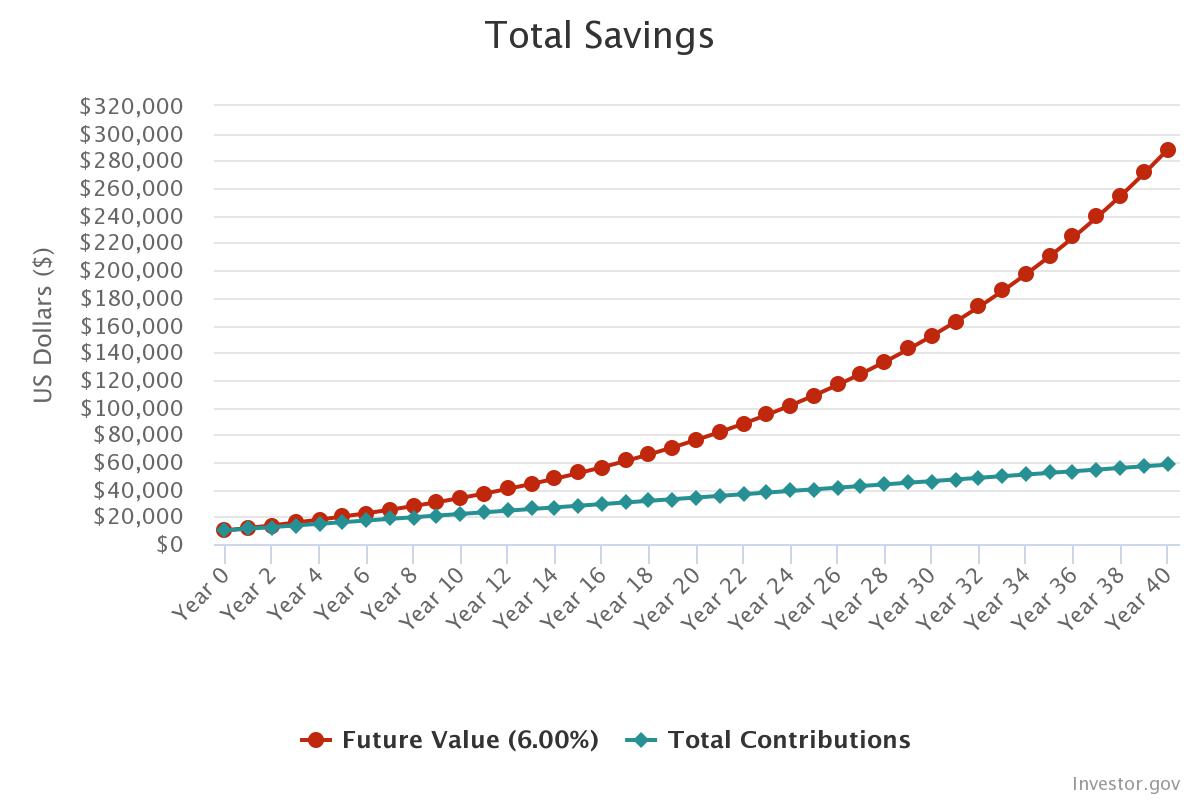

What if you started saving when you were 25 instead of 45? That is a 20-year difference. What will your retirement account look like when you turn 65?

You can see that by starting early, the compounding effect boosts your retirement savings higher than when you started late. When you start saving for retirement at 25, your account value reflects the following numbers by the time you turn 65.

- Total contribution = $58,000

- Total account value = $288,571.54

There is a huge difference between both retirement accounts. You can see that compound interest is more effective when you start saving for retirement early.

The secret to saving for retirement is not how much you save. Instead, how long you stay invested allows compound interest to work.

When should you start saving for retirement? The answer is now if you did not start yesterday.

3. Take advantage of your employer-sponsored retirement plans

One of the best ways to boost your retirement savings is to contribute to employer-sponsored plans such as pre-tax 401(k) plans. For example, if your employer offers a pre-tax 401(k) and you are eligible, start contributing to the plan immediately.

Any amount you contribute to your pre-tax 401(k) will come from your before-tax wages. This plan gives you upfront tax benefits, allowing you to grow your retirement savings on a tax-deferred basis and only pay income tax when you withdraw the money during retirement.

For 2024, you can contribute up to $23,000 or $30,500 if you are 50 or older. So, if you are in a higher tax bracket, contributions to your pre-tax 401(k) plan might put you in a lower tax bracket.

4. Take advantage of the employer match

One of the best tips to boost your retirement savings is to take advantage of your employer’s match to the plan. Some employers match employees’ contributions up to a certain percentage. Any employer match to your account is free money; therefore, you should not leave it on the table. If you cannot afford to max out your 401(k) plan, at least contribute up to your employer match percentage.

For example, if your employer matches your contributions up to 6% of your gross income, you must allocate at least 6% toward your 401(k) plan. It is free money, so take it. 6% of your gross income will automatically boost your retirement savings very fast without doing extra work.

5. Open an individual retirement account (IRA)

Whether you have a 401(k) plan with your current employer, you should always have an individual treatment account (IRA). This account allows you to save extra money toward retirement with added tax incentives.

You can either open a traditional IRA or a Roth IRA. Contributions to your Roth IRA will come from your after-tax wages. However, you will grow your account tax-free, and qualified distributions will not be taxed during retirement. Any money you contribute to your traditional IRA, on the other hand, may be tax-deductible. It will all depend on your filing status and traditional IRA income limits.

