Why should you save money and where can you cut your expenses? Saving money is the first step toward your financial freedom. It requires cutting back on some of the things you buy. Sometimes, it requires you to end some of your habits to be a successful money saver. But, where do you start? Do you know what things you can stop buying to save money?

According to CNBC (Make it), more than 21% of Americans do not save any of their annual income. This number is shocking. If you are among those who do not save or having trouble saving, this article was written specifically for you. It is a time you take control of your finances and start working on your financial independence.

In this article, I put together a list of 44 things you should stop buying to help you save money and increase your wealth.

Without further ado, let’s get started.

1. Brand name products

The world we live in can sometimes be confusing. Each company brands itself as the best in the industry. They say their products are the best in the world. However, results from their products are similar or worse than their competitors.

Brand products range from medication, food, drinks, clothes, etc. If you buy brand-name products very often, you are losing money that could be saved.

Do you want to keep paying top dollars just because you like the brand? You could save a lot of money by doing one thing: Stop buying brand-name products. Instead, buy generic products.

Generic products are much cheaper and offer superb performances. You can save the difference between the price you pay on brand-name products and generic ones. This way, your problems will be solved and you will save money at the same time.

More saving tips: 18 habits of frugal people: How do frugal people live?

2. Save money: Do not buy packaged water

Yes, you lose money when you buy packaged water. How? The price you pay for that water includes the cost of the plastic bottle and every penny spent on it from drilling the well, packaging it, and transportation to your grocery store, etc.

How can you save all that money? Stop buying packaged water. You can drink water in your house that you are paying for.

Reusable bottles can also help you save money on water. You just need to refill the bottle as many times as you can. This way, you will be saving money on water, bottles, and protecting our environment.

Do you want filtered water? You can buy a water filter to use at home if you don’t trust the water in your house. Water filters are not expensive and they are a long-term investment.

Extra tip: Struggling with debt? This is why people struggle with debt

3. Save money: Avoid take out coffee

Do you like coffee? Me too. However, there is probably one difference between you and me. I never buy coffee from coffee shops. I make it at home. If you buy one cup of coffee every day for $3, you would spend over $1000 a year for just coffee. That is a lot of money.

To save some of this money, you can buy your own coffee maker and coffee grains or grind coffee. This way, you can probably spend 5% of that money on coffee. Where will the rest go? You will put it into your savings account.

Like this one? 33 ways to save money while traveling

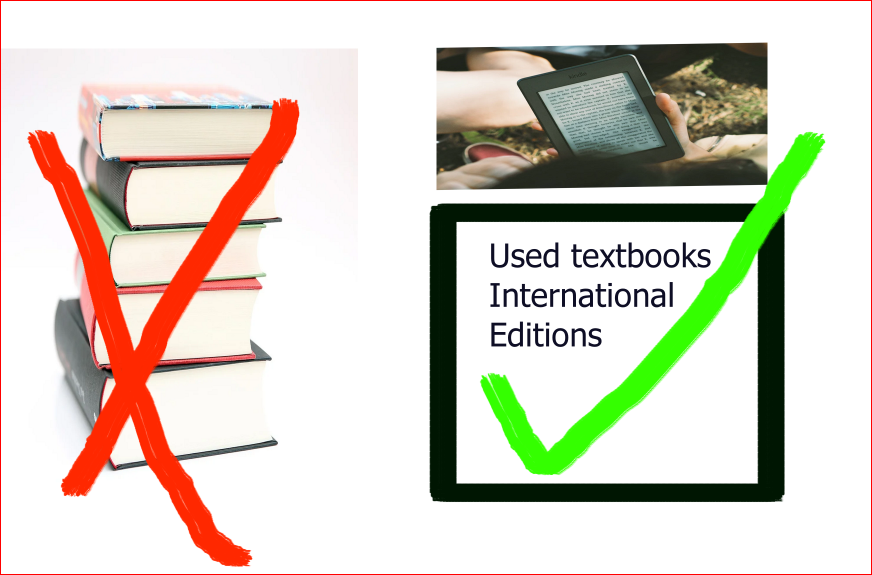

4. Latest edition textbooks and textbooks in general

All of you students out there might be wondering, how will I go to school without books then? To be honest with you, there is no big difference between the current edition you are using for your school and the previous edition.

Do you know what is different? The number of exercises at the end of each chapter and the order in which they are written. There may be a little bit of difference in the text content, but not that much. To save money, you can find PDF versions for most books online or ebooks that could possibly cost less money than the actual book.

If you need an actual book, you can buy international editions of your textbook. These books are cheaper and the contents are the same. They can cost as little as 10% of the regular cost of textbooks. The only problem with them is the order of exercise problems at the end of each chapter. The order might be different or they may lack a few exercises. That is it.

You can then work with your classmates to obtain all exercises and verify the numbers. If your teacher says do exercises 1-5 in chapter 2 for example, you can check with your classmates to make sure that exercises you have are the same as in their books.

You can also use older versions of the textbooks to save money and collaborate with classmates and teachers. You should stop buying new editions if you want to save money.

Related articles:

5. Facial and acne treatment products

I am not telling you to never treat yourself. However, you don’t need to buy expensive products because you saw tiny acne on your face. Yeah, we feel uncomfortable with acne on our faces but we don’t have to pay a fortune every day.

Before buying any products, ask yourself the possible cause of your acne. They could be stress-related acne or body transformation. If so, buying these products will not help. Instead, focus on how you can naturally cure your body by eating healthy and reducing stress.

There are times when you will definitely need to buy facial products. If you do, do not go by the most expensive or brand names. The cost does not determine the quality of the product.

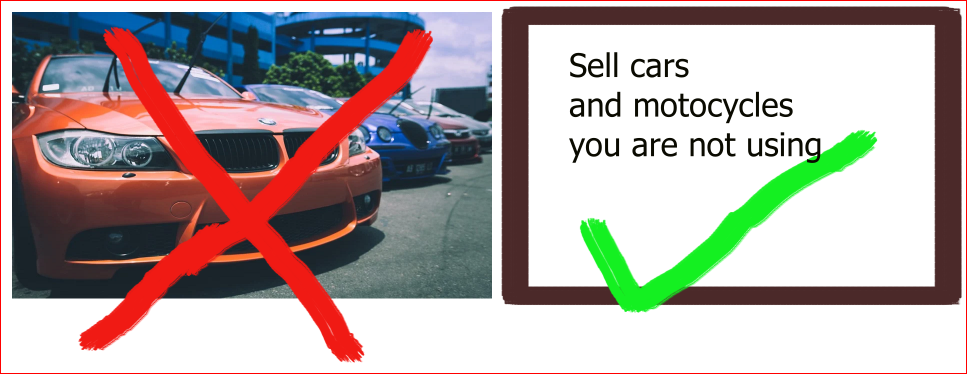

6. Save money: Do not buy cars you don’t need and their insurances

It does not make sense to be in a family of two people who are legally allowed to drive and have 4 even more cars. The extra cars are costing you money in maintenance, insurances, gas, etc. The insurance itself is a lot of money. If you are spending $70 per car on insurance, you will be spending $140 per month or $1680 per year. That is how much you will be spending on insurance alone for two extra cars you don’t need.

You can downsize on auto expenses by using only one car. Drop off and pick up each other from work. This way you can save money by not spending anything on the other cars. It requires sacrifices to save money and you are not saving if you are not feeling the pain. This could help a lot during difficult conditions like coronavirus. If you are not driving to work a lot, you could save money by not paying insurances on all cars you are not using.

Related articles:

7. Multivitamins

Why do you need multivitamins again? Oh, because you don’t have those vitamins in your body. Unless you have a condition that prohibits your body to extract them from food, you are doing a very bad job buying them. Why? Because you can get all nutrients, vitamins, and everything related to building your body from food.

If you lack vitamins and some nutrients in your body, it means you are doing the wrong thing. You are not eating right. Do you eat burgers every day? Yeah. Many people are eating junk food every day and later they say, “my doctor said my body does not have needed vitamins and ions”. This is sad.

You are lacking them because you are not eating the right food. Some of you think you can replace your meals with these chemicals. There is nothing that can replace the natural vitamins and nutrients you get from food.

Stop paying a ton of money on these chemicals. Go buy real food. Learn how to cook and make yourself the best meals packed with nutrients and vitamins your body needs.

This is the only way you will save your body and money for your financial freedom at the same time.

8. Save money by avoiding one time use products

You can save money by avoiding one-time use products. Like water bottles, disposable razors, etc. These products cost a lot of money and they make no difference in your life.

Instead of buying onetime use facial papers, you can buy cloth towels that are reusable. You can wash them and reuse them for a very long time. For water, you can buy reusable water bottles. By reducing the money you spend on these products, you will have extra money to save.

9. Pre-cut and packaged produces

Produces that are cut or packaged cost more. This is because there is extra money used on them during processing and packaging. Why would you pay top dollar on processed produce if you can pay less for better quality?