Are you not sure if your traditional IRA will be tax-deductible in 2024? Check out this guide to Traditional IRA income phase-out ranges to check your eligibility for tax deduction in 2024.

The contribution limits to an IRA in 2024 are $7,000 or $8,000 if you are 50 or older. Opening an IRA will be a smart move if you are looking for flexible ways to increase retirement savings fast. Do you have an IRA with a different institution that you want to transfer or roll over to Fidelity? Check out this guide on Rolling over a traditional IRA to a Fidelity traditional IRA.

Related articles:

- Opening a spousal IRA in 9 simple steps

- Opening a Roth IRA in 6 simple steps

- Custodial IRA: Can a minor open a Roth IRA?

6. Take advantage of catch-up contributions

Many people make the big mistake of assuming that they have a lot of time. So, they delay saving for retirement and choose to make inadequate contributions, preventing them from taking full advantage of all retirement savings benefits they qualify for. If you are one of the people who started a little late, the IRS has catch-up contributions for people who are 50 and older.

Most retirement plans come with catch-up contributions. Here are catch-up contributions to popular retirement accounts.

- Roth 401(k) and traditional 401(k) catch-up contribution for 2024 is $7,500

- SIMPLE IRA and SIMPLE 401(k) catch-up contribution for 2024 is $3,000

- Traditional IRA and Roth IRA cath-up contribution for 2024 is $1,000

- HSA catch-up contribution is $1,000 in 2024

You can quickly boost your retirement savings by taking advantage of these catch-up contributions. The more you contribute to retirement accounts, the faster you increase your savings and the more tax benefits you get.

You might also like 6 Roth 401(k) benefits you did not know about

7. Take advantage of your Health Savings Account(HSA)

A Health Savings Account(HSA) is a savings account that allows you to save a portion of your pre-tax wages for medical-related expenses. If you plan well, however, an HSA can also be used as a retirement savings account similar to a Traditional IRA and Roth IRA.

The HSA is part of some companies’ medical benefits packages. To qualify for an HSA, you must be enrolled in a High Deductible Health Plan(HDHP).

If you have an HDHP with your employer, you can contribute to your HSA up to the maximum allowed. For 2024, you can contribute up to $4,150 for self-only and $8,300 for families to your HSA.

Why is it important to contribute to your HSA account?

While the money in your HSA can only be used for qualified medical-related expenses, the HSA can also be used as a retirement savings account.

You can invest the money in your account once you reach the investment threshold established in your HSA. This strategy allows you to grow your account on a tax-deferred basis. You will have the option to choose automatic or manual investments. By default, your HSA will not come with investment options. So, before investing the money in your HSA, you must enroll in the HSA investment option.

Yes, the money you contribute to an HSA is designed for medical-related expenses. However, if you don’t spend all that money, you can invest and withdraw it for any expenses of your choice without a penalty once you reach 65. You will pay income tax when your withdrawals from HSA are not used for qualified medical expenses. According to the Michigan Civil Service Commission, a 20% penalty will also apply if you are under 65.

8. Reduce your expenses

If you are finding it difficult to boost your retirement savings, it is more likely that your current lifestyle does not allow you to save. In other words, you are living above your means.

Reducing your expenses can easily help you boost your retirement savings account, as the money you don’t spend can be used to increase your savings rate. An effective way to reduce your expenses is to establish a budget. Look at all your monthly expenses and eliminate some of your wants, such as expensive movie subscriptions, daily shopping, designer clothes, etc.

You might also need to change your financial habits, such as eating out daily, gambling, smoking, drinking, or buying brand-name products. If you are new to budgeting, try the 50-30-20 budget rule to save extra cash.

Every dollar you save in this process can help you increase your retirement savings.

Related: 9 things you must do before you create a personal budget

9. Avoid questionable debts

Millions of people make the most common financial mistake of accumulating too much debt. Debt is not bad if you use it correctly. However, if you borrow money to go shopping, then you are playing with fire.

According to Shiftprocessing, 80% of Americans have consumer debt. Among the top debt per household, mortgage debts come on top with $189,586 on average, followed by student loans at $46,822, car loans at $27,804, personal loans at $10,000, and credit card debts at $5,135 on average.

If you cannot save for retirement due to debt, paying off some of your debts will be one of the best tips. Start with high-interest debts such as credit cards and personal loans, as knocking these loans off saves you money in interest charges. If you have not accumulated too much debt already, avoid questionable debts.

You must avoid questionable debts such as consumer debts and personal loans to boost your retirement savings. These debts do not help you achieve anything that brings you value or financial stability. In addition, they come with relatively higher annual percentage rates (APRs) compared to regular loans such as mortgages.

Debt prevents you from contributing more money toward retirement, as every dollar you make is spent to pay off credit card debts, car loans, mortgages, student loans, etc. You can’t get ahead financially if everything you make goes directly to the lender.

Rule of thumb: Do not borrow if you don’t have to, and never borrow more than you can afford to pay off. If you cannot buy something with cash, do not borrow to buy it. It simply means that you cannot afford it.

10. Automate your savings

The final tip to boost retirement savings is to automate your savings. We live in a busy world with many moving parts. Sometimes, we think that everything is under control, but the opposite is true.

Sometimes, you will forget to submit your monthly contributions or forget that those accounts exist in the first place. When this happens, you will find it difficult to reach your retirement savings goals.

Automate your retirement savings to avoid missing a contribution. Decide how much you want to put in each retirement account every month or every pay period, and let technology take care of the rest.

If you choose to automate your savings, ensure you have enough funds in the bank account where the money will come from. You don’t want to pay overdraft fees for no reason.