From today, save money by avoiding packaged and pre-cut produce.

10. Save money: Do not buy books to read

We all love reading books. When you spend money on a book, it is yours forever. However, if you are trying to save money, you should avoid buying books at all costs. Books can be expensive.

To save money from books, you can use your local library for every book you want to read. If the library does not have a physical copy of the book you want, they may have a digital copy.

By reading from your local library, you will avoid spending money that could be saved. You can always buy your favorite books once your financial situations are taken care of.

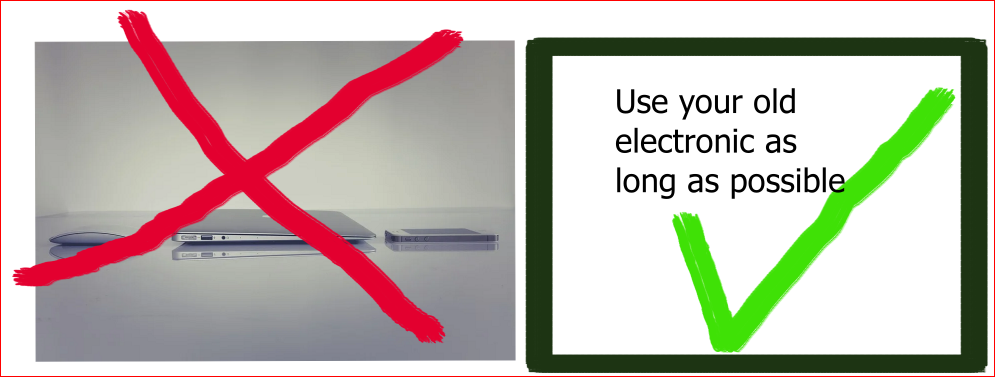

11. Buying new electronics and gadgets

Do you have an iPhone or the latest version of Samsung? Companies have found a way to attach people’s hearts and minds to their creations. Think about it. This year an iPhone is created. Next year, a new iPhone is created. What is the difference between this year and the following year? Minor stuff like how many cameras and where they are placed. Is it worth paying more than $1000?

If you go back to the evolution of the iPhone for example, you will see that there is no big difference between close versions.

Before buying the newly released version of an electronic you own, find out whether you really need that version. Why would you buy a new phone if the one you have is working well? That is just for the phone. Many people update every electronic they own. From cell phones, watches, computers, TVs, etc. If everyone in the family is doing the same thing, you can see how much money they are wasting.

To stop this madness and save money, do not buy new electronics until the ones you have are no longer working. I mean dead. Save money now so that you can leave a better life later.

Bonus: 16 Financial Habits you should start today

12. Buying alcohol in bars and restaurants

Do you know how much a beer costs in a restaurant or a bar? You can pay as much as 7$ per beer. That is the cost of a six-pack from a liquor store. You are being ripped off if you buy alcohol in bars and restaurants.

If you really want to drink and save money, do the following:

- Buy alcohol from the liquor store

- Bigger liquor stores are cheaper compared to smaller ones. Think of this as how much you pay at a gas station store and a bigger store chain like Walmart. You always pay more at a gas station.

- Drink before you go to a club and a bar

- Do not go to bars very often

You can save a lot of money by practicing the above elements. Avoid buying one beer at a cost that will pay for six beers.

13. Stop buying alcohol to save money

The money you spend on alcohol is always wasted. No matter how you see it, you are losing money on alcohol. None is telling you to never drink at all. However, you can save money if you reduce how much you drink. In addition, you can save even more money by becoming sober.

14. Eating in restaurants

Do you like having fun and quality time with your family? We all do. Instead of going to restaurants every day, try to learn a new skill. Cooking. Yeyeyeye. It is OK to not know how to cook. However, it is not OK to not want to learn how to cook.

Have you wondered why food in restaurants is expensive? The answer is:

- You are paying for the food

- The waitress get their dollar cut from you

- Cooks get their money from the money you pay

- You are paying taxes

- Oh, don’t forget the tip. Someone is looking for a tip

- The guys sitting in the office get a cut from you

- Etc

The point here is that if you are looking for ways to save money, you are not wealthy yet. Therefore, you will need to take advantage of every possible way that could help you save money. By learning how to cook, you will avoid going to restaurants every day and save money in return.

You can create beautiful memories you get from restaurants at home. Try to cook at home and get everyone involved to make it fun. You will never regret it. Nothing tastes better than a meal you made for yourself and your family.

More money tips: Difference between asset and liability: For building wealth

15. Obsessive shoppings should be stoped to save money

This is true for those who keep shopping for things they don’t need. You don’t need to buy all clothes in stores. How often do you wear all your cute and good-looking clothes? I will let you answer this question.

Saving money starts by changing your behavior. Shopping less and using resources you have already, will help you save money faster and faster. You probably need to sell some of the clothes you have to help you raise money. Do you have clothes that you have not worn for a very long time? Sell them and save the money you get from them.

16. Buying new clothes and gadgets

We talked about obsessive shoppings. However, there are times when you will need to buy clothes and that is alright. Do not buy new clothes. There are thrift stores everywhere.

The cost of clothes in these stores is a fraction of what you pay for new clothes. This will help you save a lot of money faster than you expected.

Money Tips: 15 ways to make money while traveling

17. Save money: Avoid Impulse products

Have you been to a store to buy two things and ended up buying ten times? it happens to all of us. Humans are built in a way that satisfying our desires becomes our priority. When you go to the market, impulse products create impulsive shopping desires. This is why you end up buying more products than you wanted to buy in the first place.

Making a list of what you want to buy and sticking to it will help you avoid impulse shopping. You will make sure that everything you buy is what you need.

Did you found a beautiful product that is not on the list? No problem. Do not buy it. Since it is not on your list, it is not needed.

Related: 45 Ways to save money on groceries

18. Subscriptions and more subscriptions

Social media and online services are creating a big hole in our lives. Think of them as money-sucking entities that will never stop until we are dry.

You probably have Netflix, Hulu, amazon Plus, Pandora, Spotify, etc. You pay money for each one of these streaming services. If you own one of them, it would be fine. However, the money you pay for them will add up in case you own multiple. The question you need to ask yourself is: Do you need all these subscriptions?

I know you want them but I am not sure about needing them. You can cancel one before you subscribe to the other.

You can always come back to having them in the future once your financial dilemma is dealt with.

19. Save money: Do not buy new furniture

We care about furniture every day. We think that our values and desires are satisfied when we buy beautifully looking furniture. The truth is that used home decors can achieve the same functionalities if we allow them.

Since you are interested in saving money, you should worry less about the impression your furniture will give. Save money first and worry about everything else later.

You can buy used furniture from people who are moving or get used ones at cheap prices on Craigslist, Thrift stores, Goodwill, Reservation Army, etc.

Make saving money your priority and everything else will follow.

20. Buying things because they are on sale

Did you know that you actually don’t save money when you buy an item at a 75% discount? What? It is true. When your favorite item is at a discount, you don’t save money when you buy it. You only spend less on it.

For example, let us say that you buy a jacket worth $100 at 75%. This means that you will pay $25 for it. Here is my question. Do you think that you saved $75 by buying it at $25? The answer is no.

You did not save $75 on the jacket. You only paid $25. That is, you paid less and did not save.

You must stop buying products because they are on sale to save money and achieve your wealth.

Debt tips: 11 easy ways to reduce credit card debt

21. Avoid Extended warranties to save money

Have you bought a computer or a cellphone from Best Buy or other electronic stores? You know there is a one-year warranty or more if you want to. Should you pay as much as 30% of the total cost of your product to protect it? I don’t think it is wise.

That money is like insurance. If you break it, you will get it fixed. But are you trying to break it though? What if you can protect your electronics? If you can protect it, the money you paid on warranty would have been a waste.

Instead of paying dozens of dollars on extended warranties, find a way you can safely use your product.

Save money by avoiding extended warranties.

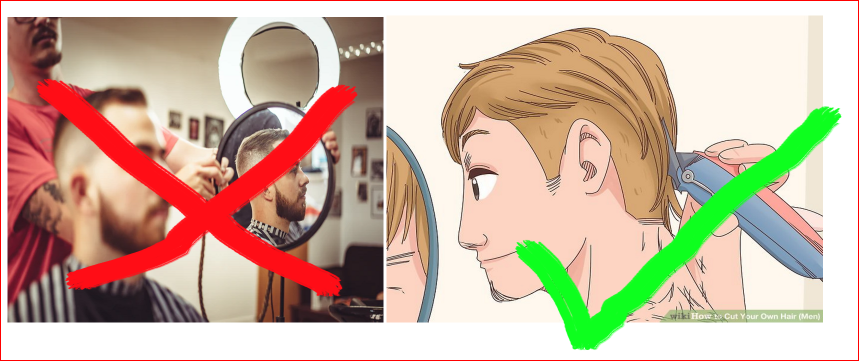

22. Paying for haircuts

Style is something many of us worry about every day. One way we ensure that our style is on point is through haircuts. Haircuts can be expensive. Depending on where you get your haircut, you could pay dozens of dollars even hundreds. If you get haircuts every week, you will pay thousands of dollars at the end of the year.

You can save money by cutting your hair or getting it at the cheapest place possible. Also, you can avoid getting a haircut very often.

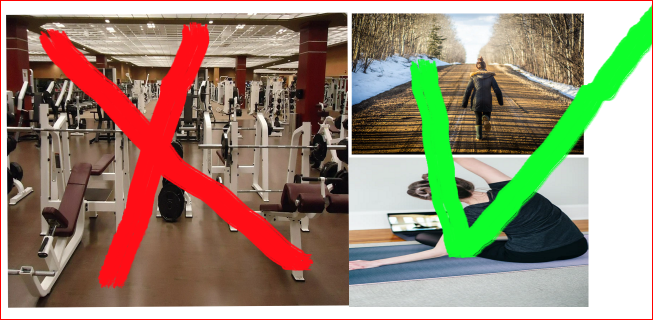

23. Fitness and gym memberships

Staying fit is very important to all of us. We are willing to go on errands to stay fit. There are many ways to stay fit and costs are different depending on the options we choose.

Getting memberships in fitness centers and recreational services is a common way for thousands of people. Is this the only way we can use to stay fit? The answer is no. $50 dollars you pay every month will add up to a big number at the end of the year.

How can you avoid these memberships and stay fit? You can run outside, work out from home, and use online free classes as a guide.

24. Never buy prepackaged and precooked food to save money

Prepackaged foods sold at grocery stores are very expensive and of low quality. They do so because of packaging material and added manpower used to make them. This is the same case for precooked food. They don’t even taste good. Even if they taste good for you, you can make your meals tastier by making them yourself.

If you are on a quest to save money, stay away from these foods. Buy unprocessed, uncooked, and unpackaged food from your grocery stores. Fresh foods are always fresh and tastier.

Making your own food will increase the quality of your life and save you money. Remember, you are also buying that packaging material that you don’t use or eat.

25. Paying for unlimited everything on your cellphone plan

It is important to stay connected with loved ones. Things can go wrong anytime and we can help only if we are able to communicate.

How much do you need to spend on your cellphone to have the reliable communication you need? It depends on your needs and your particular situations. However, we don’t need to have unlimited everything to give us the best connection possible.

Unlimited services cost more than a hundred dollars a month. This is a lot of money on just a cellphone alone. To avoid this huge expense, use limited services. This way, you can still achieve the communication necessary and save money at the same time.

It may be confusing to advocate using a credit card on expenses. It is true that you can use a credit card to save money as long as you are wise on your expenses.

You must watch what you buy and understand how your credit card will be affected by it. Learn more about what could affect your credit card and score. Some credit card providers give a 5% return on some expenses. You can use your credit card and save that 5%.

27. Never buy video games to save money

Do you like video games? Me too. To save money as a gamer, you must avoid buying video games. Video games are addictive and very expensive to buy. If you don’t watch yourself and manage your budget, you might spend every penny on games.

How can you stay in games and save money? You can play free video games while saving money. Once you become wealthy, you can buy as many video games as you want. Until then, you must stick to the plan.

Reaching success requires sacrifice even if we have to give up what we love to do every day.

Do this instead: 39 Hobbies that make money: Hobby to side hustle

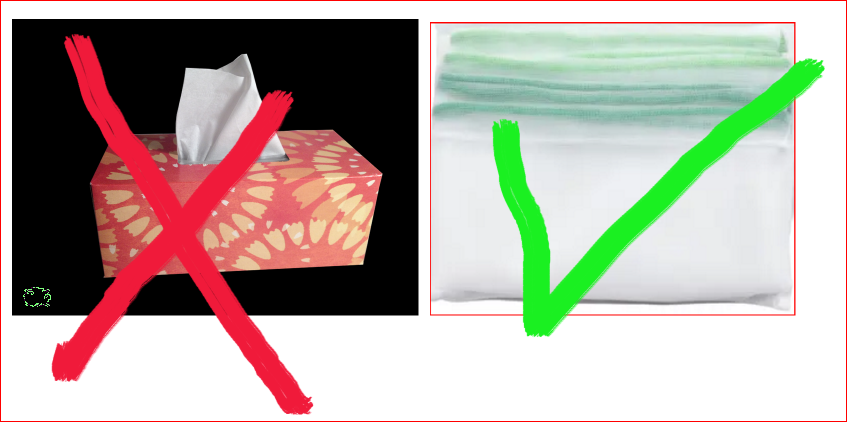

28. Paper towels and napkins

I know we all like paper towels. They make our countertops as clean as new. They help clean our mess and keep us comfortable. However, we spend a lot of money on these papers and it is hard to save once we are accustomed to having them around.

Is there anything else we can use to replace paper towels and napkins? How about cloth towels? You can pay as little as $3 dollars for a tower and you can use it for many years. Do you know how much money you have saved using this hack? A ton of money.

If you want to save money, stop using paper towels. Instead, use reusable cloth towels.

29. Avoid Junk food to save money: They are unhealthy too

Not only junk foods are bad good for you, but they also cost you a lot of money. If you bought junk food before, you know what I am talking about. One burger costs an average of 8 dollars. This is a lot of money on one meal.

How about making your own meals. This will save you money and protect your body.

You are probably unhealthy because of the junk food you eat. By cutting down the amount of junk food you eat, you will increase your health. Take charge of your personal health by avoiding junk food and save money at the same time.

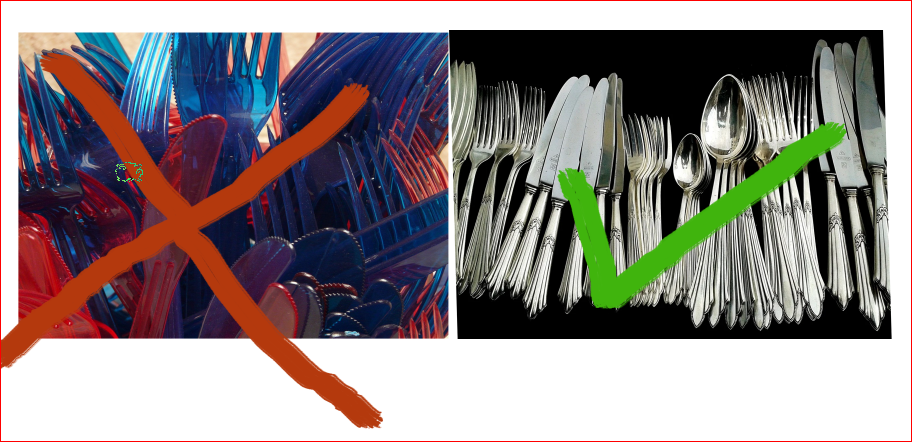

30. Disposable silverware

The plastic silverware you buy is not as good as you think. They cost you a ton of money and they are unhealthy for the environment. If you don’t like the environment, at least you can save money.

To avoid paying a lot of money on silverware, buy reusable silverware that will last longer.

You will never regret seeing your account full of saved money.

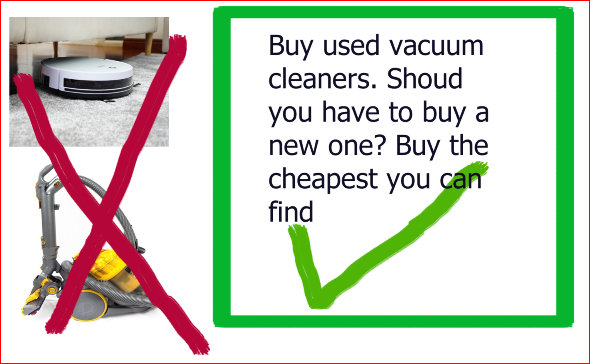

31. Avoind Brand vacuum cleaners to save money

Vacuums are a few of those products we like as they keep our apartments and houses look new. They cost a fortune though. If you buy them new, you may pay hundreds of dollars per vacuum.

How can you save money and still clean your beautiful house or apartment? Buy used vacuum cleaners. This way, you will pay a fraction of what new ones cost.

Thrift stores have fully functional vacuum cleaners and other cleaning products that cost less. By using these products, you will save money.

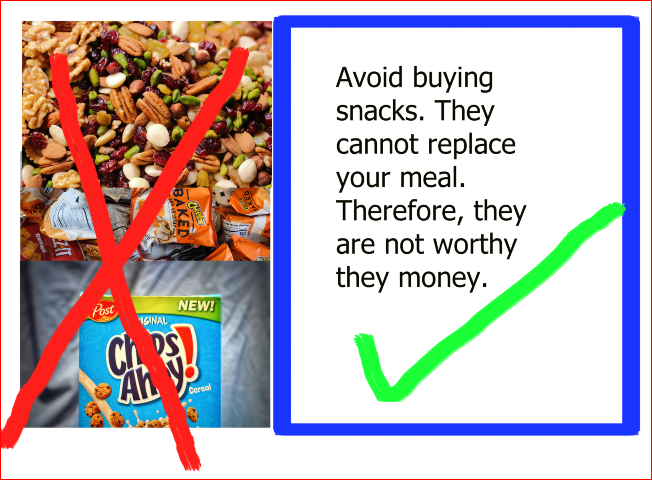

32. What about dried snacks like cheeps, nuts, etc.

I love snacks and I think you do too. However, you don’t have to pay hundreds of dollars for these processed foods. If you are saving money, processed foods must be avoided at all costs to reach your potential. A bag of chips cannot replace your lunch and they cost as much as your lunch costs. Spend that money on lunch instead.

33. Music subscriptions on streaming companies like Spotify, Pandora, etc

Music keeps us in check and helps us manage our emotions. You can watch or listen to music from many places. Some of these places are free but other ones require money. Do you have to pay a fortune to listen to music? The answer is no.

If you want uninterrupted music, you will have to pay for it. However, you can save money on music by accepting a few ads. YouTube, Pandora, Spotify, and many other streaming music companies have free music. With free versions, you will experience more ads but you will save money.

No one said that saving money will be easy. You must do what it takes to save money. Dealing with ads will be part of your problems.

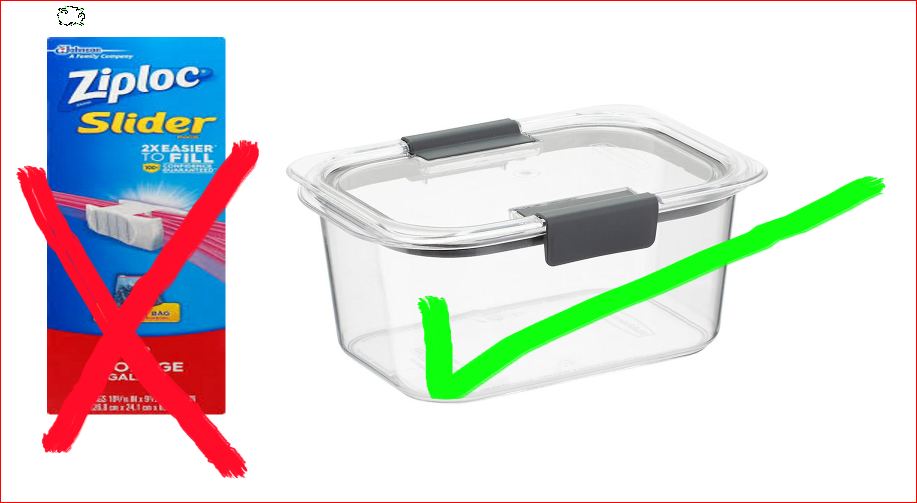

34. Save money: Avoid Single-use food storage items

Storing food helps us save food longer. However, the methods and techniques we use could be costly if not managed well. One great method is to use plastic zippers bags or sandwich bags and other related items. They don’t cost a lot of money, but every little bit helps when you are trying to save money.

Instead of using single-use food storage items, try reusable containers. You could save money you were spending on single-use storage items.

Extra money tip: 8 Reasons you are struggling with money

35. Soft drinks

Once you are used to drinking soft drinks, it is hard to give them up. Soft drinks can be addictive. There is a lot of sugar and other sweeteners in them. Stopping or reducing the amount you drink can save you money and improve your health.

What would you drink then? Water will become your best friend. Consider drinking water every day. You will save a ton of money if you choose to not buy soft drinks.

36. Newspapers and magazines subscriptions

Before the evolution of the internet, people used to learn about everything through newspapers. It was a good idea to pay for newspaper subscriptions.

Those days are gone and subscriptions are no longer needed. You can learn everything you want to learn for free from your phone or a computer. If you cannot find what you want, it is probably not important.

37. How to save money: Do not buy Cooking herbs, plant your own

The food we eat tastes better if we use herbs and spices. However, herbs are very expensive in grocery stores. You pay like two dollars or more on a small bunch. To cut on these expenses, you can grow your own.

Yes, it will be cheaper to grow your own. All you have to do is get a pot with little holes in it for drainage. It does not have to be expensive. It could be a bucket you no longer use.

Then fill the container with a compost of your choice. You can buy compost from Home-depot or other places. Next, put in seeds of herbs you want to grow or transplant seedlings in the pot. A little bit of water every once in a while will help your plants.

38. How to save money: Never buy Muscle building products, they are expensive and kill you slowly

If you are worried about saving money, I assume building muscles is not your top priority. You will still gain a ton of muscles without using muscle-building products. They are expensive, by the way. One bottle can cost $25, even more, depending on the size and type.

The money you pay on these products can be your foundation for your financial independence. You can always buy them in the future. Maybe they are not needed. You just need to stop using them, continue your workout, and then see what happens. Trust me, you will still gain muscles.

Wanna go frugal? These tips can help: Frugal Living: 19 tips that will save you money

39. Movies and movie concessions

Movies cost a lot of money. Adding popcorns, drinks, etc. on top of what you pay for a movie makes it more expensive.

You can pay less for movies by watching them during the weekdays. Usually, movies are priced at a huge discount on weekdays. Take advantage of these discounts if you have to go to the movies.

Also, avoid buying movie concessions every time you go to the movies. You can make your own popcorns at home.

Or, stop going to movies completely.

You want to save money, you must do what it takes to achieve your goal. You can watch any movie you want if you have access to the internet.

Most of us have streaming services anyways. Take advantage of the streaming services you are already paying for.

40. Renting movies from RedBox and other places

You are wasting money on Redbox. Why? Because you can watch all movies you want with the internet you have at home or on your phone.

Take a step forward and save that money instead.

41. How to save money: Do not buy Dryer sheets

The dryer sheets make our clothes smell good. However, they are expensive compared to the job they do. If you constantly use them, you will pay a lot of money at the end of the year.

Nothing bad will happen to your clothes if you don’t use dryer sheets. Stop buying them and save that money.

42. Cigarettes and smoking products

Smoking products such as cigarettes are pricey. If you smoke one pack of cigarettes every day that costs you $5, you will spend $1825 at the end of the year.

Saving that money would mark the start of your financial freedom. Furthermore, it will be the first step in taking control of your personal health.

More tips: 13 Benefits of saving money

43. Greeting cards

Expressing our love to loved ones through greeting cards feels good. They have great words in them that match with our thoughts. You just need to remember that those words were written by a person.

Do you need to pay $5,$7, even $10 per card because of those words? I don’t think it is a good idea. You can come up with your own words. Matter of fact your creativity will have more meaning to your loved ones than what you get from greeting cards.

Stop buying greeting cards and make your own cards. Write your own words on your own cards.

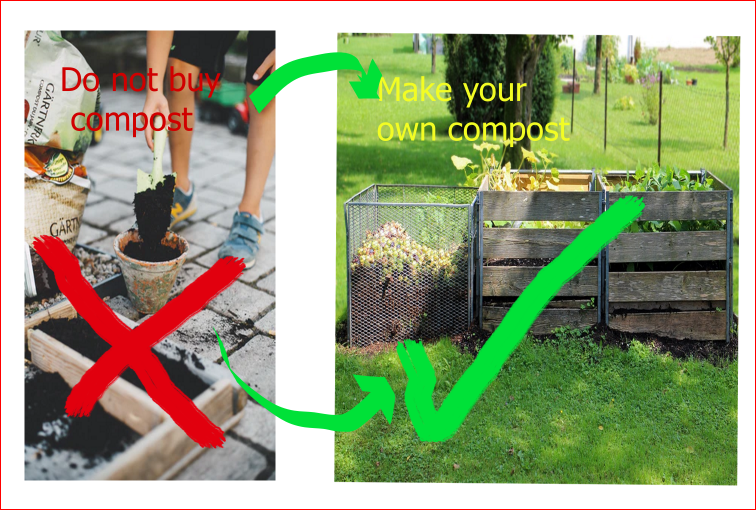

44. Compost

This is for all gardeners and farmers out there. Compost is very expensive and buying it could make you poor at some point. What if you can make your own compost? Yes, it is possible to make your own compost. Start with your food scraps and biodegradable items you have in your house like papers, cardboards, etc.

It takes a lot of months to have a final product. However, you will save money in the process.

More learning resources

- 18 habits of frugal people: How do frugal people live?

- 10 Extreme frugal tips you can start today

- 33 ways to save money while traveling

- Frugal Living: 19 tips that will save you money

- 13 Benefits of saving money

- 11 Easy ways to save money on flights